Thursday, May 30, 2024

Wednesday, May 29, 2024

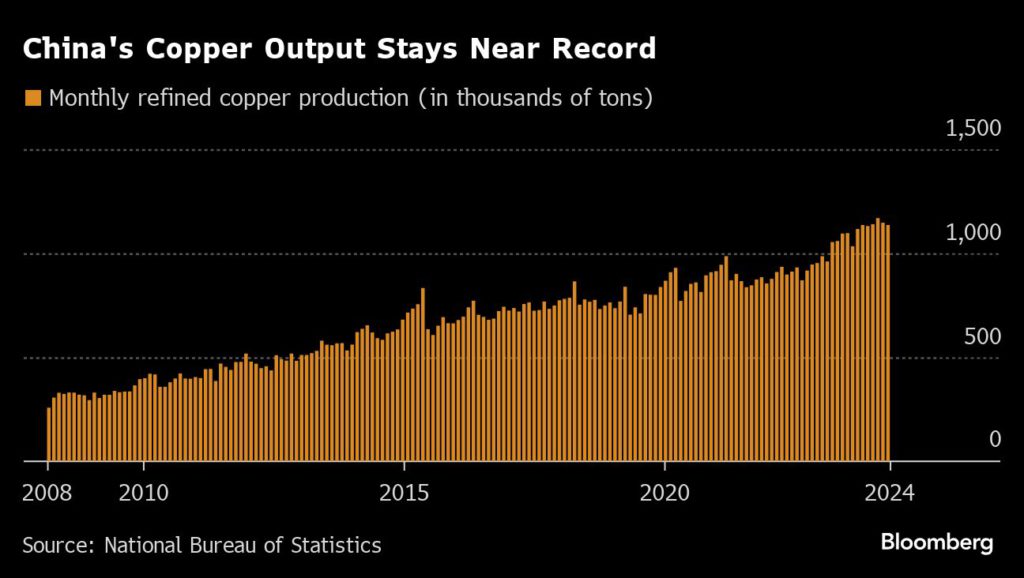

China defies global copper squeeze with near-record production

https://www.mining.com/web/china-defies-global-copper-squeeze-with-near-record-production/

The global copper market is gripped by fears of a shortage, which has propelled prices to record levels and sparked a $49 billion takeover battle. But in China, the world’s biggest producer and consumer of the refined metal, there’s more than enough to go around.![]()

At the center of that conundrum are the nation’s ever-expanding copper smelters. The industry is maintaining production at near-record levels — defying a scarcity of raw materials — as higher prices unlock more scrap metal for processing.

Sign Up for the Copper Digest

Smelters had pledged to reduce capacity after their fees collapsed because of a supply squeeze on the imports of ore they use as feedstock. The prospect of insufficient copper in China is just one of the pillars supporting a barnstorming rally that took the metal above $11,000 a ton for the first time at the start of last week. But the cuts haven’t happened and China’s faltering economy isn’t able to absorb the excess.

The mismatch between supply and demand has become more glaring in recent days, with prices retreating to just above $10,300 a ton. Although that’s still a 21% gain for the year, it suggests that as long as China remains oversupplied, copper will struggle to make further headway.

The availability of scrap from discarded pots, pipes and wires has risen quickly after copper prices surged, said Liang Kaihui, an analyst with Shanghai Metals Market. Fabricators have been busy turning that into blister, a semi-processed version of the metal, and feeding it back to smelters, he said, where it’s used as a substitute for the overseas ore that’s now in short supply.

The abundance of scrap is seen in its discount to refined copper, which blew out to 4,615 yuan ($637) a ton last week, the widest in at least eight years, according to SMM.

The smelting industry, meanwhile, keeps adding capacity. As long as they’re profitable, individual firms prefer to defend market share at the expense of margins. Local governments also want them to keep churning out metal so that they can meet their economic growth targets and maintain employment levels.

Saudi Arabia is reportedly trying to plug a $21 billion deficit by selling bonds

https://www.businessinsider.com/saudi-arabia-neom-vision-2030-bond-sale-mbs-deficit-2024-5

- Saudi Arabia is raising debt to plug holes in its finances, Bloomberg reported.

- Riyadh has pressed ahead with big spending projects as part of an economic diversification drive.

- It now needs to cover a $21 billion fiscal shortfall, per the outlet.

Saudi Arabia plans to raise money by selling bonds as it presses ahead with massive spending projects, Bloomberg reported.

The kingdom will issue dollar-denominated three, six, and 10-year sukuk notes as part of an effort to plug a fiscal shortfall that's expected to hit $21 billion by the end of the year, the outlet reported citing an unnamed source.

Riyadh previously sold $12 billion of sovereign debt in January, while planned desert megacity Neom has also reportedly mulled issuing Islamic bonds in a bid to raise more cash.

Related stories

Citigroup, Goldman Sachs, and French bank BNP Paribas will coordinate the bond sale, according to Bloomberg.

The latest bond sale comes as Saudi Arabia presses ahead with Mohammed bin Salman's Vision 2030 plan that seeks to diversify its oil-reliant economy.

As part of the massive spending project, the kingdom plans to build Neom, which could ultimately cost as much as $1.5 trillion. It's also poured billions of dollars into sports, luring soccer stars like Cristiano Ronaldo, Karim Benzema, and Neymar to play in the local Saudi Pro League and backing the breakaway LIV Golf tournament.

In February, The Wall Street Journal reported that Saudi Arabia had started borrowing to help fund Neom and other Vision 2030 "gigaprojects."

Tim Callen, a visiting fellow at the Arab Gulf States Institute think tank in Washington, estimated that the Saudi sovereign wealth fund, the PIF, would need to raise another $270 billion if it wanted to fully realize its ambitions.

Tuesday, May 28, 2024

Post-Covid, China is back in Africa and doubling down on minerals

https://www.mining.com/web/post-covid-china-is-back-in-africa-and-doubling-down-on-minerals/

China’s flagship economic cooperation program is bouncing back after a lull during the global pandemic, with Africa a primary focus, according to a Reuters analysis of lending, investment and trade data.

Chinese leaders have been citing the billions of dollars committed to new construction projects and record two-way trade as evidence of their commitment to assist with the continent’s modernization and foster “win-win” cooperation.

Sign Up for the Battery Metals Digest

But the data reveals a more complex relationship, one that is still largely extractive and has so far failed to live up to some of Beijing’s rhetoric about the Belt and Road Initiative, President Xi Jinping’s strategy to build an infrastructure network connecting China to the world.

While new Chinese investment in Africa increased 114% last year, according to the Griffith Asia Institute at Australia’s Griffith University, it was heavily focused on minerals essential to the global energy transition and China’s plans to revive its own flagging economy.

Those minerals and oil also dominated trade. As efforts falter to boost other imports from Africa, including agricultural products and manufactured goods, the continent’s trade deficit with China has ballooned.

Chinese sovereign lending, once the main source of financing for Africa’s infrastructure, is at its lowest level in two decades. And public-private partnerships (PPPs), which China has touted as its new preferred investment vehicle globally, have yet to gain traction in Africa.

The result is a more one-sided relationship than China says it wants, one that is dominated by imports of Africa’s raw materials and that some analysts argue contains echoes of colonial-era Europe’s economic relations with the continent.

“This is something late-19th century Britain would recognize,” said Eric Olander, co-founder of the China-Global South Project website and podcast.

China rejects such assertions.

“Africa has the right, capacity and wisdom to develop its external relations and choose its partners,” China’s foreign ministry wrote in response to Reuters‘ questions.

“China’s practical support for Africa’s path of modernization in accordance with its own characteristics has been welcomed by an increasing number of African countries.”

A pivot with potential?

China’s engagement in Africa, a focus of the Belt and Road Initiative (BRI), grew rapidly in the two decades before the Covid-19 pandemic. Chinese companies built ports, hydropower plants and railways across the continent, financed mainly through sovereign loans. Annual lending commitments peaked at $28.4 billion in 2016, according to the Global China Initiative at Boston University.

But many projects proved unprofitable. As some governments struggled to repay loans, China cut lending. Covid-19 then pushed it to turn inward, and Chinese construction projects in Africa fell.

A rebound in sovereign lending is not expected.

Policymakers in Beijing have instead been pushing Chinese companies to take equity stakes and operate infrastructure they build for foreign governments. The aim, China analysts say, is to help companies win higher-value contracts and, by giving them skin in the game, ensure the projects are economically viable.

Lending to Special Purpose Vehicles (SPVs), perhaps the most common means of PPP infrastructure investment, has been growing as a proportion of China’s overseas loans, according to figures shared exclusively with Reuters by AidData, a research centre at US university William & Mary.

The $668 million Nairobi Expressway, a public-private partnership built and run by the state-owned China Road and Bridge Corporation (CRBC), could be proof of concept for the model in Africa. Since it opened in August 2022, the toll road has been allowing commuters to speed above the Kenyan capital’s notorious traffic snarls, beating revenue and usage targets.

Daily average use in March was already 57,000 vehicles, exceeding a 2049 target of around 55,000 set by CRBC in a 2019 presentation on the project’s economic viability seen by Reuters.

But few companies are following CRBC’s example in Africa. While globally some 45% of Chinese non-emergency lending was to SPVs from 2018 to 2021, the most recent year for which AidData figures are available, the figure was only 27% for Africa.

Analysts point to a number of likely reasons, including a lack of legal frameworks for PPPs in many African countries and the view among some Chinese companies – many of them relative newcomers to PPPs – that African markets are risky.

China’s foreign ministry did not directly address a request for comment on the lower SPV figures for Africa. But it said the government encourages Chinese companies to “actively develop new modes of cooperation” such as PPPs to bring more private investment to Africa.

Growing engagement

The Griffith Asia Institute put China’s total engagement in Africa – a combination of construction contracts and investment commitments – at $21.7 billion last year, making it the largest regional recipient.

Data from the American Enterprise Institute, a Washington-based think tank, showed investments hitting nearly $11 billion in 2023, the highest level since it began tracking Chinese economic activity in Africa in 2005.

Some $7.8 billion of that went to mining, like Botswana’s Khoemacau copper mine, which China’s MMG Ltd bought for $1.9 billion, and cobalt and lithium mines in countries including Namibia, Zambia and Zimbabwe.

The hunt for critical minerals is driving infrastructure construction as well. In January, for example, Chinese companies pledged up to $7 billion in infrastructure investment under a revision of their copper and cobalt joint venture agreement with Democratic Republic of Congo.

Western and Gulf powers are also racing to lead the world’s energy transition, with the United States and European governments backing the Lobito Corridor, a rail link to bring metals from Zambia and Congo to Africa’s Atlantic coast.

African leaders have struggled, however, to raise financing for some other priority projects.

Despite the success of the Nairobi Expressway, for example, work on several Kenyan roads stalled when the government ran out of money to pay the Chinese construction firms.

During a visit to Beijing last October, President William Ruto asked for a $1 billion loan to complete the projects.

A Chinese foreign ministry spokesman, Wang Wenbin, said discussions about the request were ongoing. Kenya’s finance ministry did not respond to a request for comment.

The final phase of a railway line intended to traverse Kenya from its main port to the border with Uganda has been in similar limbo since Chinese financing dried up in 2019. Uganda cancelled the contract for its portion of the line in 2022, after Chinese backers pulled out.

When asked about the decline in lending for African infrastructure, Chinese officials point to a pivot to trade and investment, arguing that BRI-generated trade boosts Africa’s wealth and development.

Two-way trade reached a record $282 billion last year, according to Chinese customs data. But at the same time, the value of Africa’s exports to China fell 7%, mainly due to a decline in oil prices, and its trade deficit widened 46%.

Chinese officials have sought to assuage the concerns of some African leaders.

At a summit in Johannesburg last August, Xi said Beijing would launch initiatives to support the continent’s manufacturing and agricultural modernization – sectors African policymakers consider key to closing trade gaps, diversifying their economies and creating jobs.

China has also pledged to increase agricultural imports from Africa.

Such efforts, for now, are coming up short.

With one of Africa’s largest trade deficits to China, Kenya has been pushing to increase access to the world’s second-largest consumer market, recently gaining it for avocados and seafood. But cumbersome health and hygiene regulations mean Chinese consumers remain out of reach for many producers.

“The Chinese market is a new one,” said Ernest Muthomi, CEO of the Avocado Society of Kenya. “It was a challenge because you have to install the equipment for fumigation.”

Of 20 billion shillings ($150.94 million) worth of avocados exported last year, just 10% went to China.

Overall, Kenyan exports to China fell over 15% to $228 million, Chinese customs data showed, as a decline in titanium production led to a drop in shipments of the metal – a key export to China.

But Chinese manufactured goods kept coming.

That’s not sustainable, said Francis Mangeni, an advisor at the Secretariat of the African Continental Free Trade Area.

Unless African nations can add value to their exports through increased processing and manufacturing, he said, “we are just exporting raw minerals to fuel their economy.”

($1 = 132.5000 Kenyan shillings)

(By Rachel Savage, Duncan Miriri, Elias Biryabarema, Joe Cash, Nyasha Chingono, Chris Mfula and Felix Njini; Editing by Joe Bavier and Alexandra Zavis)

Copper price: the squeeze has been squoze

https://www.mining.com/copper-price-the-squeeze-has-been-squoze/

After hitting an all-time intraday level of a smidgen under $5.20 a pound or $11,460 a tonne in Chicago a week ago, July copper has pulled back to exchange hands for $4.85 ($10,690) on Tuesday, paring some of last week’s steep losses.

Copper trading enjoyed blow-out volumes on the way up with the paper equivalent of more than 10m tonnes, worth nearly $115 billion, traded in the most active contract in one 24 hour period on the CME mid-May. That’s more than twice the Dow’s average daily volume in dollars and three times German bunds.

Sign Up for the Energy Digest

The shorts squeeze, more of a feature of US trading than elsewhere, is now in danger of turning into a longs bear hug.

With cargoes from Chile and Peru being diverted to North America after the Chinese import arbitrage, another reliable source of volatility and tradeability, evaporated copper futures volumes are back to pre-craze days. Imagine it was fun while it lasted.

A new report by Australian bank Macquarie titled Panama hold’em suggests the copper corrections will continue and forecasts average prices in the September quarter of $9,800.

Towards the end of the year the copper price should go back above $10,000, says the London-based commodities strategist Alice Fox and analysts from Macquarie’s London, Singapore, Shanghai and Delhi desks.

Not exactly the torment the devil’s copper visited on shorts and longs in 2022 and 2023 then.

However.

For prognosticators who believe copper entered a gravity defying phase in April/May and the next stop was $15,000 before going to $40,000 by the end of the decade because of – what else – AI, Fox and Friends have worse news.

(Lest we be accused of double standards, MINING.COM is not afraid to talk our book, but at least the most ambitious copper price prediction quoted on this site was based on the log-normal shape of the grade-tonnage plot of porphyrys. Not data centers and the other recent and equally underwhelming explanations for the new bronze age – more bullets. Or as WSJ had it a year ago – Democrats and the debt ceiling.)

Even after an upward adjustment in the note, Macquarie sees the long term price at $9,000 ($4.08) in today’s money.

For the Robinhoods who thought trading copper futures is as much fun as movie theater or gaming stonks, Macquarie’s report at least gives them something to aim at (their emphasis):

“In essence, this [$9,000/t] is an equilibrium price and, given the fact that the copper market is very rarely in equilibrium, we would expect it to, potentially very significantly, overshoot during periods of tightness and undershoot during periods of weakness.”

Macquarie does say the uncertainty surrounding the future of Cobre Panama (hence the title of the note) could have a major impact on market balance and a restart, which the bank has sketched in for late next year, pulls forward predicted surpluses.

But with or without AI, military demand and Cobre Panama, over a longer horizon Macquarie’s outlook for copper is anything but supercycle-y:

“To be clear, we do not think a real-terms price higher than this will be needed for supply, including scrap, to play its role in rebalancing the market, nor needed to incentivise more demand destruction through thrifting and substitution. This is in the context of trend demand growth that we project to be very similar to that of the past 20 years, i.e. ~2.5%.

“The energy transition is taking over from China’s urbanisation and industrialisation as the major driver of global demand growth but, in our view, will not necessarily result in an overall acceleration.”

Thursday, May 23, 2024

Wednesday, May 22, 2024

Tuesday, May 21, 2024

Monday, May 20, 2024

Friday, May 17, 2024

Thursday, May 16, 2024

NTSB releases preliminary report into Baltimore Bridge incident

www.ntsb.gov/investigations/Documents/DCA24MM031_PreliminaryReport%203.pdf

The US National Transportation Safety Board (NTSB) released its preliminary report into the Baltimore Bridge incident, when container ship Dali hit the bridge after a loss of power, causing the bridge to collapse.

A primary electrical breaker which feeds most of the vessel’s equipment and lighting had unexpectedly tripped, leading to a blackout (loss of power) onboard.

The electricity was supplying pumps delivering fuel to the main propulsion engine, and so that also shut down, so the vessel’s propeller stopped.

The crew managed to restore electrical power to the vessel, and the emergency generator started.

A second electrical blackout occurred when the vessel was 0.2 miles from the bridge. The emergency generator provided electrical power to the emergency equipment continuously through the second electrical blackout.

When the pilot ordered a hard turn of the rudder, it was ineffective since there was no propulsion to help with the steering.

The crew regained electrical power before the vessel struck the pier but was unable to regain propulsion.

There had also been a loss of electrical power on the vessel during in-port maintenance 10 hours before leaving Baltimore. While working on the diesel engine exhaust scrubber system for the diesel engine driving the only online generator (generator 2), a crewmember mistakenly closed an inline engine exhaust damper. Closure of this damper effectively blocked the engine’s cylinder exhaust gases from traveling up its stack and out of the vessel, causing the engine to stall. When the system detected a loss of power, generator no. 3 automatically started.

Wednesday, May 15, 2024

Biden Orders Chinese Crypto Mining Company to Sell Land Near US Military Base

The Biden administration has ordered a China-linked cryptocurrency mining company and its partners to sell off its land near a U.S. Air Force base in Wyoming.

President Biden said the company’s cryptocurrency mining operations included the use of foreign-sourced technology, which posed national security concerns.

“The proximity of the foreign-owned real estate to a strategic missile base and key element of America’s nuclear triad, and the presence of specialized and foreign-sourced equipment potentially capable of facilitating surveillance and espionage activities, presents a national security risk to the United States,” President Biden said in the order.

President Biden said the Chinese group must remove all of its equipment on the land within 90 days and sell or transfer the property within 120 days.

The executive order explained that MineOne bought the land in June 2022 and failed to notify the Committee on Foreign Investment in the United States (CFIUS) about the transaction. Led by the Treasury Department, CFIUS is an interagency committee responsible for investigating national security risks associated with foreign investments in the United States.

CFIUS began investigating the land purchase after receiving a public tip, according to the executive order.

“Today’s divestment order underscores President Biden’s steadfast commitment to protecting the United States’ national security,” Secretary of the Treasury Janet Yellen said in a statement released on Monday. Ms. Yellen is also the chairperson of CFIUS.

“It also highlights the critical gatekeeper role that CFIUS serves to ensure that foreign investment does not undermine our national security, particularly as it relates to transactions that present risk to sensitive U.S. military installations as well as those involving specialized equipment and technologies,” she added.

The Department of Defense (DoD) also issued a statement about President Biden’s order.

“DoD regularly assesses its military installations and the geographic scope around them to ensure appropriate application in light of national security considerations,” the department said. “DoD will continue to assess its military installations on an ongoing basis to ensure the sites listed are appropriate.”

In April, FBI Director Christopher Wray warned about what he called China’s “broad and unrelenting” threat against U.S. critical infrastructure, during the Vanderbilt Summit on modern conflict and emerging threats.