Tuesday, January 31, 2023

U.S. Oil Refiners Set for Strong 4Q Earnings as Margins Stay High

U.S. oil refiners are expected to report higher fourth quarter earnings thanks to strong demand and healthy margins from processing crude oil into motor fuels, said analysts.

Profits last year from turning oil into gasoline, diesel and jet fuel hit multi-decades highs as plants ran full bore to meet rising travel and exports demand. Profits surged into the stratosphere for a sector that had been largely written off as the first victim of the energy transition.

Valero Energy, the second-largest U.S. refiner by capacity, kicks off earnings on Thursday with a projected per share profit of $7.19, according to Refinitiv, nearly three times the $2.47 of a year ago.

Top refiner Marathon Petroleum (MPC.N) is forecast to show a $5.70 per share profit, compared to $1.27 a year ago, while Phillips 66 could deliver a $4.46 per share, compared to $2.88 a year ago, according to Refinitiv. Both are scheduled to report on Jan. 31.

“Refiners are tied as the best energy sub-sector in 2022,” alongside oilfield services, wrote Jason Gabelman, a research analyst at Cowen, in a recent note.

The U.S. crack spread , a measure of the profit from buying oil and selling gasoline and diesel, peaked last quarter at $45, more than double the peak in the same period last year.

The fourth quarter could far exceed pre-pandemic profits, said Tudor Pickering Holt analyst Matthew Blair. Industry profit for the quarter could average $3.95 a share, “only a hair below full-year” 2019 profit for the sector, he wrote in a note.

Results benefited from margins on diesel, a historically wide spread between light and heavy crudes, and refiners maximizing their processing last quarter, Blair said.

Margins on diesel and other distillates rose $8 per barrel, to about $58, triple the margins in the same period last year. A historically wide, about $18 per barrel, spread between light and heavy crude oil also aided refiners.

Many ran their plants at above 90% utilization rates, according to data from the U.S. Energy Information Administration and bought feedstock at lower costs, as U.S. crude futures dropped 5.7% over the prior quarter to $81.50 per barrel.

One reason diesel demand is strong: refiners are using diesel to reduce the amount of sulfur in fuel oil sold for ocean shipping. The price difference between high- and low-sulfur fuel oil is very wide, indicating more diesel is being used to make low sulfur fuel oil, said Andrew Lipow, president of consultants Lipow Oil Associates.

The high margins may not last this year, however. Releases from the U.S. Strategic Petroleum Reserve have ended, reducing supplies of sour crude oil in the market. Less Russian crude and OPEC exports could tighten heavy and light spreads, wiping away another refiner benefit.

‘The world should be worried’: Saudi Aramco — the world’s largest oil producer — issued a dire warning over 'extremely low' capacity.

The global oil market remains tight according to Saudi Aramco, the largest oil producer in the world. And that does not bode well for a world that still relies heavily on fossil fuels.

“Today there is spare capacity that is extremely low,” Saudi Aramco CEO Amin Nasser said at a recent conference in London. “If China opens up, [the] economy starts improving or the aviation industry starts asking for more jet fuel, you will erode this spare capacity.”

Nasser warns that oil prices could quickly spike — again.

“When you erode that spare capacity the world should be worried. There will be no space for any hiccup — any interruption, any unforeseen events anywhere around the world.”

Intel’s ‘Historic Collapse’ Erases $8 Billion From Market Value

Visitors are seen at the Intel booth during the China Digital

Entertainment Expo and Conference, in Shanghai, China, on July 30, 2021.

(Aly Song/Reuters)

Intel Corp. saw about $8 billion wiped off its market value on Friday after the U.S. chipmaker stumped Wall Street with dismal earnings projections, fanning fears around a slump in the personal-computer market.

The company predicted a surprise loss for the first quarter and its revenue forecast was $3 billion below estimates as it also struggled with slowing growth in the data center business.

Intel shares closed 6.4 percent lower, while rival Advanced Micro Devices and Nvidia ended the session up 0.3 percent and 2.8 percent, respectively. Intel supplier KLA Corp. settled 6.9 percent lower after its dismal forecast.

“No words can portray or explain the historic collapse of Intel,” said Rosenblatt Securities’ Hans Mosesmann, who was among the 21 analysts to cut their price targets on the stock.

The poor outlook underscored the challenges facing Chief Executive Pat Gelsinger as he tries to reestablish Intel’s dominance of the sector by expanding contract manufacturing and building new factories in the United States and Europe.

The company has been steadily losing market share to rivals like AMD, which has used contract chipmakers such as Taiwan-based TSMC to make chips that outpace Intel’s technology.

“AMD’s Genoa and Bergamo (data center) chips have a strong price-performance advantage compared to Intel’s Sapphire Rapids processors, which should drive further AMD share gains,” said Matt Wegner, analyst at YipitData.

Analysts said that puts Intel at a disadvantage even when the data center market bottoms out, expected in the second half of 2022, as the company would have lost even more share by then.

“It is now clear why Intel needs to cut so much cost as the company’s original plans prove to be fantasy,” brokerage Bernstein said.

“The magnitude of the deterioration is stunning, and brings potential concern to the company’s cash position over time.”

Intel, which plans to cut $3 billion in costs this year, generated $7.7 billion in cash from operations in the fourth quarter and paid dividends of $1.5 billion.

With capital expenditure estimated to be around $20 billion in 2023, analysts said the company should consider cutting its dividend.

Lithium’s historic rally fuels record profits for China’s miners

https://www.mining.com/web/lithium-price-historic-rally-fuels-record-profits-for-chinas-miners/

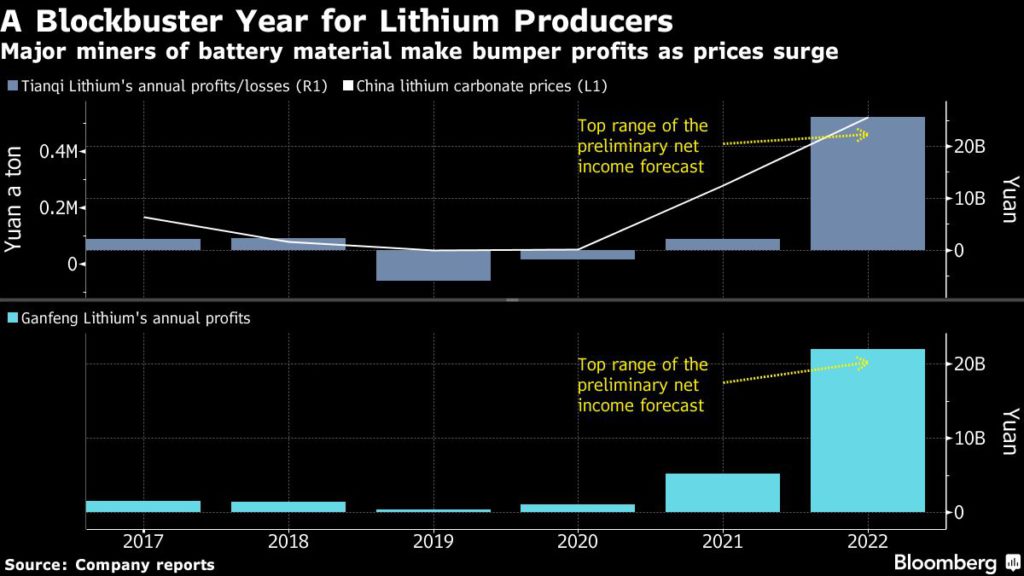

China’s big lithium miners are set to reap record earnings after booming demand for the electric vehicle battery material sent prices surging to an all-time high last year.

Tianqi Lithium Corp. forecasted preliminary net income for 2022 skyrocketed more than 10-fold, while rival Ganfeng Lithium Group Co. is predicting a surge of as much as 321%.

Sign Up for the Battery Metals Digest

The bumper profits come as Chinese prices for lithium carbonate, a refined form of the material used in EV batteries, peaked in November after jumping around 15 times from lows in 2020. The global push toward an electrified transport fleet has fired up consumption but supplies have struggled to keep pace.

Lithium producers have unveiled a flurry of expansion plans to meet the battery boom, while takeover activity is also picking up in the sector. This month, Tianqi’s joint venture with IGO Ltd. said it will purchase Sydney-listed Essential Metals Ltd., while Ganfeng announced plans to spend 15 billion yuan ($2.22 billion) building two battery plants in China.

Battery manufacturers and automakers, meanwhile, have complained lithium has become too expensive over the past year, crimping margins. Lithium-ion battery costs rose for the first time last year in the EV era, according to BloombergNEF.

While prices have softened in recent weeks, there are still risks this year if miners from Chile to China and Australia hit hurdles in producing daunting volumes of new supply.

Tianqi Lithium is forecasting 2022 preliminary net income surged 1,011%-1,132% from a year earlier to a range of 23.1 billion yuan to 25.6 billion yuan. Ganfeng Lithium reported on Sunday its preliminary net income could climb 244%-321% to a range of 18 billion yuan to 22 billion yuan. The companies are yet to announce when they will report official results.

(By Annie Lee)

Monday, January 30, 2023

US blocks mining in parts of Minnesota, dealing blow to Antofagasta’s Twin Metals copper project

The US Interior Department on Thursday blocked mining in part of northeast Minnesota for 20 years, the latest blow to Antofagasta Plc’s Twin Metals copper and nickel mining project but a step officials said is needed to protect the state’s vast network of interconnected waterways.

Interior Secretary Deb Haaland signed an order on Thursday withdrawing 225,504 acres in the Superior National Forest from leasing to mining or geothermal companies through 2043.

Sign Up for the Battery Metals Digest

In 2019, Chilean miner Antofagasta (LON:ANTO), through its subsidiary Twin Metals, carried out a feasibility study for the project, an underground copper-nickel mine and processing facility along the shores of Birch Lake and the South Kawishiwi River, which lie in the Rainy River watershed.

A coalition of businesses, environmental advocates and outdoor recreation groups in the state of Minnesota went to court challenging a Trump administration’s decision that opened the door to a copper, nickel and platinum project by a wilderness area.

In August 2022, Antofagasta Plc’s Twin Metals subsidiary sued the US government in a bid to revive the proposed Minnesota copper and nickel mine, which Biden administration officials had blocked over concerns it could pollute a major recreational waterway.

Twin Metals asked the US District Court in Washington to restore the leases, which were first granted in 1966 and have been passed between successor companies. No mining has taken place at the site.

The underground mine would, if built, be a major US source of copper and nickel, two metals crucial for the green energy transition. The only existing US nickel mine is set to close by 2025.

(With files from Reuters)

Peru’s violent protests imperil 30% of its copper output

https://www.mining.com/web/perus-violent-protests-imperil-30-of-its-copper-output/

An upsurge in the violent protests wracking Peru is crimping copper output in the world’s No. 2 supplier, with about 30% of its production at risk at a time of low global stocks and high prices

One copper mine is offline after demonstrators stormed the site, another has seen shipments choked by roadblocks, while others have slowed operations as a precaution to manage scarce supplies of fuel and other inputs, according to industry group SNMPE.

Sign Up for the Copper Digest

“The situation of protests and the escalation of violence have affected the industry,” Magaly Bardales, who heads a mining sector committee at the association, said in a telephone interview. “We hope an understanding, a dialog with authorities, can be found to provide a swift solution.”

Demonstrators have blocked roads across Peru and clashed with security forces in more than six weeks of violent turmoil that began when President Pedro Castillo was impeached after he attempted to dissolve congress. Protesters are calling for both interim President Dina Boluarte and congress to be replaced, with more than 50 deaths and the violence showing no signs of easing.

The disruption coincides with operational setbacks and regulatory headwinds in neighboring Chile and the prospect of a mine shutdown in Panama as the government there seeks a bigger share of profit. Those supply threats have combined with optimism over Chinese demand after the lifting of covid restrictions to send copper futures to seven-month highs.

Related: Violent demonstrations roil Peru’s southern copper and tourism heartland

With global stockpiles of the wiring metal at historically low levels, traders are keeping close watch on events in Peru. The Andean nation accounts for about a 10th of global copper supply and is a major exporter of zinc and silver. About $160 million of production has been lost in 23 days of protests, Bardales said.

To be sure, protests are nothing new in Peru. It’s emergence as a major mineral producer has exacerbated historically tense relations with poor rural communities. The mining industry says not enough of the record-high revenue it generates for the state goes to improving local infrastructure and services.

But the current wave of unrest stands out from past events.

“I haven’t seen this level of violence, the coordinated nature of action, seeking to affect mining and energy, during the time I have been working in the sector,” Bardales said.

Much of the unrest is centered in the southern region of Puno, where Minsur SA’s San Rafael tin mine has been targeted. About 1,500 workers at San Rafael still can’t be evacuated, she said.

Tensions have fanned out into other areas of the south including Espinar, Arequipa and Cusco. Glencore Plc’s Antapaccay mine has halted operations after protesters entered and damaged a worker camp.

The Las Bambas complex is mining at a reduced rate due to blockade-related supply challenges, its Chinese-owned operator MMG Ltd. said, without elaborating. Bardales said Las Bambas is operating at just 20% of capacity, even as it continues to process ore on site.

The Cerro Verde mine in Arequipa isn’t being directly affected by protests but it has slowed mill operations by 10-15% in the past several days in a bid to conserve supplies such as lime amid a “very complicated” political situation, operator Freeport-McMoRan Inc. said this week on an earnings call.

Other mines to the north, such as BHP Group-Glencore’s Antamina are running normally, as are mines in the south that don’t depend on the so-called mining corridor for the transport of supplies, copper and people.

While the transport of semi-processed copper to ports has seen some disruption, the ports themselves are operating normally, Bardales said. She hadn’t heard of any “relevant” impacts on shipments.

The mining society continues to project an increase in Peruvian copper production this year as a new mine ramps up, although much depends on how long the current spate of protests lasts.

The unrest also jeopardizes the rollout of $53.7 billion in possible investments at a time when the world needs to accelerate decarbonization and boost minerals required for electromobility, according to BTG Pactual analyst Cesar Perez-Novoa.

“The combination of instability in other jurisdictions may exert upward pressure on copper prices,” Perez-Novoa said.

(By James Attwood)

Thursday, January 26, 2023

Current market "very favourable to tanker owners" - TEN

https://www.tankeroperator.com/ViewNews.aspx?NewsID=13491

The current tanker market is "very favourable to tanker owners" on both the supply and demand side, said Harrys Kosmatos, Corporate Development Officer, speaking at a management presentation organised by Capital Link.

PRESENTATION

Capital Link hosted a presentation by the senior management of TEN Ltd. (NYSE: TNP) on Thursday, January 12, 2023. During the 45-minute session, Dr. Nikolas P. Tsakos, Founder, President & CEO, Paul Durham, CFO, George Saroglou, Chief Operating Officer and Harrys Kosmatos, Corporate Development Officer, described the strong tanker market, the current state of the company’s fleet, and its dividend policy as part of Capital Link’s Company Presentation Series.

A replay of the full session of the presentation and the extensive Q&A can be accessed at:

https://www.youtube.com/watch?v=yZKsCkb4Y6M

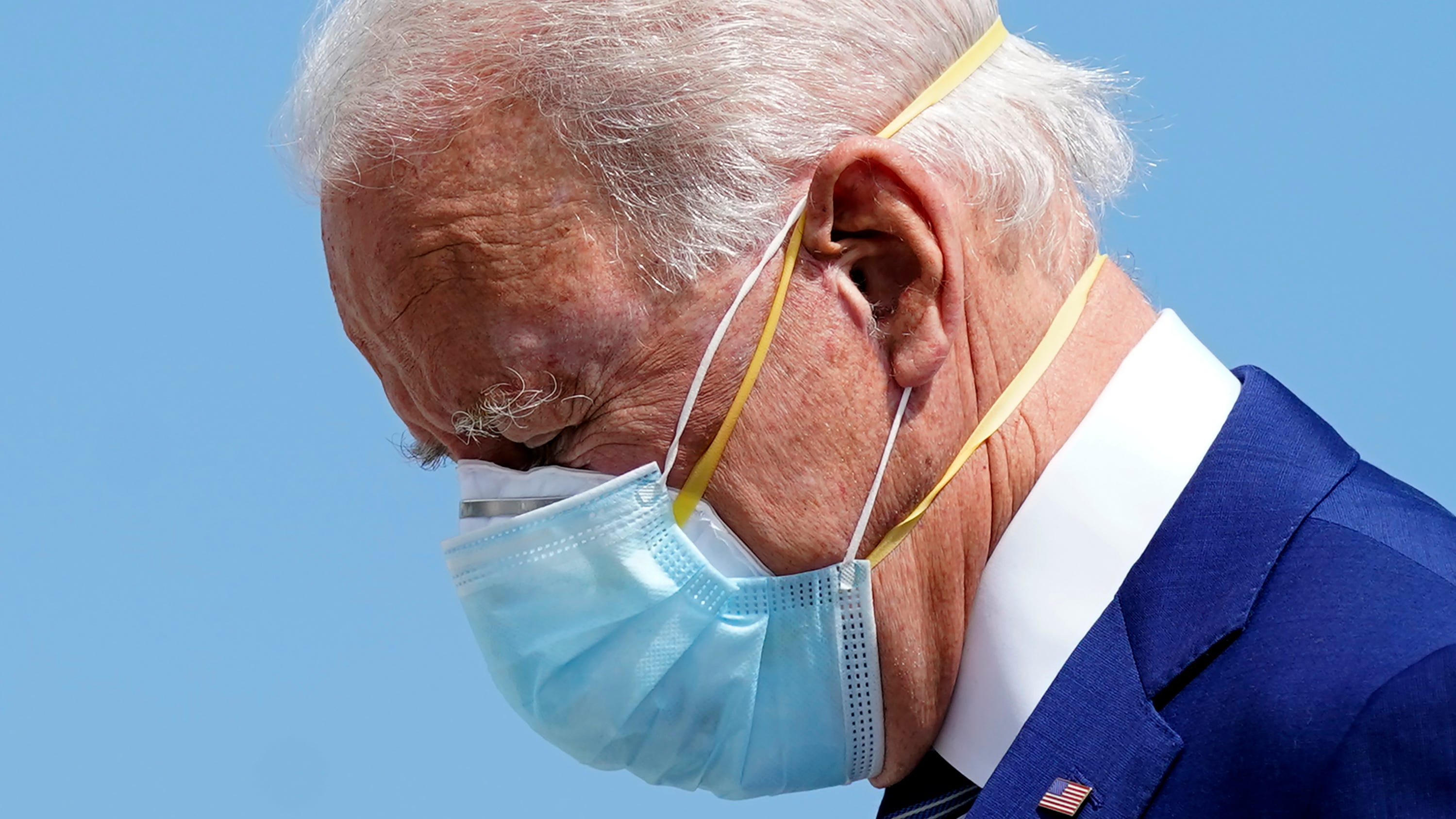

Biden Announces US Will Send M1 Abrams Tanks to Ukraine

The United States will send M1 Abrams main battle tanks to Ukraine as Kyiv’s conflict with Russia nears its one-year anniversary, President Joe Biden confirmed on Jan. 25.

The president said during a White House announcement that the United States will send 31 tanks to Ukraine, adding that the “U.S. and Europe are fully united.” He reiterated that the tanks are “not an offensive threat to Russia.”

“That’s what we all want: an end to this war,” Biden said. “Our terms that preserve … Ukraine’s sovereignty and territorial integrity and honor the U.N. Charter … they’re the terms we’re working on.”

Earlier this week, unconfirmed reports that cited anonymous sources said the United States was poised to send dozens of its top battle tank to Ukraine after saying for months that it wouldn’t be deployed in the country. Since the start of the conflict, Ukraine’s government has asked for battle tanks from Western powers amid protracted fighting in the eastern portion of the country.

Previously, U.S. officials have said that the M1 Abrams’ systems are too complex to operate and maintain, while adding that it would take months to get the tanks to Ukraine. It would also take months to train Ukrainians in using them.

Germany confirmed on Jan. 25 that it would send 14 of its high-tech Leopard tanks to Ukraine.

“Germany will always be at the forefront when it comes to supporting Ukraine,” Chancellor Olaf Scholz told the German Parliament, to applause.

Berlin’s move paves the way for pledges from other countries that field Leopards, which Germany made in the thousands and exported to allies. Finland said it would send them, as did Poland, which has already sought Berlin’s approval.

Spain and the Netherlands said they were considering it, and Norway was reported to be discussing it. Britain has offered a company of 14 of its comparable Challengers, and France is considering sending its Leclercs.

Earlier in the day, Ukrainian President Volodymyr Zelenskyy told German media that the tanks would provide needed support.

“They do only one very important thing—they motivate our soldiers to fight for their own values, because they show that the whole world is with you,” Zelenskyy told Germany’s ARD channel.

Ukrainian Defense Minister Oleksiy Reznikov said he spoke with U.S. counterpart Lloyd Austin on Jan. 25, promising “more good news to be announced soon.” Reznikov said they discussed the “further strengthening of [Ukraine’s army], including tank supplies and maintenance of the new armament.”

Moscow Responds

Russian officials bristled at the reports saying Abrams and Leopard tanks would be sent to its enemy. Earlier this week, a top Russian envoy claimed that the Abrams tanks would be destroyed during fighting, while escalating American involvement in the war.

“If a decision to transfer to Kyiv M1 Abrams is made, American tanks without any doubt will be destroyed, as all other samples of NATO military equipment,” Russia’s ambassador to the United States, Anatoly Antonov, wrote in a Telegram statement. “The Americans are constantly raising the ‘bar’ of military assistance to their puppet government,” he added.

Going further, Antonov echoed previous claims that the United States is using Ukraine as a decoy to carry out a “proxy” war against Russia.

“If the United States decides to supply tanks, it will be impossible to justify such a step using arguments about ‘defensive weapons.’ This would be another blatant provocation against the Russian Federation,” he added. “No one should have illusions about who the real aggressor is in the current conflict.”

The Russian Embassy in Berlin denounced Germany’s “extremely dangerous decision” for sending the Leopard tanks, which, it said, “destroys the remnants of mutual trust” and could draw Germany into the war. Scholz pledged that no such thing would happen.

Western officials who support sending the tanks have dismissed Moscow’s threats, arguing that Russia is already waging war at full tilt and has been deterred from attacking NATO or using nuclear arms.

Last week, allies pledged billions of dollars worth of military aid including hundreds of armored fighting vehicles and troop carriers. Those are seen as more effective for attacking enemy lines when used alongside tanks.

Reuters contributed to this report.

Razor blades placed on gas pump handles in North Carolina city

(Source: Forest City Police Department)

FOREST CITY, N.C. ( WSPA ) — Police are warning the public after finding razor blades on gas pump handles in Forest City, North Carolina and surrounding areas.

The Forest City Police Department said they have located multiple instances of razor blades being placed in gas pump handles.

Lt. Brandon Rothrock said the blades were found during an inspection of the pumps by the Department of Agriculture.

“[The inspector] made us aware. … He said that he was checking some yesterday and found some in Ellenboro at a Roco Station,” said Rothrock. “So, that led him to check some of our local stations, and he found one at 74 Junction.”

It also happened at another gas station in Forest City.

“There is no explanation as to why someone would do this,” he said.

Pope Francis: Homosexuality not a crimeHe said all known blades have been removed.

“If you’re pumping gas, check. Look before you grab. Protect yourself however you need to,” said Rothrock. “It’s going to take some hours of reviewing video to see if we can come up with a suspect.”

Customer Dan O’Bryan is no stranger to 74 Junction gas station.

“This particular gas station, I’m pretty much here every single morning, because I work just two minutes down the road from here,” said O’Bryan.

He said now he’s going to double-check before picking up the pump.

“I’m not surprised, but that’s definitely good to know. I’ll tell my wife about it,” said O’Bryan.

Five ways federal government can try to avoid defaultRothrock said there haven’t been any injuries but that it is unknown how long the blades have been there or who is responsible.

“With these times — germs and things anyway — maybe wear gloves. Until we can come up with a solid answer,” he said.

These incidents are under investigation by the Department of Agriculture. In the meantime, police ask that you be aware of your surroundings while pumping gas.

Wednesday, January 25, 2023

US court gives $153 million to Miami man jailed in Venezuela

FILE - Venezuelan Carlos Marron poses for a portrait at his home in

Miami, Dec. 2, 2020. A federal judge in Miami on Monday, Jan. 23, 2023,

has awarded $153 million in damages to the family of Marron, an exiled

Venezuelan lawyer lured back home by his father’s kidnapping only to end

up imprisoned for two years on trumped up charges of working as a

“financial terrorist” undermining President Nicolas Maduro's rule. (AP

Photo/Cody Jackson, File)

MIAMI (AP) — A federal judge in Miami has awarded $153 million in damages to the family of an exiled Venezuelan lawyer lured back home by his father’s kidnapping only to end up imprisoned for two years on trumped up charges of working as a “financial terrorist” undermining President Nicolás Maduro’s rule.

Carlos Marrón brought the lawsuit after fleeing Venezuela and describing to The Associated Press the beatings, asphyxiation and other abuse he claims to have suffered while detained.

His ordeal drew harsh rebuke from the United Nations’ Human Rights Council, which determined he had been arbitrarily detained for allegedly operating a website that published the black-market exchange rate of Venezuela’s erratic bolivar for U.S. dollars, something the socialist government considered a crime.

The ruling issued Monday is the second of its kind in recent months targeting Maduro’s government over its alleged ties to the Revolutionary Armed Forces of Colombia under a little used federal law that allows American victims of foreign terror groups to seize the assets of their victimizers. In September, another federal judge awarded $73 million to the family of a prominent opponent of Maduro who died after falling from the 10th floor of a building belonging to Venezuela’s intelligence services in what the U.S. court likened to “a murder for hire.”

As in the earlier case, Marrón in his lawsuit accused Maduro of heading the “Cartel of the Suns,” a purported drug-smuggling ring involving top Venezuelan officials and guerrillas from the FARC — a designated terrorist group under U.S. law — that allegedly sends 200 metric tons of cocaine from Venezuela into the U.S. each year.

Judge Federico Moreno issued a default judgment against Maduro and five other insiders — including his Attorney General Tarek William Saab and former Supreme Court President Maikel Moreno — for failing to respond to the lawsuit. In it, Moreno wrote that the officials were liable for Marrón’s unlawful imprisonment because they were trying to shut down his Florida business, viewing it as a threat to a “criminal organization” based on narcotics trafficking, acts of terror and human rights violations.

“Defendants exchange drugs for hard currency. The hard currency allows the Defendants to stay in power in Venezuela. Defendants leverage that power to kidnap and torture dissidents” like Marrón, Moreno wrote in a 13-page ruling benefitting Marrón and his family.

Marrón, 45, was arrested by the Venezuelan military counterintelligence unit in April 2018 without a warrant upon his arrival to Caracas’ international airport. He had been forced to travel to Venezuela from Miami — his home for the previous decade — upon learning that his father had been detained by state officials.

It was an elaborate trap seeking to punish Marrón for a website domain, dolarpro.com, he’d bought years earlier as a business prospect but says he never developed. Under a friend’s stewardship, the website began publishing news and information on the nation’s black-market exchange rate, which varied vastly from official figures.

Attorney General Saab likened Marrón’s actions to “mass murder.”

“Perhaps he’s out to destroy more than 30 million Venezuelans,” Saab said in a nationally televised address announcing his arrest.

A 2010 presidential decree made it illegal to publish anything but the official exchange rate, and authorities regularly accused “speculators” of spreading false information, stoking inflation and fueling a collapse of the bolivar as an act of economic sabotage against Maduro.

But critics say the huge disparity between the two rates is a vehicle for graft by government insiders.

Marron declined to comment on the judgment and there was no immediate response from Maduro’s government.

—

Follow Goodman on Twitter: @APJoshGoodman

Top Ukrainian officials quit in anti-corruption drive

![]()

https://www.bbc.com/news/world-europe-64383388

Several senior Ukrainian officials have resigned as President Volodymyr Zelensky begins a shake-up of personnel across his government.

A top adviser, four deputy ministers and five regional governors left their posts on Tuesday.

Their departures come as Ukraine launches a broad anti-corruption drive.

Recently, authorities have seen bribery claims, reports of officials buying food at inflated prices and one figure accused of living a lavish lifestyle.

Senior aide Mykhailo Podolyak said Mr Zelensky was responding to a "key public demand" that justice should apply to everyone.

The president has already banned state officials from leaving the country unless on authorised business.

The first to resign on Tuesday was Kyrylo Tymoshenko, the president's deputy head of office, who oversaw regional policy and had earlier worked on Mr Zelensky's election campaign.

After Russia launched its invasion of Ukraine last February he became a frequent spokesperson for the government.

He was accused by Ukrainian investigative journalists of using several expensive sports cars throughout the war - though denies any wrongdoing.

In a Telegram post, he thanked Mr Zelensky for "the opportunity to do good deeds every day and every minute".

Deputy Defence Minister Vyacheslav Shapovalov also resigned, following reports he oversaw the purchase of military food supplies at inflated prices from a relatively unknown firm. The department called this a "technical mistake" and claimed no money had changed hands.

The defence minister himself - Oleksii Reznikov - has been under scrutiny for the same reason.

A host of other top officials were dismissed on Tuesday, including:

- Deputy Prosecutor General Oleskiy Symonenko

- Deputy Minister for Development of Communities and Territories Ivan Lukerya

- Deputy Minister for Development of Communities and Territories Vyacheslav Negoda

- Deputy Minister for Social Policy Vitaliy Muzychenko

- And the regional governors of Dnipropetrovsk, Zaporizhzhia, Kyiv, Sumy and Kherson

Ukraine has a history of corruption and in 2021 Transparency International ranked the country at 122 out of 180 countries in its ranking of corrupt states.

A crackdown is one of the EU's key demands if the country is to advance its application to join the bloc.

In an address on Sunday, Mr Zelensky promised there would be "no return to what used to be in the past, to the way various people close to state institutions" used to live.

His comments followed the arrest of Ukraine's Deputy Infrastructure Minister Vasyl Lozinskyi on Saturday on suspicion of accepting a bribe worth over $350,000 (£285,000) over the supply of electricity generators. He has denied the charges.

David Arakhamia, the head of Mr Zelensky's Servant of the People party, has said that corrupt officials could face jail.

"Officials at all levels have been constantly warned through official and unofficial channels: focus on the war, help the victims, reduce bureaucracy and stop doing dubious business.

"Many of them have actually listened, but some, unfortunately, did not," he said in a Telegram statement.

"If it doesn't work in a civilised way, it will be done according to the laws of wartime. This applies both to recent purchases of generators and to fresh scandals in the ministry of defence."

While there have been anti-corruption reforms in recent years, the stakes are high for Kyiv - which is receiving billions of dollars worth of financial aid from Western allies.

Sen. Markwayne Mullin Highlights New GOP Energy Reforms

Rep. Markwayne Mullin (R-Okla.) asks questions to Dr. Richard Bright,

former director of the Biomedical Advanced Research and Development

Authority, during a House Energy and Commerce Subcommittee on Health

hearing to discuss protecting scientific integrity in response to the

coronavirus outbreak, in Washington on May 14, 2020. (Greg

Nash-Pool/Getty Images)

Newly sworn-in Sen. Markwayne Mullin (R-Okla.) has been in the U.S. Senate for three weeks and he’s moving forward with his first legislative package, which is focused on expanding U.S. energy production and cross-border energy permits.

On Tuesday, Mullin introduced three new Senate bills focused on the energy sector. The first bill he introduced seeks to clarify that a state has the sole authority to regulate hydraulic fracturing—also known as fracking—on federal land within the boundaries of the state. Mullin’s second bill would give states further control over energy production on federal lands available to those states. His third bill would reform the process for permitting the construction and operation of cross-border oil and natural gas lines, with a goal to make the process more uniform and transparent.

“It is not Washington, D.C., that creates jobs,” Mullin told NTD. “Washington, D.C., is to create an environment for entrepreneurs and job creators to create jobs. It’s also not Washington, D.C.’s position—and it shouldn’t be their position—to choose the products, choose the industry. That is a consumer that makes those decisions.”

While he expressed his view that consumers should be able to choose the products and industries that succeed, Mullin said “D.C. elites, bureaucrats” have been controlling those decisions. “So if they’re going to play this game, and it looks like they’re going to, then we need to take it out of their hands.”

US Doesn’t Need to Tap Strategic Oil Reserves: Mullin

President Joe Biden repeatedly withdrew oil from the Strategic Petroleum Reserve (SPR) throughout 2022 as gas prices rose throughout the year.

Mullin said the Biden administration timed withdrawals from the SPR as a ploy to lower gas prices before the 2022 midterms.

“They used the Strategic Petroleum Reserve, SPR, which is supposed to be for national security emergency purposes, for a political ploy,” Mullin said.

According to the U.S. Energy Information Administration (EIA), the United States had 588 million barrels of oil in the strategic reserve at the start of 2022. By October, the supply of oil in the SPR had fallen to 398 million barrels, placing the SPR at its lowest level since April 1984.

“We’re at the lowest level we’ve been since 1984, yet we’re at a very volatile time around the world,” Mullin said. “We see the aggressiveness of [Russian President Vladimir] Putin and we see the aggressiveness of China, and we’re at the lowest level we’ve been. And what we’re saying is, ‘Listen, you’re playing games using the SPR for something that it wasn’t supposed to be used for, you’re using it to bring down gas prices.'”

Mullin noted Rep. Cathy McMorris Rodgers (R-Wash.) recently introduced a bill that would restrict the executive branch from making withdrawals from the SPR without developing a plan to boost domestic oil and gas production to match the amount being taken out of the SPR. The bill stipulates emergency situations where the executive branch may make withdrawals from the SPR without having to develop plans to refill the reserve.

Mullin said withdrawing oil from the SPR wouldn’t be necessary with higher domestic oil production.

“Underneath the Trump administration, we became a net [oil] exporter. We were exporting nearly a million barrels per day underneath Trump. Today, we’re importing that same amount,” Mullin said. “So we don’t have to tap our strategic oil or strategic petroleum reserves.”

“All we had to do is let the [oil] industry go,” he added.

The Biden administration has indicated the president would veto McMorris Rodgers’ bill if it does pass in the House and the Senate.

In a Monday press conference, Energy Secretary Jennifer Granholm said the bill “would not offer any tangible benefits to the American people” and would instead “interfere with our ability to be responsive to release oil during an international emergency, helping Putin’s war aims.”

During the press conference alongside Granholm, White House Press Secretary Karine Jean-Pierre repeatedly described McMorris Rodgers’ bill as a Republican plan to “raise” prices on Americans at the pump.

Keystone XL Cancellation Was ‘Political’

As one of his bills would reform how cross-border oil and natural gas lines are built, Mullin spoke out on the Biden administration’s decision to cancel the Keystone XL pipeline project.

The Keystone XL line was a proposed new route for the existing Keystone Pipeline, which carries gas from Canada to the United States. Former President Donald Trump had permitted the Keystone XL pipeline construction to proceed, but Biden revoked the pipeline permits through an executive order on his first day in office.

Mullin said Biden revoked the Keystone XL pipeline permits “for nothing more than political reasons, not national security interests.”

Mullin said the current authority that the president has to approve cross-border energy pipelines can create complications for the companies working to build the pipelines.

“If you’re an investor and you’re looking at the Keystone pipeline, and say a next administration comes in—say Trump comes back in and he approves the Keystone pipeline—well, you’re going to get four years for it to be approved. So you’re going to invest billions of dollars knowing that the next president that comes in can reject that permit just like Biden did? And all of sudden you have all this material that was already on the ground and in the ground … and then some of it already dug, that you’re just going to stop the project?” Mullin said.

Mullin said if the United States wants to attract energy investors who could create thousands of jobs with new energy construction projects, it will need to change the permitting process so that years of work to gather permits and prepare for construction aren’t canceled as they were under Biden’s order.

Tuesday, January 24, 2023

California Democrats consider wealth tax — including for people who moved out of state

California Democrats consider wealth tax — including for people who moved out of state

https://www.yahoo.com/news/california-democrats-consider-wealth-tax-010948671.html

California lawmakers are pushing legislation that would impose a new tax on the state's wealthiest residents — even if they've already moved to another part of the country.

Assemblyman Alex Lee, a progressive Democrat, last week introduced a bill in the California State Legislature that would impose an extra annual 1.5% tax on those with a "worldwide net worth" above $1 billion, starting as early as January 2024.

As early as 2026, the threshold for being taxed would drop: those with a worldwide net worth exceeding $50 million would be hit with a 1% annual tax on wealth, while billionaires would still be taxed 1.5%.

Worldwide wealth extends beyond annual income to include diverse holdings such as farm assets, arts and other collectibles, and stocks and hedge fund interest.

The legislation is a modified version of a wealth tax approved in the

California Assembly in 2020, which the Democrat-led state Senate

declined to pass

The current version just introduced includes measures to allow California to impose wealth taxes on residents even years after they left the state and moved elsewhere.

Exit taxes aren't new in California. But this bill also includes provisions to create contractual claims tied to the assets of a wealthy taxpayer who doesn't have the cash to pay their annual wealth tax bill because most of their assets aren't easily turned into cash. This claim would require the taxpayer to make annual filings with California's Franchise Tax Board and eventually pay the wealth taxes owed, even if they've moved to another state.

California was one of several blue states last week to unveil bills to impose new wealth taxes. The other states were Connecticut, Hawaii, Illinois, Maryland, Minnesota, New York and Washington. Each state's proposal contained a difference tax approach, but they all centered around the same basic idea: the rich must pay more.

Lee's office didn't respond to a request for comment for this story. However, he's made public statements echoing the message that wealthier residents should pay higher taxes.

"The working class has shouldered the tax burden for too long," Lee wrote in a tweet. "The ultra-rich are paying little to nothing by hoarding their wealth through assets. Time to end that."

According to Lee, the tax would affect 0.1% of California households and generate an additional $21.6 billion in state revenue, which would go to the state general fund. California has among the highest taxes of any state in the country.

Advocates argue that the money could boost funding for schools, housing and other social programs. Perhaps more importantly, however, Lee hopes it could help address California's massive $22.5 billion budget deficit.

LIST OF COMPANIES LEAVING CA GROWS AS BLUE STATE'S EXODUS TREND CONTINUES

"This is how we can keep addressing our budgetary issues," he told the Los Angeles Times. "Basically, we could plug the entire hole."

However, experts counter that the bill will have the exact opposite effect through high administrative costs and by causing an exodus of people to flee the state.

"It brings significant administrative challenges with respect to asset and liability valuation, high and distortionary effective rates, among other problems that make it an inefficient revenue source," Gordon Gray, director of fiscal policy at the American Action Forum, told Fox New Digital.

Others echoed this point, also arguing a new wealth tax would likely lead many wealthy residents to leave California.

"The proposed California wealth tax would be economically destructive, challenging to administer and would drive many wealthy residents — and all their current tax payments — out of state," Jared Walczak, vice president of state projects at Tax Foundation, told Fox News Digital. "The bill sets aside as much as $660 million per year just for administrative costs, more than $40,000 per prospective taxpayer, giving an idea of how difficult such a tax would be to administer."

People are already moving from high-tax states into low-tax ones, according to a recent analysis by James Doti, president emeritus and economics professor at Chapman University. He found that the 10 highest tax states lost nearly 1 in 100 residents in net domestic migration between July 2021 and July 2022, while the 10 lowest tax states gained almost 1 in 100.

California lawmakers pushing the wealth tax think they can "get around" the problem of residents leaving "by trying to tax people even after they leave the state," said Patrick Gleason, vice president of state affairs at Americans for Tax Reform. However, he, Gray and Walczak all questioned the legality of such an approach or labeled it outright unconstitutional.

CALIFORNIA VOTERS REJECT TAX THAT WOULD HAVE FUNDED ELECTRIC VEHICLES

Past studies have shown that the top 1% of taxpayers pay about 50% of state income taxes in New York, California and elsewhere, raising the question of how damaging a mass exodus of wealthy residents could be to tax revenue.

Walczak noted that a wealth tax would be especially problematic for California, joking that the people most excited about such a law should be people in Texas, where some high-profile Californians have relocated in recent years.

"A wealth tax could be particularly destructive in California, home to so many tech startups, because the owners of promising businesses could be taxed on hundreds of millions of dollars' worth of estimated business value that never actually materializes," said Walczak. "Very few taxpayers would remit wealth taxes, but many taxpayers would pay the price. The only people who should genuinely love a California wealth tax are the ones who work in Texas' economic development office."

However, some proponents of wealth taxes argue they're necessary to combat economic inequality.

Maryland Democrat Delegate Jheanelle K. Wilkins, for example, has proposed a bill so that families would owe taxes on inheritances over $1 million rather than $5 million, as is the case today. She said such ideas will now gain more support after the COVID-19 pandemic exposed inequality between the rich and poor.

"That's quite a bit of funds that we're leaving on the table," she told the Washington Post.

Other supporters say wealth taxes are small and the rich can afford them. But experts note that because the rates are on net worth, not on income, they have an outsized effect.

CLICK HERE TO GET THE FOX NEWS APP

Walczak illustrated the point in a recent blog post, using as an example a $50 million investment, held for 10 years and earning a 10% nominal annual rate of return in an environment of 3% annual inflation. Without a wealth tax, that investment would yield $46.5 million in investment returns, in current dollars, after 10 years. With a 1% wealth tax, however, it would yield $37.3 million, wiping out nearly 20% of the gains.

Wealth taxes "cut deeply into investment returns, to the detriment of the broader economy," wrote Walczak. "Average taxpayers may not care if the ultra-wealthy have lower net worths. But they will certainly care if innovation slows and investments decline."

Timeline: 150 Years of U.S. National Debt

https://www.visualcapitalist.com/timeline-150-years-of-u-s-national-debt/

Published2 years agoonBy Marcus Lu

This interactive visualization uses debt held by the public for its calculations, which excludes intragovernmental holdings.

Looking Back at 150 Years of U.S. Debt

The total U.S. national debt reached an all-time high of $28 trillion* in March 2021, the largest amount ever recorded.

Recent increases to the debt have been fueled by massive fiscal stimulus bills like the CARES Act ($2.2 trillion in March 2020), the Consolidated Appropriations Act ($2.3 trillion in December 2020), and most recently, the American Rescue Plan ($1.9 trillion in March 2021).

To see how America’s debt has gotten to its current point, we’ve created an interactive timeline using data from the Congressional Budget Office (CBO). It’s crucial to note that the data set uses U.S. national debt held by the public, which excludes intergovernmental holdings.

*Editor’s note: This top level figure includes intragovernmental holdings, or the roughly $6 trillion of debt owed within the government to itself.

What Influences U.S. Debt?

It’s worth pointing out that the national debt hasn’t always been this large.

Looking back 150 years, we can see that its size relative to GDP has fluctuated greatly, hitting multiple peaks and troughs. These movements generally correspond with events such as wars and recessions.

| Decade | Gross debt at start of decade (USD billions) | Avg. Debt Held By Public Throughout Decade (% of GDP) | Major Events |

|---|---|---|---|

| 1900 | - | 4.8% | - |

| 1910 | - | 10.0% | World War I |

| 1920 | - | 22.9% | The Great Depression |

| 1930 | $16 | 36.4% | President Roosevelt's New Deal |

| 1940 | $40 | 75.1% | World War II |

| 1950 | $257 | 56.8% | Korean War |

| 1960 | $286 | 37.3% | Vietnam War |

| 1970 | $371 | 26.1% | Stagflation (inflation + high unemployment) |

| 1980 | $908 | 33.7% | President Reagan's tax cuts |

| 1990 | $3,233 | 44.7% | Gulf War |

| 2000 | $5,674 | 36.6% | 9/11 attacks & Global Financial Crisis |

| 2010 | $13,562 | 72.4% | Debt ceiling is raised by Congress |

| 2020 | $27,748 | 105.6% | COVID-19 pandemic |

| 2030P | - | 121.8% | - |

| 2040P | - | 164.7% | - |

| 2050P | - | 195.2% | - |

Source: CBO, The Balance

To gain further insight into the history of the U.S. national debt, let’s review some key economic events in America’s history.

The Great Depression

After its WWI victory, the U.S. enjoyed a period of post-war prosperity commonly referred to as the Roaring Twenties.

This led to the creation of a stock market bubble which would eventually burst in 1929, causing massive damage to the U.S. economy. The country’s GDP was cut in half (partially due to deflation), while the unemployment rate rose to 25%.

Government revenues dipped as a result, pushing debt held by the public as a % of GDP from its low of 15% in 1929, to a high of 44% in 1934.

World War II

WWII quickly brought the U.S. back to full employment, but it was an incredibly expensive endeavor. The total cost of the war is estimated to be over $4 trillion in today’s dollars.

To finance its efforts, the U.S. relied heavily on war bonds, a type of bond that is marketed to citizens during armed conflicts. These bonds were sold in various denominations ranging from $25-$10,000 and had a 2.9% interest rate compounded semiannually.

Over 85 million Americans purchased these bonds, helping the U.S. government to raise $186 billion (not adjusted for inflation). This pushed debt above 100% of GDP for the first time ever, but was also enough to cover 63% of the war’s total cost.

The Postwar Period

Following World War II, the U.S. experienced robust economic growth.

Despite involvement in the Korea and Vietnam wars, debt-to-GDP declined to a low of 23% in 1974—largely because these wars were financed by raising taxes rather than borrowing.

The economy eventually slowed in the early 1980s, prompting President Reagan to slash taxes on corporations and high earning individuals. Income taxes on the top bracket, for example, fell from 70% to 50%.

2008 Global Financial Crisis

The Global Financial Crisis served as a precursor for today’s debt landscape.

Interest rates were reduced to near-zero levels to speed up the economic recovery, enabling the government to borrow with relative ease. Rates remained at these suppressed levels from 2008 to 2015, and debt-to-GDP grew from 39% to 73%.

It’s important to note that even before 2008, the U.S. government had been consistently running annual budget deficits. This means that the government spends more than it earns each year through taxes.

The National Debt Today

The COVID-19 pandemic damaged many areas of the global economy, forcing governments to drastically increase their spending. At the same time, many central banks once again reduced interest rates to zero.

This has resulted in a growing snowball of government debt that shows little signs of shrinking, even though the worst of the pandemic is already behind us.

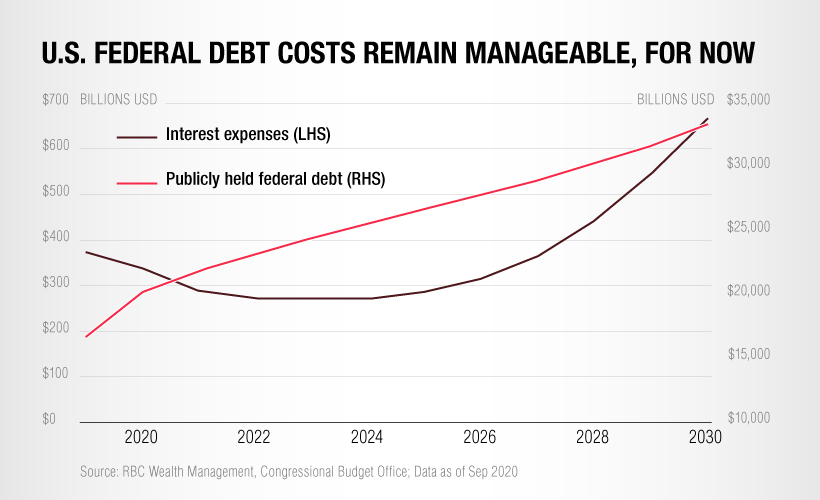

In the U.S., federal debt has reached or surpassed WWII levels. When excluding intragovernmental holdings, it now sits at 104% of GDP—and including those holdings, it sits at 128% of GDP. But while the debt is expected to grow even further, the cost of servicing this debt has actually decreased in recent years.

This is because existing government bonds, which were originally issued at higher rates, are now maturing and being refinanced to take advantage of today’s lower borrowing costs.

The key takeaway from this is that the U.S. national debt will remain manageable for the foreseeable future. Longer term, however, interest expenses are expected to grow significantly—especially if interest rates begin to rise again.

Congo president demands more from $6.2 billion China metals deal

Felix Tshisekedi, President of the Democratic Republic of the Congo. Image courtesy of the World Economic Forum via Flickr.

https://www.mining.com/web/congo-president-demands-more-from-6-2-billion-china-metals-deal/

Democratic Republic of Congo President Felix Tshisekedi criticized a $6.2 billion minerals-for-infrastructure contract with China, saying the world’s largest producer of a key battery metal hasn’t benefited from the deal.

Congo, Africa’s second-largest nation by landmass, is flush with natural resources — including copper and cobalt that are major components in electric vehicles — but remains one of the world’s least-developed countries. Most of its minerals end up in China, which signed a landmark deal with Tshisekedi’s predecessor in 2008 to trade roads and buildings for the two metals.

Sign Up for the Battery Metals Digest

“The Chinese, they’ve made a lot of money and made a lot of profit from this contract,” Tshisekedi said in an interview at the World Economic Forum in Davos, Switzerland. “Now our need is simply to re-balance things in a way that it becomes win-win.”

The contract renegotiation is part of a campaign by the president to ensure the country gets paid for the full value of its resources, which are increasingly in high demand.

The accord with China was signed at a time when Congo was emerging from decades of dictatorship and war and newly elected President Joseph Kabila was desperate for financing. It mandated that Chinese companies invest $3.2 billion in a copper-cobalt mine and another $3 billion in infrastructure funded by the mine’s revenue.

‘Nothing tangible’

Congo’s government says China has released less than a third of the infrastructure funds.

“We’re happy to be friends with the Chinese, but the contract was badly drawn up, very badly,” Tshisekedi said. “Today, the Democratic Republic of Congo has derived no benefit from it. There’s nothing tangible, no positive impact, I’d say, for our population.”

The Chinese Embassy in Congo and the Chinese ambassador didn’t immediately respond to an email and a text message requesting comment on the negotiations, which have gone on for more than a year.

“You know, the Chinese are the champions of marathon discussions,” Tshisekedi said. “They’re known worldwide for it. We’re undergoing this experience now and so, we’ll see, but we remain optimistic.”

Negotiations are also dragging on over the Grand Inga site with Australia’s Fortescue Metals Group Ltd., which has a memorandum of understanding with Congo to develop what could be the world’s largest hydropower project, Tshisekedi said.

African investors

The president wants Fortescue to allow other investors into the deal, especially from Africa, and possibly scale down its ambitions in order to speed up development, he said.

“We’re not on the same wavelength,” he said, adding that he’d met at Davos with Andrew Forrest, Fortescue’s billionaire chairman.

“We want to make it a kind of opportunity to also unite other interests, particularly African interests,” Tshisekedi said. “We’re open to everything, to all discussions, to all meetings.”

Talks with Fortescue are continuing, Tshisekedi’s director of communications later confirmed. Fortescue Future Industries Ltd. plans to use Inga’s energy, which could eventually be twice as powerful as China’s Three Gorges project, to produce green hydrogen and green ammonia.

The company is in “active discussions” about the project, FFI Chief Executive Officer Mark Hutchinson said in an emailed response to a request for comment. Tshisekedi plans to visit Australia to continue those talks, he said.

“Fortescue has a team in the DRC and are continuing to work closely with the government to take this forward,” Hutchinson said. “Fortescue welcomes other partners to this important project.”

There’s no timetable for the next phase of Inga, the 10-gigawatt project known as Inga 3, Tshisekedi said.

Regional conflict

The president, who’s also dealing with a multitude of violent conflicts at home and a reelection campaign at year’s end, has grown more outspoken against outsiders taking advantage of Congo’s resources for their own gain.

This has been particularly true in the country’s east, where an offensive by the M23 rebel group — allegedly backed by neighboring Rwanda — has displaced more than 450,000 people. Rwanda denies that it’s supporting the militants, who say they’re fighting for the rights of Congolese of Rwandan heritage.

Eastern Congo has been wracked by conflict since the 1990s, when violence from the aftermath of Rwanda’s civil war and genocide spread across the border. More than 100 armed groups remain active in the region, some of whom profit from the illegal trade in natural resources, which often transit through neighboring countries.

“Rwanda has been at the base of instability in Democratic Republic of Congo for twenty years,” Tshisekedi said. “It’s thanks to this instability that it can create mafia networks of illicit exploitation of gold, coltan and other minerals.”

Cobalt monopoly

Rwanda’s government rejected Tshisekedi’s accusation.

“The root cause of instability in eastern Congo is the security and governance failures of the Congolese government and the longtime involvement in the mining sector of the Democratic Forces for the Liberation of Rwanda, the genocidal militia that fled Rwanda in 1994, as well as dozens of Congolese illegal armed groups that are supported by the Congolese military and government, and which exploit Congo’s natural resources with impunity,” spokeswoman Yolande Makolo said by text message.

A plan to impose a monopoly on the sale of all hand-dug cobalt is also part of Tshisekedi’s goal to ensure Congo is paid for its minerals, he said.

Congo’s state-owned Entreprise Generale du Cobalt, or EGC, still needs a full management team and a regulator, according to the president. Talks are ongoing with potential partners, including Trafigura Group, the Singapore-based commodities trader, he said.

Congo is responsible for about 70% of world cobalt production, as much as 30% of which comes from so-called artisanal miners.

Those miners often work in dangerous and unregulated conditions, and EGC “represents one of the brightest hopes for instigating the improvements needed,” Trafigura said in an emailed response to questions Thursday.

“Trafigura remains committed to its commercial agreement with EGC and delivering on the pressing need to kick-start the large-scale formalization” of the artisanal and small-scale mining cobalt industry, it said.

(By Jacqueline Simmons and Michael J. Kavanagh, with assistance from James Fernyhough and Kamlesh Bhuckory)