https://www.mining.com/gold-price-hits-weekly-high-on-middle-east-tensions/

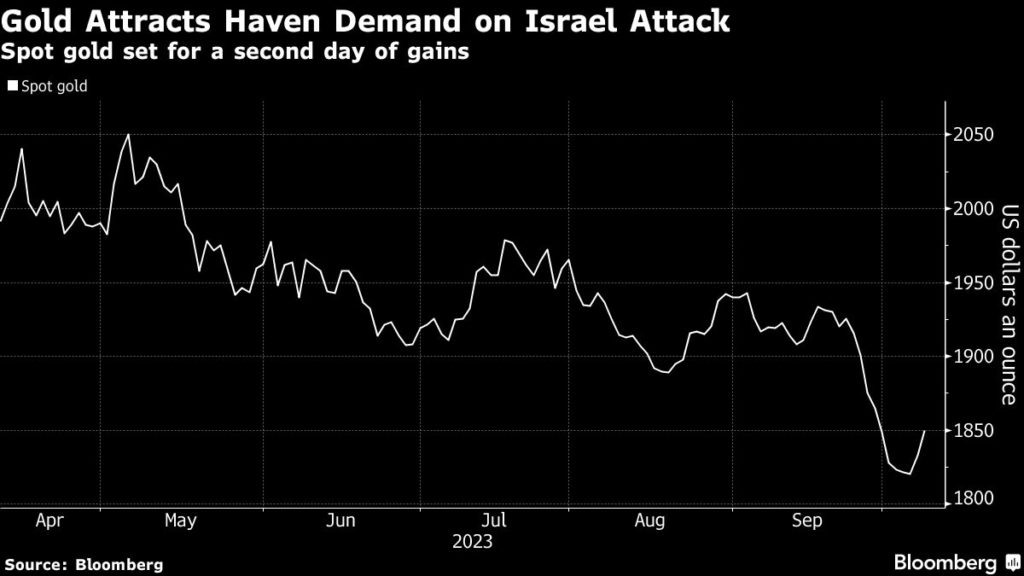

Gold prices rose the most since July on Monday as safe haven demand soared after tensions ramped up in the wake of the Hamas attack on Israel.

Spot gold gained 1.0% to $1,850.26 per ounce by 1 p.m. EDT, its highest since Sept. 29. US gold futures were also up 1.0%, trading at $1,863.60 per ounce in New York.

[Click here for an interactive chart of gold prices]

The precious metal had risen as much as 1.2% earlier in the session before paring some of the gains as financial markets braced for headwinds and volatility from the shock attack by Gaza militants.

Oil surged as the conflict threatened to inflame tensions in the Middle East, home to almost a third of global supply. The US dollar also strengthened.

“While the sudden crisis in Israel has added a small premium to gold, bigger gains will only come if there is a much more substantial escalation across the region,” David Lennox, an analyst at market research firm Fat Prophets, told Bloomberg News.

Bullion started to rally on Friday after last week approaching its lowest level since March, when it was impacted by signals from the Federal Reserve that it would keep monetary policy tight.

The tensions in the Middle East may mean that the Federal Reserve will not “continue to hike rates into increased uncertainty, and the prospect for peak rates have suddenly move closer despite the potential inflationary impact of higher oil prices,” said Ole Hansen, head of commodity strategy at Saxo Bank A/S.

“We conclude that this development could signal a low in the gold price and as the attention turns to rate cuts instead of hikes it may receive additional demand from investors.”

Hedge fund managers trading Comex futures have flipped to a net short position for the first time in 11 months, while investors in exchange-traded funds have continued to sell the metal.

(With files from Bloomberg)

No comments:

Post a Comment