Tunnel vision. Chuquicamata mine, Chile. Credit: Codelco.

After an early jobs-report bump on Friday in New York, the copper market turned negative by lunchtime, marking its sixth straight session of losses. December contracts for the orange metal are now trading down 8% for the week.

Disappointing manufacturing data in China was behind the recent pullback after PMIs from the country, responsible for 55% of global copper consumption, unexpectedly slipped into contractionary territory.

But worries about global growth, inflation and interest rates, and an energy crisis in Europe have been hounding the metal for months. The copper price has now fallen by one third since hitting all-time highs early in March above $5 per pound.

No fun in fundamentals

Amid all the economic gloom and doom, a bombshell announcement this week by the world’s number one copper producer appears to have gone largely unnoticed or ignored by large-scale speculators on futures markets who’ve been net short on copper for the last seven weeks.

Chile’s state-owned Codelco last week said it expects output to reach between 1.49 million and 1.51 million tonnes this year, down from a previous forecast of 1.61 million tonnes.

On Wednesday, Codelco chairman Maximo Pacheco told a newspaper 2023 guidance is 1.45m tonnes, but significantly, there is no prospect of an improvement.

“For the five-year period between 2023 and 2027, the best forecast we have is 1.5 million tonnes on average.

“Structural projects [to maintain output levels] are effectively behind schedule and over budget.”

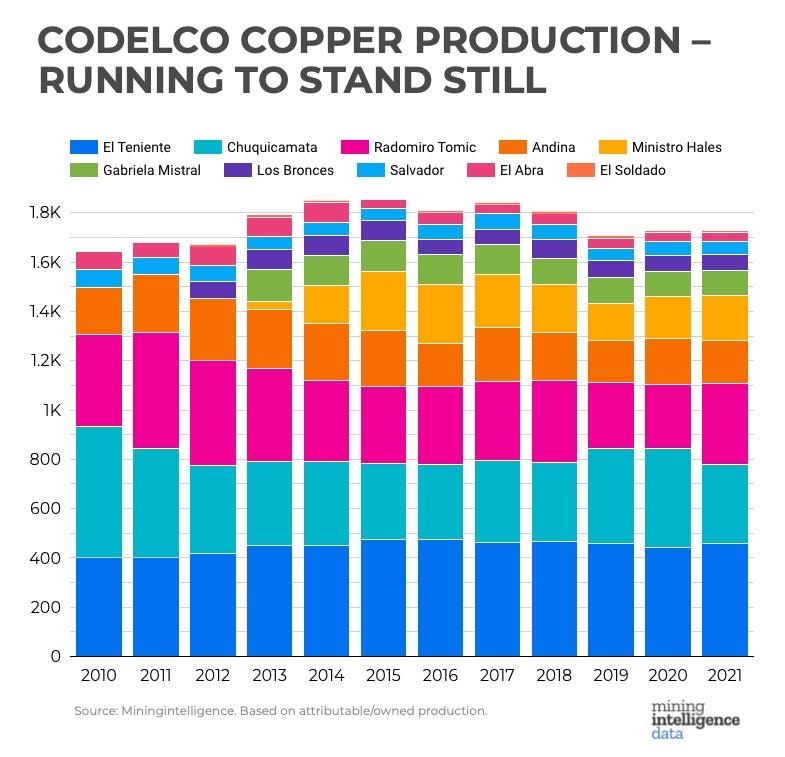

The “best forecast” would constitute the lowest output in at least a decade and compares to average attributable output of 1.74m since 2010 according to data from sister company Miningintelligence.

Codelco’s output next year, would more than 400,000 tonnes below its 2015 peak. A 400ktpa mine would be the world’s fifth largest according to 2021 production tables.

Two lost decades

Codelco’s struggles are Chile’s struggles: water scarcity, declining grades, depletion rates, skinny project pipelines, industrial action, taxation increases and regulatory uncertainty and ever-expanding capex budgets.

In 2021 Chile produced a quarter of the world’s primary copper output of 21m tonnes, according to the US Geological Survey. On a proportional basis that makes Chile’s position in the world of copper on par not with Saudi Arabia’s in crude oil, but the combined output of the 13 members of Opec.

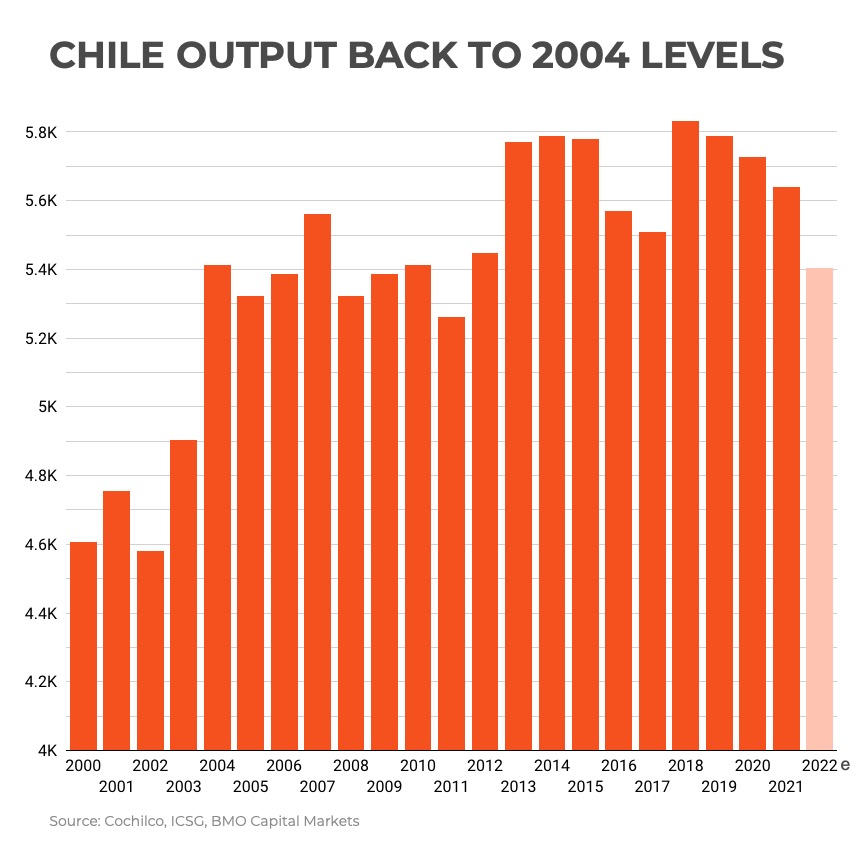

In a recent report, BMO Capital Markets says Chile is now heading towards two “lost decades” in terms of copper output growth:

“Following the steady ramp-up in the 1990s and early 2000s, output levels have stagnated, with the projections of 6Mtpa-plus of output never coming to pass.

“And this is not for a lack of investment, with a number of large new mines coming to market over this period. Rather, it is a function of decline at existing assets.”

BMO notes that in particular, SX-EW production in Chile “continues to trend inexorably lower” and is now roughly 500,000 tonnes below peak levels seen in 2009.

No comments:

Post a Comment