The logo of the Nord Stream 2 gas pipeline project is seen on a pipe at

the Chelyabinsk pipe rolling plant in Chelyabinsk, Russia, February 26,

2020. REUTERS/Maxim Shemetov

LONDON,

Sept 22 (Reuters) - Global record high natural gas prices are pushing

some energy-intensive companies to curtail production in a trend that is

adding to disruptions to global supply chains in some sectors such as

food and could result in higher costs being passed on to their

customers.

Some

companies, including steel producers, fertiliser manufacturers and

glass makers, have had to suspend or reduce production in Europe and

Asia as a result of spiking energy prices. That includes two of the

world’s largest fertiliser makers, which said they would cut production

in Europe. The UK on Tuesday said it agreed to provide state support to

one of the companies to restart production of by-product carbon dioxide,

which is used in food production, to avert a supply crunch. read more

Natural

gas prices have risen sharply around the globe in recent months. That

has been due to a combination of factors: including increased demand

particularly from Asia due to a post-pandemic recovery; low gas

inventories; and tighter-than-usual gas supplies from Russia.

Gas

prices in Europe have risen more than 250% this year, while Asia has

seen about a 175% increase since late January. In the United States,

prices have surged to multi-year highs and are about double where they

were at the start of the year. Electricity prices have also risen

sharply as many power plants are gas-fired.

Industrial

Energy Consumers of America, a trade group representing chemical, food

and materials manufacturers, has in recent days called on the U.S.

Department of Energy to stop the country's liquefied natural gas

producers from exporting gas to help keep the energy costs down for

industry. read more

Additional

supplies of gas could alleviate pressure. Norway has allowed increased

gas exports. More supply could flow from Russia by the end of the year

with the country’s new Nord Stream 2 pipeline awaiting approval from

Germany’s energy regulator. The pipeline project has drawn criticism

from the United States, which says it will increase Europe’s reliance on

Russian energy supplies. read more

PRODUCTION DISRUPTIONS

The

pressures so far have been particularly acute in Europe, where gas

stocks are much lower than usual heading into winter. Norway’s Yara

International ASA (YAR.OL),

one of the world’s largest fertiliser makers, on Friday said it would

cut about 40% of its European ammonia production due to high gas prices.

That came after U.S.-based CF Industries Holdings Inc (CF.N)

said gas prices were prompting it to halt operations at two of its

British plants. Natural gas is the most important cost input for

nitrogen-based chemicals and fertilizers. read more

Yara’s

chief executive, Svein Tore Holsether, told Reuters in an interview

Monday that the company was bringing ammonia to Europe from production

facilities elsewhere, including the United States and Australia.

"Instead of using European gas, we are essentially using gas from other

parts of the world to make that product and bring it into Europe," he

said. read more CF Industries didn’t respond to requests for comment.

Some

industries are calling on governments to intervene on their behalf.

These pleas come as some countries have acted to protect consumers from

soaring energy bills, such as Spain, which last week approved a package

of measures including price caps.

Among

those asking for help is the food industry following a shortage of

carbon dioxide (CO2) caused by the suspension of production in some

fertiliser plants. CO2 is used in the vacuum packing of food products to

extend their shelf life, to stun animals before slaughter and to put

the fizz in soft drinks and beer.

In

the UK, meat processors had warned they will run out of CO2 within five

days, forcing them to halt production. Soft drink manufacturers, who

rely on the gas to make carbonated drinks, said supplies were running

low. read more

On

Tuesday, the British government said it struck a three-week deal with

CF Industries for the American company to restart the production of

carbon dioxide in the UK. Britain’s environment minister, who said the

state support could run into tens of millions of pounds, also warned the

food industry that carbon dioxide prices would rise sharply.

CF

Industries said in a statement it is immediately restarting ammonia

production at its Billingham plant following the agreement.

WEATHERING THE STORM

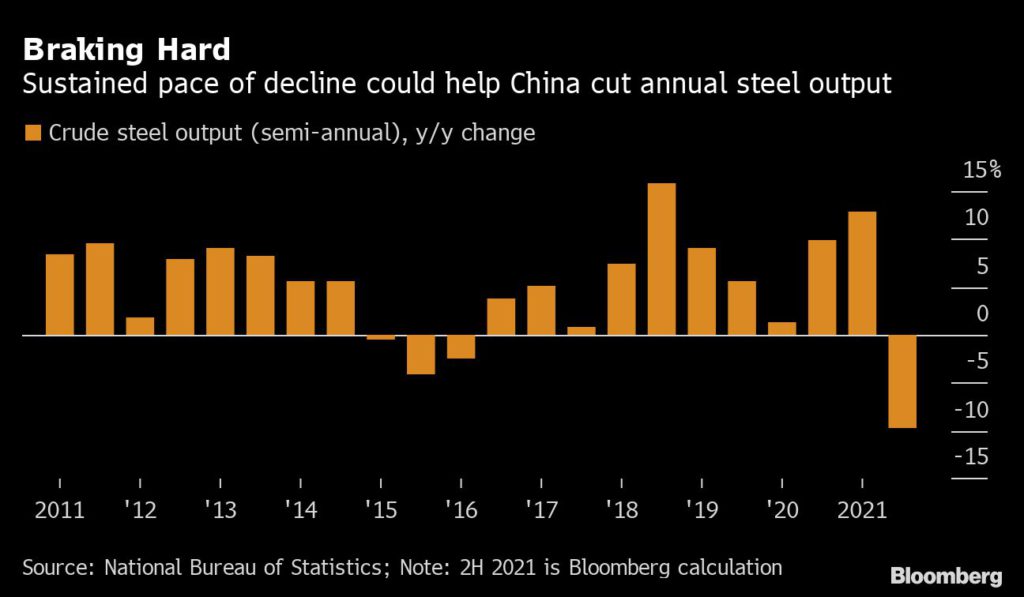

Other energy-intensive sectors such as steel and cement are also feeling the pinch.

Soaring

gas prices have in the past couple of weeks "forced some steelmakers to

suspend operations during those periods of the night and day when the

cost of energy rockets," said Gareth Stace, director general at industry

group UK Steel. He declined to identify which companies.

British

Steel, the country’s second-largest steel producer, said it was

maintaining normal levels of production but that the “colossal”

energy-price increases made “it impossible to profitably make steel at

certain times of the day.”

Some manufacturers say they are able to cope, so far.

Germany’s Thyssenkrupp AG, (TKAG.DE)

Europe’s second-largest steelmaker, said hedging mechanisms it had in

place against energy price increases, especially gas, meant it was not

curbing production. But it said it was indirectly affected because the

industrial gases it used are linked to electricity prices.

HeidelbergCement AG (HEIG.DE)

of Germany, the world’s second-largest cement maker, said higher energy

prices were driving up production costs but that operations had not

been halted as a result.

In

China, several steel, ceramic and glass makers have reduced production

to avoid losses, according to Li Ruipeng, a local supplier of liquefied

natural gas in the northern province of Hebei. And, China’s southwestern

province of Yunnan this month imposed limits on production of some

heavy industries, including producers of fertilisers, cement, chemicals,

and aluminium smelters due to energy shortages, a move that analysts

said could reduce exports.

To

weather the storm, some energy-intensive industries and utility firms

in Asia and the Middle East have temporarily switched from gas to fuel

oil, crude, naphtha or coal, analysts and traders said. That trend is

expected to continue for the rest of the year and into the beginning of

next, according to the International Energy Agency, the Paris-based

energy watchdog.

In

Europe, demand for coal as an alternative power source has also risen

significantly. But options for switching to alternative sources of

energy are limited in the region largely due to government policies

aimed at encouraging the use of gas over more polluting fuels such as

coal.

The

glass industry was historically run on fuel oil, but almost all sites

in the United Kingdom have now transitioned to natural gas, according to

Paul Pearcy, federation coordinator at British Glass, a UK trade

association. Only a few sites have fuel oil tanks that enable them to

switch energy source if prices skyrocket, he added.

Reporting

by Bozorgmehr Sharafedin and Susanna Twidale in London, Roslan

Khasawneh in Singapore

Additional reporting by Guy Faulconbridge, Nigel Hunt, Eric Onstad and

Ahmad Ghaddar in London, Jessica Jaganathan and Chen Aizhu in Singapore,

Yuka Obayashi in Tokyo, Nidhi Verma in Delhi, Scott DiSavino in New

York, Heekyong Yang in Seoul, and Christoph Steitz in Frankfurt, Tom

Kaeckenhoff in Düsseldorf, Polina Devitt in Moscow, Arathy S Nair in

Houston

Editing by Cassell Bryan-Low

Our Standards: The Thomson Reuters Trust Principles.