Monday, January 31, 2022

Friday, January 28, 2022

Federal Judge Throws Out Oil Lease Sale in Gulf of Mexico

U.S. District Judge Rudolph Contreras

https://www.newsmax.com/us/oil-leasing-federal-judge/2022/01/27/id/1054400/

A federal court has rejected a plan to lease millions of acres in the Gulf of Mexico for offshore oil drilling, saying the Biden administration failed to conduct a proper environmental review.

The decision Thursday by U.S. District Judge Rudolph Contreras sends the proposed lease sale back to the Interior Department to decide next steps. The ruling said it was up to Interior to decide whether to go forward with the sale after a revised review, scrap it or take other steps.

Environmental groups hailed the decision and said the ruling gave President Joe Biden a chance to follow through on a campaign promise to stop offshore leasing in federal waters. The decision was released on the one-year anniversary of a federal leasing moratorium Biden ordered as part of his efforts to combat climate change.

"We are pleased that the court invalidated Interior's illegal lease sale," said Brettny Hardy, a senior attorney for Earthjustice, one of the environmental groups that challenged the sale.

"This administration must meet this critical moment and honor the campaign promises President Biden made by stopping offshore leasing once and for all," Hardy added. "We simply cannot continue to make investments in the fossil fuel industry to the peril of our communities and increasingly warming planet."

A spokeswoman for Interior Secretary Deb Haaland said the agency was reviewing the decision.

Energy companies including Shell, BP, Chevron and ExxonMobil offered a combined $192 million for drilling rights on federal oil and gas reserves in the Gulf of Mexico in November.

The Interior Department auction came after attorneys general from Republican states led by Louisiana successfully challenged a suspension on sales that Biden imposed when he took office.

Companies bid on 308 tracts totaling nearly 2,700 square miles. It marked the largest acreage and second-highest bid total since Gulf-wide bidding resumed in 2017.

The auction was conducted even as Biden has tried to cajole other world leaders into strengthening efforts against global warming, including at United Nations climate talks in Scotland in early November. While Biden has taken a number of actions on climate change, he has faced resistance in Congress and a sweeping $2 trillion social and environmental spending package remains stalled. The Build Back Better Act contains $550 billion in spending and tax credits aimed at promoting clean energy.

In his 68-page ruling, Contreras said Interior failed to accurately disclose and consider the greenhouse gas emissions that would result from the lease sale, violating a bedrock environmental law.

"Barreling full-steam ahead with blinders on was simply not a reasonable action for BOEM to have taken here," he said, referring to Interior's Bureau of Ocean Energy Management.

Environmental reviews of the lease auction — conducted under former President Donald Trump and affirmed under Biden — reached the unlikely conclusion that extracting and burning more oil and gas from the Gulf would result in fewer climate-changing emissions than leaving it.

Similar claims in two other cases, in Alaska, were rejected by federal courts after challenges from environmentalists.

Federal officials have since changed their emissions modeling methods but said it was too late to use that approach for the November auction.

The National Ocean Industries Association, which represents the offshore industry, slammed the ruling and called U.S. oil and gas production crucial to curbing inflation and strengthening national security.

"The U.S. offshore region is vital to American energy security and continued leases are essential in keeping energy flowing from this strategic national asset," said Erik Milito, the group's president. "Uncertainty around the future of the U.S. federal offshore leasing program" would benefit Russia and other adversaries, he said.

The administration has proposed another round of oil and gas sales in Wyoming, Colorado, Montana and other states. Interior Department officials proceeded despite concluding that burning the fuels could lead to billions of dollars in potential future climate damages.

Emissions from burning and extracting fossil fuels from public lands and waters account for about a quarter of U.S. carbon dioxide emissions, according to the U.S. Geological Survey.

© Copyright 2022 The Associated Press. All rights reserved. This material may not be published, broadcast, rewritten or redistributed.

Department Of Energy To Release Millions Of Barrels Of Oil From Reserve To Combat Surging Gas Prices

By Harry Wilmerding

The Department of Energy (DOE) announced Tuesday the release of millions of barrels of oil from the Strategic Petroleum Reserve (SPR) to combat soaring gas prices.

The DOE approved the release of 13.4 million barrels from its SPR, marking the second-largest exchange from the reserve and bringing the total amount of oil released from the cache to almost 40 million barrels.

Exchange contracts for the released oil have were awarded to seven companies. President Joe Biden authorized a plan in November 2021 to release 50 million barrels of crude oil from the SPR in a coordinated effort with China, India, Japan, South Korea and the U.K. to combat surging gas prices and assist in the COVID-19 pandemic recovery.

U.S. crude oil prices soared to a seven-year high last week, with West Texas Intermediate crude oil prices surging over 13% on a year over year basis, according to Bloomberg. The nationwide average price of unleaded gasoline in the U.S., which has increased for 10 consecutive days, hit $3.34 a gallon on Wednesday, according to American Automobile Association (AAA) data.

Before Tuesday’s announcement, the DOE granted over 8 million barrels of strategic reserve oil as part of the exchange program, which offered contracts totaling 32 million barrels, Bloomberg reported. Those receiving the oil are reportedly expected to return the barrels between 2022 and 2024.

Meanwhile, the Biden Administration has sold 18.1 million barrels of SPR oil for delivery between February and March, according to Bloomberg.

Politics turning against copper mining – Freeport’s Adkerson

Freeport-McMoRan CEO Richard Adkerson | Screen capture from Youtube

The copper market has cooled since touching record levels above $10,000 a tonne in May, but longer-term fundamentals for the bellwether metal remain bullish thanks to a global effort to electrify transport and shift to renewable power generation.

Sign Up for the Copper Digest

Adkerson, top tier copper mining’s longest serving CEO, said the task of increasing copper supply is getting harder as environmental groups and local communities refuse to grant miners a so-called social licence to operate and politicians seek a bigger share of industry profits:

“That’s just the reality around the world today.”

In Chile, Freeport is deferring a decision on a major project until it gets further political clarity, Adkerson said, according to a Bloomberg report, adding that even the investor-friendly US has proven reluctant to green-lighting new mines.

Despite this, Freeport is well positioned for growth via expansion projects at existing operations, he said, and in anticipation of rising demand, Freeport expects its capital expenditure to be $4.7 billion in 2022, compared with $2.1 billion last year. Excluding Indonesian smelter projects to serve the company’s expanded Grasberg operations in the country, the figure is estimated to be $3.3 billion.

Record supply gap

Green-related demand will gather pace in the second half of this decade, ultimately generating nearly 5 million tonnes of additional demand, according to a recent Goldman Sachs forecast.

Set against a peak in global mine supply from 2024 onwards, the investment bank believes these fundamentals will generate “a record long term supply gap by the end of the decade that has to be solved by investment in new mine capacity.”

The long-term supply gap has really opened up in the last few years and at the current 8 million tonnes is close to double the supply gap during the last bull markets in the 2000s and early 2010s.

“This can only be resolved by higher prices stimulating investment in new supply,” according to Goldman.

RELATED: Rising copper prices boost Freeport-McMoRan profits

Thursday, January 27, 2022

Wednesday, January 26, 2022

Tuesday, January 25, 2022

Iron ore price highest in four months on China stimulus

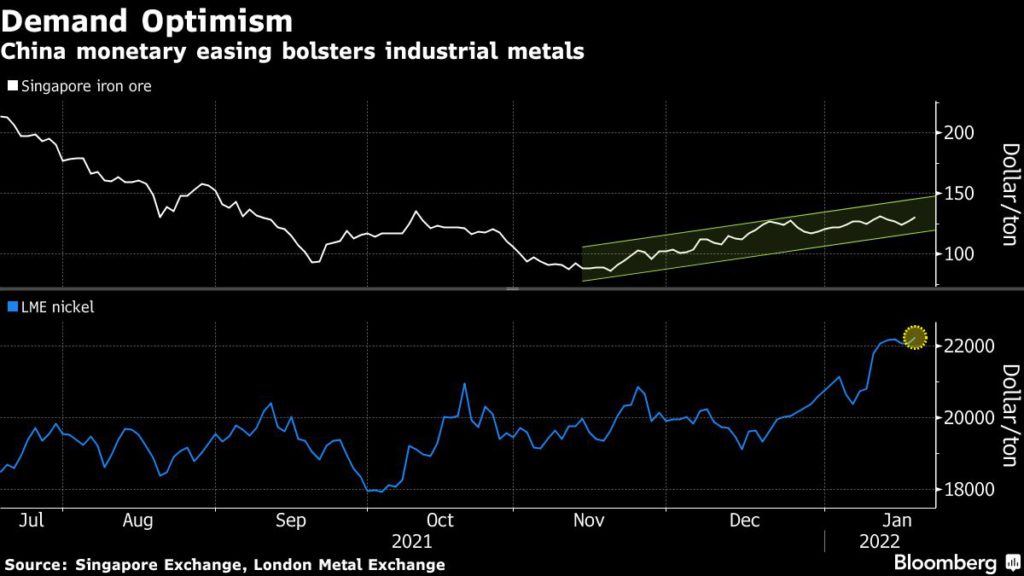

The iron ore price pushed higher on Thursday on expectations of further monetary easing measures in China, while stainless steel futures jumped to a three-month peak, buoyed by record-high prices of key ingredient nickel.

According to Fastmarkets MB, benchmark 62% Fe fines imported into Northern China were changing hands for $134.72 a tonne during morning trading, up 2.3% compared to Wednesday’s closing, the highest since September 7, 2021.

Iron ore’s most-traded May contract on China’s Dalian Commodity Exchange ended daytime trading 1.3% higher at 742 yuan ($116.97) a tonne, after touching a one-week high of 747.50 a tonne earlier in the session.

China stepped up its monetary easing efforts to prop up a slowing economy this week by lowering a set of key policy rates and lending benchmarks, with markets expecting further moves.

“We view this week’s rate cuts as a pre-emptive move to drive a growth rebound in 2022,” said Commonwealth Bank of Australia commodity analyst Vivek Dhar, citing downside pressures from the reimposition of covid-19 curbs and the property sector’s downturn.

Mysteel estimates that utilization rates of blast furnaces will drop to about 55% in the key steel-making hub of Tangshan in China in February and March. It also expects rates to fall in the Shandong and Henan provinces.

Apart from China’s stimulus measures, Dhar said improved steel margins also supported iron ore prices.

“The fact that steel margins rose from November to December also suggests that steel demand has held up reasonably well – potentially indicating that steel demand from China’s infrastructure sector may be offsetting demand weakness from China’s property sector,” Dhar said.

Related Article: Metals rally heats up as nickel price hits $24,000 on supply snarls

(With files from Bloomberg)

World’s Largest Oil Trader: Prices Are Set To Rise Further

Crude oil has already gained 10 percent since the start of the year and has further to go, Vitol’s head of Asia told Bloomberg in an interview.

“These prices are justified,” said Mike Muller. “Strong backwardation is very much justified.”

The executive added that unlike natural gas, whose high price has already prompted lower consumption for some industrial users, oil has yet to reach that price level.

The latest in the gas sector “serves to remind us that people will abstain from buying expensive energy at some point,” Muller said at an industry webinar, adding, “The question is at what point that affects the oil market.”

Crude oil prices have posted four consecutive weeks of gains, which is the longest winning streak since October, in evidence that the demand recovery remains robust as fears about the effect of Omicron die down.

News that China will release oil from its strategic reserve next month had the potential to disrupt the rally but did not, with Brent crude reaching a two-month high last week and trading at over $86 per barrel at the time of writing. WTI was trading at over $84 per barrel.

“People looking at the big picture realize that global supply versus demand situation is very tight and that’s giving the market a solid boost,” Phil Flynn, Price Futures Group senior analyst, told Reuters last week.

Meanwhile, according to Vitol’s Muller, the White House may decide to release more crude oil from the strategic petroleum reserve, on top of the 50 million barrels announced in November last year.

“The market’s saying: ‘More, please,'” Muller said, as quoted by Bloomberg.

According to traders that Reuters interviewed, there is a strong appetite for future oil supply ahead of spring and summer, otherwise known as driving season in the northern hemisphere. There is also an element of anticipation of even tighter supply.

“With spring and summer on the horizon … people are getting prepared to enjoy a strong market,” one trader said.

“I think it’s more trying to get ahead of tightness they think is coming … back to a ‘herd of lemmings’ market dynamic,” said another.

Monday, January 24, 2022

China’s record coal spree seen preventing any new energy crunch

China is better prepared to avoid any energy supply crisis even with power demand forecast to continue to grow rapidly, authorities said.

Sign Up for the Energy Digest

Utilities have also secured more longer-term coal contracts to manage price volatility, while gas suppliers are maintaining high inventories and have been able to meet home heating needs so far this winter without curbing flows to industrial users.

To support China’s adoption of wind and solar power, authorities will speed up approvals for giant, cross-regional power transmission lines and back the development of desert-based hubs for renewables, the NDRC said. President Xi Jinping in October announced the first 100 GW of projects in a desert build-out were already under construction.

Codelco adds 30 years to Andina copper mine

Chile state-owned copper miner Codelco has cut the ribbon at its $1.4 billion Andina Transfer project at its namesake division, which allows the world’s largest copper producer to extend the life of the asset for another 30 years.

The project turned the underground operation into an open pit mine located 3,500 metres above sea level nestled in the Andes Mountains – which hold 30% of Chile’s copper reserves.

Sign Up for the Suppliers Digest

Andina Transfer will also operate with a 4km underground, regenerative ore conveyor belt that will supply over 3.6MW to the division’s electricity network, reducing energy consumption from external sources.

The crushing and ore transportation system will now need only 14 pieces of equipment, down from 50 previously needed.

Andina Transfer’s production capacity is set at 240,000 tonnes of copper per year. Until now, the division had annual production of 184,000 tonnes of the metal, representing only 10% of Codelco’s total output.

The operation is currently in the commissioning phase and the ramp-up stage will begin in February.

Chile, the world’s largest producer of the metal used in everything from construction to electric vehicles and renewable energy, accounts for nearly 30% of the world’s output.

The nation expects to receive almost $69 billion in mining investments through the end of the decade, down 6.9% from the previous forecast, state copper commission Cochilco said in November.

Friday, January 21, 2022

Thursday, January 20, 2022

Iron ore price back above $130 as China pledges support

Workers in machinery factory in China. (Stock Image)

Iron ore led gains among industrial metals Wednesday as China vows to use more monetary policy tools to spur the economy, brightening the outlook for raw materials demand.

“Expectations of easing from the People’s Bank of China while bracing for tighter US monetary policy will spur traders to punt on rates-sensitive assets such as commodities and bonds,” Hong Hao, head of research at BOCOM International, wrote in a research note.

China, the world’s biggest buyer of metals, has been mired in a property market slump, credit stress and repeated virus outbreaks. In response, the central bank this week cut its policy interest rate for the first time in almost two years, signaling the beginning of an easing cycle.

“There’s a trend of strengthening the macro policies to stabilize the economy amid downward pressure on the real-estate market,” Huatai Futures said in a note.

Top steel-producing region Tangshan announced plans for winter curbs on Tuesday, Mysteel reported, citing local government documents.

According to Mysteel’s own survey, the capacity utilization rate for blast furnaces in the city will be lowered to 63% from 78% when 16 more furnaces shut from January 30 to February 20 and from March 3-13, affecting capacity of about 60,000 tonnes a day.

“The resumption of production at steel mills may have to wait until after the Lunar New Year holidays, which could have an impact on the supply of steel,” Huatai said.

Read More: BHP posts 5% jump in second-quarter iron ore output

(With files from Reuters and Bloomberg)

Shell to Hand Over Deer Park Refinery to Pemex Next Week - Sources

Mexican state oil company Petroleos Mexicanos will take control of the Deer Park refinery in Houston, Texas on Jan. 20, three sources with knowledge of the matter said on Thursday.

Royal Dutch Shell (RDSa.L) had agreed in May to sell its majority stake in the Deer Park refinery, which can process up to 340,000 barrels per day (bpd), to Pemex (PEMX.UL), its long-time partner in the plant, for about $596 million.

“Next Thursday, the payment and transfer of the asset will happen,” said a Pemex source, who spoke on condition of anonymity. “The refinery will then be operated directly by Pemex”.

Pemex has reached an agreement with personnel already working in the refinery, the source added.

The operators would be the same to guarantee stability, but they would no longer be working for Shell, the source said.

A Pemex delegation, including Chief Executive Officer Octavio Romero, will travel to Texas to finalize the deal on Thursday, a second source added.

Pemex did not immediately respond to a request for comment and a Shell spokesman did not immediately confirm the delivery date.

A third source close to the talks said there are still final transition activities pending, but added that he expected the deal to complete in the next few days.

Mexican Energy Minister Rocio Nahle did not confirm the Jan. 20 date in an interview with local television network Milenio, saying the timing of the process was being managed between Shell and Pemex.

“It is very risky to give a date … but this process is already underway,” Nahle said. “Hopefully soon.”

Conversations had accelerated in recent days in order to complete the entire purchase operation before Feb. 1, the third source said.

Neither Shell nor Pemex have detailed what volumes of refined product Mexico will receive from the Texas plant nor how much crude it will be able to supply from now on.

Wednesday, January 19, 2022

De Beers makes diamond buyers cough up cash with fresh price rise

The miner increased the price of its rough diamonds throughout much of 2021 as it sought to recover from the first year of the pandemic. (Image courtesy of De Beers Group.)

De Beers has implemented its biggest

price increase for diamonds in years as the industry consolidates its

recovery from the first pandemic-induced shutdowns.![]()

The Anglo American unit hiked prices by about 8% at its first sale of the year, according to Bloomberg. The sharpest increases of up to 20% were for smaller, cheaper stones.

The changes at the January sight, which runs from Monday to Friday this week, reflected buoyant polished sales during the recent US festive period, as well as a hot rough market.

The company increased the price of its rough diamonds throughout much of 2021 as it sought to recover from the first year of the pandemic when the industry came to a near halt. Most of these hikes, however, were applied to stones bigger than 1 carat.

The strategy granted De Beers a steady recovery during 2021. Its diamond prices rose by 23% in “just over a year,” said Mark Cutifani, CEO of Anglo American in a December presentation.

De Beers sells its gems through 10 sales each year in Botswana’s capital, Gaborone, and the handpicked buyers — known as sightholders — generally have to accept the price and the quantities offered.

Customers are given a black and yellow box containing plastic bags filled with stones, with the number of boxes and quality of diamonds depending on what the buyer and De Beers agreed to in an annual allocation.

Main winners

Diamonds ended up being the big winners from lockdowns around the globe as access to rival luxury offerings was limited. That first showed with stronger-than-expected holiday sales, from Thanksgiving through to Christmas, and has since continued.

“The rough market is hot. There’s enthusiastic buying across all rough categories,” Anish Aggarwal, a partner at specialist diamond advisory firm Gemdax told Bloomberg in June. “There are supply shortages at the moment. That’s creating a sense of scarcity at every stage of the pipeline.”

Russia’s Alrosa, the world’s top diamond producer by output, has also increased the price of its diamonds over the last few months, triggering complaints from some industry actors. They claim the price hike has gone too far, especially as polished prices need to climb higher to justify the rates that rough stones are fetching.

(With files from Bloomberg)

Tuesday, January 18, 2022

Work on Africa’s Largest Oil Terminal to Be Completed in April

opinion.premiumtimesng.com

Africa’s largest oil terminal, at the port of Mombasa, is expected to be completed in April and operational in July, according to Kenyan president Uhuru Kenyatta.

Kenyatta made the announcement after inspecting the works with Chinese Foreign Minister Wang Yi on Thursday.

The terminal’s $350m jetty, which is currently 96% complete, was funded by Kenya Ports Authority and built by China Communications Construction Company.

The 770m jetty will be capable of handling tankers of up to 200,000 deadweight tonnes, carrying all categories of petroleum products including crude oil, white oils and liquefied petroleum gas.

According to Kenyatta, the terminal will ensure price stability of oil products and will handle exports from the Turkana field in the northwest of the country, which this year is expected to begin producing up to 100,000 barrels a day.

He said: “Once complete, the facility will be able to reduce not only the cost of fuel but also to ensure that Kenya is able to consistently have an adequate supply of fuel for our needs and development needs of our people.

“This terminal will result in the saving of almost 2 billion Kenyan shillings ($18m) that we are currently paying every year because of demurrage occasioned by the long queues of vessels parked outside our harbour waiting to discharge their product.”

The jetty will replace the 50-year old onshore Kipevu Oil Terminal.

Monday, January 17, 2022

Sunday, January 16, 2022

Saturday, January 15, 2022

Friday, January 14, 2022

Thursday, January 13, 2022

Bullish investors add $90bn to top 50 biggest mining companies

Antamina mine, Peru. Image from Glencore.

https://www.mining.com/featured-article/bullish-investors-add-90bn-to-top-50-biggest-mining-companies/?utm_source=Daily_Digest&utm_medium=email&utm_campaign=MNG-DIGESTS&utm_content=bullish-investors-add-90bn-to-top-50-biggest-mining-companies

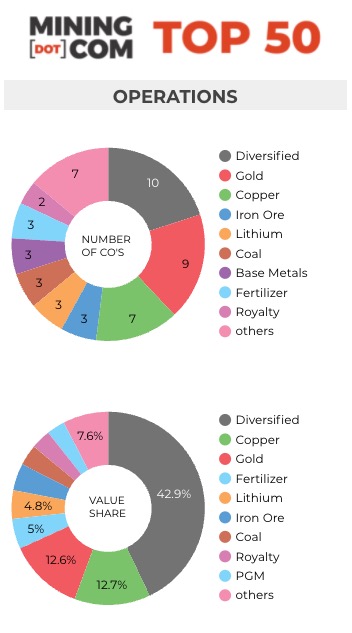

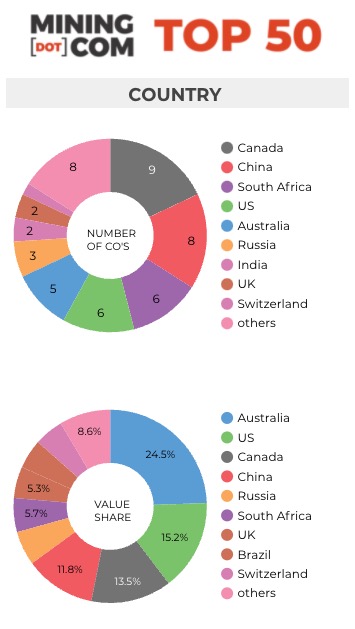

The MINING.COM Top 50* most valuable mining companies pared much of the losses suffered in the third quarter, adding a combined $86.3 billion in market capitalization over the final three months of 2021, as investors in the sector position for what should be another strong year for the industry.

After peaking mid-year, the total value of the top 50 ended 2021 at just under $1.4 trillion, up around $100 billion since the start of the year and double the market capitalization during March/April 2020 at the height of the pandemic.

Iron will

The Big 3 – BHP, Rio Tinto and Vale – dragged down the index last year, losing a combined $56 billion over the year as the pullback in iron ore prices and a cooling copper market in the latter part of 2021 hammered valuations at the top.

BHP peaked at a valuation of just shy of $200 billion last year, and for a time was worth more than the oil major Royal Dutch Shell, making it the most valuable stock in the UK.

It is an indication of the belief investors have in the effect on mining of the green energy transition or GET™. That BHP gave up nearly $50 billion subsequently (Rio Tinto lost $43 billion since its peak) despite burnishing its battery metals credential with its pursuit of nickel assets is also an indication that iron ore remains the bread and butter of the industry.

Iron ore’s waning fortunes also saw Kumba Iron Ore of South Africa emerge as the worst performer for the year, with a 30% plunge in the stock. The world’s no. 4 producer Fortescue Metals Group gave up almost $13 billion of its market worth over the course of the year and dropped six spots on the ranking as its Fortescue Future Industries arm gets off to a slow start.

With the iron ore market in retreat, Brazil’s CSN Mineração, one of the biggest mining IPOs since Glencore in 2011 when it debuted in Q1, fell out of the top 50, but thanks to an 87% surge last year, Cleveland-Cliffs looks secure in the top 50 for now after spending years in the wilderness.

Lithium lift

Lithium prices have extended their year-long rally as electric car demand motors along and the three producers in the top 50 now have collective value of over $66 billion.

Tianqi Lithium briefly fell out of the ranking at the end of 2019 as its market value fell below $5 billion, but the Shenzhen-listed producer has now pierced the top 20, surpassing SQM in the process, with a value of some $25 billion.

The world’s number one producer, Albemarle, is up 59% since the start of the year making its investors a cool $10 billion richer. The Charlotte-North Carolina company in September announced it’s buying a Chinese lithium processor in efforts to expand downstream.

Lithium is becoming a crowded market.

While Rio Tinto’s Jadar project is off to a rocky start in Serbia, the Anglo-Australian giant’s lithium business would probably start showing up in valuations in coming years as would Sibanye’s move into the battery metal with an acquisition in Nevada.

Top lithium chemicals manufacturer Ganfeng (excluded here because mining is a minor part of its business) is desperate for upstream investment and copper giant Codelco is bringing forward work on its lithium project, but other concessions in Chile may become scarcer or cease altogether.

Also look out for Pilbara Minerals to join the top 50 in the not too distant future, as the stock continues to set record highs and the company’s Pilgangoora operations ramp up to supply booming demand for spodumene from Chinese converters. At today’s valuation, Pilbara Minerals would occupy position number 54.

Coal crown

With no exposure to iron ore other than trading, Glencore bucked the trend, and investors in the Swiss commodities giant ended the year a collective $25 billion richer. Glencore has not abandoned coal mining, like its peers and and its coal, gas and oil trading arm is benefiting from sky high prices for energy.

Evidence of the volatility of commodities markets is the performance of coal miners, especially in China, in 2021. Although some air escaped the sector towards the end of the year not long ago, coal miners (and coal divisions at diversifieds) looked set to disappear from the ranking altogether.

The value of the three remaining coal companies (the ranking excludes power utilities such as Shenhua Energy that operate their own mines) surged and Coal India finally arrested its decline. Four years ago the world’s largest coal miner made it to no 4.

Uranium upside

Thanks to a rally in the nuclear fuel a decade in the making since the Fukushima disaster, uranium stocks rejoin the top 50 ranking for the first time in many years.

The value of Kazakhstan’s Kazatomprom, which has expanded its exchange listings well beyond Almaty, more than doubled this year, and turmoil in the country responsible for some 40% of global uranium output has, so far, not affected the state-controlled company’s fortunes.

Top rival Cameco was just pipped by AngloGold Ashanti and does not appear in the end-year top 50 although relative share price performance since the close on December 31 would have the Saskatoon-based company firmly back in the ranking on hopes it can capitalize on a revived uranium market and Kazakh troubles.

*NOTES:

Source: MINING.COM, Miningintelligence, Morningstar, GoogleFinance, company reports. Trading data from primary-listed exchange where applicable at close Dec 31 2021, currency cross-rates Jan 7 2022.

Percentage change based on US$ market cap difference, not share price in local currency.

Market capitalization calculated at primary exchange, where applicable, from total shares outstanding, not only free-floating shares.

As with any ranking, criteria for inclusion are contentious issues. We decided to exclude unlisted and state-owned enterprises at the outset due to a lack of information. That, of course, excludes giants like Chile’s Codelco, Uzbekistan’s Navoi Mining, which owns the world’s largest gold mine, Eurochem, a major potash firm, Singapore-based trader Trafigura, and a number of entities in China and developing countries around the world.

Another central criterion was the depth of involvement in the industry before an enterprise can rightfully be called a mining company.

For instance, should smelter companies or commodity traders that own minority stakes in mining assets be included, especially if these investments have no operational component or warrant a seat on the board?

This is a common structure in Asia and excluding these types of companies removed well-known names like Japan’s Marubeni and Mitsui, Korea Zinc and Chile’s Copec.

Levels of operational or strategic involvement and size of shareholding were another central consideration. Do streaming and royalty companies that receive metals from mining operations without shareholding qualify or are they just specialized financing vehicles? We included Franco Nevada, Royal Gold, and Wheaton Precious Metals.

Vertically integrated concerns like Alcoa and energy companies such as Shenhua Energy where power, ports and railways make up a large portion of revenues pose a problem as do diversified companies such as Anglo American with separately listed majority-owned subsidiaries. We’ve included Angloplat in the ranking as well as Kumba Iron Ore.

Many steelmakers own and often operate iron ore and other metal mines, but in the interest of balance and diversity we excluded the steel industry, and with that many companies that have substantial mining assets including giants like ArcelorMittal, Magnitogorsk, Ternium, Baosteel and many others.

Head office refers to operational headquarters wherever applicable, for example, BHP and Rio Tinto are shown as Melbourne, Australia but Antofagasta is the exception that proves the rule. We consider the company’s HQ to be in London, where it has been listed since the late 1800s.

Please let us know of any errors, omissions, deletions or additions to the ranking or suggest a different methodology:

Wednesday, January 12, 2022

Tuesday, January 11, 2022

Monday, January 10, 2022

Copper price set for biggest weekly decline since November

The copper price rose on Friday, supported by a rebound in equities and tight supply, but a firmer dollar and expectations of an early US interest rate hike kept the metal on track for its biggest weekly decline since November.

The most-traded February copper contract on the Shanghai Futures Exchange was down 0.5% at 69,560 yuan ($10,910.69) a tonne.

Click here for an interactive chart of copper prices.

“Market sentiment improved a little bit after participants digested the hawkish US Federal Reserve’s minutes of December policy meeting,” a Singapore-based trader said.

“Concerns over tight supply, already affected by covid-19-related controls, were exacerbated by the unrest in Kazakhstan,” he added.

The Fed, at its December meeting, began plans to start cutting the amount of bonds it is holding, with members saying that a reduction in the balance sheet likely will start sometime after the central bank begins raising interest rates.

Goldman Sachs Group said it is “extremely bullish” on commodities, amid a supercycle that has the potential to last for a decade, according to Jeff Currie, the bank’s global head of commodities research.

“The new year has started against a backdrop that includes record dislocations in energy, metals and agriculture, and significant amounts of money in the system,” Currie said in a Bloomberg Television interview.

“In addition, investment positions in commodities are low,”

“The best place to be right now, particularly given the Fed pivot, are commodities,” Currie said.

“We think you’re going to see another year of out-performance of commodities and real assets more broadly.”

On-warrant copper stocks in LME-registered warehouses were last at 80,525 tonnes, up from a historic low of 14,150 tonnes in October but far below peaks seen in August.

(With files from Reuters and Bloomberg)

Saturday, January 8, 2022

Friday, January 7, 2022

Thursday, January 6, 2022

Copper think tank signals how Chile’s new Constitution can boost the mining sector

Chilean President Elect

Chile’s Centre for Copper and Mining Studies (Cesco) presented a document titled More and better mining for Chile before the constituents working on the country’s new Political Constitution, which should be subjected to a referendum by mid-2022.

Led by the Centre’s director Leopoldo Reyes, the presentation emphasized that even though Chile would be between 20% and 25% poorer if it didn’t exploit its mineral resources, the mining sector needs a new purpose that goes beyond increasing production because grades continue to lower and because the local industry has not been able to build a strong value chain that promotes sustainable development.

Considering that due to the climate change-driven energy transition, the world will need the equivalent of an additional 25% of Chile’s current copper production, Reyes said that the country has an opportunity to match its metal and mineral exports with the provision of knowledge, technology and services to international partners.

In his view and that of the nonprofit he leads, in order for Chile’s mining sector to step up its game, a model shift is needed. Thus, the new Constitution should emphasize that the Chilean state is the owner of the country’s mineral bounty and has the obligation to generate the greatest sustainable value by undertaking mining exploration and exploitation projects led by state-owned companies.

Such projects, however, could be run under a mixed model in which state-owned and private companies join forces to maximize results.

Concessions and royalties

When it comes to concessions, the Centre for Copper and Mining Studies proposes new legal measures that promote and guarantee that concessions are used as they were intended to. “In this sense, we propose modifications to the Qualified Quorum Law so that the obligations of concessionaires are laid out in a clearer manner,” the document states.

Cesco also poses the idea of creating more efficient mechanisms to collect rent and royalties from private companies, both local and foreign, keeping in mind that mining activities are capital-intensive, cyclical and long-term and that it is important to keep attracting investors.

For the organization, the existing Specific Tax on Mining needs to be raised so that the state can continue to invest in the sector, grow the country’s production capabilities and boost technological developments.

“The State should also invest or incentivize investments in activities that complement the exploitation of mineral resources, namely, science, technology and innovation, thus strengthening the value chain and the competitiveness of the metallurgical sector,” the document reads.

The final recommendations of the Centre for Copper and Mining Studies focus on working towards a greener future. It suggests that the government makes an effort to move away from fossil fuels and starts dealing with historical environmental liabilities. This means identifying and characterizing such liabilities, compensating those who have suffered due to the destruction of the natural environment and making efforts to restore the country’s natural assets.

Pemex Looks to Double Refinery Throughput, Take Business from Gulf Coast Refiners

/religious-leaders-rally-for-immigrant-rights-at-capitol-57193123-592a30d83df78cbe7edd7726.jpg)

The National oil company of Mexico, Pemex, is exporting ~1mb/d of crude oil, with ~60% flowing to the US and gulf-coast refineries, but the current CEO wants to change that.

At a press conference in Mexico City yesterday, CEO Octavio Romero shared plans to cut exports to ~430kb/d in 2022 and eliminate them entirely by 2023, as Pemex refineries ramp up to consume the domestic crude.

The Dos Bocas refinery, a 340kb/d plant currently under construction, will be fully operational in 2023 and account for ~1/3 of increased domestic crude consumption.

The Pemex downstream system processed ~1.2mb/d from 2010-2014 before utilization dropped to as low as 690kb/d in 2020.

Currently processing ~800kb/d, the Pemex system could increase runs ~400kb/d by simply returning existing refineries to historic utilization rates.

Cutting exports by the full 1mb/d appears to be a challenge, as running the legacy system at rates not seen in half a decade, and running the new Dos Bocas refinery at capacity would only reduce exports by ~780kb/d.

Nevertheless, 780kb/d of increase in oil production in Mexico and the Gulf region would cut into share for US Gulf Coast refiners like Valero (NYSE:VLO), Phillips (NYSE:PSX) and Marathon (NYSE:MPC), as well as reducing margins for integrated companies like Exxon (NYSE:XOM) and Chevron (NYSE:CVX).

In addition to cutting into market share, reduced Mexican exports would reduce the supply of heavy crude oil to the Gulf Coast system, leaving US refiners in search of additional heavy barrels from Canada, Venezuela and the Middle East.

Wednesday, January 5, 2022

China’s Reliance on Middle East Oil, Gas to Rise Sharply

© Ingram Pinn/Financial Times

As China embarks on a long transition to renewables, Middle East’s strategic significance for Beijing will only grow

China has long relied on the Middle East to secure much of the oil needed to fuel its rapid economic development. Now Chinese President Xi Jinping wishes to create an “ecological civilization” that relies less on fossil fuels and more on renewable energy.

As the world’s largest oil importer seeks to become greener and more self-reliant, one might expect a shift in its attention and capital. The reality, however, is not that simple.

A growing interdependence

Since China became a net importer of oil in 1993, the Middle East has emerged as an increasingly important source of this critical commodity. By the time China surpassed the US as the largest importer of crude oil in 2017, almost half its supply originated from this troubled region.

Despite China’s years-long efforts to ramp up local production and diversify its acquisition, its dependency on the Middle East for crude oil remains intact. In 2020, China imported crude oil that totaled roughly US$176 billion. Almost half (47%) of these official imports came from Middle Eastern countries.

Notably, Saudi Arabia emerged as China’s largest crude oil supplier and was still maintaining its leading position as of October 2021. The $28.1 billion worth of oil exported from the Kingdom to China in 2020 accounted for 15.9% of China’s total crude oil imports.

Iraq found itself in third place, shipping $19.2 billion (10.9%) worth to the mainland over 2020. Oman, the United Arab Emirates and Kuwait were also among China’s top 10 suppliers, exporting $12,8 billion (7.3%), $9.7billion (5.5%), and $9 billion (5.1%), respectively.

China’s thirst for Middle Eastern oil is perhaps best exemplified by the case of Iran. During 2020 and into early 2021, Iran had reportedly exported almost 17.8 million tonnes (306,000 barrels per day) of crude oil to China in the face of US sanctions on the Islamic Republic.

Besides oil, the Middle East also provides another vital resource to China – natural gas. As one of the world’s largest exporters of Liquefied Natural Gas (LNG), Qatar records the second-highest export volume of 106.1 billion cubic meters in 2020.

That year, China received 8 million metric tonnes of LNG from Qatar, accounting for 20% of its total LNG imports. With China’s demand for gas set to remain relatively strong over the next several years, Qatar continues to be part of this important equation.

China’s dependence on the Middle East for oil and gas has elevated the region’s strategic significance to Beijing. China has accordingly sought to expand cooperation beyond the energy sector from maritime and railway infrastructure projects within the framework of its Belt and Road Initiative to investments in advanced technologies such as 5G networks, artificial intelligence and nuclear energy.

According to the American Enterprise Institute’s China Global Investment Tracker, more than $123 billion flowed from China into BRI-related investments across the region between 2013 and 2019. The resulting economic entanglement has created an interdependence that has established China as a major player in the region.

Uncomfortable realities

Geopolitical instability in the Middle East remains a significant energy security concern for Beijing. The attack on Saudi Aramco’s oil facilities by Houthi insurgents in September 2019, which caused oil prices to surge 15%, serves but one telling example.

That crude oil and LNG traveling from the Middle East to China moves through some of the most unstable regions of the world, only compounds the challenge for Beijing.

Tankers leaving the Middle East and North Africa first transit the Strait of Hormuz or Bab el-Mandeb strait, two maritime chokepoints that straddle regions fraught with conflict. From there, they move south past the port of Gwadar in Pakistan’s troubled Balochistan province and towards Myanmar, where one of the longest-running civil wars is threatening China’s $1.5 billion natural gas and oil pipeline links to the Indian ocean.

Traversing through the narrow Strait of Malacca, ships then move north through the contested waterways of the South China Sea and Taiwan Strait before discharging at Chinese ports.

To secure these waterways and ensure the steady flow of energy to the mainland, China deployed its first modern battle-ready warships to the region as part of a naval task force to conduct escorts and patrols in the pirate-infested Gulf of Aden in 2008.

While pirate activity has primarily shifted to other regions – like the Gulf of Guinea – since 2012, the People’s Liberation Army Navy (PLAN) remains active in the Gulf of Aden. This has led some pundits to raise questions about China’s intentions.

A 2016 report by the French Institute For International Relations posits that China’s anti-piracy missions “have evolved from protecting Chinese shipping interest” into a “strategic forward deployment, contributing to the rise of Chinese sea power in the Indian Ocean.”

The authors’ assessment seems congruent with China’s 2015 military strategy, which states “the security of overseas interests concerning energy and resources, strategic sea lines of communication, as well as institutions, personnel and assets abroad, has become an imminent issue.”

Beijing has sought to bolster the capacity of its deployment of military assets by establishing forward operating bases – such as the opening of the first Chinese overseas naval base in Djibouti in 2017.

Notably, on December 14 at the Sixth Annual Conference on Israel’s China Policy, Israel’s former Mossad Chief Efraim Halevy pointed out that China had recently constructed a pier large enough to accommodate an aircraft carrier at the naval base in the eastern African nation.

More recently, an attempt by China to construct a secret military facility in Abu Dhabi’s Khalifa port that was halted due to US pressure serves as another example of China’s determination to enhance its power projection capabilities in the region.

While the true intent of the project remains unclear at present, China’s development of commercial ports in outposts around the world has been described by US officials as a “clear effort to develop footholds for military access.”

From the Chinese perspective, Beijing needs this power. Besides threats stemming from piracy and political instability along its energy supply chain, the narrow straits through which most of China’s oil and gas transits pose another geopolitical conundrum for Beijing: the US Navy and its allies could interdict shipments of energy supplies and hence threaten China’s energy security.

Considering China’s dependence on foreign suppliers for oil remains in excess of 70%, Chinese fears of such disruptions to the energy supply chain will only grow.

While many analysts have called into question the viability and sustainability of executing such a blockade, there is no doubt that the possibility occupies an important place in Chinese strategic thinking.

As Richard Ghiasy, Fei Su, and Lora Saalman explain in a 2018 report on the 21st Century Maritime Silk Road, “the CPC mindset [is] to prepare for the worst and to alleviate sources of vulnerability, rather than hope for the best.”

Evidence of this can be found in China’s efforts to develop the China-Myanmar oil and gas pipelines that run from Kyaukpyu port to Kunming, the China-Central Asia pipeline, and its plans to construct a China-Pakistan-Iran-Turkey (CPIT) energy corridor – to transport oil and natural gas primarily from Iran overland through Pakistan to China.

These projects are all designed to reduce the country’s heavy reliance on critical maritime chokepoints, through which roughly 83% of China’s oil imports transit.

In addition to the construction of new overland routes, China has developed a significant strategic reserve of oil, which according to the Oxford Energy Institute, is “estimated to contain 40 days’ supply.”

Meanwhile, Chinese national oil companies – CNPC, CNOOC and Sinopec – are planning to boost spending and are expected to drill 118,000 wells over the next five years at a projected cost of $123 billion. However, considering that only 2.4% of global proven oil reserves are located in China, the scope for increasing domestic production remains limited.

Energy in transition

China’s 14th five-year plan, the blueprint that will guide China’s development through 2025, places a significant emphasis on energy security and climate change. The Five-Year Plan commits the government in very broad terms to “formulate an action plan for peaking carbon emissions before 2030” and to “anchor efforts to achieve carbon neutrality by 2060.”

The world’s second-largest economy had already embraced green energy production prior to this plan, including wind, solar, hydro and nuclear, as well as the electrification of the energy and transportation systems.

China has come to dominate many of the vital global renewable energy supply chains of the 21st century and is the biggest producer of batteries, electric vehicles, solar panels, power control systems and wind turbines.

China today controls roughly 60% of the solar market and has maintained its position as the top investor in renewable energy for 10 years in a row. In 2019 alone, China invested a staggering $83.4 billion in the clean energy sector.

Over the last decade, China added 36% of the world’s total new renewable generation capacity. By 2060 China aims to transform its power generation mix from roughly 70% from fossil fuels today to 90% from renewable sources.

As international energy expert Edward C Chow explains: “China does this partly but not solely because it recognizes its overdependence on oil and gas imports and the security vulnerability this causes.”

Not so fast; and not so simple

However, the transition towards a greener, more sustainable world will take time and is likely to be both a messy and costly process. According to Zang Xiaohui, dean of economics at Tsinghua University’s PBC School of Finance, China will need to invest as much as $46.6 trillion by 2060 to meet this goal.

Deputy Secretary-General of the National Development and Reform Commission, Su Wei, has emphasized that despite the country’s ambitious plans to go green, economic growth remains a top priority.

Considering the stability that traditional power sources have provided China’s industrialization efforts compared to the “intermittent and unstable” renewable sources, Su Wei points out that China has little choice but to rely on energy sources such as oil, gas and coal power while “transiting.”

The power cuts and blackouts that recently rippled across China, causing factories to slow production or close entirely, illustrated the extent to which the country relies on non-renewable sources to maintain economic growth.

Despite its ideals to transit towards green and clean energy, China’s dependence on oil and gas imports is projected to grow to 80% by 2030. According to a parametric review of data from the US Energy Information Administration (EIA) by Emeritus Chair in Strategy at Center for Strategic and International Studies Anthony H Cordesman: “China and Asia will have a sharply growing dependence on MENA and Gulf petroleum exports that may well extend through 2050.”

Cordesman points out that “China will depend – as will the rest of Asia – on energy exporters like Algeria, Libya, Egypt and Syria, as well as the states of the Arab/Persian Gulf – Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, the UAE, and Yemen.”

Against the backdrop of escalating tensions between China and the US, such reliance only lends further impetus for China to expand its influence and secure its interests in the region.

Through 2060, China will need to protect the sea lines of communication to ensure the integrity of its oil and gas supply chains. This reality increases the possibility that Beijing will seek to establish more military outposts to enhance its naval power projection capabilities.

Meanwhile, Middle Eastern countries are not standing by idly as the world transitions to a greener future and are increasingly looking to Beijing to assist them in constructing their very own clean energy ecosystems.

As these ecosystems mature and the world begins to rely less on the region’s oil, Beijing’s dominance of the renewable energy supply chain promises to turn the geopolitical status quo on its head and may leave the Middle East uncomfortably dependent on China in the green economy.

Tuesday, January 4, 2022

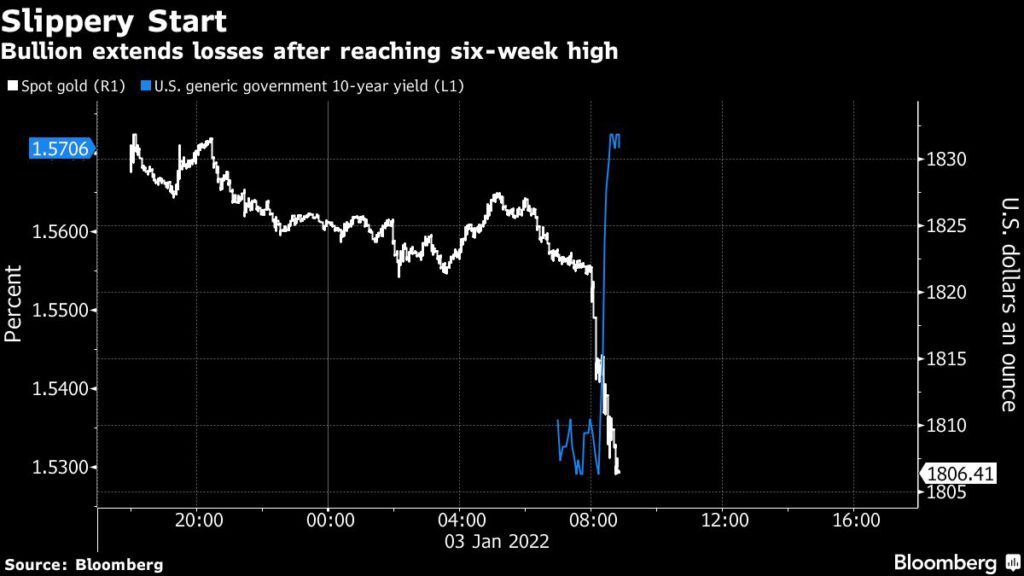

Gold price extends loss with bond yields, equities rallying

Prometheus statue at Rockefeller Center, New York. Credit: Wikimedia Commons

"Only in NYC"

Gold extended its decline heading into 2022, falling by more than 1% on Monday as a risk-on rally in equities pressured bullion, with investors shrugging off concerns surrounding the omicron coronavirus variant.

Sign Up for the Precious Metals Digest

[Click here for an interactive chart of gold prices]

S&P 500 futures approached record levels on Monday as equity markets looked to extend a recovery from the pandemic shock into the new year.

Benchmark 10-year US Treasury yields meanwhile rose to a six-week peak, drawing investors away from the non-yielding bullion.

Also pressuring gold by making it more expensive for overseas buyers, the dollar rose against a basket of major currencies, tracking government bond yields as investors anticipate the US Federal Reserve to stay on its path of interest rate hikes in 2022.

“Rising yields, a firmer dollar and improved risk sentiment are boosting equities, collectively putting pressure on the gold market,” Bob Haberkorn, senior market strategist at RJO Futures, told Reuters.

Bullion ended the previous calendar year down 3.6%, the biggest annual decline since 2015, as major central banks around the world started to dial back pandemic-era stimulus to fight inflation.

UBS analyst Giovanni Staunovo said rising US interest rates and declining inflation over the course of 2022 could weigh on gold, forecasting a price of $1,650 at the end of the year.

Some investors view gold as a hedge against higher inflation, but bullion is highly sensitive to rising US interest rates, which increase the cost of holding the commodity, he said.

With major markets all closed for holidays, investors will look ahead to the release of minutes from the Fed’s latest meeting on Wednesday and the US nonfarm payrolls figures due Friday.

(With files from Bloomberg and Reuters)