Tuesday, October 31, 2023

Monday, October 30, 2023

US Supreme Court Rejects Challenge to Trump's Steel Import Tariffs

The U.S. Supreme Court on Oct. 30 rejected a challenge from a manufacturer to tariffs on steel imports that were created by former President Donald Trump and have been kept in place by President Joe Biden.

The justices declined to hear PrimeSource Building Products' appeal of a lower court decision that upheld a 25 percent tariff on imports of steel derivatives.

The court did not explain its decision.

PrimeSource's lawyers did not immediately respond to a request for comment.

The tariffs were adjusted in 2020 to include some steel derivatives, such as nails.

The original orders followed the law because they came after officials found a threat to national security, but the expansion did not because it came years later without a fresh finding of a threat, Texas-based PrimeSource, a nail importer, has argued.

Tariff Laws

Under the law, the president must decide within 90 days of receiving a report from the secretary of commerce whether he agrees with the recommendations and has another 15 days beyond that to impose tariffs.Then-Commerce Secretary Wilbur Ross found in a 2018 report that “domestic steel production is important for national security applications” and that steel imports were on track to account for more than 30 percent of domestic consumption. He also determined that “excessive quantities of imports has the effect of weakening the internal economy of the United States, threatening to impair the national security.”

The New York-based U.S. Court of International Trade struck down the steel derivatives tariffs in 2021, saying the White House missed statutory deadlines to impose them.

The expansion "does not comply with the limitation on the President’s authority imposed by the 105-day time limitation" of the law, U.S. trade Judge Timothy Stanceu, appointed under President George W. Bush, said in the ruling.

But the Washington-based U.S. Court of Appeals for the Federal Circuit in February reversed that decision, citing its own 2022 ruling that presidents are authorized to impose "contingency-dependent" tariff increases to fulfill their original national security objectives, if those objectives remain valid.

President Trump created the 2020 tariffs to "close a loophole exploited by steel-derivatives importers ... to address a specific form of circumvention," U.S. Circuit Judge Richard Taranto, appointed under President Barack Obama, wrote in the federal circuit's decision.

PrimeSource was among the companies urging the Supreme Court to review the decision, saying the expansion of the tariffs implicated how Congress delegates power and warranted "special separation of powers scrutiny."

"One might think that courts would strictly construe the statutory conditions on such extraordinary delegations lest the judiciary permit an even greater injury to separation of powers than Congress intended," the company said in a petition to the nation's top court. "But the federal circuit applies the opposite rule, deferring to the executive’s view of the statutory limits on its own authority unless it is clearly wrong."

President Biden's administration defended the tariffs, telling the Supreme Court a review was not necessary because the appeals court decision does not conflict with any decisions from another appeals court.

Government lawyers pointed out that after then-President Dwight Eisenhower adjusted tariffs on oil imports in 1959 after receiving a report from the secretary of commerce, dozens of adjustments to the tariffs were made over the next 16 years without any new reports. The Office of the Attorney General has said in the past that Section 232 of the Trade Expansion Act “contemplate[s] a continuing course of action, with the possibility of future modifications.”

"Section 232’s deadlines do not restrict the president’s power to adopt such amendments," Biden administration attorneys said in a brief to the Supreme Court. "The relevant statutory provisions set deadlines for 'the adoption and initiation of a plan of action or course of action,' not for 'each individual discrete imposition on imports.'"

PrimeSource appealed to the Supreme Court in July. Oman Fasteners, another company challenging the tariffs, filed a separate appeal on Oct. 20 that is currently pending.

The Supreme Court in March turned away a challenge to the 2018 tariffs by a group of U.S.-based steel importers. The justices in 2022 refused to hear a separate challenge by steel companies to President Trump's 2018 decision to double tariffs on steel imports from Turkey, also on national security grounds.

COVID-19, Flu Vaccines Taken Together Linked to Stroke Risk

A growing number of studies indicate people are at higher risk of stroke if they receive COVID-19 and influenza vaccines at the same time, though other papers have not found an elevated risk.

The link between the vaccines and stroke, according to authorities, is not yet proven, but some experts say the papers boost the position of spacing out shots to reduce the risk of side effects.

“Oftentimes, we suggest if you want to minimize the chance of interactions and minimize confusing side effects from one with another, you wait about two weeks between the vaccines," he said.

Dr. David Boulware, an infectious disease expert at the University of Minnesota Medical School, told The Epoch Times in an email that he generally recommends receiving the COVID-19 and influenza vaccines on separate occasions "so as to not have one vaccine blunt the response of the other."

Uncertainty

Other papers have found no elevated risk for the COVID-19 vaccines and stroke, including a study in England that examined simultaneous COVID-19 vaccination and influenza vaccination. The COVID-19 vaccines analyzed in the study were versions never administered in the United States."Available data do not provide clear and consistent evidence of a safety problem for ischemic stroke with bivalent mRNA COVID-19 vaccines when given alone or given simultaneously with influenza vaccines, or when influenza vaccine is given alone," Dr. Tom Shimabukuro, a CDC vaccine safety official, told a panel of the agency's advisers on Oct. 25 as he went over the papers from the FDA, Kaiser Permanente, and England.

The researchers that have found an elevated risk say further research is required to validate the signals.

"The potential association between bivalent COVID-19 vaccination and ischemic stroke .... warrants further investigation among individuals," the Kaiser Permanente researchers said in their preprint paper.

The self-controlled case series only examined stroke incidents among vaccinated people. The researchers compared the incidence of stroke in people the first 42 days after vaccination with the incidence in the same people in the time beyond that.

They identified 373 strokes within 42 days of bivalent vaccination and 1,511 after 42 days.

The elevated risk was found among people younger than 65 who received a Pfizer or Moderna vaccine, had a history of COVID-19, and received an influenza vaccine at the same time.

An elevated risk was also found among the same age group in people who received Pfizer's shot with an influenza shot and did not have a history of COVID-19, and people who received Moderna's shot, had a history of COVID-19, and did not receive an influenza vaccine concomitantly.

The FDA researchers also conducted a self-controlled case series among Medicare beneficiaries, excluding unvaccinated people. They used risk intervals within 42 days after vaccination and a control interval of 43 to 90 days after a shot.

The researchers identified elevated risks of non-hemorrhagic stroke and non-hemorrhagic stroke/transient ischemic attack among Pfizer recipients 85 and older, and non-hemorrhagic stroke/transient ischemic attack in Moderna recipients aged 65 to 74.

There was also an increased risk of non-hemorrhagic stroke among all recipients, who are 65 and older, 22 to 42 days after concomitant high-dose/adjuvanted influenza and Pfizer vaccination, and an elevated risk of transient ischemic attack one to 21 days after concomitant high-dose/adjuvanted influenza and Moderna vaccination.

Dr. Boulware, who was not involved in the research, said he'd like to see the findings replicated by other researchers.

The

FDA researchers said that their study did not alter the agency's

position that the benefits of the COVID-19 outweigh their risks in the

elderly, but did indicate a "need for additional investigations" into

the safety of high-dose/adjuvanted influenza vaccines. The Australian

researchers said their study supported coadministering Pfizer's vaccine

with an influenza vaccine.

Gov. Hochul unveils new guidance for N.Y. law enforcement agencies

STATEN ISLAND, N.Y. — Gov. Kathy Hochul announced new law enforcement guidelines this week for cops responding to domestic violence incidents.

What the governor’s office calls the “Law Enforcement Domestic Incident Model Policy,” seeks to center domestic violence victims by assessing how much danger their in, particularly as it relates to possible firearms in the house and the state’s red flag law.

That law prevents individuals who show signs of being a threat to themselves or others from purchasing or possessing any kind of firearm, and requires someone bring a petition before the block goes into effect.

“I’m committed to leading an administration that treats survivors with dignity and respect,” Hochul said. “This is personal to me: my mother was a lifelong advocate for victims of domestic abuse, and our family founded a transitional home for survivors in Western New York.”

The new protocols give law enforcement guidance on how best to determine if a domestic violence response might warrant an extreme risk protection order, which is needed to put the red flag law into effect.

Under the protocols, police officers would be required to file a domestic incident report whether or not an offense occurred, or an arrest is made, limit their use of body-worn cameras if a victim requests, and notify vitcims of the available legal mechanisms to obtain orders of protection along with custody and housing assistance.

Additionally, the governor also announced a new $1 million investment to expand the use of the state’s red flag law through training and technical assistance for community-based organizations potential extreme risk protection orders petitioners.

In 2022, Hochul signed an expansion to the red flag law that requires law enforcement, medical and mental health providers, and select education staff to petition the court if they determine a person is a risk to themself or others.

Furthering the state’s efforts against domestic violence, the governor signed legislation requiring the State Office for the Prevention of Domestic Violence to distribute informational materials on economic abuse.

New York State’s Domestic and Sexual Violence Hotline provides free, confidential support 24/7 and is available in most languages: 800-942-6906 (call), 844-997-2121 (text) or @opdv.ny.gov (chat). Individuals also can visit OVS Resource Connect to find a victim assistance program in their community.

More from the governor's offcie

- Some New York families will receive $100 payments in the mail; here’s why

- New York employers can no longer access private social media of workers, applicants under new law

- Hundreds of construction and long-term jobs to be added to Staten Island shipping terminal as new tenant invests $200M+

- New York opens applications for $500 million in child-care grants

- Gov. Hochul warns against price-gouging scams in NY following upstate flooding

The world’s iron ore powerhouse is preparing to reinvent itself

https://www.mining.com/web/the-worlds-iron-ore-powerhouse-is-preparing-to-reinvent-itself/

Vast heaps of crushed brown rock hem the Indian Ocean at Western Australia’s Parker Point port — each a stockpile of 200,000 tons of iron ore, ready to be poured into a procession of bulk carriers bound for Asia’s steel mills.

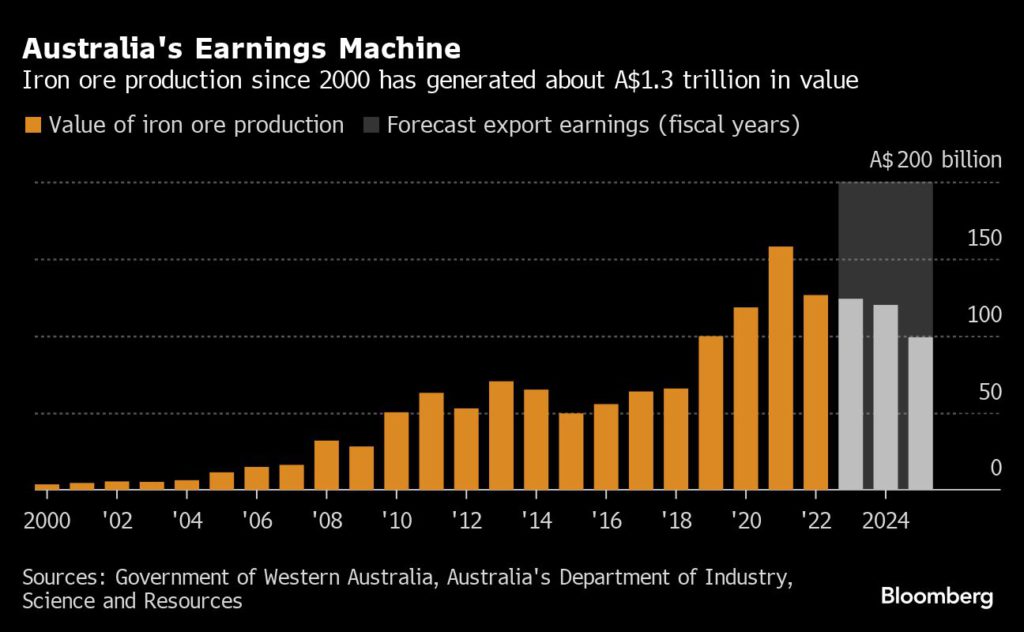

Rio Tinto Group, the world’s largest iron ore producer, shipped its first cargo of the steelmaking ingredient from this spot in 1966, at the dawn of a boom that minted billionaires and lifted the Australian economy, generating A$1.3 trillion ($820 billion) in earnings in the past two decades alone. Last year, iron ore shipments accounted for about 5% of the country’s gross domestic product.

Sign Up for the Iron Ore Digest

But now China is cooling, while steel producers are under pressure to clean up a sector that accounts for at least 7% of global greenhouse gas emissions, a change that will require new methods and higher-quality raw materials. Much of the dry, dusty Pilbara region’s gargantuan resource base may no longer make the grade.

Rio, BHP Group Ltd. and Fortescue Metals Group Ltd. produce almost two-thirds of the world’s seaborne iron ore from Western Australia, and margins remain enviable. For the first time in a generation, though, the specter of disruption looms over mining’s most reliable profit generator.

“Australia’s ore industry is now at the start of a long-term structural decline,” said Tom Price, a London-based analyst at Liberum Capital Ltd. “It’s a fundamental shift that will resonate across the Australian economy.”

The first, and most urgent, question is China, which accounts for about 85% of Australia’s export earnings from iron ore.

Demand for steel in the second-biggest economy has plateaued and production is on track to peak before the end of the decade, dented by a years-long crisis in China’s property sector, which has typically consumed more than a third of the country’s steel output. While there’s some growth in smaller segments like manufacturing of electric cars and air conditioners, the economy is no longer building at breakneck speed, meaning the nation’s iron ore imports are forecast to decline. Impact is inevitable, even if other emerging nations make up for some of China’s lost appetite.

Still, the more intractable long-term challenge for the Pilbara’s giants may well be a green one.

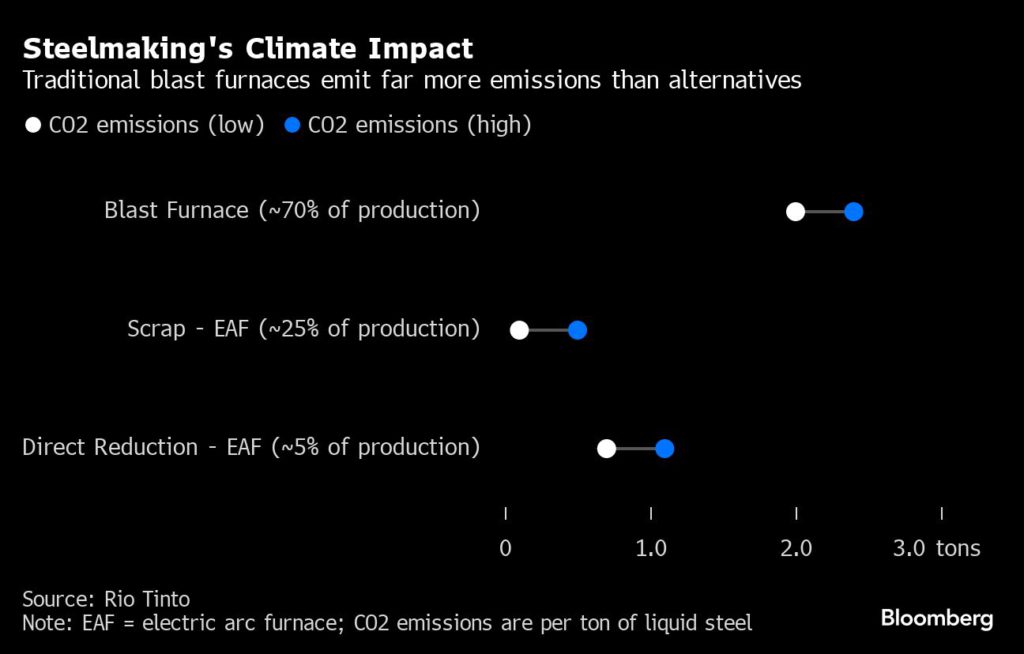

At least 70% of steel is produced today using a process that’s been deployed in much the same way since the 14th century: metallurgical coal is heated to create coke, which is then used in a blast furnace to melt iron ore at temperatures of more than 1800C.

It’s an energy-intensive activity and one that produces about two tons of carbon dioxide for each ton of liquid steel, according to Rio.

Global demand for steel is still rising, and will climb by as much as a quarter through 2050, as India and developing economies across Asia industrialize — but investor, consumer and climate pressure on one of the dirtiest corners of industry is growing. Governments are acting too, with policies like the European Union’s carbon border adjustment mechanism, that penalizes carbon-heavy imports.

The trouble for big diggers is that there are few attractive alternatives. Existing lower-emissions options include the use of electric arc furnaces — a method that doesn’t require coal and uses recycled steel scrap in place of iron ore. A shaft furnace route, deployed in about 5% of steel production, needs high grade pellets with low levels of impurities.

Among the most favored prospective solutions is to combine a renewables-powered electric furnace with direct reduced iron, a material produced by deploying natural gas to remove oxygen from premium ores. Eventually replacing the gas with green hydrogen — created using solar or wind energy — could dramatically cut steel emissions.

But Australia’s typical iron ore has a grade of between 56% and 62%, making it largely unsuitable for DRI production — or only with additional processing that could add as much as 25% to costs, according to Wood Mackenzie Ltd.

“The premium for higher grade material is going to increase significantly,” said David Cataford, chief executive officer of Champion Iron Ltd., a competitor to Australian producers which supplies higher-grade iron ore from Canada. “If you’re producing lower grade, we do feel it’s going to be more complicated in the medium-term.”

The biggest miners say they already produce the better stuff. Vale SA, which ships higher-quality raw material from Brazil and expects to command a green premium in future, is among those eager to forecast a world that favors richer ores. But higher-grade production — with an iron content of 66% or more — currently makes up only about 3% of global supply, so the race is on to crank up output from projects like the expansive (and expensive) Simandou development in Guinea, in which Rio is an investor.

“There’s an obvious shortage if demand ramps up during the course of decarbonization,” said Liu Yinghao, technical director at the low carbon metallurgy innovation center of China Baowu Steel Group Corp., one of the world’s top steelmakers.

The shortfall in higher grade iron ore could be as much as 200 million tons a year by 2050, Wood Mackenzie estimated in a report this month — a volume roughly equivalent to about a fifth of China’s current annual imports.

To plug the gap and hold on to their position in the market, Australia’s iron ore producers are experimenting with everything from microbes to straw, in a series of trials aimed at making their materials suitable for greener steelmaking. BHP is studying use of carbon capture technology at conventional steel mills and has a pilot with Hatch Ltd. to build an electric smelting furnace — a method that adds an additional process step and holds potential to utilize lower-grade raw material.

“If we can crack the code on the Pilbara ores, that is potentially a game changer,” Tania Archibald, chief executive for Australian steel products at BlueScope Steel Ltd. — among 40 entities collaborating with Rio — told an investor day last month.

Billionaire Andrew Forrest’s Fortescue, meanwhile, has begun production of small volumes of high-quality magnetite ore at its Iron Bridge project in the Pilbara, and has tested a coal-free electrolysis method to convert ore to green iron.

Forrest sees potential to go further than that intermediate step, and to use Australia’s advantages in renewable energy for a low-carbon revival of a domestic steelmaking sector that saw output peak a quarter of a century ago.

“Australia has got everything going for it to make its own steel,” Forrest said earlier this month in Perth, citing the country’s solar and wind resources, and potential to produce green hydrogen. “The policies right now channel against doing that — and encourage offshore production.”

Steelmakers are positioning for that shift, including South Korean giant Posco, which aims to develop new industrial facilities in Port Hedland, the Pilbara’s export hub.

Few changes come fast in mining. Australia’s iron ore incumbents say they have sufficient time to make the technology breakthroughs or strategy shifts they need to continue to prosper.

“The transition away from coal-based steel making is a reality, but it will take some time and there remain significant uncertainties,” said Simon Farry, Rio’s head of steel decarbonization.

After all, traditional blast furnaces in Asia are relatively new — on average about 12 years old in China, compared to more than 40 years across the mostly wealthy nations in the Organisation for Economic Co-operation and Development — and will operate for decades more, according to BHP’s Chief Economist Huw McKay. “The age of capital stocks is a critical factor in assessing the energy transition,” he told Bloomberg Television in an Oct. 24 interview. India will likely to prioritize the need for affordable steel from existing processes, he said.

But several markets are already adapting quickly, including Japan, South Korea, and — to a more limited extent — China, as Vale said in a written response to questions. Iron ore’s No. 2 supplier is adding output tailored to direct reduction in Brazil, and developing hubs in locations including Saudi Arabia, the United Arab Emirates and Oman to produce materials from as soon as 2027 for future green steelmaking.

Australia’s mining industry has been caught out before by the pace of change. Back in the early 2000s, it struggled to keep up with China’s accelerating iron ore consumption. Now, the risk is repeating the error at the other end of the economic and green cycle.

“The world is going to decarbonize,” Vale said. “If we don’t act quickly, we could miss this opportunity.”

(By David Stringer)

US Halts Exports of Most Civilian Firearms for 90 Days

https://www.theepochtimes.com/us/us-halts-exports-of-most-civilian-firearms-for-90-days-5518951

The United States has paused the approval of new export licenses for most civilian firearms and ammunition sold to all non-governmental users for 90 days, the Commerce Department said late Friday, citing national security and foreign policy interests.

The decision includes most semiautomatic and non-automatic firearms, shotguns, and optical sights.

The Commerce Department is also reviewing its support of the country’s biggest gun trade show to ensure it “does not undermine US policy interests.”

“The review will be conducted with urgency and will enable the Department to more effectively assess and mitigate risk of firearms being diverted to entities or activities that promote regional instability, violate human rights, or fuel criminal activities,” the department said in its announcement.

The Commerce Department gave no further details about the motivation behind the decision, nor whether long-term changes could be expected in the future.

The halt covers most of the guns and ammunition that could be purchased in a U.S. gun store, said Johanna Reeves, a lawyer who specializes in export controls and firearms with the law firm Reeves & Dola in Washington.

Ms. Reeves said she had not seen the Commerce Department take such a sweeping action like this before. “For sure they have individual country policies—but nothing like this,” she said.

U.S. companies that sell firearms, including Sturm Ruger & Co., Smith & Wesson Brands, and Vista Outdoor, could be impacted by the export ban. Overseas customers include distributors and stores that sell firearms.

The freeze doesn’t apply to Israel, Ukraine, and several close allies that signed a multilateral export-control agreement with the United States. Nevertheless, the pause targets some of the biggest export markets for American gunmakers, including Brazil, Thailand, and Guatemala.

Exporters can continue to submit license requests during the pause, but they will be “held without action” until the pause is lifted.

The pause does not affect previously issued export licenses, the Department of Commerce said.

In 2020, the oversight of most commercial gun exports was transferred from the State Department to the industry-friendly Department of Commerce, which has for a decade now been a strong supporter of the Shooting, Hunting and Outdoor Trade (SHOT) Show, an international gun expo that occurs every January in Las Vegas.

Legislation against the illicit trafficking of civilian firearms was introduced in December by Rep. Joaquin Castro (D-Texas), Rep. Norma Torres (D-Calif.), then-Rep. Albio Sires (N.J.), and others. According to Mr. Castro, the Americas Regional Monitoring of Armed Sales (ARMAS) Act seeks to disrupt firearms trafficking from the United States to Latin America and the Caribbean by implementing stronger transparency, accountability, and oversight mechanisms for U.S. small arms exports.

“Violence and insecurity continue to drive migration to the United States. If we fail to implement strict monitoring and take responsibility for the illicit use of American exported weapons, the result will be more of the same,” Mr. Sires said.New York state has spent over $316M in 6 months on emergency funding related to migrant crisis

STATEN ISLAND, N.Y. — New York state has spent hundreds of millions of dollars in emergency funding related to the migrant crisis over six months, state Comptroller Tom DiNapoli’s office announced on Friday.

The state used $316.2 million between April 1 and Sept. 30, according to a report released by the comptroller. The report stated the massive figure only includes spending specifically coded by agencies as spending related to asylum seekers.

As noted in the report, Gov. Kathy Hochul indicated additional spending is anticipated.

New York City, according to Spectrum News NY1, has spent $2 billion on asylum seekers. The majority of spending went toward the Departments of Homeless Services and Social Services for emergency shelter costs, followed by payments to NYC Health + Hospitals to operate humanitarian emergency response and relief centers and a central intake center, the comptroller’s report stated. According to NY1, the city’s spending on asylum seekers is expected to grow to $12 billion over three years.

As of Oct. 26, there were 65,300 asylum seekers in city care, the Mayor’s Office of Immigrant Affairs announced on Saturday. Since the spring of 2022, the agency added, 133,400 asylum seekers have gone through the city’s intake system.

This week, Hochul extended her executive order declaring a state of emergency in response to the influx of migrants. The order continues to allow the state to mobilize members of the National Guard, who currently provide logistical and operational support at shelter sites; allow the state and localities to quickly purchase necessary supplies and resources, including food and equipment; and gives the state more flexibility in providing municipalities with support.

“While New York continues to respond to the asylum seeker crisis, I’m extending our State of Emergency to ensure communities have the resources needed to support our ongoing efforts,” Governor Hochul said. “My administration remains committed to ensuring state and local officials have all of the support they need to address this unprecedented humanitarian crisis.”

Earlier this month, Hochul announced the state has identified more than 18,000 job openings with nearly 400 employers who are willing to hire migrants and asylum seekers who have attained legal work status in the United States.

More on the Migrant Crisis

- NYC offering migrants free, one-way plane tickets to anywhere in the world, says report

- New York state has spent over $316M in 6 months on emergency funding related to migrant crisis

- Elected officials, local residents call for action after alleged illegal driving incidents linked to migrant shelters

- Island Shores migrant shelter plagued by protesters flashing lights, loud music, blaring megaphones

- They put family first: Facing misery or death, these migrants say they had to flee

Friday, October 27, 2023

Saudi Arabia is serious about its Jan. 1 deadline for companies to move regional headquarters to Riyadh — or lose out on government contracts

- In a bold surprise move back in February 2021, the Saudi government announced that it would, by 2024, cease doing business with any international companies whose regional headquarters were not based within the country.

- The news stunned investors and expat workers, many of whom saw the move as a shot at Dubai, the UAE commercial capital that is home to the highest concentration of Middle East regional headquarters.

- Saudi Arabia's economy minister told CNBC how the kingdom is working to support companies making the move.

RIYADH — Saudi Arabia is holding on to its ultimatum that foreign companies will need to base their regional headquarters in the kingdom or be barred from lucrative government contracts. The deadline: Jan. 1, 2024.

In a bold surprise move back in February 2021, the Saudi government announced that it would, by 2024, cease doing business with any international companies whose regional headquarters were not based within the country.

The news stunned investors and expat workers, many of whom saw the move as a shot at Dubai, the United Arab Emirates commercial capital that is home to the highest concentration of Middle East regional headquarters.

Faisal Al Ibrahim, Saudi minister of economy and planning, told CNBC that the plan is still going ahead and discussed how the kingdom aims to support foreign companies with the change.

When asked by CNBC's Dan Murphy if the deadline is still in place, Al Ibrahim replied "Yes. And when you move, there are some benefits and some incentives that will make that make sense."

The minister was speaking from Riyadh at the Future Investment Initiative, an annual three-day finance and investment conference hosted by Saudi Arabia's Public Investment Fund and a brainchild of the Vision 2030 project.

"There's a slew of incentives and benefits and support that's always changing, always evolving, that are being discussed with these players as well," Al Ibrahim said. "So it's not just a negative reinforcement. There's a lot of positive reinforcement as well."

'A lot of momentum'

Vision 2030, an ambitious campaign launched by Crown Prince Mohammed bin Salman in 2016, aims to create private sector jobs and diversify its economy away from oil as as Saudi Arabia's population — more than 60% of whom are under the age of 30 — booms. The kingdom's regional HQ drive is a part of that.

When first announced, the HQ ultimatum engendered skepticism and criticism on the part of many regional investors and analysts, who questioned the ability of Saudi Arabia — an infamously conservative Muslim theocracy known for its highly criticized human rights record — to sufficiently attract foreign talent. Expats in the regional HQ hub of Dubai questioned the kingdom's ability to provide sufficient quality-of-life services like international schools, ample housing, and aspects of a more Western lifestyle, such as alcohol, which is currently illegal in Saudi Arabia.

But as more companies eye Saudi Arabia's large and relatively untapped market, the kingdom is receiving plenty of interest and rapidly growing investment, Al Ibrahim said. The presence of several thousand foreign investors and financiers from all over the world at the week's FII conference in Riyadh appeared to be a good gauge of that interest.

"We're seeing a lot of momentum going through, we definitely prioritize the companies that are bringing the value creation to where the value is consumed, that create high quality jobs for people in Saudi Arabia, Saudis and others, and that actually help us achieve our quality outcomes from our needs, whether it's services or goods at a better and more meaningful way," the minister said, adding that the kingdom is receiving daily applications.

"[The companies'] responses are very meaningful and very positive," he described. "For decades, our value has been leaking to other economies, which is fine. But today, the bet that the best for [35 million] and growing in terms of population is to bring the value creation to where the value is consumed," he said.

"And in the long term, that's better for these investors, these operations as they move, they can get closer to these markets. And they can leverage the young talent that's available in Saudi, Saudi talent, and leverage the rest of the platform for them to even grow more competitively to other regions. We think ultimately, this is not just about Saudi Arabia, improving its position and procurement policy, but also it will have a strong trickle down effect on these companies and the economies around us."

The World Bank forecasts an economic contraction of 0.9% for Saudi Arabia in 2023 on the back of lower oil production and prices. But the International Monetary Fund notes strong non-oil growth for the kingdom, which it says has accelerated since 2021, "averaging 4.8 percent in 2022," and is expected to "remain close to 5 percent in 2023, spurred by strong domestic demand."

China Providing Iran With Infrastructure Investments in Exchange for Oil

An oil tanker is pictured off the Iranian port city of Bandar Abbas on April 30, 2019. (Atta Kenare/AFP via Getty Images)

China’s communist leadership may be laundering money for Iran through the purchase of crude oil and bartered deals, Congress has heard.

The Chinese Communist Party (CCP) “has provided an economic lifeline” to Iran as it supports Islamic terror organizations, said Gabriel Noronha, a fellow at the Jewish Institute for National Security of America think tank.

The effort, he said, is vital to Tehran’s efforts to insulate itself from the effects of U.S.-led sanctions.

Related Stories

“The Iranian regime is seeking to isolate itself from U.S. and Western sanctions by deepening economic ties with Russia and China,” Mr. Noronha said in his written testimony to the House Financial Services Committee on Oct. 26.

Chinese Companies Buying Iranian Oil

Iran’s economic partners have come under scrutiny following a deadly attack in Israel by the Tehran-backed Hamas earlier this month.The Islamist regime in Tehran, Mr. Noronha said, has supplied more than $20 billion to support foreign terror groups in the Middle East and provides Hamas with around 93 percent of its military budget.

The Biden administration did not enforce sanctions against Chinese individuals and companies at the time, as it sought to reestablish an Obama-era nuclear deal with Iran. When that deal fell through, however, the administration began to penalize companies known to be violating the sanctions but stopped short of penalizing the CCP regime itself.

The limited U.S. response has not stopped the CCP from exploiting Iran’s need for cash flow.

Mr. Noronha said that that money could effectively help to wash funds for Iran through multiple non-sanctioned entities, allowing Tehran and Beijing to both profit.

CCP Sidesteps Sanctions With Barter Deals

There is some evidence that the CCP itself is helping Tehran with more direct, unsanctioned assistance.Chinese state-owned entities appear to be making barter deals with Iran, for example, circumventing the need for sanctionable currency transactions altogether.

Tasnim News Agency, a media outlet associated with Iran's Islamic Revolutionary Guard Corps, said in August, for example, that China would provide a €2.5 billion modernization of Iran’s largest airport. Instead of being paid in sanctionable cash, however, the report said that China would rather be paid in oil.

“We are seeing evidence of major barter deals in which Beijing pays for this oil in the form of multi-billion-dollar infrastructure projects, like a $2.7 billion redevelopment of Tehran’s international airport announced in late August,” Mr. Noronha said.

“The United States should apply economic, regulatory, and diplomatic pressure [on China] to force them to reduce imports of Iranian oil—including as part of broader bilateral trade and diplomatic negotiations.”

ideas for expanding democracy are heading to council

Read more at: https://www.thecoast.ca/news-opinion/two-ideas-for-expanding-democracy-are-heading-to-council-31743805

Read more at: https://www.thecoast.ca/news-opinion/two-ideas-for-expanding-democracy-are-heading-to-council-31743805

Read more at: https://www.thecoast.ca/news-opinion/two-ideas-for-expanding-democracy-are-heading-to-council-31743805

Read more at: https://www.thecoast.ca/news-opinion/two-ideas-for-expanding-democracy-are-heading-to-council-31743805

Read more at: https://www.thecoast.ca/news-opinion/two-ideas-for-expanding-democracy-are-heading-to-council-31743805