Electric vehicle giant Tesla (NASDAQ: TSLA) is said to have secured a multi-year deal with Vale (NYSE: VALE) for the supply of nickel, one of the key ingredients in the batteries that power EVs.

Since Musk’s pledge to miners, Tesla has inked nickel supply deals with the world’s largest miner, BHP, (ASX: BHP) in Australia, with Prony Resources in New Caledonia and with Talon Metals (TSX: TLO) for its Tamarack nickel project in Minnesota, US.

Nickel helps cram more energy into cheaper and smaller battery packs, allowing EVs to charge faster and travel farther between plug-ins.

Prices for the commodity have – not surprisingly – shot to historic records over the last year. It surged by an unprecedented 250% in a day earlier this month, forcing the London Metal Exchange (LME) to halt trading of the metal.

[Click here for an interactive chart of nickel prices dating back to 1989]

Musk has repeatedly flagged nickel supply as the company’s biggest concern, as the metal is a key component in batteries for longer-range vehicles. Tesla uses iron-phosphate for shorter-range vehicles.

According to BloombergNEF, battery-sector demand for

nickel is expected to hit 1.5 million tonnes in 2030, up from 400,745

tonnes expected to reach this year.

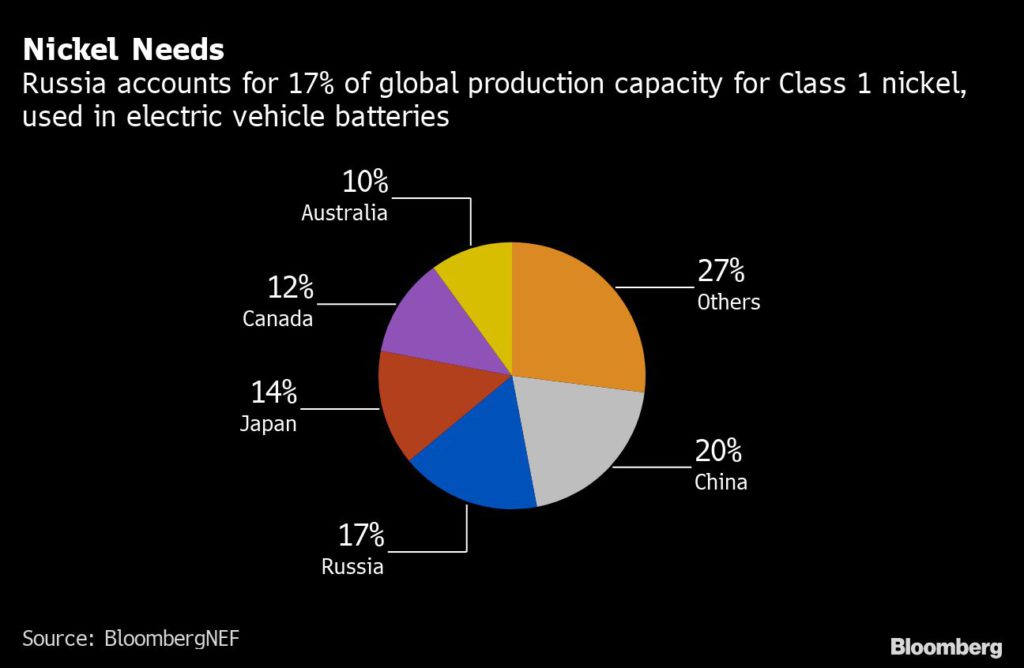

Sanctions against Russia over the invasion of Ukraine have added urgency to secure supplies of the metal, since the country holds about 17% of global capacity for refined Class 1 nickel, the type required for EVs.

Vale is the world’s top nickel producer, with mine and operations in Brazil, Canada and Indonesia, as well as fully-owned and joint venture refineries in China, South Korea, Japan, the UK and Taiwan.

Tesla has also secured lithium mining rights in Nevada and has off-take agreements for the battery metal with Liontown Resources (ASX: LTR) and Ganfeng Lithium (SHE: 002460), China’s no.1 producer of the commodity.

For cobalt, Tesla has partnered with Glencore, (LON: GLEN) the world’s largest producer, thanks to its mines in Congo and it has even inked deals for graphite.

(With files from Bloomberg)

No comments:

Post a Comment