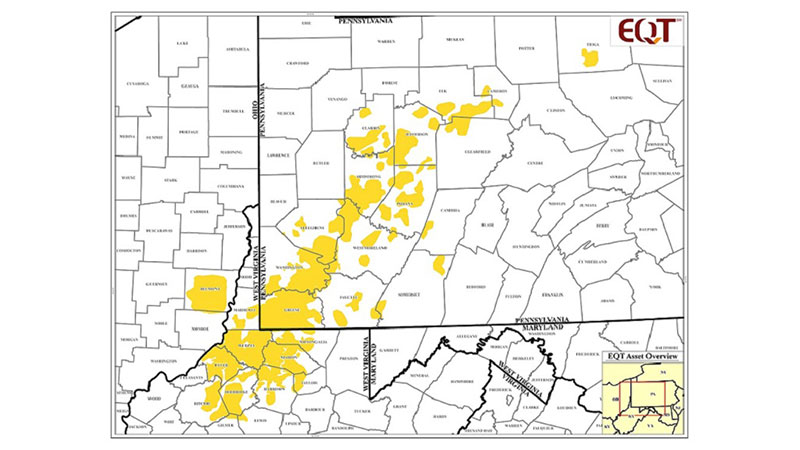

EQT Operational Footprint

The largest natural gas driller in the United States just announced a

massive write-down for its assets, offering more evidence that the shale

sector faces fundamental problems with profitability.

In a regulatory filing on Monday, Pittsburgh-based EQT took a

$1.8 billion impairment for the fourth quarter, as the natural gas

market continues to sour. EQT said that the write down comes as a result

of the “changes to our development strategy and renewed focus on a

refined core operating footprint,” which is a jargon-y way of saying

that some of its assets are now worth much less.

EQT also slashed

spending for 2020 to between $1.25 and $1.35 billion, down by another

$50 million compared to the guidance the company provided in the third

quarter of last year.

Although not a household name, EQT is the largest gas

producer in the country, and is a giant in the Marcellus shale. EQT

purchased Rice Energy in 2017, growing into a huge gas producer and

pipeline company, but it has posted disappointing results in the last

few years. The poor performance led to an internal battle for control of

the company. Toby Rice, who co-founded Rice Energy and maintained small

ownership stakes in EQT after the tie up, wrestled control from

management, convincing the company’s board that he could right the ship.

He became CEO last year.

So far, the company’s problems continue.

Natural gas prices slid sharply in 2019, and are at rock-bottom levels,

particularly for the time of year. According to the FT,

while Henry Hub natural gas prices for February delivery trade at

$2.24/MMBtu, they are only trading at around $1.83/MMBtu at the Dominion

South hub in Pennsylvania. Related: Canada Faces A New Oil Price ‘’Blowout’’

EQT

itself admits that it can’t succeed in this environment. “Gas prices

are down. It has a big impact, the difference between $2.75 gas and

$2.50 gas,” Toby Rice said in December “A lot of this development doesn’t work as well at $2.50 gas.”

EQT

hopes to cut $1.5 billion in debt by selling assets and boosting cash

flow. However, the cash flow part will be hard to pull off with prices

stuck in the doldrums.

Moody’s cut

EQT’s credit rating on Monday to Ba1 with a negative outlook, moving it

into junk territory after the gas giant said it would issue new bonds

to refinance debt. “EQT's significantly weakening cash flow metrics in

light of the persistent weak natural gas price environment and the

company's intent to refinance its 2020 maturities in lieu of debt

reduction through repayment drives the ratings downgrade,” Moody’s

senior analyst Sreedhar Kona said.

The agency also noted the

“volatility associated with the cash flow of pure-play natural gas

producers necessitate a higher retained cash flow to debt ratio

threshold than EQT can deliver over the medium term even with

significant debt reduction.”

“Additionally, EQT's cash flow

metrics compare poorly to other Baa3 rated oil producing companies,

despite EQT's size and scale,” Moody’s concluded. Related: This Was The Most Successful Energy Niche Last Year

EQT’s share price is down by more than half since last spring, and it is also down by more than 75 percent since 2017.

These

problems are obviously much larger than EQT. Range Resources recently

slashed its dividend in order to pay off debt, while also taking out

another $550 million in new debt in order to pay off maturing debt this

year. Meanwhile, Chesapeake Energy, the second largest gas producer, is

now trading at pennies on the dollar and faces the prospect of being delisted from the New York Stock Exchange.

EQT’s

predicament reflects the broader financial questions that have long

plagued the shale industry. Fracking can produce lots of oil and gas,

but steep decline rates make profits elusive. If the largest gas

producer in the country is struggling, and has a credit rating in junk

territory, then something is wrong with the business model.

The

problems endemic to the shale gas industry are starting to affect

production. The decade-long boom in gas production from Appalachia may

have finally come to a halt.

By Nick Cunningham of Oilprice.com

No comments:

Post a Comment