Friday, October 29, 2021

Thursday, October 28, 2021

Wednesday, October 27, 2021

US gas prices hit highest level since 2014

Pexels

https://localnews8.com/life/gas-prices/2021/10/25/us-gas-prices-hit-highest-level-since-2014/

BOISE, Idaho (KIFI) – According to AAA, the national average price for regular gas hit $3.39 per gallon this week, the highest it’s been since September 2014.

Rising fuel demand, tightening supplies and the high price of crude oil are all playing a part in higher prices at the pump.

Meanwhile, at $3.72 per gallon, Idaho drivers are paying much more than the U.S. average, but prices here have been slowly falling since Labor Day. This week, Idaho traded places with Alaska, dropping to 7th in the country for most expensive fuel.

Here’s a look at Idaho gas prices as of 10/25/21:

- Boise - $3.82

- Coeur d’Alene - $3.41

- Franklin - $3.68

- Idaho Falls - $3.65

- Lewiston - $3.37

- Pocatello - $3.76

- Twin Falls - $3.81

“The rising price of crude oil, now climbing toward $84 per barrel, is a bad omen, but it doesn’t appear to be changing anyone’s driving behavior just yet,” AAA Idaho spokesman Matthew Conde said. “Fuel demand jumped by nearly 400,000 barrels per day this week, which suggests that people are determined to push through the pain at the pump to continue their normal activities.”

Domestic crude oil stocks currently sit at 426 million barrels, which is 13% below last year.

At $3.39, the U.S. average is six cents higher than a week ago and 20 cents higher than a month ago. Idaho’s current average of $3.72 is the same as a week ago and three cents less than a month ago. This week, eight states saw prices jump ten cents or more. The most expensive fuel in the country is in California at $4.54 per gallon, while the cheapest gas can be found in Oklahoma at $3.01 per gallon. No state average is below the $3 mark this week.

“The cost of crude oil accounts for half of the price of finished gasoline, so as long as crude remains expensive, pump prices will follow. But tight supplies are making the problem worse,” Conde said. “The best thing drivers can do is bundle their errands and avoid rush-hour travel if possible. That could help drive down demand and relieve a little bit of pressure in the market.”

Tuesday, October 26, 2021

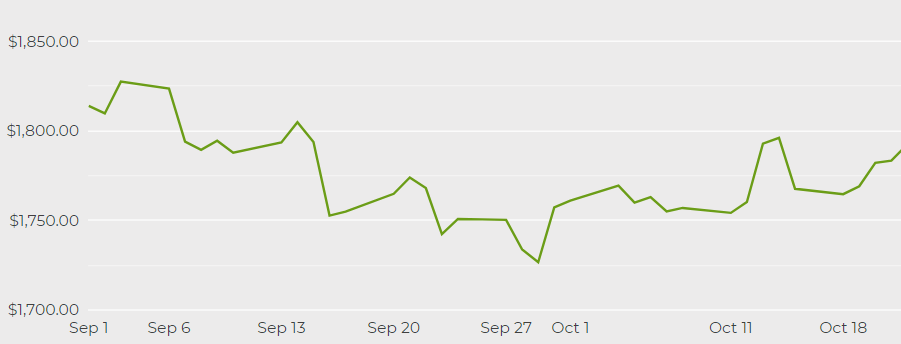

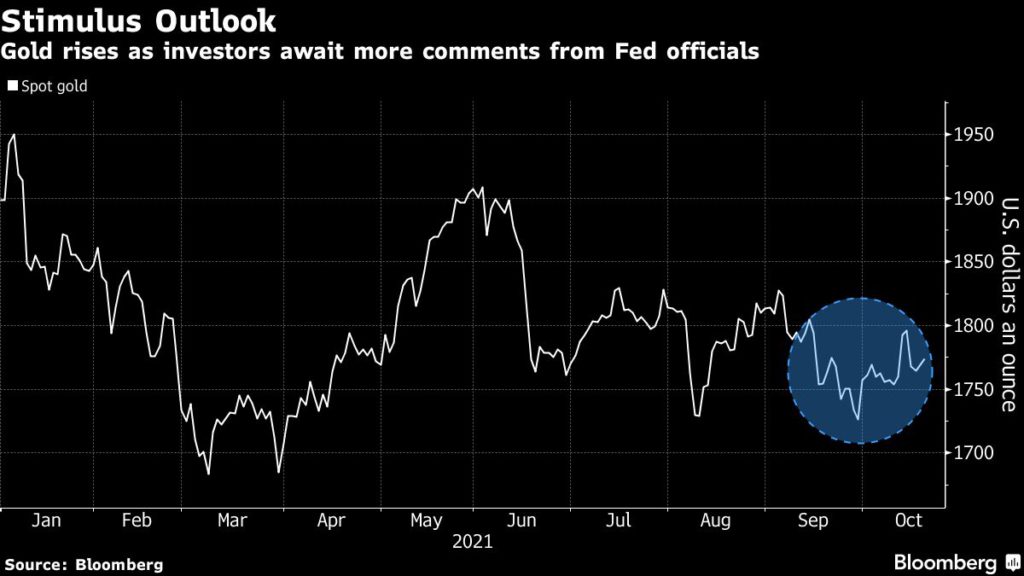

Gold price back above $1,800 as Fed prepares to taper asset purchases

Gold prices surpassed the key $1,800 level on Monday as investors continue to assess the Federal Reserve’s likely response to inflationary pressures after its chair said last week that inflation “could last longer than expected.”

[Click here for an interactive chart of gold prices]

Gold’s rise above $1,800 comes on the back of last week’s rally, which saw the metal at one point hitting its highest levels since early September after Fed chair Jerome Powell said the US central bank should start reducing its asset purchases.

Powell, however, added that talks of raising the short-term interest rate are “premature” as of now.

Gold is often considered an inflation hedge, but reduced stimulus and interest rate hikes tend to push government bond yields up, translating into a higher opportunity cost for the non-yielding bullion.

“There is some short-term momentum building in gold as some investors look for an inflation hedge and see gold as a potentially provider of that,” IG markets analyst Kyle Rodda told Reuters, adding that $1,830 is a key resistance level if gold breaks above $1,800.

In the long term, however, Rodda said gold’s trajectory hinged mainly on how aggressive central banks would act to contain inflation.

In a Bloomberg article last week, mining industry veterans David Garofalo and Rob McEwen predicted that investors will catch on soon that global inflationary pressures are less transitory and more intense than central bankers and consumers price indexes suggest.

As such, gold’s inflation-protection appeal probably will send prices to $3,000/oz when that realization sets in, the former Goldcorp executives said.

(With files from Reuters)

Monday, October 25, 2021

Friday, October 22, 2021

Truth Social / Donald Trump's social network (2021)

TRUTH Social is America’s “Big Tent” social media platform that encourages an open, free, and honest global conversation without discriminating against political ideology.

Thursday, October 21, 2021

Gold price up after Fed official downplays chances of imminent rate hikes

Gold prices rose for a second day in a row Wednesday following commentary from a Federal Reserve official that played down the possibility of imminent interest rate hikes.

[Click here for an interactive chart of gold prices]

Bullion has fluctuated recently as traders attempt to gauge the pace at which pandemic-era stimulus will be reined in by central banks.

Ongoing inflation, driven by the global energy crisis and supply chain constraints, has sparked widespread concerns that rate hikes could come sooner than expected, a painful prospect for the safe-haven metal.

However, recent mixed economic data from the US is casting doubts among investors about an early hike, which weakens the dollar and raises commodity prices.

On Tuesday, Fed Governor Christopher Waller told Bloomberg the US central bank should begin tapering its bond-buying program next month, though rate increases are probably “still some time off.”

He added that if inflation keeps rising at its current pace over the next few months, Fed policymakers may need to adopt “a more aggressive policy response” next year.

Upcoming speeches and discussions by officials including Randal Quarles, Mary Daly and Chair Jerome Powell will also be keenly watched ahead of the Fed’s meeting next month.

Hedge fund manager Paul Tudor Jones said in a CNBC interview on Wednesday that it’s time to double down on inflation hedges, including commodities.

“What they’re telling you by their actions, is that they’re going to be slow and late to fight inflation,” said the founder and chief investment officer of Tudor Investment Corp.

Tudor Jones also advised investors not to hold bonds due to increasing signals that the Fed will not be quick to fight inflation.

Bob Haberkorn, senior market strategist at RJO Futures, shared similar views in a Reuters report:

“There is a global concern on what is going on with supply crunches and the lack of action from the Federal Reserve. It seems like the Fed is behind the ball on inflation.”

“With supply chain and inflation issues, how will stocks continue to make new highs?” Haberkorn said, adding that “there is a flight to safety into gold that will go on for the next couple of months.”

Longer term, analysts still expect gold to face downward pressures as soon as the Fed starts reining in its monetary stimulus.

“Gold is trading above what we deem as fair value at this moment, and I believe this premium is due to the market pricing inflation fears,” Howie Lee, an economist at Oversea-Chinese Banking Corp., told Bloomberg.

“With the Fed due to begin monetary normalization, I still believe gold will face more downward pressure in the coming year.”

(With files from Bloomberg and Reuters)

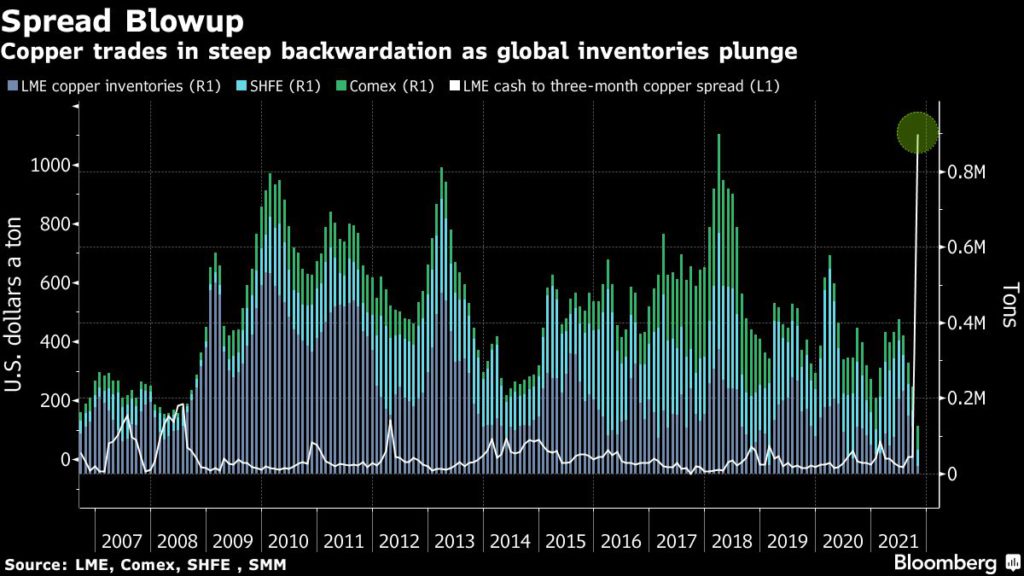

Copper price surges past $11,000 on supply squeeze

The copper price continued to rally towards record highs on Tuesday as signs of extremely tight supply outweighed concerns that slowing growth in China will impact demand.

CASH copper on the London Metal Exchange also soared to a new record high overnight. Spot copper jumped 7.2% to $11,299.50 per tonne.

Prices of the metal used in power and construction leaped 10% last week and are up and more than 30% this year after gaining 26% in 2020.

[Click here for an interactive chart of copper prices]

The spread between cash and three-month futures surged to over $1,000 a tonne on the LME on Monday, a premium not seen since at least 1994. The spread has been widening since early October as demand outpaced supply amid dwindling global exchange inventories.

Related read: Copper spread widens to most in more than 25 years on supply squeeze

“The LME notes recent price activity in the copper market,” the exchange said in an email to Bloomberg.

“We will continue to closely monitor the situation, and have further options available to ensure continued market orderliness if these are required.”

Copper’s short-term direction will depend on whether high premiums bring more metal into LME warehouses, alleviating the supply squeeze, said independent analyst Robin Bhar.

“It is not clear if low LME stockpiles point to a genuine shortage or if metal is available in private storage, but the copper’s longer term outlook is positive due to rising demand as the world moves from fossil fuels to copper-intensive electrification. The fundamentals are bullish.”

On-warrant copper inventories in LME-registered warehouses rose to 21,050 tonnes from 14,150 tonnes, the lowest in decades, on Friday.

Copper inventories in Shanghai Futures Exchange warehouses at 41,668 tonnes are the lowest since 2009.

Fears of supply disruption also supported the market, as a Peruvian community promised to block a key mining road used by MMG’s Las Bambas copper mine in protest after failed negotiations with the Andean nation’s government.

Related: Peru community says will block key mining road used by MMG’s Las Bambas mine

(With files from Bloomberg and Reuters)

Wednesday, October 20, 2021

Tuesday, October 19, 2021

Uranium ETFs roaring back after $1 billion influx on nuclear bet

The rally for two exchange-traded funds focused on uranium is surging back, delivering fresh gains to investors who’ve poured more than $1 billion into them this year in a bet on nuclear power’s resurgence.

The NorthShore Global Uranium Mining ETF (ticker URNM) and the Global X Uranium ETF (URA) jumped 13.52% and 11.65%, respectively, on Tuesday, and extended the gains after markets opened Wednesday.

The jumps end what had been a rocky start to October for both ETFs, which had pulled back from a steep rally in the face of rising fossil-fuel prices. Those gains tracked the price of Uranium higher as investors gave a fresh look to the radioactive metal as worsening power shortages increase the allure of nuclear power as an alternative.

That view has been buttressed by some recent announcements. On Tuesday, the French government said it will help a state-controlled utility company develop so-called small modular nuclear reactors by 2030, a move President Emmanuel Macron signaled as key to reducing global carbon emissions. Japan’s new prime minister said that the nation should replace aging nuclear power plants with such module reactors.

ETFs that track uranium are some of the best performers of the last two years, reversing a downturn that came when investors shunned the commodity in the wake of Japan’s Fukushima nuclear disaster.

“There is a growing realization among people in the energy industry and those investing in it that the baseload (always available) feature of nuclear power — as well as the fact it delivers carbon free electricity — makes it an important component of the world’s carbon neutral goals,” said Michael Alkin, founder of Sachem Cove Special Opportunity Fund, which invests in uranium.

(By Emily Graffeo, with assistance from Eric Balchunas)

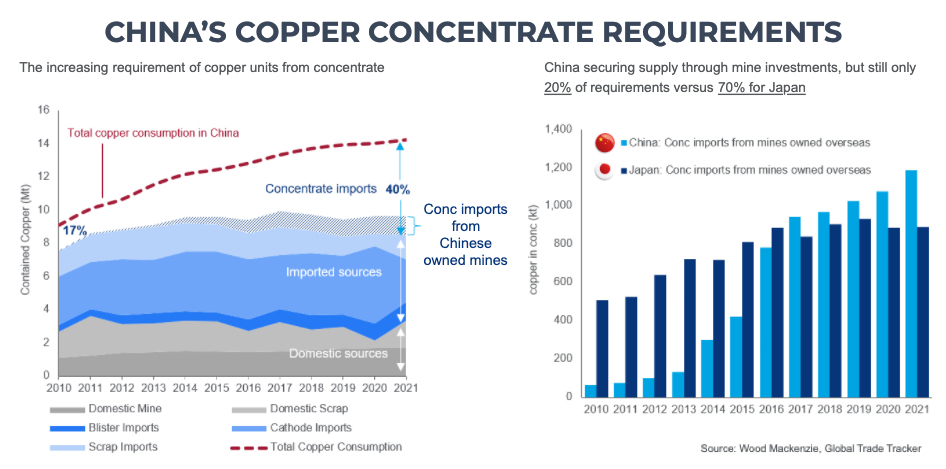

CHARTS: Chinese investment in overseas copper projects just beginning

China consumes nearly 14 million tonnes of copper each year – more than the rest of the world combined. But domestic supply last year was only around 2m tonnes, including scrap, and mined output has been stagnant for years.

In a presentation at the Wood Mackenzie LME Forum, Nick Pickens, research director for copper markets, showed two graphs that put China’s significant copper supply challenges in perspective.

Imported concentrate, including from roughly 30 Chinese-owned mines in Africa and elsewhere, now supplies 40% of the country’s needs, a share that has more than doubled over the past decade as imports set fresh records every year.

Tanked up on Tenge

Over and above direct foreign investment in mining projects around the world China, has splashed more than $16 billion on buying overseas copper companies and assets since 2010.

Glencore’s disposal, under some duress, of Las Bambas in Peru to a Chinese consortium, China Moly’s 2016 acquisition of the Tenke Fungurume mine from Freeport for $2.65 billion and Zijin Mining’s joint venture with Ivanhoe Mines on the Kamoa-Kakula mine, both in the Congo, are three high-profile examples.

Turning Japanese

But if China is to follow the Japanese model of securing long term supply to feed its downstream industry — it has some work to do.

Japan has managed, through well-known companies like Sumitomo, Marubeni and Mitsui acquiring minority interests and JVs in scores of projects, to own 70% of the copper in concentrate it imports.

While larger in absolute terms at just shy of 1.2 million tonnes of metal in concentrate, Chinese-owned companies overseas supply only 20% of the country’s needs. Needs that have grown significantly in just the last few years on breakneck refinery buildouts.

Scramble for Africa

Asked which regions have the best investment potential Pickens said that it pretty much aligns with the current environment although investing in Chile and Peru has become a riskier proposition as political pressure increases in the two top producing nations.

Vast reserves in the central Africa copper belt remains attractive, likewise North America, and further out Ecuador and Argentina could become the next copper frontiers, according to Pickens.

China enjoyed a pretty much open field in Africa, its number one copper – and crucially, cobalt – destination by some stretch, but the Congo is now chafing under some of these investments.

China may in the future also have to compete with the likes of BHP, which recently said it could consider looking at erstwhile no-go areas like Zambia or Congo following its foray into Ecuador (rumours of a BHP tie-up with Ivanhoe in the DRC remain just that at the moment though).

Monday, October 18, 2021

Wild markets gatecrash London Metal Exchange Week party

(The opinions expressed here are those of the author, Andy Home, a columnist for Reuters.)

This year’s London Metal Exchange (LME) Week was a subdued affair by comparison with past excess.

Put on ice last year due to covid-19, the annual metals party returned in slimmed-down form with many opting for virtual over physical drinks.

Analysts were in equally sober mood.

Everyone’s still positive on the longer-term energy transition story but more immediately worried about China.

The debt problem faced by real estate developer China Evergrande Group is no Lehman Moment, to quote Bank of China’s head of commodity strategy Amelia Fu, speaking at the LME Seminar. But weakening Chinese property sales spell trouble for what is a big metallic demand driver.

Average copper, nickel and zinc prices will decline next year as slowing demand growth coincides with increased supply, according to research house CRU, summing up the broad consensus among analysts last week.

Unfortunately, no one told the markets, which rudely gate-crashed last week’s proceedings.

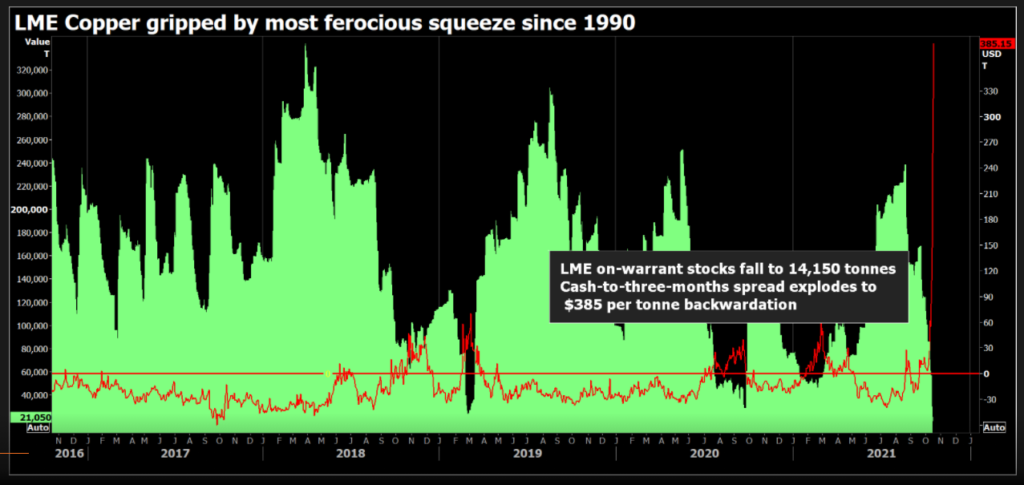

By Friday’s close zinc had shot up to a 14-year high of $3,944 per tonne and copper was in the grip of the most ferocious squeeze seen in the London market since 1990.

Power woes galvanise zinc

Jonathan Leng, principle zinc analyst at WoodMackenzie, had the unenviable task of explaining why the research house is expecting prices to weaken to $2,900 per tonne next year just as Nyrstar announced Wednesday it was cutting output by up to 50% at its three European smelters due to the soaring price of electricity.

The zinc market was caught equally off-guard by the potential metal loss at what amounts to 700,000 tonnes per year of collective annual capacity.

China’s power woes were in the price. Europe’s weren’t and the sense of panic was reinforced when Glencore said it too “is monitoring the situation across its European zinc smelters and adjusting production to reduce exposure to peak price periods during the day.”

LME three-month zinc opened last week at $3,160 and closed it out at $3,795 after visiting that 14-year high on Friday. Time-spreads were similarly rocked, the cash-to-three-month period flipping from small contango to a backwardation of $52 per tonne at the Friday close.

Copper carnage

That level of tightness, however, pales into insignificance next to the London copper market.

The LME copper cash-to-threes period exploded to a $350-per tonne backwardation on Friday with the cash premium rising further to $380 on Monday morning. That’s the widest spread since 1990, when the cash premium reached $483.

The cost of rolling a position overnight reached $175 per tonne at one stage on Friday and was still painfully high at up to $100 on Monday morning.

This squeeze came with advanced warning in the form of the daily 10,000-tonne cancellations of LME stock that have been running since the start of the month.

The pace was upped in the Friday LME stocks report, which showed another 33,000 tonnes had been moved into the physical departure lounge. That left just 14,150 tonnes of available copper in the LME’s warehouse system, the lowest level since March 1974 and enough metal to cover global consumption for just five hours.

Is all this cancelled copper going to China, where stocks are also low? Or is it part of a premeditated attack on unwary bears?

The truth is it doesn’t matter much for anyone still short of cash-date copper or the cluster of call options sitting above $3,000 per tonne, which were all brought into play on last week’s price action.

“Copper remains a physical good, whose futures price is ultimately tied to the ability to deliver physical units into the exchange,” according to Goldman Sachs, which highlighted the depletion of LME stocks in its counter-consensus bullish call for the copper price to hit $10,500 by year end.

LME three-month metal has almost got there with a Monday high of $10,452.50. Cash metal has already punched higher.

Monday’s LME stocks report showed 5,150 tonnes of arrivals and short-position holders can only hope more is on the way. A lot more.

Structural shifts in aluminum and nickel

Aluminum was the analysts’ bull pick last week and the LME three-month price has duly obliged by racing up to a 13-year high of $3,229 per tonne on Monday.

Here too, though, events are unfolding faster than the consensus as China’s power crisis spreads to Europe with several regional smelters thought to be lowering production in the face of spiralling spot power costs.

A new concern is a growing shortage of both silicon and magnesium due to supply-chain disruption. The two metals are widely used across a spectrum of aluminum products, suggesting a downstream hit may shortly be following the upstream smelter hit.

The underlying narrative, however, remains one of a structural shift in the aluminum market as China tries to pivot away from coal in its power mix, leaving a big question mark hanging over its coal-hungry aluminum smelting sector.

Nickel is also facing a “structural uplift in pricing” thanks to rising usage in electric vehicle batteries, according to Jessica Fung, head strategist at Pala Investments.

One-third of nickel will be used as an energy source by 2030, creating an entirely new market and price driver for the metal, Fung told the LME Seminar.

Whether there will be too little or too much supply by that stage remains a hot topic among analysts and in a week of broken records, LME nickel didn’t do much at all.

Tin the wild child

There is no doubt that tin remains in short supply.

Few bank analysts even cover the tiny tin market but it has been the wildest of all this year and remains so, LME three-month metal extending its bull charge to another all-time high of $38,249 per tonne on Monday.

The cash-to-three-month tin spread closed on Friday at a $1,250 per tonne backwardation, which would have been extraordinary in any year but this after it hit $6,500 in February.

Tin is trading at scarcity levels and is likely to continue to do so for another three to six months, according to Tom Mulqueen, head of research at LME broker AMT.

Super low inventory – LME warranted stocks are just 255 tonnes – has limited the market’s ability to absorb supply shocks, Mulqueen told the LME Seminar.

This is a problem when there are so many potential supply shocks, ranging from renewed outbreaks of the coronavirus to power shortages in both China and Europe and a dysfunctional global shipping sector.

LME Week can often be a wild occasion for the great and the good of global metals trading. This year it was the markets that turned wild. And as tin has shown, they can remain wild for a long time before any sort of normality returns.

(Editing by Susan Fenton)

Friday, October 15, 2021

Jesus Christ Actually Born? September 29, 2 B.C.

https://meridianprophecy.com/2015/07/07/birth-of-jesus-christ/

September 29, 2 B.C. is without a doubt, the correct date of Jesus Christ’s date of Birth, confirmed by all of the information below, some new, that I have pulled together, particularly from the books of Luke, Daniel, and Revelation as well as the free Stellarium Astronomy software among several other historical sources. To get started, Jewish tradition implies that Jesus started his 3.5-year Ministry on his 30th birthday based on Levitical Rabbinical tradition (Numbers 4:3). Jesus was 33.5 years old at Crucifixion by many traditional accounts. The calculated crucifixion date from the previous blog post related to Daniel’s 70-Weeks Prophecy (Daniel 9:24-27) with historical and astronomical information regarding various constraints, confirms the time frame. I declare that this is the most compelling case on the Internet for the Birth of Christ date because of the 2 new ways I have found to verify it. Comment below if you disagree by the end of this blog post. Read on!

Here are the Top 10 Reasons Why Jesus’ Birthday was September 29, 2 B.C.

- 1. Derived from His 33 A.D. Crucifixion and Palm Sunday Dates, as calculated from the 70-Weeks Prophecy.

- 2. Aligned with the 2 B.C. Feast of Trumpets – Jewish New Year’s Day.

- 3. NEW! Confirmed by Revelation 12:1 and Stellarium Software.

- 4. Verified by Saint Irenaeus, 2nd Century Church Theologian & by Eusebius, 4th Century Church Bishop, Scholar, & Historian.

- 5. Verified by Tiberius Caesar’s’ Reign.

- 6. Verified by Josephus, 1st Century Jewish Rabbi, Scholar, & Historian.

- 7. Verified by Sir Isaac Newton, 17th Century Scientist, Scholar, & Historian.

- 8. Perfectly Aligned with the 3 B.C. Winter Solstice & Summer Solstice – John the Baptist.

- 9. NEW! Perfectly Aligned with Mary’s Birth Date, as calculated from the 70-Weeks Prophecy.

- 10. Jesus’ Birth and Death Dates Align with a New Moon and an Eclipsed Full Moon.

Thursday, October 14, 2021

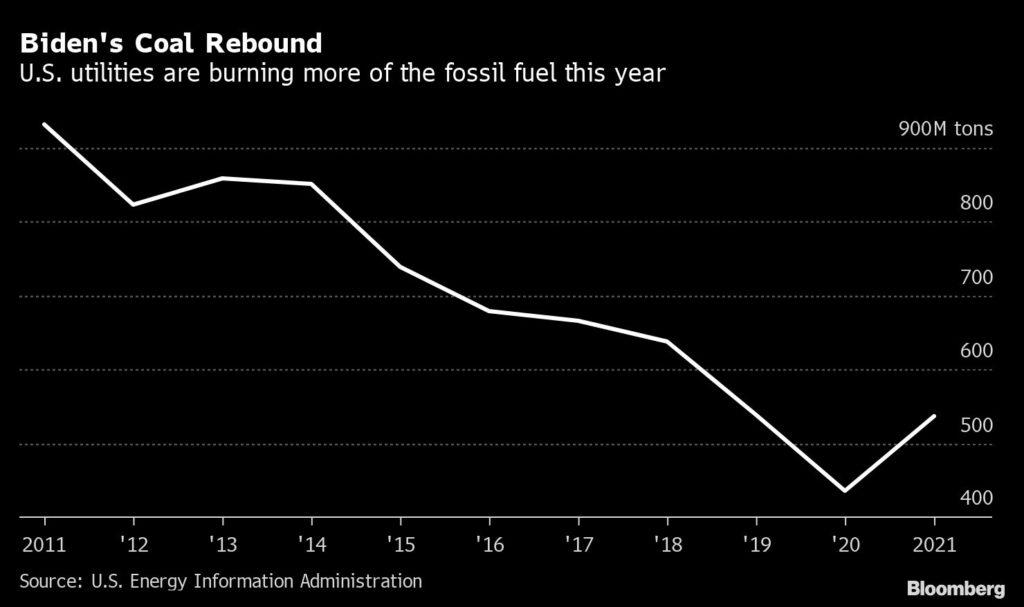

US coal use is rebounding under Biden like it never did with Trump

A CSX train carrying a load of coal stops near the James River in Richmond in July 2019.(Sarah Vogelsong/Virginia Mercury)

Donald Trump vowed to revive the coal industry, but it’s President Joe Biden who’s seeing a big comeback of the dirtiest fossil fuel.

“Over the short term, the market will always dominate,” said Jeremy Fisher, senior adviser for the Sierra Club’s environmental law program.

As the world emerges from the coronavirus pandemic, reopening economies are driving a huge rebound for power demand. But natural gas is in short supply, creating shortfalls at a time when wind and hydro have been unreliable in some regions. Europe and Asia have been hit the worst, with skyrocketing markets, blackouts in places like India, power shortages in China and the threat of outages in other countries. Energy prices are also soaring in the U.S., though not to the same extremes.

The situation is driving up coal demand around the world, and in the U.S., utilities are cranking up aging power plants and miners are digging up as much as they can.

The shift means that coal will supply about 24% of U.S. electricity this year, after falling to 20% in 2020, an historic low after years of efforts to push utilities toward clean power and amid cheap natural gas supplies. That resurgence may look even more extreme when the Energy Department releases its latest monthly report Wednesday.

’Markets have spoken’

“The markets have spoken,” said Rich Nolan, chief executive officer

of the National Mining Association. “We’re seeing the essential nature

of coal come roaring back.”

In 2021, the U.S. utilities

are poised to burn 536.9 million short tons of coal, up from 436.5

million in 2020, the Energy Information Administration forecasts.

Coal from the central Appalachia region has climbed 39% since the start of the year to $75.50 a ton, the highest since May 2019. Prices in other regions are lower, but also on the rise.

Demand for coal will likely remain strong into next year, said Ernie Thrasher, CEO of Xcoal Energy & Resources, the biggest U.S. exporter of the fuel. Supply is already constrained, and Thrasher said he’s hearing some utilities express concern that they may face fuel shortages over the next several months as colder weather pushes energy demand higher to heat homes.

“It won’t be easy this winter,” he said.

Kevin Book, managing director of research firm ClearView Energy Partners, said the current crisis has added fodder to the debate over efforts to move away from coal.

“The goal of policy, if you listen to what’s being said in Western countries in the context of climate discussions, is not only to stop building new coal but to eliminate the existing capacity to burn coal,” Book said. “This is a moment in time when that idea is going to be challenged.”

Short-lived boom?

While the coal boom is dramatic, the moment may be short-lived.

Global pressure to curb carbon emissions remains strong, and in the long-term, “policy absolutely matters,” said Cara Bottorff, a senior energy sector analyst at the Sierra Club.

Coal consumption plunged under Trump largely because utilities shifted to gas, which was far cheaper at the time, and increasingly embraced renewables as the cost of wind and solar fell. The decline was also the result of key policy decisions from his predecessor Barack Obama. And though Trump sought to revive the industry, legal challenges and the risk of an unpredictable regulatory environment discouraged long-term investments in coal.

Coal mining and generating capacity declined 40% over the past six years, according to B. Riley Securities.

Similarly, Biden’s policies will likely eventually lead to further reductions in coal use. He’s pursuing structural changes including tax incentives and new market rules that will drive decisions at energy companies.

“The transition is well underway, but it won’t be over tomorrow,” said Dennis Wamsted, an analyst for the Institute for Energy Economics and Financial Analysis.

(By Will Wade, with assistance from Jennifer A Dlouhy)

Wednesday, October 13, 2021

Oil Gains as Energy Demand Rises; WTI Tops $80

https://tankterminals.com/news/oil-gains-as-energy-demand-rises-wti-tops-80/?utm_source=ActiveCampaign&utm_medium=email&utm_content=Sunoco-Nustar+Latest+Deal%2C+US+Ports++Huge+Upgrade+Preps%2C+Oil+Market+is+Both+Bullish+and++On+Edge+%2C+BP+Invests+in+Refinery%2C+Exxon+s+Houston+JV+-+Week+41&utm_campaign=TankTerminals+com+Newsletter+-+Week+41+%28OTHER%29&vgo_ee=peYRwyI2Ab3FcNxZ0pnEDgA3SuMkJhmkGexv49sZvNU%3D

Oil prices rose on Monday, extending multiweek gains, amid supply restraint from major producers and growing demand for fuels as economies try to recover from the coronavirus pandemic.

Brent crude was up 81 cents, or 1%, at $83.20 a barrel by 0212 GMT, after gaining almost 4% last week. U.S. oil was up $1.15, or 1.5%, at $80.50 a barrel, the highest since late 2014. U.S. crude rose 4.6% through Friday.

Prices have risen as more vaccinated populations are brought out of lockdowns and fuel economic activity, with Brent advancing for five weeks and U.S. crude for seven.

Coal and gas prices have also been surging as economies recover, making oil more attractive as a fuel for power generation, pushing crude markets higher.

But with inventories in the U.S. starting to increase again after recent drawdowns, oil prices may start to falter.

“We think crude prices will struggle to climb much higher this quarter and still forecast them to gradually drop next year,” Caroline Bain, chief commodities economist at Capital Economics, said in a note.

U.S. crude inventories rose for a second straight reporting period last week as more production returned after extended shut-ins due to hurricanes. [EIA/S]

The Organization of the Petroleum Exporting Countries (OPEC) and allies, together called OPEC+, last week decided to maintain a steady and gradual increase in production.

Tuesday, October 12, 2021

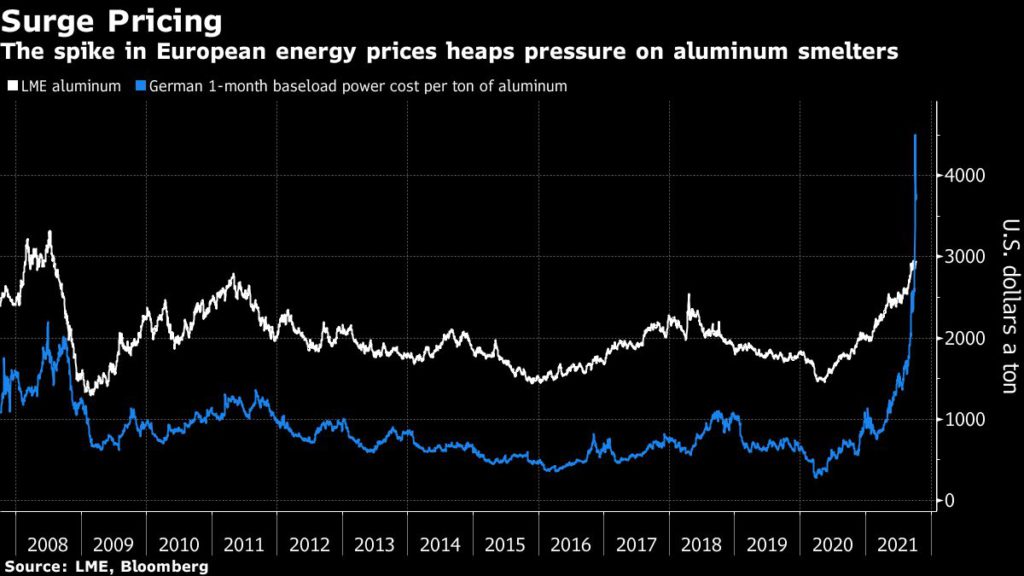

Aluminum price hits 13-year high as energy surge pressures supply

Aluminum jumped to the highest since 2008 as a deepening power crisis squeezes supplies of the energy-intensive metal that’s used in everything from beer cans to iPhones.

That meant aluminum was one of the first targets in China’s efforts to curb industrial energy usage. Even beyond the current power crisis, Beijing has placed a hard cap on future capacity that promises to end years of over-expansion and raises the prospect of deep global deficits. Energy costs surging across Asia and Europe mean there’s a risk of more supply cuts, and some investors are betting that prices have much further to run.

Aluminum rose as much as 2.8% to $3,049 a ton on the London Metal Exchange Monday, the highest since July 2008, leading broad gains among base metals. Copper rose to the highest since mid-September, while zinc and lead pared early losses as oil and other commodities, including metals like iron ore, keep climbing.

For investors looking to bet on a future price spike, LME options contracts offer a popular and low-risk way.

In recent weeks, investors have been buying calls with strike prices of up to $4,000 a ton, according to traders active in the market — effectively betting that prices could move significantly beyond that level to reach new all-time highs.

“It feels very much like a structural hedge-fund play,” said Keith Wildie, head of trading at Romco Metals, who’s been trading LME options for more than 20 years. “What they’re positioning for is a significant market dislocation, and a sharp move higher in the price.”

As the global metals world prepared to gather in London for the annual LME Week, signs of pressure on the aluminum industry have continued to mount. China’s State Council announced Friday it will allow higher power prices in a bid to ease the worsening energy crunch. In the Netherlands, aluminum producer Aldel will curtail production from this week due to high electricity prices, Dutch Broadcaster NOS reported.

A number of aluminum plants in China are being mothballed and the country’s production has probably peaked, at least in the short term, said Mark Hansen, chief executive officer at London-based trading house Concord Resources Ltd. With the market in a deficit and needing to stimulate investment in new production outside China, prices could hit $3,400 a ton in the next 12 months, he said.

Next, traders and analysts say investors are watching for a possible hit to Chinese aluminum exports. With its own production under pressure and demand booming, the country has been importing ever-greater quantities of primary metal. However, it’s still exporting huge volumes of semi-finished aluminum, in part supported by tax rebates.

“Given the acuteness of the power shortages and the curtailments we’ve seen, it just doesn’t seem rational for China to be exporting that volume of aluminium products every single month,” James Luke, commodities fund manager at Schroders, said by phone from London. “It’s essentially just a net export of energy resources.”

Analysts including at Goldman Sachs Group Inc. say there’s potential for Beijing to lower or remove the value-added tax rebates on exports to slow the flow of metal beyond its borders. With China likely to continue importing huge volumes of aluminum next year, that could leave the rest of the world desperately short, and raises the risk of a violent price spike.

Separately, prices got an extra boost Monday after the European Union imposed an anti-dumping duty on flat-rolled aluminum from China, although it excluded some key material, including metal used by the drinks cans, car and aircraft industries.

This year’s surge in aluminum prices would typically prompt producers elsewhere to reopen old plants and consider adding new supply. Yet the even-bigger jump in power costs is putting pressure on smelters and may make restarts difficult.

As an example, if a smelter in Germany was exposed to one-month baseload rates for power, it would need to pay about $4,000 for the energy needed to produce a ton of metal, far outstripping current aluminum prices.

“The global metal market in 2022 will be the tightest it’s ever been,” Eoin Dinsmore, head of aluminum primary and products research at CRU, said by phone from London. “The rest of the world cannot deliver these quantities to China indefinitely.”

(By Mark Burton and Jack Farchy, with assistance from Alvaro Ledgard, Akshat Rathi and Eddie Spence)

Monday, October 11, 2021

Friday, October 8, 2021

Oil prices hit a 7-year high as industry feud with Biden administration continues

A gas pump at a Marathon station in Alpharetta, Ga.

Darryl Brooks / Shutterstock.com

(The Center Square) – Oil prices hit a 7-year high this week as American oil and gas companies continue to fight the Biden administration over policies restricting production.

As the economy began to reopen this year and the demand for fuel increased, President Joe Biden, through executive order, halted and restricted oil and gas leases on federal lands, stopped construction of the Keystone Pipeline, and redirected U.S. policy to import more oil from Organization of the Petroleum Exporting Countries and Russia (OPEC+) instead of bolstering American oil and gas exploration and production.

The U.S. led the world in oil and gas production for seven consecutive years prior to this year. It produced more oil and petroleum liquids than any other country, with Texas leading the way, according to U.S. Energy Information Administration (EIA) data.

Texas remains the top crude oil and natural gas producing state in the U.S. In 2020, Texas accounted for 43% of the nation's crude oil production and 26% of its marketed natural gas production, EIA reports.

In Texas and across the country, however, gas prices have soared. In Houston, the state’s largest city with close access to refineries, gas prices were historically low last year, hovering at $1.50 a gallon at the pump. Now gas in some areas of the state is $3 a gallon or more. In other states like California, gas prices have already surpassed $5 a gallon.

As of Oct. 6, the average national retail price was $3.22 a gallon for regular gasoline, according to AAA, roughly one dollar more than it was last year. The highest average was $4.42 in California.

On Oct. 4, OPEC+ said it planned to increase oil production by up to 400,000 barrels a day in November, causing a market reaction.

West Texas Intermediate, the U.S. benchmark, rose 2.3%, reaching a seven-year high. Its international counterpart, Brent, rose 2.5%, its highest level in three years. Oil is expected to reach over $100 a barrel by the end of the year, driving prices up even further.

In August, while the administration saw gas prices and inflation rising, and asked OPEC+ to increase oil output, it imposed harsher restrictions on American companies and failed to comply with a court order reversing an executive order.

In an Aug. 11 statement, National Security Adviser Jake Sullivan said, “While OPEC+ recently agreed to production increases, these increases will not fully offset previous production cuts that OPEC+ imposed during the pandemic until well into 2022. At a critical moment in the global recovery, this is simply not enough.”

At the same time, the Western Energy Alliance and the Petroleum Association of Wyoming were fighting Biden’s ban on oil and natural gas leasing after the Department of the Interior failed to comply with a Louisiana court ruling overturning the ban. As gas prices were going up and many Americans in the oil and gas sector were still out of work, “the Interior Department still had not issued a plan on how it would conduct its reported comprehensive review of the federal oil and natural gas program” as directed by a January executive order, the Alliance argued.

“[F]or six months the leasing ban [was] completely futile, as no progress [was] made on the supposed reason for the ban in the first place,” the Alliance said.

On Oct. 4, White House press secretary Jen Psaki said at a press briefing, “We’re going to continue to use every tool at our disposal to ensure we can keep gas prices down for the American public.” But those in the oil and gas sector argue the surest way to do this is to allow American companies to produce more oil and gas and for the Biden administration to follow the law.

Instead, the federal government has buckled down on not allowing onshore lease sales to be held for the entire year of 2021.

Plaintiffs in Louisiana and Wyoming have asked the judges in their respective cases to force the Department of the Interior to comply with federal law and “meet its obligations under the Mineral Leasing Act. This administration is not above the law. It must comply with laws passed by Congress and orders by the federal judiciary, whether it agrees with them or not.”

Pete Obermueller, president of the Petroleum Association of Wyoming, said, “the Biden Administration must do more than say it will follow the law, it must follow the law in practice.”