https://www.mining.com/web/hedge-funds-bullish-copper-bets-run-into-chinas-slowdown/

As copper surged to record highs last

month, several senior Chinese traders started trying to contact western

hedge fund managers whose names they’d only read in the press. For

years, the veteran traders’ privileged insight into their own economy

had given them an edge in the copper market, where China accounts for

more than half of global demand.

But now they were bewildered. Everything in China pointed to a market

that should be slumping, and yet prices were soaring on a wave of

speculative money. What were they missing?

Sign Up for the Copper Digest

The approaches – direct and through intermediaries, to fund managers

like Pierre Andurand and Luke Sadrian who had made a splash as some of

the market’s biggest bulls – highlight the tug of war that has gripped

the copper market in the past few months.

On one side are bullish fund managers in London and New York, who

have plowed tens of billions of dollars into copper with an eye to

future shortages. On the other are Chinese purchasers, more focused on

the here and now, who have rarely if ever been so gloomy.

For the Chinese traders, it has been a humbling experience. The

downbeat mood at home had persuaded them to bet against international

copper prices. Then a wave of investor buying pushed prices to a record,

and traders who fancied themselves the smartest players in the market

were wiped out.

“This year has been tough for Chinese traders,” Tiger Shi, managing

director at broker Bands Financial Ltd., said in an interview last week.

“Their vaunted information advantage over the Chinese physical market

didn’t bring them the rewards they imagined.”

But now, as the dust settles on last month’s frenzy, the importance

of the Chinese market has reasserted itself. Prices have dropped about

13% from the peak above $11,100 a ton, as speculators sharply reduced

their bullish bets in the wake of the surge — with much of that

reduction driven by trend-following funds, according to traders.

Without western investors buying, all eyes are back on China, and a

copper market that several industry insiders say is still the weakest

they’ve ever seen it.

The tug of war between the two is likely to determine where copper

prices go next: If tentative signs of a recovery in Chinese buying are

sustained, some copper bulls believe the market could be gearing up for

fresh record highs in the second half of the year.

But if weak Chinese orders persist, it would suggest that the soft

patch is not just a result of delayed buying, but an indicator of poor

underlying demand. Prices could fall even further — back to $9,000 or

even $8,000 a ton, according to the most bearish traders.

It’s a dynamic that’s likely to dominate conversations as more than

1,000 smelter executives, traders, bankers and analysts are set to

gather in Hong Kong this week for the London Metal Exchange’s annual

Asia party. It’s traditionally an occasion for western investors to

glean insight into Chinese fundamentals, but this year Chinese traders

are likely to be just as interested in better understanding their

counterparts.

It’s also a sign that, after more than two decades in which China’s

industrialization and urbanization has been the major driver of the

copper market, the situation is evolving as the electrification of

everything gobbles up greater volumes of copper the world over.

Among Chinese copper traders and the fabricators who shape raw metal

into pipes, wires and other parts used in everything from air

conditioners to power transmission cables, the mood remains

overwhelmingly gloomy.

“Business is shrinking significantly. The physical sales business is very bleak”

Even though some of the people Bloomberg spoke to in the

past two weeks said they had seen a recent uptick in demand, they were

reluctant to suggest that the market is turning around.

“This could be the most difficult year during my over-a-decade

industry history,” said Ni Hongyan, vice general manager at trading firm

Eagle Metal International Pte. “Business is shrinking significantly.

The physical sales business is very bleak,” she said.

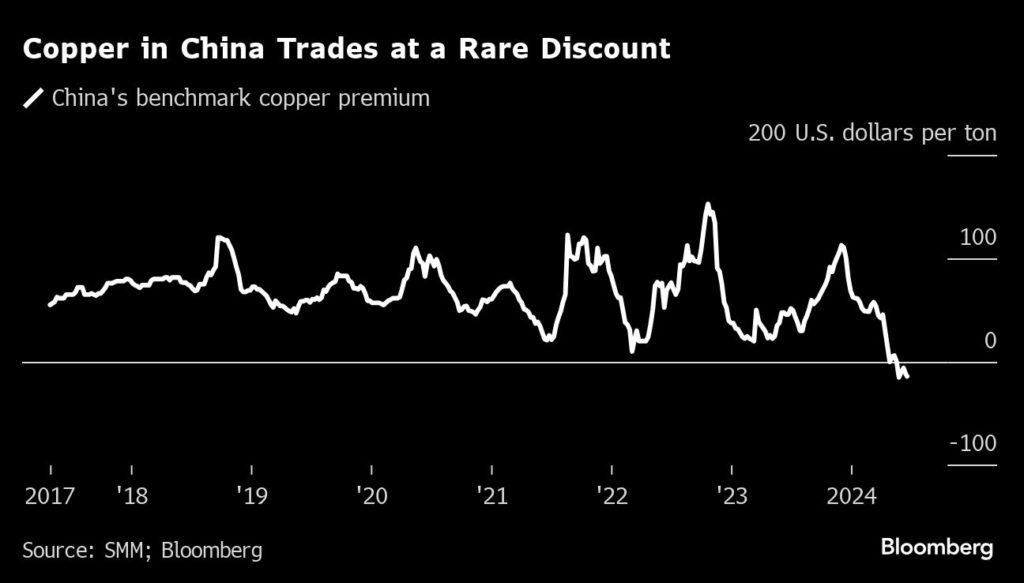

The data paints a similar picture. Copper in Shanghai’s tax-free

bonded zone has been selling at a highly-unusual discount to London

Metal Exchange prices for more than a month. That was painful for many

Chinese merchants, who consider the second quarter the peak season for

fabricators to purchase and prepare raw material stocks after the annual

political meetings of the country. Instead, copper inventories on the

Shanghai Futures Exchange have risen by 78% since the end of Chinese New

Year to a record high for this time of the year.

A senior executive at one of the world’s top metals traders said the

market for refined copper in China was weaker than he had ever seen it –

“by a distance.”

Short squeeze

The disconnect between the Chinese market and western investors had

been building for several months. Investors and analysts fell over one

another to make the most bullish prediction for copper prices amid

forecasts of soaring demand from the energy transition, and challenges

boosting mine production. A series of reports estimating massive amounts

of copper needed for artificial-intelligence data centers added to the

frenzy.

Goldman Sachs Group Inc. said copper was in “the foothills of what

will be its Everest,” predicting prices would average $15,000 a ton next

year, while Andurand called for copper to hit $40,000.

The situation came to a head in May. As copper prices in China lagged

international prices, many domestic traders had been placing bets that

the gap would narrow, going short the international copper contracts and

long the Shanghai market. After their brokers refused to put on new

short positions in London to avoid being exposed to volatility during a

week-long Chinese holiday, some traders placed bearish bets on the Comex

in New York instead.

But as investor money kept piling in to the market, particularly US

copper futures in New York, the Chinese traders were caught in a short

squeeze. Faced with rising copper prices, their cash flow was running

out and they had no choice but to give up, causing an unprecedented

blowout in New York futures that saw them trade far above other price

benchmarks.

Since then, however the Chinese market has reasserted itself.

Chinese copper exports hit a record 149,000 tons in May. LME stocks

in South Korea and Taiwan — the locations closest to China — have been

rising. And traders have been rushing to ship copper to the US to

arbitrage the difference in prices – though none of it has yet appeared

in Comex-registered inventories.

‘Not there yet’

In compiling this account, Bloomberg spoke to more than a

dozen senior figures in China’s copper trading industry, most of whom

who asked not to be identified discussing private information.

Many of the traders gathering in Hong Kong this week will still be

nursing their wounds. The past six months could be among the worst

performing period in their copper trading careers, several said.

For the wider market, the key question is what happens next.

In China, some traders say there have been tentative signs of a

pick-up in buying in the past couple of weeks, a move which, if

sustained, could put a floor on prices. Inventories of copper on SHFE

have fallen for the past two weeks, albeit by a modest 14,000 tons.

Beijing is also set to announce more long-term policy support for the

economy at a key Communist Party meeting next month, which is seen

boosting demand for raw materials like copper.

Wang Wei, general manager at major copper trader Shanghai Wooray

Metals Group Co., which sells refined copper to hundreds of Chinese

fabricators, said that demand was “rebounding a bit,” although only to

return to similar levels as a year ago.

But there are still reasons to worry about China’s underlying copper

consumption. Property is a key driver of copper demand, and the weakness

in the Chinese sector is likely to continue as a drag, according to

Eugene Chan, trading manager at Zhejiang Hailiang Co. There are also

some indications that high prices are spurring a greater push for

substitution of copper for aluminum.

“The financial market flood of net new length has become a trickle.

Without that incremental macro-driven buyer, it comes down to whether

the underlying physical market can support the current price,” said

Colin Hamilton, managing director for commodities research at BMO

Capital Markets. “We have to reset to a level to bring these buyers

back, and we’re not there yet.”