Friday, February 26, 2021

Thursday, February 25, 2021

Exxon takes Canadian oil sands off its books in historic reserves revision

This map shows the extent

of the oil sands in Alberta, Canada. The three oil sand deposits are

known as the Athabasca Oil Sands, the Cold Lake Oil Sands, and the Peace

River Oil Sands.

HOUSTON (Bloomberg) --Exxon Mobil erased almost every drop of oil-sands crude from its books in a sweeping revision of worldwide reserves to depths never before seen in the company’s modern history.

Exxon counted the equivalent of 15.2 billion barrels of reserves as of Dec. 31, down from 22.44 billion a year earlier, according to a regulatory filing on Wednesday. The company’s reserves of the dense, heavy crude extracted from Western Canada’s sandy bogs dropped by 98%.

In practical terms, the revision clipped Exxon’s future growth prospects until oil prices rise, costs slide or technological advances make it profitable to drill those fields. Exxon has enough reserves to sustain current production levels for 11 years, down from 15.5 years a year ago, based on Bloomberg calculations.

The pandemic-driven price crash that rocked global energy markets was the main driver of Exxon’s reserve downgrade, along with internal budget cuts that took out a significant portion of its U.S. shale assets. The oil sands have historically been among the company’s higher-cost operations, making them more vulnerable to removal when oil prices foundered.

Price Sensitive

The reserves accounting doesn’t mean Exxon is closing up shop or walking away from Canada because the company can bring them back onto its ledger as crude prices rise.

“Among the factors that could result in portions of these amounts being recognized again as proved reserves at some point in the future are a recovery in the SEC price basis, cost reductions, operating efficiencies, and increases in planned capital spending,” Exxon said in the filing.

The blow to future production potential comes just weeks after Exxon posted its first annual loss in at least four decades. Exxon shares were little changed at $56.85 in after-hours trading and have advanced 38% this year.

The Wall Street Journal reported last month that Exxon was being investigated by the U.S. Securities and Exchange Commission for allegedly overvaluing a key asset in the Permian Basin. Exxon has said the allegations are demonstrably false.

CEO’s Priorities

Exxon previously flagged that low prices could wipe as much as one-fifth of its oil and gas reserves from its books but steep cuts in drilling expenditures also imperil the assets its able to keep on the books.

Chief Executive Officer Darren Woods has prioritized high-return projects such as offshore oil in Guyana, shale in the Permian Basin as well as chemical and gas operations along the Gulf Coast in order to defend the company’s dividend. This year’s rally in oil prices will help bolster Exxon’s cash generation, which in recent quarters has failed to cover both its capital spending and dividend, leading to an increase in debt to almost $70 billion.

Wednesday, February 24, 2021

Gas Surges Above $3 In These States as Oil Prices Jump

The best predictor of gasoline prices is oil prices. They almost always outweigh refinery costs, transportation costs and state gas taxes. Crude oil prices, which were $36 a barrel at the end of November, have risen to almost $60, the highest price in a year. Gas prices have started to follow. In three states, they have topped $3 a for a gallon of regular.

According to AAA Fuel Gauge, the average price for a gallon of regular nationwide is $2.631. That is up from $2.505 a month ago. Over the past four weeks, the increase has been fairly steady.

Oil prices have risen for three reasons, none of which is likely to change soon. The first is that global stockpiles have fallen. World Oil recently said of crude inventories:

Crude inventories at a key storage hub in the U.S. are now below their five-year average, and nationwide inventories continue to slump, an early indication that Saudi Arabia and allied producers are succeeding in their efforts to eliminate a glut.

The other factor has been called “post-vaccine euphoria.” The base of this is that the economy has already started to spring back from the COVID-19 pandemic. If the rate of vaccine distribution quickens, global economies will reopen and gross domestic product and employment will surge, and with these, the demand for oil.

Finally, refinery shutdowns due to the huge cold and snowstorms that

have run through Texas. These massive refineries are critical to U.S.

supply.

Gas prices by state are either above or below the national average for several reasons. The first is proximity to refineries. States near the huge refineries along the Gulf of Mexico tend to have the lowest prices in the country. Notably, the four states with the lowest per-gallon gas prices are Mississippi ($2.25), Texas ($2.30), Oklahoma ($2.33) and Louisiana ($2.26). The transportation costs from refineries to nearby areas shaves the average price of gas down, compared with much of the rest of the nation.

Another primary factor is gasoline taxes. According to the American Petroleum Institute survey of state gas taxes as of January 1, the U.S. average is $0.5523 a gallon. States with low gas taxes include Missouri ($0.3582), Mississippi ($0.3719) and New Mexico ($0.3738). The states with the highest gas taxes are California ($0.8145) and Pennsylvania ($0.7710). These are the states with the highest gas taxes in America.

Three states currently have average prices for a gallon of regular of over $3. California’s $3.452 price is clearly affected by its gas tax. In Hawaii, the price of $3.288 is affected by a relatively high gas tax at $0.6524 per gallon. However, the cost of transportation to islands that are 2,500 miles from the west coast is also a major contributor to Hawaii’s price. And, the price for a gallon of regular in Washington State is $3.10. Its gas tax is a high $.678.

Gas prices nationwide were last at $3 a gallon in 2014. There is still a long way to go before prices reach that level again. However, crude prices are on a sharp climb upward, which means gas prices will continue to increase, for now, as well. Moreover, gas prices can affect overall living costs in some places. This is the cost of living in every state in America.

Tuesday, February 23, 2021

Opec, U.S. oil firms expect subdued shale rebound even as crude prices rise

FILE PHOTO: A 3D printed oil pump jack is seen in front of displayed

Opec logo in this illustration picture, April 14, 2020. REUTERS/Dado

Ruvic/Illustration/File Photo

https://www.reuters.com/article/us-shale-opec-outlook-idUSKBN2AM0E2

LONDON/HOUSTON (Reuters) - OPEC and U.S. oil companies see a limited

rebound in shale oil supply this year as top U.S. producers freeze

output despite rising prices, a decision that would help OPEC and its

allies.

OPEC this month cut its 2021 forecast for U.S. tight crude, another term for shale, and expects production to decline by 140,000 barrels per day (bpd) to 7.16 million bpd.

The U.S. government expects shale output in March to fall about 78,000 bpd to 7.5 million bpd and also sees an annual drop.

Graphic: U.S. Tight Oil output in 2021 -

The OPEC forecast preceded the freezing weather in Texas, home to 40% of U.S. output, that has shut wells and curbed demand by regional oil refineries.

The lack of a shale rebound could make it easier for OPEC and its allies to manage the market, according to OPEC sources.

“This should be the case,” said one of the OPEC sources, who declined to be identified. “But I don’t think this factor will be permanent.”

While some U.S. energy firms have increased drilling, production is expected to remain under pressure as companies cut spending to reduce debt and boost shareholder returns. Shale producers are also wary that increased drilling would quickly be met by OPEC returning more oil to the market.

‘MORE DISCIPLINE’

“In this new era, (shale) requires a different mindset,” Doug Lawler, chief executive of shale pioneer Chesapeake Energy Corp, said in an interview this month. “It requires more discipline and responsibility with respect to generating cash for our stakeholders and shareholders.”

That sentiment would be a welcome development for the Organization of the Petroleum Exporting Countries, for which a 2014-2016 price slide and global glut caused partly by rising shale output was an uncomfortable experience. This led to the creation of OPEC+, which began cutting output in 2017.

OPEC+, which includes OPEC, Russia and their allies, is in the process of slowly unwinding record output curbs made last year as prices and demand collapsed due to the pandemic. Alliance members will meet on March 4 to review demand. For now, it is not seeing history repeat itself.

“U.S. shale is the key non-OPEC supply in the past 10 years or more,” said another OPEC delegate. “If such limitation of growth is now expected, I don’t foresee any concerns as producers elsewhere can meet any demand growth.”

Still, OPEC is no rush to open the taps. Saudi Arabian Energy Minister Prince Abdulaziz bin Salman said on Feb. 17 oil producers must remain “extremely cautious.”

OPEC Secretary General Mohammad Barkindo echoed that sentiment.

“U.S. shale is an important stakeholder in our global efforts to restore balance to the oil market,” he told Reuters. “We all have a shared responsibility in this regard.”

$60 OIL HELPS

Shale output usually responds rapidly to price signals and U.S. crude has this month hit its highest level since January 2020, topping $60 a barrel.

While shale companies have added more rigs in recent weeks, a tepid demand recovery and investor pressure to reduce debt has kept them from rushing to complete new wells.

“At this price point, any oil production is profitable, especially the relatively high-cost U.S. shale patch,” said Stephen Brennock of broker PVM Oil Associates.

“Yet despite these positive growth signals, U.S. tight oil production is far from recovering its pre-COVID mojo.”

The chief executive of shale producer Pioneer Natural Resources Co, Scott Sheffield, recently said he expects small companies to increase output but in the aggregate U.S. output will remain flat to 1% higher even at $60 per barrel.

PRODUCTION FREEZE

Last week’s severe cold will wreak havoc on oil and gas production as companies deal with frozen equipment and a lack of power to run operations. The largest U.S. independent producer, ConocoPhillips, said on Thursday the majority of its Texas production remained offline.

But J.P. Morgan analysts said in a Feb. 18 report that rising oil prices might prompt a quicker shale revival.

“As long as operators have sufficient drilled but unfracked well inventory to complete, they should be able to easily grow production while keeping capex in check,” the bank said, using a term for drilling spending.

Forecasts for 2022 such as from the U.S. Energy Information Administration are for more U.S. supply growth [EIA/M], although perhaps not enough to cause problems for OPEC+ for now.

“U.S. oil output will not go back to pre-COVID levels any time soon,” said PVM’s Brennock. “But that is not to say that U.S. shale will not one day return as a thorn in OPEC’s side.”

By Alex Lawler in London and Jennifer Hiller in Houston; Editing by Gary McWilliams, Matthew Lewis and Mark Potter

Monday, February 22, 2021

Plans for $10bn Aramco Refinery in Pakistani ‘Oil City’ Ready by Year-End

Balochistan Province Pakistan

A masterplan for Pakistan’s largest oil city, including a $10

billion Aramco oil refinery project, is underway and expected to be

ready before the end of the year, Pakistani officials said this week.

The proposed mega oil city will be developed on 88,000 acres of land in the Gwadar district of the southwestern Balochistan province to refine and process petroleum products mainly imported from the Gulf region, for local and regional consumption.

“The planning for the mega oil city which will host an Aramco refinery and petrochemical complex is in progress, and we will take six to seven months to complete the masterplan,” Shahzeb Khan Kakar, director general of Gwadar Development Authority (GDA), told Arab News.

During a 2019 visit by Saudi Crown Prince Mohammed bin Salman, Saudi Arabia and Pakistan signed seven investment deals worth $21 billion. The deals covered mineral, energy, petrochemical and food and agriculture projects, and involved players such as Aramco, Acwa Power and the Saudi Fund for Pakistan.

The $10 billion Aramco Oil Refinery — with a 250,000-300,000 barrel per day capacity — is expected to be commissioned in about five to six years.

The project will have a $1 billion petrochemical complex that will lay

the foundations for Pakistan’s petrochemical industry by producing

polyethylene and polypropylene.

“Though the federal government is directly dealing with the Saudis, we will invite them after the planning is completed,” Kakar said, adding: “The oil city is equally big as Gwadar. We have made the masterplan of Gwadar as a smart city with an area of 88,000 acres, keeping in view requirements up to 2050.”

Apart from the oil city, Gwadar authorities are also developing an industrial zone expected to be completed by 2023 that will also attract significant investment in the area.

“Industrialization is expected to start from 2023 with the provision

of basic utilities, including electricity,” Attaullah Jogezai, managing

director of the Gwadar Industrial Estate Development Authority, told

Arab News.

Gwadar has been touted as the “crown jewel” of the multi-billion dollar China-Pakistan Economic Corridor.

Through the development projects backed by Saudi and Chinese investment, the GDA chief forecast that the per capita income of Gwadar will surge to $15,000 by 2050.

“Fisheries, an oil refinery, petrochemical complexes, a shipyard, the

tourism industry, and most importantly the operations of Gwadar port,

will all generate huge incomes and increase per capita income,” Kakar

said.

“This can be achieved by providing electricity, protection and a sound management system.”

Authorities developing a 300 MW coal-fired power plant and a 5 million gallon per day desalination plant say both projects will be functional by January 2023.

“Regulations have been framed to allocate lands in the industrial

zone,” Manzoor Hussain, additional secretary of industries for

Balochistan, told Arab News, adding: “Now land will be allotted only to

those industrialists who will set them up within the given time frame.

“Our mission is to create employment in the province.”

Friday, February 19, 2021

Gas prices to rise as winter storm rages, shutting refineries, stores and delaying shipments. Is $3 fuel coming?

Gasoline prices are expected to rise 10 to 20 cents a gallon in the coming days after winter storms knocked out about a dozen refineries in Texas, capping a sharp run-up in prices since Halloween and possibly heralding a move toward $3 by summer as the pandemic eases.

Regular unleaded gas averaged $2.54 a gallon nationally Wednesday, up two cents from the previous day, according to AAA.

The storm also has disrupted package deliveries to consumers and product shipments to retailers, possibly leading to shortages of some items on shelves. And it has shut hundreds of stores and factories.

The refinery outages have removed 3.5 million to 4 million, or about 20%, of the nation’s oil refining capacity, according to fuel-saving app GasBuddy and the Oil Price Information Service (OPIS). The refineries shut down due to power outages and shortages of natural gas, which are needed to run the facilities, says Tom Kloza, chief global head of energy analysis at OPIS.

Generator safety tips:How to run your generator safely during a power outage caused by winter storms

Job cuts in cities:Unemployment: Cities have permanently lost 400,000 jobs during COVID-19 pandemic as many shift to suburbs

Refineries also don’t work well in subfreezing temperatures, says Patrick DeHaan, head of petroleum analysis at GasBuddy.

Wholesale gasoline prices have edged up 10 to 14 cents a gallon and retail prices should follow by Monday, Kloza says.

$60 crude oil

Pump prices already have jumped from $2.10 a gallon in late November, DeHaan says. That followed a surge in crude oil prices in the wake of OPEC production cutbacks and anticipation of a spike in global demand by late spring as a COVID-19 vaccine becomes widely distributed, DeHaan says. Since late October, West Texas Intermediate, the U.S. benchmark crude oil, has climbed from about $35 a barrel to $61.

Also pushing up pump prices in recent months is low refining capacity, says analyst Phil Flynn of the Price Futures Group. Refiners have grappled with weak U.S. gasoline demand and thin margins amid the health crisis, as Americans drive less and air travel pulls back sharply. Some refiners have gone out of business while others have scaled back capacity because of both low demand and worker shortages due to COVID, Flynn says.

Gas prices will likely average about $2.70 a gallon within days, analysts say, but should fall back near current levels by March. But Flynn and DeHaan say refiners will begin to switch to cleaner – and more expensive -- summer gasoline blends next month, nudging prices higher again.

$3 gas by spring?

Flynn says widespread vaccinations and Americans’ return to the road will likely push gas prices to $3 a gallon by late spring. DeHaan predicts $2.60 $2.80 but says $3 is possible.

“The era of low gasoline prices has ended and we are entering a new era of higher prices,” Flynn says.

Tax and stimulus guide:Taxes Q&A: When is the filing deadline for 2020 taxes? Will I owe taxes on stimulus checks?

Kloza believes such forecasts are overstated. Stronger demand is already priced into crude prices and he doesn’t think they’ll rise much higher. OPEC, he notes, plans to boost production within months.

“It’s not a march to $3,” he says. To get to $3, you really need to get $80 a barrel.”

Other effects of the winter storm:

Empty store shelves

As a result of power outages or severe weather, many manufacturers shut operations, a big chunk of truck and rail transportation was idled, and many retailers couldn’t accept deliveries, says Tracy Rosser, executive vice president of operations for Transplace, a logistics consulting company.

All told, about 20% of product shipments scheduled Wednesday in Texas, Louisiana, Mississippi and Arkansas did not occur, says Rosser. Snarls also have started to emerge in Massachusetts, Michigan, New York and Ohio.

In the next week or two, consumers, particularly in the southern states, may not find certain items on store shelves, including paper products, canned goods and beverages.

Stalled Fedex package deliveries

Fedex says the storm caused significant disruptions at its Memphis World Hub, though it “continues to move COVID-19 vaccines where and when possible.” UPS closed sorting at its main Dallas hub earlier this week, creating bottlenecks in Texas for local delivery and for sorting to other destinations, says John Haber, CEO of Spend Management Experts, a supply chain consulting firm.

Walmart, CVS store closures

CVS has closed about 600 stores in states affected by power outages, mostly in Texas, Oklahoma and Louisiana. Walmart closed up to 500 stores in the South and Midwest, Haber says. Walgreen closed about 200 stores in Texas, according to the New York Times.

GM plant shutdowns

General Motors halted production at its highly profitable pickup plant in Fort Wayne, Indiana, as well as three other plants, affecting about 4,800 workers. Ford Motor Co. shut production of its hot-selling F-150 and Transit Vans for a full week in Kansas City, Missouri. Toyota Motor Manufacturing idled first shift production of its Tundra and Tacoma pickups in San Antonio, Texas. And Nissan North America said first and second shift production at all four of its U.S. plants was temporarily suspended for the second day in a row.

Contributing: Jamie L. LaReau of the Detroit Free Press

Thursday, February 18, 2021

Texas deep freeze hits energy sector, Houston ship channel shut

Deep freeze hits U.S.

https://www.reuters.com/article/us-energy-texas-weather-idUKKBN2AG1PK

HOUSTON (Reuters) - A deep freeze that hit Texas over the weekend wrought more havoc on the U.S. energy sector on Tuesday, curbing output in the largest U.S. oil field, knocking out a fifth of the nation’s refining capacity, and shutting a key shipping channel in Houston.

Historic cold has knocked out roughly 4 million barrels per day of refining capacity, more than one-fifth of national capacity, according to Reuters calculations. About 500,000 to 1.2 million bpd of crude production has also been affected, and it could be weeks before it is fully restored, industry analysts said.

Around 5.3 million customers were without power nationwide due to winter storms. Texas was hardest hit with around 4.4 million customers affected, according to local power companies, as the state’s electrical grid operates largely independent of other states and therefore cannot draw power from nearby operators.

“The entire Texas system from the wellhead to the electric meter on a home is more designed to deal with multiple 100 degree days than multiple single-digit days,” said Todd Staples, president of the Texas Oil & Gas Association.

Many refiners, including the biggest in the United States, have shut down due to the freeze. Around 4 mln bpd, or 21% percent of U.S. refining capacity, is shut, the biggest weather-related hit since Hurricane Harvey rumbled through the Gulf in 2017.

“We’re talking about a major portion of the U.S. Gulf Coast refining capacity currently being offline, in all likelihood, above 4,000,000 barrels a day,” said Marc Amons, senior research analyst with Wood Mackenzie.

The cold snap sent U.S. oil prices to near 13-month highs, while front-month gas futures jumped to an over three-month high.

In the spot market, next-day power at the ERCOT North hub jumped to a record high of $1,489.75 per megawatt hour (MWh).

The largest U.S. refinery, Motiva Enterprises’ 600,000 bpd facility at Port Arthur, was shut. Elsewhere, freezing temperatures shut other refineries and chemical plants in the state owned by Royal Dutch Shell Valero Energy Corp, Exxon Mobil Corp and Total SE.

Cold weather primarily impacts instrumentation that monitors and operates refinery units. The cold has shut natural gas production and pipelines, which refineries use in power generation. Widespread power outages or instability of external power supply can force shutdowns.

“The vast majority of their equipment will be inoperable once the weather warms up, so while we don’t feel that we’re looking at a hurricane-like scenario,” it would probably take about a couple weeks for the refineries to return to pre-storm operations, Amons said.

TERMINAL CLOSURES

The Houston Ship Channel, a 53-mile (85 km) waterway crucial to oil and fuel exports, had opened for some vessel traffic during Tuesday but was expected to shut again due to an impending cold blast in the evening.

J.J. Plunkett, port agent for Houston Pilots, said ship pilots were moving at least five vessels along the Houston Ship Channel on Tuesday.

Whether they will be able to do so through the night will depend on the weather, Plunkett said. Freezing rain expected with another Arctic front may prevent ground transportation within ports and along docks.

“The biggest obstacle is moving people around as most of the highways and bridges are closed... There are a lot of electricity outages in the area, the whole of Galveston is under a blackout. Even we do not have power, but have backup.”

In the oil patch, access to wells has been cut off by icy roads, while power and cellular services have been lost, Staples said.

Artem Abramov, partner at Rystad Energy, estimated the effect on the Permian, the biggest U.S. oil field in west Texas, at anywhere between 500,000 to 1.2 million bpd over the course of five days, though he said most volumes should be restored very quickly.

Reporting by Swati Verma and Arpan Varghese in Bengaluru and Jennifer Hiller and Erwin Seba in Houston; additional reporting by Diptendu Lahiri in Bengaluru; Editing by Marguerita Choy, Emelia Sithole-Matarise and David Gregorio

Crew of oil tanker beached off UAE to go home after four years stranded at sea

Monchand Sheikh, one of the five crew, on the beach at Umm Al Quwain with the MT Iba in the background. Photograph: Spencer Shea

Five men abandoned without wages on ship that ran aground have received settlements and will be repatriated to their families

The crew of an oil tanker who have not set foot on dry land for nearly four years after being abandoned on board their ship, which later ran aground off the United Arab Emirates, are finally going home to see their families.

The seafarers, who said they experienced “living hell” on board the 5,000-ton MT Iba after the tanker’s owner hit financial problems and stopped paying salaries almost three years ago, have been given a settlement for wages owed to them. They hope to be repatriated in March.

The five-man crew had a brief and emotional trip to dry land to meet with representatives of Alco Shipping, the vessel’s owner, on the beach at Umm Al Quwain, on Monday. Two cheques from a new buyer, Shark Power Marine Services, were handed over to the crew via the Mission to Seafarers charity, which has been negotiating on their behalf. They agreed to accept $165,000 (£119,000) in unpaid wages, around 65% to 70% of the wages they were owed.

Work is under way to assess the damage to the oil tanker when it broke anchor and drifted from the busy port, before beaching two and a half weeks ago.

Nay Win, the 53-year-old chief engineer, who is from Myanmar, said: “The buyer has promised us we will get home and I hope I will get home after 5 March. My family are really happy.”

Win and Riasat Ali, a 52-year-old second engineer from Pakistan, have been on board since July 2017. Monchand Sheikh, 26, a cook from India, joined in late 2018, while Vinay Kumar, 31, another second engineer, and Nirmal Singh-Bora, 22, both from India, joined in late 2019.

The Rev Andy Bowerman, Mission to Seafarers regional director in the Middle East and south Asia, said: “Hopefully, all being well, 15 days from now, they will be at the port of Dubai and ready to go home.”

It was an emotional meeting at the beach, Bowerman said, marking the first time some of the seafarers had been ashore in almost four years.

“The crew came off and swam to the shore. Nay Win was in tears. He was off the boat, there was a cheque in my hands. But unfortunately they could not just step down and go home.”

The seafarers have agreed to stay on to do essential work on the ship before it is towed to Dubai, where they will wait 15 days for legal work on the sale of the vessel to be completed.

They will then be paid the other half of the money they are owed, and repatriated.

A spokesperson for the UAE Ministry of Energy and Infrastructure said the authorities were helping the seafarers renew passports via their embassies, so they could be quickly repatriated. The crew will require a PCR Covid-19 test, and will be allowed to fly if the test is negative; otherwise, arrangements will be made for quarantine.

Asked why the UAE is the worst country for seafarer abandonment, according to a database run by the International Maritime Organization, the spokesperson said that it was a busy maritime hub, with 20 active ports, and that more traffic led to more cases. New legislation that would allow the port to arrest an abandoned ship and auction it without the involvement of the courts was not yet in place.

Mohamed Arrachedi, Arab world and Iran network coordinator for the International Transport Workers’ Federation (ITF) said the long-running case of the Iba was a “symptom that something very wrong exists and has to change”.

“The seafarers are the workforce that keeps ships at sea. Their rights, wellbeing, wages, conditions and welfare must be at the centre of priorities.”

Wednesday, February 17, 2021

Tuesday, February 16, 2021

Monday, February 15, 2021

Oil Prices Are Running Ahead Of The Fundamentals

John Raoux AP

As the pandemic rages, so do oil prices, reaching levels not seen

since January 2020, when the virus was still a gleam in the

epidemiologists’ eyes.

A variety of reasons have been given for this trend, including recovering demand and suppressed supply, the vaccine roll-out, and falling inventories. Indeed, the futures price has returned to backwardation, with the current contract nearly $1 higher than the 4th month contract, almost the same as early 2020.

Which is a bit perverse, given that the fundamentals do not—at this point—seem to justify such prices, let alone backwardation. Backwardation, when current prices are above future prices, implies that the market is tight, which is why current contracts have a premium. (Remember that futures prices are not predictions of the price in the future but what people are willing to pay today for barrels at a future date.)

The figure below shows the prompt (1st month) contract minus the fourth month contract, and for most of the past year, the market was in contango: prompt prices were discounted, reflecting the glut in the market.

Without a doubt, the market has been tightening, thanks to the efforts of OPEC+ and the recent voluntary 1 mb/d reduction by the Saudis. Low oil prices have also reduced North American production by as much as 2 mb/d, only some of which can be restored quickly. Still, it might be argued that the price is reflecting the combination of tighter inventories and an optimistic economic outlook.

But, and it is a big but (no snide remarks, please), market fundamentals have hardly recovered. It would be nice to know what global oil inventories are, but that data doesn’t really exist—most non-OECD nations do not report them in a timely way, if at all, and even OECD data is badly lagged. The mid-January Oil Market Report from the IEA shows inventories for end-November, at which point they were about 200 million barrels above normal. For them to have fallen to levels of end-2019 would have required a 3 mb/d inventory draw in December and January, which is not impossible but would certainly be unusual.

The table below compares the oil market in early January 2020, the last time prices were this high, with the current (lagged) data. The best indicators of market fundamentals do not suggest these prices are warranted: spare capacity in OPEC and Russia is much above year-ago levels, implying recovering demand will not tighten markets but allow a relaxation of quotas. (At $60/barrel, some growth in U.S. shale is possible, although the increase by year’s end should be modest.)

Inventories are also a primary indicator of market fundamentals, since they represent the difference between supply and demand, at least kind of, in a vague way. Unfortunately, as mentioned, OECD inventory data is lagged, but the U.S. less so, and traders often focus on that info the way drunks look for their keys under the street light. U.S. inventory data is very timely and does not show a balanced market by any means, which does not support a bullish price outlook.

Some would object that U.S. inventories are a mere 5% above the level of a year ago, which is true, but as petroleum economist Meryl Streep would say, “It’s complicated.” For one thing, actual usable inventories are much smaller than the total, as I discussed last year. Some Clarity On Oil Storage Capacity Estimates (forbes.com) Oil in pipelines remains at a constant level; you can’t draw them down without emptying the pipeline. And storage tanks have to maintain certain minimum levels to operate, so that the amount which can be drawn upon, the ‘usable inventory,’ is a fraction of the total. Thus, with inventories up by 5%, the usable inventories have probably doubled.

A further complicating factor is that the absolute inventory level is less important than the relative level. If demand drops, as it has done lately, less inventories are needed. Expert traders pay sharp attention to inventories in days of consumption or, for crude oil, days of refinery runs. Both are shown in the table above and given the depressed level of demand it is hardly surprising that relative inventories have increased significantly.

Of course, there are two other drivers of oil prices that need to be considered. First are the expectations of traders for future supply and demand, which arguably are having a bullish effect. However, the possibility of a tight market in the fourth quarter of this year should not be elevating prices to the extent seen now (I think, guess, speculate, okay not speculating). This implies to me that oil prices are higher in part because of asset inflation due to the extraordinary fiscal stimuli being enacted (or promised) around the world, including the U.S.

Which suggests to me that current prices might be inflated, such that I wouldn’t expect them to go much higher in the next six months, but the gradually tightening market also implies that they won’t drop significantly. But, and it is another big but, I have been wrong before and there is always the possibility that day traders on social media will talk us into another bubble.

Friday, February 12, 2021

Copper price rally reaches new high

Codelco copper Fundición el Teniente Chile. Credit: Consejo Minero.

https://www.mining.com/copper-price-rally-reaches-new-high/

Copper prices surged on Wednesday as rising inflation expectations caused by US stimulus, a falling dollar, decreasing rates of coronavirus infections and historically low stocks spurred fresh buying.

On the Comex market, copper for delivery in March advanced 2% to $3.7955 a pound ($8,350 a tonne). If it closes at these levels it would be the highest since March 2012.

“The idea that US stimulus is going to lead to higher inflation has taken hold this week, which is a positive for copper and other commodities used as a hedge against inflation,” Tom Mulqueen, an analyst at Amalgamated Metal Trading told Reuters.

“New coronavirus cases are starting to come down and the dollar is lower,” Mulqueen said.

US president Joe Biden’s $1.9 trillion stimulus plan is expected to boost economic growth and fuel inflation at a pace faster than previously expected.

“We expect high metal prices to continue, with a positive effect on our metal result,” said Roland Harings, CEO of Europe’s largest copper producer Aurubis.

“We anticipate a strong improvement in demand for our products overall,” he said.

While most of Wall Street is gearing up for higher prices, the rally is not without its doubters.

JPMorgan Chase & Co. analysts last month said the current China-driven supercycle has peaked, and Chinese investment growth is set for declines.

“People are generally optimistic for the long-term prospect globally, but it’s a question of when it’s going to really take hold,” portfolio manager at Orion Resource Partners Jon Lamb told Bloomberg.

“It’s clarity on what those initiatives — from the next round of covid relief funding to post covid stimulus infrastructure projects where EVs and renewable energy are going to be big focuses — will look like and the timing will be the catalyst.”

Inventories

Copper stocks in LME-registered warehouses stand at 74,675 tonnes, close to last September’s 15-year trough.

Low stocks have fuelled concern about availability on the LME market, creating a premium for cash copper over the three-month contract.

“Falling inventories could help to draw bulls back in,” Citigroup analyst Oliver Nugent told Bloomberg. Citigroup sees a likely short-term drop in prices as a buying opportunity.

“The extra kicker you need is those organic moves to a market that’s trading like it’s experiencing really tight fundamentals,” he said.

“Spring is likely to bring a fresh demand boost,” Morgan Stanley analysts Susan Bates and Marius van Straaten told Bloomberg.

“The supply side appears ill-positioned” to meet it, he said.

(With files from Bloomberg and Reuters)

Thursday, February 11, 2021

Complaint seeks forfeiture of Iranian oil aboard tanker based on connection to terror group

https://www.tankeroperator.com/ViewNews.aspx?NewsID=12131

The United States filed a forfeiture complaint in the U.S. District Court for the District of Columbia alleging that all oil aboard a Liberian-flagged vessel, the M/T Achilleas (Achilleas), is subject to forfeiture based on U.S. terrorism forfeiture laws.

The complaint alleges a scheme involving multiple entities affiliated with Iran’s Islamic Revolutionary Guard Corps (IRGC) and the IRGC-Qods Force (IRGC-QF) to covertly ship Iranian oil to a customer abroad. Participants in the scheme attempted to disguise the origin of the oil using ship-to-ship transfers, falsified documents, and other means, and provided a fraudulent bill of lading to deceive the owners of the Achilleas into loading the oil in question.

The complaint alleges in part that the oil constitutes the property of, or a “source of influence” over, the IRGC and the IRGC-QF, both of which have been designated by the United States as foreign terrorist organizations. The documents allege that profits from oil sales support the IRGC’s full range of nefarious activities, including the proliferation of weapons of mass destruction and their means of delivery, support for terrorism, and a variety of human rights abuses, at home and abroad.

“The forfeiture complaint filed today serves as a reminder that the IRGC and IRGC-QF continue to exert significant control over the sale of Iranian oil,” said Assistant Attorney General John C. Demers for the National Security Division. “As we have demonstrated in the past, the department will deploy all tools at its disposal to ensure that the IRGC and IRGC-QF cannot use profits from the sale of Iranian oil to fund terrorism and other activities that threaten the safety and security of all Americans.”

“The U.S. Attorney’s Office for the District of Columbia will continue working with our law enforcement partners to stem the flow of illicit oil from Iran’s Islamic Revolutionary Guard Corps and Qods Force,” said Acting U.S. Attorney Michael R. Sherwin. “We will use all available tools, including our jurisdiction to seize and forfeit assets located abroad, to combat funding for terrorists and those who would do harm to the United States.”

“This latest civil forfeiture action exemplifies the remarkable work of this multi-agency task force that works tirelessly toward furthering our shared goal of protecting the homeland from regimes that threaten our national security,” said Special Agent in Charge Peter C. Fitzhugh for the U.S. Immigration and Customs Enforcement’s Homeland Security Investigations (HSI), New York. “This investigation sends a message that the attempted circumvention of U.S. sanctions by the IRGC-QF will not be tolerated. HSI will continue to work with our partners and utilize the full scope of our authorities to disrupt the attempts of hostile countries and regimes to generate profits from oil sales used to support terrorism and the proliferation and delivery of weapons of mass destruction.”

“Iran uses profits from its petroleum sector to fund the malign activities of the IRGC-QF, a designated terrorist group,” said Special Agent in Charge Michael F. Paul of the FBI’s Minneapolis Field Office. “The FBI will continue to prioritize the enforcement of sanctions, and we applaud the efforts of our agents and partners on this investigation.”

A civil forfeiture complaint is merely an allegation. The United States bears the burden of proving that the oil in question is subject to forfeiture in a civil forfeiture proceeding. Funds successfully forfeited with a connection to a state sponsor of terrorism may in whole or in part be directed to the United States Victims of State Sponsored Terrorism Fund (http://www.usvsst.com/) after the conclusion of the case.

HSI New York and the FBI’s Minneapolis Field Office are leading the investigation of Iranian petroleum shipments. Assistant U.S. Attorneys Michael P. Grady and Brian P. Hudak of the U.S. Attorney’s Office for the District of Columbia and Trial Attorney David Lim of the Counterintelligence and Export Control Section of the National Security Division are prosecuting the case. The Money Laundering and Asset Recovery Section’s Program Operations Staff of the Justice Department’s Criminal Division has provided extensive assistance throughout the investigation.

Opec+ seaborne exports down 1.8 mbd in January ahead of further planned cuts

Map of the OPEC countries. Image source: Getty Images

https://www.tankeroperator.com/ViewNews.aspx?NewsID=12127

New analysis released by commodities intelligence platform Kpler.

Kpler data shows OPEC+ seaborne oil exports slumped by 1.8 mbd to 25.5 mbd in January. The decline is relatively unsurprising: although OPEC+ had agreed to boost production by an additional 500 kbd in January, we had actually seen a 1 mbd increase in seaborne exports in December 2020 already. The decrease in exports also comes as Saudi Arabia has pledged a voluntary 1 mbd cut in February and March, part of which may have already been factored in into Saudi production. Further Saudi cuts are likely to boost storage draws: global oil inventories have fallen 33 million barrels (mb) in January, of which 20 mb in Eastern Asia only.

The only significant increases were seen in Venezuela, Russia and Iran (up by 138 kbd, 137 kbd and 79 kbd m/m respectively) although our final estimate for Iran may change to the upside. The exports increase reflects Russia's ability to increase production by 65 kbd in each of February and March and stronger confidence from Iran that the worst of sanctions is behind them.

Lower exports from the group help decrease expected market supply: we estimate 8.28 mbd of oil were removed in market supply since the reference month of October 2018, compared to a production cut target of 7.2 mbd in January 2021 against reference levels. Our models now include refinery runs estimates in partnership with Facts Global Energy (FGE).

Key takeaways:

· Saudi Arabia returns to cutting production and exports

· Iraq's exports fall despite the launch of Basrah Medium

· Africa’s shipments fall, a crude quality matter?

· Iran's exports jump over 500 kbd: Is Iranian oil on the brink of being back in the market?

OPEC+ seaborne oil exports variation in January (kbd)

Saudi Arabia starts cutting while lighter oil exports from OPEC Africa fall out of favour in Asia.

Saudi Arabia starts cutting production and exports, helping to push global inventories lower

Saudi Arabia’s exports have been 435 kbd lower in January, a sign that the kingdom is on track to cut output as promised. However, despite this exports cut, Aramco’s exports level is only 100 kbd lower than November as December exports were close to 300 kbd higher m/m.

Saudi’s oil exports reached 6.33 mbd in January, with lower volumes being shipped to Asia: combined exports to China, Japan, South Korea, Taiwan and Indonesia were down 380 bd m/m while shipments towards India (+60kbd m/m) and especially the US (+230 kbd) rose.

Lower Saudi shipments towards Eastern Asia are likely to boost storage draws: global oil inventories have fallen 33 million barrels (mb) in January, of which 20 mb in Eastern Asia only.

Iraq's exports fall despite the launch of Basrah Medium

Iraq’s exports (including exports out of Ceyhan) fell 121 kbd m/m, after having boosted by close to 250 kbd in December. Basrah shipments decreased by 50 kbd m/m while exports out of Ceyhan fell by 71 kbd. The decrease comes as the country plans to cut production in January and February to make up for breaching its OPEC+ quota last year.

Earlier in the month, Iraq's SOMO launched a new grade called Basrah Medium, a move that would normally allow the country to unleash more production, as its oil production is increasingly heavy. 20 cargoes or 922 kbd of Basrah Medium were shipped on the month, mostly heading towards Iraq's key customers: China and India. SOMO announced that up to 1 mbd of its oil exports will be sold as Basrah Medium.

Africa’s shipments fall, a crude quality matter?

In addition to Saudi Arabia, exports from many African countries are down: Nigeria (-315 kbd), Algeria (-188 kbd), Libya (-152 kbd), Angola (-95 kbd), Gabon (-42 kbd) and Equatorial Guinea (-19 kbd). Only Congo and South Sudan were up by only 12 kbd and 11 kbd respectively. Nigeria’s exports have reached their lowest level since June 2013, boosting the country’s compliance to OPEC+ cuts after it already made strong efforts in the past few months.

One of the reasons of this may be explained in crude quality. Most of these countries’ oil blends are light oil, which are more suitable for refineries that target a higher yield for clean products such as naphta, gasoline or jet fuel. However, in the middle of a cold winter, buyers of crude may favour heavier blends in order to reach a higher yield of middle distillates or dirty petroleum products, in order to use such products for heating or power generation purposes. Eastern Asia’s net exports of gasoil and fuel oil show that the region went from a surplus of 300 kbd in November to 84 kbd in January.

Iran's loadings jump over 500 kbd: Is Iranian oil on the brink of being back in the market?

The National Iranian Oil Company (NIOC) has grown bolder on the back of Biden's inauguration in the US. Iran’s oil exports have increased by 80 kbd to 550 kbd, while the 3-month moving average reached 484 kbd. Our estimate of Iran's shipments is likely to be revised upwards as we receive more information about ghost ships.

Unsurprisingly, all this oil is heading eastwards towards Malaysian waters where STS operations have been happening and eventually towards China. Even if a full agreement between Iran and the Biden administration isn’t reached in months, we expect China to boost intakes of Iranian oil and to achieve better pricing for competing grades such as Basrah Medium and Arab Medium. Chinese firms CNPC and Sinopec are still recouping cost recovery and remuneration fee from their participation in two Iranian oil fields in the past decade.

NIOC has already started ramping up production: Deputy Oil Minister Amir Hossein Zamaninia said the country could reach back previous production levels (+2-2.5 mbd) in just 1-2 months. We estimate this to be too optimistic and estimate it could take around 6 months to achieve such an increase. But the key issue remains the lifting of US sanctions. When this happens, traditional customers such as India, Japan, South Korea and Europe could come to Iran's door.

OPEC+ market supply reductions against pledged cuts (kbd)

A strong decrease in exports coupled with lower cut targets have boosted market supply cut expectations to 115%.

Wednesday, February 10, 2021

Tuesday, February 9, 2021

Arctic shuffle february polar vortex effect puts gas prices back in play

The science behind the polar vortex.(NOAA)

https://rbnenergy.com/arctic-shuffle-february-polar-vortex-effect-puts-%243-gas-prices-back-in-play

Weather is the perpetual wildcard in the natural gas market, but it’s

been particularly shifty this winter, keeping market participants — and

weather forecasters, for that matter — on their toes. Gas futures prices

started this season at $3.30-plus/MMBtu, but then endured some of the

warmest weather on record (in November and January), including a couple

of polar vortex head fakes over the past month or so — weather forecasts

at times in January started off much colder but ultimately reversed

course. Prompt CME/NYMEX Henry Hub futures prices have seesawed as a

result. Despite the weather setbacks, however, prices have held on in

the $2.40-$2.70/MMBtu range through much of winter and averaged more

than $0.60/MMBtu higher year-on-year in January. And, with an Arctic

blast set to unfurl across the Lower 48 this week, prices last Friday

topped $3/MMBtu again in intraday trading before settling in the

high-$2.80s/MMBtu Friday and Monday. Today, we examine the supply-demand

factors underlying the recent price action, and prospects for sustained

$3/MMBtu gas prices.

In yesterday’s blog, Cold As Ice, we discussed the potential impacts of this week’s polar vortex event on the U.S. propane market (and how it may differ from similar events in the past). Now we turn our attention to what the extreme weather will mean for the U.S. natural gas market.

Well before the storage withdrawal season got underway in November 2020, it was apparent that the gas market was poised to tighten in late 2020. Rig counts were at decade-long lows, Lower-48 gas production was trailing by more than 7 Bcf/d year-on-year heading into the winter season (November through March), and it would take months, if not more than a year, for production volumes to return to their pre-pandemic peaks. At the same time, U.S. LNG exports were set to make a strong comeback after being throttled by anemic international demand and prices for much of 2020. But the storage inventory had exited injection season (April through October) with a 200-Bcf surplus vs. the previous year. So the question was not whether the market would tighten but rather by how much. And that ultimately would come down to weather — still the biggest driver of domestic gas consumption and the #1 unknown, made even dicier by the polar vortex effect in recent years. A cold winter could rapidly wipe out the storage surplus and even lead to a substantial deficit, enough to support prices throughout 2021. On the other hand, another warm winter could easily offset the effects of production losses and LNG exports, leaving a lingering or even larger storage surplus to weigh on prices.

Figure 1. CME/NYMEX Henry Hub Prompt Futures. Source: CME via Bloomberg

Given all that, it’s not surprising that the market has been dancing to the tune of weather forecasts this winter, making double-digit moves day to day, or even intraday, as weather models were revised. What’s actually transpired though has been more complicated and nuanced, particularly when put in perspective with previous years. For example, what otherwise would have been considered normal-to-bullish weather for November was exceptionally bearish for the gas market in November 2020 when compared with November 2019, especially the first half of the month. As a result, the year-on-year storage surplus expanded in November 2020, and the December prompt contract, which had started November near $3.35/MMBtu, quickly fell below $3/MMBtu to as low as $2.59/MMBtu and ended the month in the $2.80s/MMBtu (dashed orange box). Similarly, December 2020 weather was closer to normal, but weather-driven demand still lagged December 2019, which was especially cold. Once again, fundamentals did little to make a dent in the storage surplus, and prompt prices lost more ground, falling to a low near $2.30/MMBtu by the end of 2020 (dashed orange oval).

The opposite occurred in January 2021. It was one of the warmest Januaries on record, but still managed to be bullish relative to January 2020 (which had been very mild), allowing the storage surplus to shrink. The price action was halting, however, as weather forecasts bounced around, hinging on the direction of the wobbly polar vortex split — what happens when the stratospheric air above the North Pole warms and breaks down the polar vortex wind pattern, blasting icy Arctic air farther south in the Northern Hemisphere, either toward Europe and Asia or towards North America, or both. Prompt futures last month pinballed from the $2.50s to $2.70s, back down to the $2.40s, and again up to the $2.70s (dashed green oval) as weather models at least twice forecast, then retracted, expectations for extreme cold.

Now, both a polar vortex event and $3/MMBtu prices are back in play as forecasts show the polar split breaking towards the U.S. this week, bringing freezing, even sub-zero temperatures as far south as Texas. What’s been the net effect of all the weather shuffling so far this winter, and what will this week’s Arctic blast mean for supply-demand fundamentals, storage and, ultimately, prices?

A good way to assess the relative tightness (or looseness) of the gas market is to compare current fundamentals with the previous year. We do that using historical supply-demand data from the daily RBN NATGAS Billboard report. Figure 2 shows the year-on-year changes for each of the supply and demand components for the first three months of winter 2020-21, from November through January. The navy-blue bars indicate an increase vs. the same period last year, while the red bars indicate a decline.

Figure 2. Year-on-Year Changes in Lower-48 Supply-Demand Balance. Source: RBN NATGAS Billboard

Starting with supply to the left in Figure 2, Lower-48 production for November 2020 through January 2021 was down a whopping 3.9 Bcf/d year-on-year, averaging just 91.4 Bcf/d this winter vs. 95.3 Bcf/d during the same period a year earlier. Imports from Canada jumped 1 Bcf/d year-on-year to 5.7 Bcf/d, partially offsetting U.S. production losses, though LNG sendout (pipeline receipts of regasified LNG volumes from imports) slipped 0.2 Bcf/d from last winter to just 200 MMcf/d this time around.

As for demand (middle section of Figure 2), Lower-48 consumption from the primary sectors — power generation, residential and commercial heating (res/comm), and industrial end-users — has been substantially lower too this winter. Power burn, which averaged 27.4 Bcf/d in November through January, has lagged by 1.4 Bcf/d year-on-year. Res/comm, the main driver of demand during winter, has trailed by 2.2 Bcf/d year-on-year, with an average 44.2 Bcf/d this season, down from 46.4 Bcf/d last year. While res/comm was nearly flat year-on-year in December and up nearly 4 Bcf/d year-on-year in January, November 2020 was especially bearish, lagging 2019 levels by nearly 11 Bcf/d. [Note that the res/comm bucket in our model includes miscellaneous volumes, including fuel, pipe loss, and any observed flows that can’t be categorized due to insufficient visibility of what happens to the molecules once they get on an intrastate system or behind a local distribution company (LDC).] Finally, industrial demand also took a hit, averaging 24.4 Bcf/d, down 0.7 Bcf/d from a year earlier.

The only upside in demand has come from exports. Exports to Mexico averaged 5.5 Bcf/d this winter through January, up 0.3 Bcf/d year-on-year as some additional pipeline capacity was completed, particularly on the Mexico side and gas from the Permian moved south to displace LNG imports previously at Mexico’s Manzanillo terminal (see the NATGAS Permian report for details). Then there are LNG exports, which, after months of languishing well below capacity, have surged to record highs as a number of factors — strong winter heating demand in Europe and Asia, a supply shortage in Asia due to Panama Canal delays and vessel shortages, and fast-declining storage inventories in Europe, among others — tightened global LNG supply and sent international gas/LNG prices soaring (some of the logistical constraints have eased in recent weeks; see the LNG Voyager report for details). LNG feedgas deliveries for November-January averaged 10 Bcf/d, up 2.3 Bcf/d year-on-year.

That brings us to the Lower-48 gas market balance (the difference of supply minus demand, shown on the right side of Figure 2). If we net the supply components — production plus imports — total supply averaged 97.3 Bcf/d from November through January, down a net 3.1 Bcf/d. Demand, including exports, totaled 111.5 Bcf/d, down 1.7 Bcf/d as incremental exports were more than offset by declines in domestic consumption. With supply down more than demand, the balance averaged negative 14.2 Bcf/d (97.3 Bcf/d of total supply minus 111.5 Bcf/d of total demand), about 1.4 Bcf/d tighter year-on-year (3.1 Bcf/d less supply plus 1.7 Bcf/d less demand). In other words, production declines have done much of the heavy lifting when it comes to shrinking the storage surplus, with help from LNG exports — if not for incremental exports mitigating the bearish weather effects on domestic consumption, futures prices likely would be closer to $2/MMBtu than $3/MMBtu today.

Now consider what’s transpiring in February. Production remains at a year-on-year deficit. LNG exports remain stout, with nearly all terminals operating at or above full contracted capacity. What’s different this month is that given the potentially prolonged Arctic wave bearing down on the Lower 48 this week, U.S. gas consumption will likely set new records — potentially by a lot. The latest weather forecasts as of Monday morning showed somewhat less extreme temperatures for the current storage week but only because it pushed the coldest days out by a couple of days into the weekend. Moreover, Monday’s early model runs ended up adding another 50 Bcf of demand to the back half of February. On top of that, production is likely to see further declines as freezing temperatures cause wellheads to freeze-off, a phenomenon that disproportionately affects liquids-rich production regions. So if weather and related demand materialize as expected, the winter supply-demand balance will tighten significantly this month compared with last year and we should see the year-on-year storage surplus, which was down to less than 100 Bcf/d as of January 29, not only disappear but flip to more than a 200-Bcf deficit by mid-February. As of Monday morning, our temperature-based storage model was estimating a total withdrawal of over 800 Bcf for weeks ending February 5 through February 26, compared with 518 Bcf in the same period last year and the five-year average of about 440 Bcf. (Our weekly storage outlook is updated daily in the NATGAS Billboard report, based on the latest weather, supply and demand fundamentals.)

This scenario certainly makes $3/MMBtu gas prices more plausible. But for now, the market appears to be just as sensitive to the downside as it has been to the upside. As we saw last week, while prompt futures breached $3/MMBtu in intraday trading last Friday, they ultimately recoiled and settled at $2.86/MMBtu after midday weather runs moderated the length of the deep freeze. And price action largely appeared to stall Monday, with the March contract settling at $2.882/MMBtu, up just 1.9 cents from Friday. Normal temperatures gradually rise through late February and March as winter transitions into spring, so the ability for cold weather to make quite as big an impact on heating demand and the overall supply-demand balance will become handicapped after February, a reality that is likely weighing on traders’ minds.

Looking past winter, it gets even trickier. While production so far this year has been showing year-on-year losses, that could change by May, with volumes potentially showing substantial gains through spring and early summer compared with last year, when producer shut-ins were in effect. Even if shut-ins occur to some degree this year, such as in the Northeast if takeaway constraints develop, they are unlikely to be as severe as last year given the higher commodity prices. If we extend our January production average of 91.5 Bcf/d through summer, that will equate to nearly 3 Bcf/d of incremental production year-on-year through injection season. That means that demand will have to come in at least that much stronger in order to keep the supply-demand balance in line with last year. That may not be so tall an order, since LNG exports experienced a level of cancellations through the 2020 injection season that is also less likely to repeat, at least to that extent. But as production continues its recovery, it will take both full utilization of LNG export capacity and supportive weather to balance the market. And given that the weather wildcard is ever-looming, the market may remain rangebound and highly sensitive to both upside and downside signals.

In music...

"Harlem Shuffle" was written by Bob Relf and Earl Nelson and originally released by the soul music duo Bob & Earl as a single in 1963. That release went to #44 on the Billboard Hot 100 Singles chart. It was subsequently re-released in the UK in 1969, when it went to #7 on the UK charts. George Harrison reportedly called it his favorite record of all time.

The Rolling Stones' cover version of the song appeared as the third song on side one of their 20th American studio album, Dirty Work. Released as a single in February 1986, the song went to #5 on the Billboard Hot 100 Singles chart. It was the first cover song that the Stones released as the opening single of a studio album since 1965. Personnel on the record were: Mick Jagger (lead and backing vocals), Keith Richards (guitars, backing vocals), Ronnie Wood (guitars, tenor sax, backing vocals), Bill Wyman (bass), Charlie Watts (drums), Chuck Leavell, Phillip Saisse (keyboards), Dan Collette (trumpet), with backing vocals from Bobby Womack, Jimmy Cliff, Don Covay, Beverly D'Angelo, Kirsty MacColl, Dolette McDonald, Janice Pendarvis, Patti Scialfa, and Tom Waits.

Dirty Work was recorded between April and August 1985 and released in March 1986. Produced by Steve Lilywhite and The Glimmer Twins (Jagger and Richards), the album went to #4 on the Billboard Top 200 Albums chart. It has been certified Platinum by the Recording Industry Association of America. Two singles were released from the album.

The Rolling Stones are an English rock band formed in London in 1962 by Mick Jagger, Keith Richards, Brian Jones, Bill Wyman, and Charlie Watts. Brian Jones left the band one month before his death in 1969. He was replaced by Mick Taylor, who left the band in 1974, to be replaced by Ronnie Wood. Bill Wyman left the band in 1993, and Darryl Jones has been their bassist since that time. The Rolling Stones have released 30 studio albums, 33 live albums, 29 compilation albums, three EPs, and 121 singles. They have won one Billboard Music Award, two Grammy Awards, seven Grammy Hall of Fame Awards, three MTV Video Music Awards, and two World Music Awards. They were inducted into the Rock and Roll Hall of Fame in 1989. The band continues to record and tour.

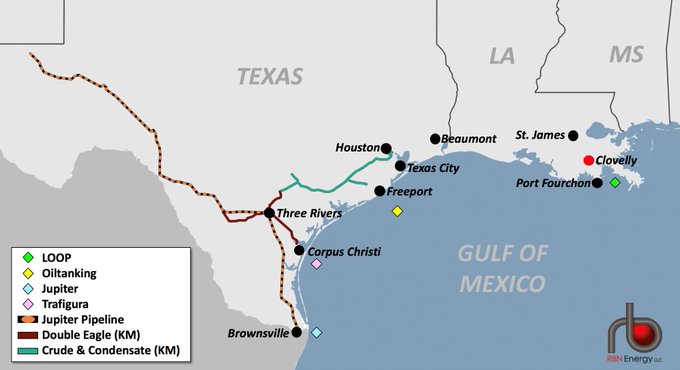

NuStar Bullish on Returning Volumes and Corpus Christi Crude Exports

https://rbnenergy.com/

The lagging Corpus Christi hub in Texas should continue to rebound in 2021 as rising global oil demand boosts US crude exports from South Texas, NuStar said Feb. 4.

NuStar’s Corpus crude volumes fell 50% from 613,000 b/d in December 2019 to 306,000 b/d in the second quarter of 2020, hitting the minimum-volumes commitments of its contracts. As of January 2021, Corpus volumes were up to 369,000 b/d and rising for the San Antonio-based pipeline and terminal firm, NuStar CEO Brad Barron said during a Feb. 4 earnings call.

Both the Permian Basin and South Texas’ Eagle Ford Shale are showing signs of strength early this year, Barron said. He noted that NuStar typically moves about 10% of the Permian’s volumes, but that NuStar’s footprint covers about 20% of the Permian’s inventory of drilled-but-uncompleted wells, seemingly giving NuStar an extra advantage in 2021.

Barron said the momentum in January is making him more “cautiously optimistic” for 2021.

“We are starting this year encouraged by the rebound we have seen, and continue to see, across our footprint,” Barron said. “January was promising, and we hope to see that improvement continue.”

The biggest growth area for 2021 should be volumes and exports from Corpus Christi, he said.

Total US crude exports fell from an all-time high of 3.71 million b/d in February down to just 1.83 million b/d for the week that ended Dec. 4, the lowest weekly average since 2018, according to the US Energy Information Administration.

However, exports are back on the rise thus far in 2021. Crude exports rose to 3.48 million b/d for the week ending Jan. 29 and the four-week average jumped to 3.03 million b/d, the EIA said. The question now is whether early 2021 is more of a blip or a sign of a growing trend.

Pre-pandemic, US crude exports were projected to rise to at least 4.5 million b/d by the end of 2021, but S&P Global Platts Analytics has since projected export volumes to dip or stay flat in 2021 and 2022 before rebounding above current volumes in 2023 and growing from there.

However, more midstream firms are increasingly more bullish on export

volumes rising more quickly as the vaccine rollout continues and global

crude demand rises.

Corpus vs. Houston

As global crude oil demand picks back up, so is the rivalry between Corpus Christi and the Houston Ship Channel for exports, especially with a glut of long-haul Permian pipelines leading to both hubs.

Permian Basin crude production peaked early in 2020 at about 4.8 million b/d before plummeting and, as of February, has rebounded to just over 4.3 million b/d, according to the EIA. At the same time, Permian crude pipeline capacity is already above 6 million b/d after rapid growth in recent years and should exceed 7.5 million b/d once the ExxonMobil-led Wink-to-Webster system is fully online in the third quarter of 2021, according to Platts Analytics.

Platts Analytics expects Permian production will continue to fall into mid-2021 as natural declines outpace new wells, although production is expected to climb in the second half of the year. Still, 2021 output is expected to be 360,000 b/d lower year on year, according to Platts Analytics.

The 650-mile Wink-to-Webster crude oil pipeline system will trek from the Permian to multiple destinations in the Houston market and connections to Texas City and Beaumont.

On Feb. 3, rival pipeline and terminal firm Magellan Midstream Partners, which has its major hub in East Houston, argued that new Wink-to-Webster contracts should steal more barrels from Corpus Christi and further boost the Houston markets. Magellan said barrels have more destination options in Houston with the major refining networks connected.

However, Barron and NuStar Executive Vice President Danny Oliver said the oil refineries are ramping back up to capacity and that the incremental crude barrels will need to be exported. The argument favoring Corpus Christi is the region has less tanker traffic.

Oliver said NuStar’s customers are committed to moving barrels to Corpus.

Monday, February 8, 2021

China’s Oil Storage Levels Are Falling In Early 2021

China Petroleum Storage Map

Crude oil inventories in China have accelerated their decline in recent weeks, Bloomberg reported on Wednesday, quoting data analytics company Kayrros.

At this time last year, Chinese stocks stood at 856 million barrels, according to Kayrros, which compiles and analyzes satellite data.At the start of this month, inventories stood at around 990 million barrels, down from a peak of 1 billion barrels last September, the data cited by Bloomberg showed.

The decline in crude oil stocks in recent weeks is bullish for oil prices as it suggests that the market has accelerated the inventory drawdown.

According to Kayrros, “COVID-19 has accelerated a rebasing of Chinese stocks also led by new storage capacity, new refining capacity, and a renewed focus on import independence and energy security,” co-founder Antoine Halff said.

China’s inventory build last year was initially led by demand after the Chinese lockdowns ended, and then stocks increased because of soaring crude oil imports, Kayrros said in a report.

“China effectively served as a sink for the world’s excess production at a time when other consumers cut back on imports and started drawing down inflated inventories,” the company said.

The expansion of China’s storage capacity and the efforts to have more stocks to ensure energy security has likely reset China’s baseline for inventories at a higher level, said Kayrros, noting that a drop from the current levels—albeit still high—would “likely be more bullish for prices than would have been the case in the past.”

Alongside faster onshore stock drawdowns in China and elsewhere in the world, floating storage has also started to shrink at a faster pace.

Global floating oil storage declined at a fast pace in December as traders sold crude held on tankers in the absence of price incentives to store it, and in order to meet peak winter demand in Asia, analysts and sources at trading firms told Reuters last month.

Sunday, February 7, 2021

Iran Gives Biden Ultimatum: Lift Sanctions Or No Nuke Deal

Ayatollah Ali Khamenei

https://matzav.com/iran-gives-biden-ultimatum-lift-sanctions-or-no-nuke-deal/

Iran’s supreme leader Ayatollah Ali Khamenei said Sunday the US must “completely lift” sanctions first, followed by verification by Tehran, before the Islamic republic returns to its nuclear deal commitments.

“If they want Iran to return to its commitments … America must completely lift sanctions, and not just in words or on paper,” Khamenei said in a televised speech to air force commanders.

“They must be lifted in action, and then we will verify and see if they have been properly lifted, and then return,” he added.

The 2015 landmark deal has been hanging by a thread since US President Donald Trump’s decision to withdraw from it in 2018 and reimpose sanctions on Tehran.

Friday, February 5, 2021

Saudi Arabia Raises Oil Prices To U.S. And Europe

Oil tanker loading at Abqaiq, Saudi Arabia

The world’s top oil exporter, Saudi Arabia, raised on Thursday the prices of all its crude oil that will go to the United States and Europe in March while leaving unchanged the official selling prices of its crude to its key market in Asia.

The Saudi state oil giant Aramco raised the prices of all its crude grades to the U.S. by $0.10 per barrel, while the Saudi oil prices to Europe were lifted by between $1.30 and $1.40 a barrel, according to Bloomberg.

The price of the Saudi flagship Arab Light crude grade to Northwest Europe was raised by $1.40 a barrel for March compared to February and set at a discount of $0.50 a barrel against ICE Brent, Reuters reported, citing a pricing document it had seen.

Last month, a day after surprising the market with a 1-million-bpd additional production cut for February and March, the Saudis raised the official selling prices (OSPs) of their oil for Asia for February. Saudi Aramco lifted the price of the flagship Arab Light grade by $0.70 a barrel to a premium of $1 per barrel against the Middle East benchmark, the Oman/Dubai average.

This month, however, the Saudis are leaving the prices to Asia unchanged for March compared to February, after the extra production cut created a rush among refiners in Asia in January, with buyers scrambling to secure crude oil supplies from Europe.

Saudi Arabia has also reportedly announced reductions in crude oil volumes to be supplied to at least nine clients in Asia and Europe for this month. The cuts were made for shipments under long-term contracts and concern Aramco’s heavier grades, according to Bloomberg.

The extra Saudi cut looks to be working, for now, in favor of the OPEC+ producers who are desperate to see higher oil prices to patch up their budgets hit by the crash in oil prices and the economic downturn due to the pandemic. Oil prices have rallied over the past month since Saudi Arabia announced the additional 1-million-bpd cut.

By Tsvetana Paraskova for Oilprice.com