Thursday, February 29, 2024

Wednesday, February 28, 2024

Tuesday, February 27, 2024

Monday, February 26, 2024

Bitcoin breaks all records with a massive $1.347 billion transaction

https://financefeeds.com/bitcoin-breaks-all-records-with-a-massive-1-347-billion-transaction/

This transaction has surpassed previous records, setting a new benchmark for Bitcoin trades. Before this event, the largest Bitcoin transactions included a $1.1 billion trade in April 2020 involving 161,500 BTC, and other significant transactions ranging from $491 million to $1.033 billion throughout 2019 and 2020.

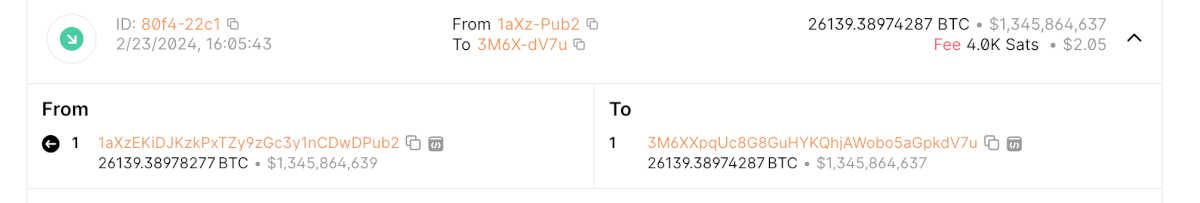

On February 23, 2024, at 16:05:43, the largest Bitcoin transaction in history was executed. The transaction involved the transfer of 26,139.38974287 BTC, valued at approximately $1.347 billion at the time of the transaction.

This monumental trade was conducted between two digital wallets, identified by their addresses as “1aXzEKiDJKzkPxTZy9zGc3y1nCDwDPub2” and “3M6XXpqUc8G8GuHYKQhjAWobo5aGpkdV7u.”

UP NEXT: Should the largest Bitcoin trade be priced in BTC or USD?

The commission for this trade was notably low, at 4.0K Sats (Satoshis), equivalent to $2.06, which goes to show how efficient and cost-effective large-scale transactions within the Bitcoin network have become.

The trade of just a little over 26,000 BTC, valued around $1.347 billion, has surpassed previous records, setting a new benchmark for Bitcoin trades.

Before this event, the largest Bitcoin transaction was a 161,500 BTC trade in April 2020, valued at approximately $1.1 billion, which involved two Bitfinex addresses, later confirmed by CTO Paolo Ardoino. Prior to that, other significant transactions ranged from $491 million to $1.033 billion throughout 2019 and 2020.

These historical transactions highlight the growing scale and value of Bitcoin trades over the years, reflecting the increasing acceptance and integration of cryptocurrencies into the financial landscape.

Who owns this mysterious address?

The address “1aXzEKiDJKzkPxTZy9zGc3y1nCDwDPub2,” associated with the record-breaking Bitcoin transaction, presents an intriguing narrative within the cryptocurrency landscape. Despite its recent entry into the annals of Bitcoin history through a transaction of unparalleled magnitude, this address has engaged in a remarkably low number of transactions on the Bitcoin blockchain, totaling just five before this monumental event. These transactions have resulted in the address receiving an astonishing sum of 26,215.39974287 BTC, equivalent to approximately $1.350 billion. Contrasting with its significant incoming value, the address has sent out a mere 0.01000000 BTC, valued at around $515.34.

This restrained transaction activity coupled with the colossal amount of Bitcoin held introduces a veil of mystery surrounding the owner’s identity and intentions. The sparse transaction history, characterized by receiving a vast quantity of Bitcoin while barely distributing any, raises questions about the strategic objectives behind accumulating such wealth in cryptocurrency.

UP NEXT: Should the largest Bitcoin trade be priced in BTC or USD?

The secrecy surrounding the owner further amplifies the intrigue. In the decentralized and anonymous nature of blockchain, where transactions are transparent but identities are obscured, the actions of this address capture the imagination.

Who owns this address? Is it an individual investor, a collective, or an institution operating behind a veil of blockchain anonymity? The careful curation of transactions, the significant value amassed, and the strategic silence in the blockchain space leave room for endless speculation about the proprietor’s identity and their future moves in the cryptocurrency market.

Should the largest Bitcoin trade be priced in BTC or USD?

In a separate article, we discuss the issue of ranking the largest Bitcoin trade based on their USD value instead of being simply based on the amount of BTC transacted.

For example, the 26,139 BTC trade worth $1.347 billion contrasts sharply with a notable event from 2011, where 500,000 BTC were moved, then valued at around $1.13 million.

While the 2011 transaction boasts a higher volume of Bitcoin, the recent transfer’s fiat valuation far exceeds that of any previous transaction. Read more about it here.

After Jeff Bezos unloaded $4 billion in Amazon stock, Jamie Dimon sold $150 million in JPMorgan shares—a first for the banking chief

https://fortune.com/2024/02/23/bezos-amazon-stock-jpmorgan-dimon-sold/

JPMorgan Chase & Co. Chief Executive Officer Jamie Dimon and his family sold $150 million worth of the bank’s stock, following through on last year’s announcement that he would begin selling shares for the first time since taking the helm 18 years ago.

Dimon and his family sold about 822,000 shares in a series of transactions on Thursday, according to a U.S. Securities and Exchange Commission filing. The stock, which has outperformed the broader market and peers during his tenure, is trading at a record high.

“Mr. Dimon continues to believe the company’s prospects are very strong and his stake in the company will remain very significant,” the company said in an October filing about his planned sales. A representative for the firm declined further comment on Friday.

The October announcement said Dimon planned to sell one million shares, subject to terms of a stock-trading plan. Along with his family, he continues to hold about 7.7 million shares after Thursday’s sales.

JPMorgan was a winner among banks last year amid its deal for First Republic Bank, with its stock rallying 27% and the New York-based company posting record net interest income.

When he took over as CEO, the stock was trading for about $40. He sold the shares on Thursday for nearly $183 a piece, as the stock had rallied roughly 30% since the October announcement that he planned to offload shares. Shares gained 0.5% on Friday.

On Wall Street, analysts are decisively bullish on JPMorgan shares’ prospects. Two dozen hold buy-equivalent recommendations, giving it the highest consensus rating among its handful of biggest banking peers. The return potential implied by their price targets is more than 4% over the next twelve months.

Wednesday, February 21, 2024

Tuesday, February 20, 2024

Monday, February 19, 2024

Saudi Arabia Adjusts Oil Capacity Expansion in Response to Energy Transition

Saudi Arabia has revised its oil capacity expansion plans, attributing the change to the ongoing global energy transition.

On January 30, the Saudi government directed the state-owned oil company, Aramco, to maintain its maximum sustained production capacity at 12 million barrels per day (bpd), scaling back from a previously set target of 13 million bpd to be achieved by 2027.

This announcement was made by the Saudi Energy Minister, Prince Abdulaziz bin Salman, during the IPTC petroleum technology conference in Dharan.

The decision to adjust the expansion plan aligns with Saudi Arabia’s broader environmental commitments, including its goal to achieve net zero emissions by 2060, with Aramco aiming for net zero emissions from its operations by 2050.

Prince Abdulaziz emphasized the kingdom’s substantial spare oil capacity, highlighting its readiness to mitigate potential disruptions in global oil supplies due to conflicts or natural disasters.

Aramco’s CEO, Amin Nasser, reaffirmed the company’s capability to adjust production levels as needed, noting a current spare capacity of approximately 3 million bpd.

This flexibility is part of Saudi Arabia’s strategy to adapt to market demands and maintain its position as the world’s largest holder of spare oil capacity, under the current OPEC+ agreement which has Saudi oil production approximately 3 million bpd below its maximum sustainable capacity.

The Energy Minister also expressed criticism of the International Energy Agency’s decision to release oil from emergency reserves following Russia’s invasion of Ukraine, questioning the lack of appreciation for countries that maintain emergency oil capacities.

Despite adjustments in production targets and the anticipated energy transition, Nasser predicts an increase in oil demand, projecting a rise to 104 million bpd in the current year and further to 105 million bpd by 2025.

This forecast suggests a continued reliance on oil in the near term, despite the global shift towards renewable energy sources.

Friday, February 16, 2024

Thursday, February 15, 2024

Monday, February 12, 2024

Some Service Members Say They Were ‘Coerced’ Into Taking COVID-19 Vaccine: Survey

In an independent survey conducted by the author last fall, 229 individuals currently serving in the U.S. military voluntarily participated by responding to a multitude of questions. Results helped to reveal the difficulties faced by some members of the U.S. Armed Forces who were confronted by Defense Secretary Lloyd Austin’s August 2021 military vaccine mandate.

Part of the anonymous questionnaire addressed the COVID-19 vaccine status of the participating service member, various details about the now-rescinded military vaccine mandate, as well as the deliberate coercion faced by many who opposed it.

All branches of the military as well as enlisted and officer ranks responded to the survey. Survey participants served in the military for an average of about 16 years.

Out of the 229 participants, 169 were active duty service members. Eighty-seven percent, or 199, were unvaccinated against COVID-19. Of the 30 who were vaccinated, only two said they had wanted to do it.

Twenty out of 30 individuals who admitted taking the vaccine claim they were injured by the vaccine. Ninety-three percent of the participants said they know someone they believe has been injured by the COVID-19 vaccine.

Coercion

Officer Alvin Johnson (a pseudonym) is a 20-year combat veteran of the Army with multiple deployments around the world. He opposed the COVID-19 vaccine that was once-mandated by the Department of Defense (DOD) in August 2021.“I’m not a lab rat and neither are the people I work with,” he told The Epoch Times.

Officer Johnson was one of the 227 participants who believe the COVID-19 vaccine should not have been mandated. Approximately 95 percent said the mandate was unlawful.

“While holding out [from taking the vaccine], I was forced to wear a mask and was often singled out for being unvaccinated,” Officer Johnson said. Bringing these concerns to his command, “I was simply told: ‘I don’t make the rules.’” Threats that would negatively impact his personal life and career soon followed.

Without the vaccine, Officer Johnson would have been prohibited from coming home to see my family. At the time, his wife was at risk of a serious medical concern that could require his presence at a moment’s notice. “You can see I had no choice but to take the shot,” he said. “At the same time I would be prevented from being my wife, my orders to deploy were also being threatened.”

Like Officer Johnson, over 72 percent of survey participants also said they were “coerced” into receiving the COVID-19 vaccine and/or boosters. Nearly 95 percent of those who objected to the vaccine said they faced reprisals, including verbal threats of punitive legal action, loss of promotion, and exclusion from career enhancing schools.

Officer Johnson reluctantly took the first round of the COVID-19 vaccine at a local pharmacy chain store.

After the August 2021 mandate was rescinded in January 2023, and having received the vaccine, Officer Johnson still faced roadblocks to his career advancement. “With a General Officer Memorandum of Reprimand (GOMOR) in my record for initially refusing the vaccine, I was not promoted to a higher rank,” he said.

“Even though I have since taken the vaccine, I’m losing month income and hundreds of thousands of dollars over my lifetime in retirement pay for not being able to promote.” Almost half of the participants in the survey said they were also “financially harmed by non-compliance with the COVID-19 vaccine mandate.”

Officer Johnson said he knows others in a similar predicament, including some who were forced to retire or separate from the Army long before finishing their career. Nearly 90 percent of the survey’s participants said they know someone who was separated or forced to leave military service because of the COVID-19 vaccine mandate.

Calls For Accountability

Master Sergeant Asher Grove (a pseudonym) has served in the Air Force for nearly 20 years. While investigating the COVID-19 vaccine, he said adverse risks that might have been associated with the drug were never made available to service members.According to the survey, only three percent were informed by qualified medical personnel of known risks associated with the COVID-19 vaccine, including damage to reproductive health for females and increased risk of heart disease.

With past immunizations, he was given “a fact sheet,” he said. With a pre-existing health concern and guidance from God, he was adamantly opposed to the COVID-19 vaccine.

With the denial of both religious accommodation and medical exemption requests, Master Sgt. Grove said he was “slapped with a letter of reprimand.” According to him, “this was the only real coercion I faced, that I’d get continue to get in trouble for taking objection to the vaccine.”

“DOD leaders should be held accountable in the manner [the mandate] was enforced,” he said. All 229 participants of the survey agreed to this proposition.

“Trust in leadership suffered greatly when people were forced to do something they should have never been forced to do,” he said.

“Having witnessed so many people oppose the vaccine for religious concern and more, I was able to witness the greatest battle I’ve seen in my life,” Master Sgt. Grove said. “It wasn’t a battle fought on a foreign field, but it was a battle against good and evil in our own country.”

For him, the rescission of the vaccine mandate in January 2023 was “a step in the right direction, but more needs to be done so this never happens again.”

The Department of Defense, Department of the Army, and Department of the Air Force didn’t respond by press time to requests by The Epoch Times for comment

Friday, February 9, 2024

Thursday, February 8, 2024

Wednesday, February 7, 2024

Tuesday, February 6, 2024

Monday, February 5, 2024

Friday, February 2, 2024

Verdict Delayed in Trump Civil Fraud Trial as Judge Engoron Weighs Lifetime Business Ban

The verdict in former President Donald Trump’s civil fraud trial in Manhattan that could see him banned for life from doing business in New York has been delayed until mid-February, according to a court spokesperson.

After the tentative Jan. 31 deadline came and went without a verdict, the spokesperson for the New York State Office of Court Administration, Alfred Baker, said that the judge is now expected to deliver his decision in early to mid-February.

Mr. Robert also questioned the monitor’s competency, alleging “numerous factual inaccuracies” in her report, which he characterized as “misleading and disingenuous.”

He argued that the errors cited by the monitor have been blown out of proportion and that every item she identified had been fully resolved.

“The Monitor now twists immaterial accounting items into a narrative favoring her continued appointment, and thereby the continued receipt of millions of dollars in excessive fees,” Mr. Robert argued.

Ms. Jones did not immediately respond to a request for comment on the Trump attorney’s claims.

The Trial

The trial centers on allegations that the former president and his company, The Trump Organization, defrauded banks, insurers, and others by allegedly overvaluing his assets and exaggerating his net worth in documents used in deals and to secure loans.The case was brought by New York Attorney General Letitia James, who initially wanted to fine the former president $250 million but later increased this to $370 million.

Ms. James, a Democrat, has requested a broad range of penalties against President Trump, including a $370 million disgorgement and a permanent ban on his doing business in New York state and with any New York-based financial institution.

Recently, Ms. James’s office provided Justice Engoron with a “notice of supplemental authority,” basically a newfound legal precedent, to bolster her call for a Trump business ban.

While it’s unclear how the judge will weigh the notice, even before the start of the trial he ordered the immediate cancellation of President Trump’s business certificates and the dissolution of his LLCs.

However, that order was paused by an appeals court for at least the duration of the trial after the defense argued it would suddenly cast hundreds of Trump Organization employees’ livelihoods into disarray.

The former president has denied any wrongdoing and has claimed that the case is a politically motivated plot to undermine his 2024 White House run. He is the front-runner by far for the Republican presidential nomination.

Thursday, February 1, 2024

Traders divert Russian oil products around Africa to avoid Red Sea -sources, LSEG

Reporting by Reuters; Editing by Bernadette Baum

Vale cranks up iron mining just as demand concerns resurface

https://www.mining.com/web/vale-cranks-up-iron-mining-just-as-demand-concerns-resurface/

World No. 2 iron ore supplier Vale SA delivered a bigger-than-expected increase in production last quarter in a result that may undermine prices of the key steelmaking ingredient.

The Brazilian mining giant is accelerating production, posting its best December in five years, after investing in its prized Amazonian operations and improving performance at its oldest mines in the country’s southeast. Production was up from both a year ago and the previous three months, with full-year output ahead of guidance.

Sign Up for the Iron Ore Digest

The bumper haul may generate some headwinds for the iron ore market, which has been fairly resilient to a slowdown in China, the biggest buyer. Prices have rallied by more than a third since mid-August, leading some analysts to forecast a decline in 2024. Still, top producer Rio Tinto Group sees increased stimulus fueling a gradual recovery in China.

Vale produced 89.4 million metric tons last quarter, easily beating the 83 million-ton average estimate among analysts tracked by Bloomberg. In a statement Monday, the Rio de Janeiro-based firm reiterated its 2024 guidance.

While production was strong, shipments came in slightly below estimates and premiums for high-grade products shrank. Vale shares fell as much as 2.6% in New York Tuesday as renewed concerns over the real estate crisis in China pushed down iron ore prices.

Vale is also a major nickel producer and a significant supplier of copper. It saw nickel output slip 5.3% from a year ago, while copper production jumped about 50%. A slump in nickel prices is stress-testing producers worldwide, raising the prospect of investment delays and production curtailments, with miners including BHP Group and First Quantum Minerals Ltd. halting some operations.

In an e-mailed response, Vale said it continues to believe in long-term nickel fundamentals driven by rising energy transition demand and moving ahead with projects. Its realized price last quarter was 7% higher than futures prices.

The sharp drop in nickel prices may prompt some closing of high-cost shafts, with the business unit close to breakeven in the fourth quarter and in the red at current prices, BI senior analyst Grant Sporre wrote in a research note.

Vale, which is set to report earnings on Feb. 22, is enduring leadership tensions amid pressure from Brazil’s government to make changes as the board prepares to decide whether to retain Eduardo Bartolomeo as chief executive officer or seek a replacement.

(By Mariana Durao)