https://www.mining.com/big-5-diversified-mining-companies-are-having-a-rough-2024/

At the end of the first quarter 2024, the MINING.COM TOP 50* ranking of the world’s most valuable miners had a combined market capitalization of a shade under $1.4 trillion, down $13 billion since the start of the year.

The historic gold run and copper’s comeback, up 14% and 12% so far in 2024, only kicked into a higher gear after the end of the March quarter, but copper and gold counters nevertheless dominate the best performer list for Q1.

The lacklustre combined performance of the sector’s majors came despite the revival in the bellwether metals, but the broader market has been a mixed bag in 2024.

Aluminium is trading not far off 52-week highs, but zinc seems unlikely to breach $3,000 a tonne any time soon and cobalt is bobbing along historic lows below $30,000 a tonne.

Nickel has been bumped up after lows in the mid-$15,000s last year, but remains firmly stuck in bear territory and lithium’s 2024 good fortune also looks in danger of petering out.

Sentiment towards PGMs has hardly improved with both platinum and palladium drifting lower in 2024. Even iron ore prices back above $100 a tonne – the bread and butter of the diversified majors – was not enough for investors to jump back into the sector.

Gold, copper boost

First Quantum Minerals with market valuation up 58% in US dollar terms, made a welcome return at position 44 after dropping out at the end of last year following the closure of its Cobre Panama mine.

Amman Mineral continued its astounding run – the Indonesian copper and gold miner has added 380% in value since its July listing and could soon vie for a place in the top 10.

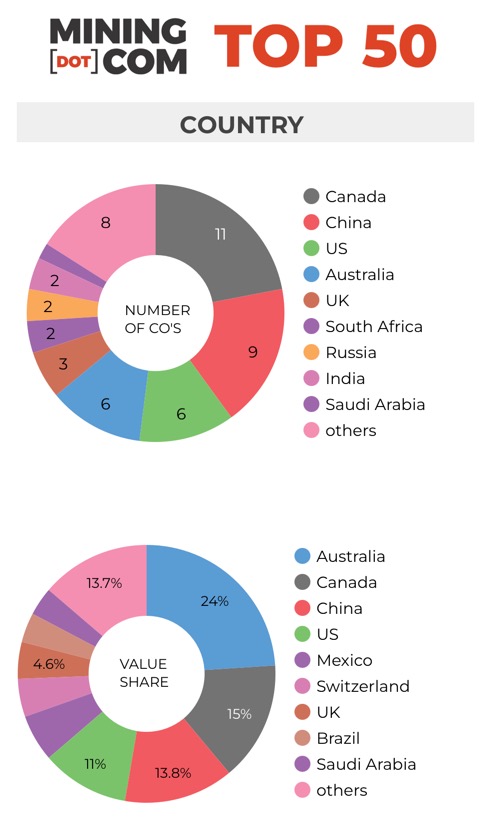

Lundin Mining joins the top 50 for the first time, jumping five places to 48 and is already climbing thanks to the red metal approaching 14-month highs. Lundin’s 25% rise in 2024 also restores Vancouver as the number one location among top 50 headquarters after Pilbara Minerals’ exit this quarter.

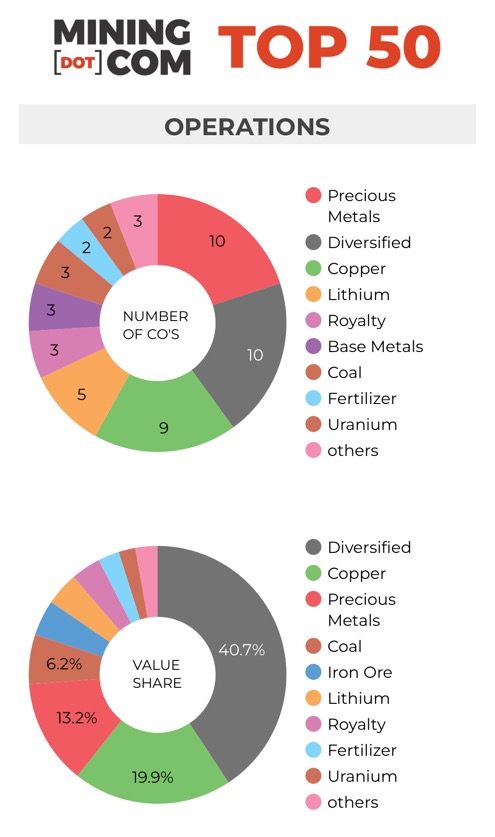

Anglogold Ashanti’s re-entry boosts the number of precious metals miners in the top tier to 10 and their collective value to $183 billion.

China’s Yintai Gold, which in February picked up Canada’s Osino Resources, could also challenge for a position in the upper echelon from its current 54th position should gold continue to rally, but long term top 50 participant KGHM has a hill to climb to make it back despite shares in the Polish mining company rising 15% year to date.

Pan American Silver, like its primary metal, could ride gold’s coattails to become the only silver-focused miner in the top 50 following Fresnillo’s exit more than a year ago. Silver is now the best performing metal year to date, up more than 18%.

Diversified drubbing

While the top 50 mining companies as a whole drifted sideways during the quarter, the largest diversified companies faced headwinds going into 2024, and uncharacteristically some of the biggest names in mining feature on the worst performers list for the quarter.

The only $100bn companies in the ranking – BHP and Rio Tinto – were both down by double digits at the end of Q1 and Glencore’s rerating over the past couple of years went into reverse with declines of 9% in 2024.

Vale’s pullback from its valuation at the end of 2023 places the stock firmly in bear territory with losses of nearly 24% in US dollar terms. The Brazilian giant sold 13% of its base metals unit for $3.4bn to amongst others, the Saudi Arabia’s sovereign wealth fund, but given the performance of nickel a separate listing seems off the table for now.

Anglo American stock had a fairly uneventful Q1 2024 after the sharp H2 2023 sell-off sparked by copper guidance, PGM and South African power woes, and despite the bad news from its Woodsmith fertiliser project in England.

Nevertheless, the counter has dropped below a $30 billion market cap for the first time since the outset of the pandemic and losses for the past 12 months top 30%. Rumours that Glencore may be interested after the Swiss behemoth’s bid for all of Teck Resources fell through have died down, probably for the right reasons.

The ranking remains top heavy, but as a group the historic top five diversified mining companies’ share of the MINING.COM Top 50’s overall valuation fell to a new low of 29%, down from 36% at the end of 2022.

China cheer

The historic top 5 diversifieds should in fairness be expanded to seven and include Saudi Arabia’s Ma’aden and Zijin Mining, the highly acquisitive Chinese firm is up over 30% so far this year and appears to be well ensconced in the top 10.

Xiamen-based Zijing at the end of Q1 fell just short of a $60bn market worth (indeed gold and copper’s run in the first week of Q2 has now lifted the stock above that milestone).

On the best performer list for the quarter, Zijin sits just behind CMOC Group, formerly China Molybdenum and for years before being overtaken by Zijin the most valuable middle kingdom mining stock, and ahead of Jiangxi Copper, which jumps 9 places to 41 in Q1.

The 10 Chinese companies in the ranking collectively are worth $192bn or 14% of the overall value, up from 8 companies valued at $115bn and 9% of three years ago.

Lithium loss

Three counters dropped out of the top 50 during the first quarter. Brazil’s CSN Mineração, an iron ore miner, China’s Huayou Cobalt and Australian lithium producer Pilbara Minerals.

Pilbara Minerals only just lost out to Kinross Gold for the last spot as at end-March and lithium prices have recovered somewhat this year, but probably not enough for the lithium sector to outperform gold stocks in Q2.

The merger of Livent and Allkem to form Arcadium Lithium also did not result in an increase in lithium mining’s representation in the ranking. Arcadium Lithium has been hammered down to below a $5bn valuation this year.

From its height of a collective $119bn valuation at the end of the second quarter of 2022, the combined value of the lithium stocks in the top 50 has now fallen to $59 billion.

Click on the table below for a full-size image.

*NOTES:

Source: MINING.COM, GoogleFinance, stock exchange data, company reports. Share data from primary-listed exchange at March 28, 2024 – March 29, 2024 close of trading converted to US$ at cross-rates March 29, 2024.

Percentage change based on US$ market cap difference, not share price change on exchange in local currency.

As with any ranking, criteria for inclusion are contentious. We decided to exclude unlisted and state-owned enterprises at the outset due to a lack of information. That, of course, excludes giants like Chile’s Codelco, Uzbekistan’s Navoi Mining, which owns the world’s largest gold mine, Eurochem, a major potash firm, and a number of entities in China and developing countries around the world.

Another central criterion was the depth of involvement in the industry before an enterprise can rightfully be called a mining company.

For instance, should smelter companies or commodity traders that own minority stakes in mining assets be included, especially if these investments have no operational component or warrant a seat on the board?

This is a common structure in Asia and excluding these types of companies removed well-known names like Japan’s Marubeni and Mitsui, Korea Zinc and Chile’s Copec.

Levels of operational or strategic involvement and size of shareholding were other central considerations. Do streaming and royalty companies that receive metals from mining operations without shareholding qualify or are they just specialised financing vehicles? We included Franco Nevada, Royal Gold and Wheaton Precious Metals on the basis of their deep involvement in the industry.

Vertically integrated concerns like Alcoa and energy companies such as Shenhua Energy or Bayan Resources where power, ports and railways make up a large portion of revenues pose a problem. The revenue mix also tends to change alongside volatile coal prices. Same goes for battery makers like CATL which is increasingly moving upstream, but where mining still makes up a small portion of its valuation.

Another consideration is diversified companies such as Anglo American with separately listed majority-owned subsidiaries. We’ve included Angloplat in the ranking but excluded Kumba Iron Ore in which Anglo has a 70% stake to avoid double counting. Similarly we excluded Hindustan Zinc which is listed separately but majority owned by Vedanta.

Many steelmakers own and often operate iron ore and other metal mines, but in the interest of balance and diversity we excluded the steel industry, and with that many companies that have substantial mining assets including giants like ArcelorMittal, Magnitogorsk, Ternium, Baosteel and many others.

Head office refers to operational headquarters wherever applicable, for example BHP and Rio Tinto are shown as Melbourne, Australia, but Antofagasta is the exception that proves the rule. We consider the company’s HQ to be in London, where it has been listed since the late 1800s.

Please let us know of any errors, omissions, deletions or additions to the ranking or suggest a different methodology.

No comments:

Post a Comment