-

Saudi oil giant cuts capex target by as much as 24% vs 2019

-

Profit slumped 21% in 2019 on lower oil prices and production

Saudi Aramco is slashing planned spending this year in the first sign

that plunging demand and the oil-price war the kingdom unleashed are

hitting home.

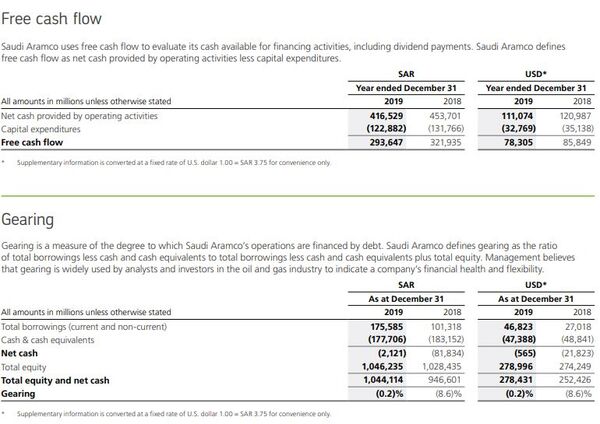

Capital expenditure will be between $25 billion and $30 billion

in 2020 and spending plans for next year and beyond are being reviewed,

Aramco said. The oil giant is lowering that range from the planned $35 billion to $40 billion announced in its IPO prospectus, and compares with $32.8 billion in 2019.

“That was the surprise,” Ahmed Hazem Maher, an analyst at EFG

Hermes in Cairo, said of the spending cut. “They’re adding production

in a low price environment so their cash flows could be impacted.”

Cutting investment could help absorb some of the impact of the drop in

oil prices, he said.

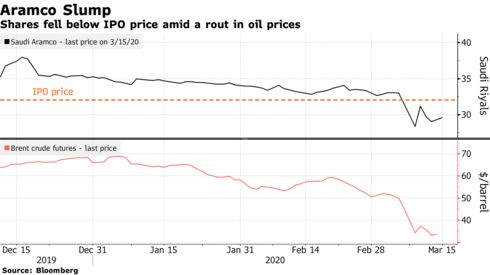

The oil-price war led by Saudi Arabia and Russia means more

pain for Aramco as producing nations prepare to boost supply. Discounted

pricing to markets already reeling from weak demand and crude that lost

roughly half its value since the beginning of the year is likely to hit

revenue further.

Aramco

shares fell as much as 1% on Sunday, extending the decline this year to

about 19%. Aramco’s market value has slumped from a peak of over $2 trillion in December to about $1.5 trillion. Aramco executives are set to brief financial analysts of the results at 3 p.m. Saudi time on Monday.

The

coronavirus’ blow to oil use has overwhelmed OPEC’s initial optimism

for demand this year, with analysts now expecting a drop in consumption.

The OPEC+ group’s failure on March 6 to agree on further cuts is only

exacerbating a glut as buyers search for storage tanks and vessels.

“We have already taken steps to rationalize our planned 2020

capital spending,” Chief Executive Officer Amin Nasser said. Given the

impact of the coronavirus pandemic on economic growth and demand, Aramco

is adopting “a flexible approach to capital allocation,” he said.

Saudi

Arabia, Russia and others intend to boost production once the current

accord to lower output expires in March. The kingdom pledged to supply

25% more oil in April than it produced last month, and Wednesday ordered

Aramco to boost output capacity by 1 million barrels a day.

Key 2019 numbers |

|---|

|

|

|

Oil

prices fell last year even as Saudi Arabia trimmed output as part of

efforts between OPEC and other producers to rein in production. Drone

and missile attacks on two of its biggest facilities in September

temporarily slashed production by more than half, but didn’t cause a big

surge in prices.

Aramco reiterated its plan to pay $75 billion

in dividends this year. The company needs to balance its pledge to pay

investors with spending on its upstream projects -- maintaining oil

production and expanding fields -- and boosting its global refining and

chemical operations -- the downstream segment of the business.

“Aramco

can restructure the strategy to concentrate more on the upstream

expansion rather than downstream,” said Mazen Al-Sudairi, head of

research at Al Rajhi Capital. “They can do it easily from their cash

flow. But it might affect the money transfer to the government for one

or two quarters.”

Brent crude averaged $64.12 a barrel in 2019 compared with $71.67

the previous year. Saudi production slipped to an average of 9.83

million barrels a day from 10.65 million in 2018, according to data

compiled by Bloomberg. Aramco restored output to pre-attack levels by

early October.

Aramco’s 2018 net of $111 billion

made it by far the world’s most profitable company, exceeding the

combined incomes of some of the world’s biggest companies including

Apple Inc., Samsung Electronics Co. and Alphabet Inc.

— With assistance by Verity Ratcliffe

No comments:

Post a Comment