Nicolas Maduro speaks in Caracas on March 22, 2018.

Photographer: Carlos Becerra/Bloomberg

Nicolas Maduro speaks in Caracas on March 22, 2018.

Photographer: Carlos Becerra/Bloomberg

-

Central bank to decide if crypto can count as foreign reserves

-

Government hampered by sanctions that limit access to dollars

Venezuela’s central bank is running internal tests to determine

whether it can hold cryptocurrencies in its coffers, according to four

people with direct knowledge of the matter.

The efforts come at the behest of state-run Petroleos de Venezuela SA,

which is seeking to send Bitcoin and Ethereum to the central bank and

have the monetary authority pay the oil company’s suppliers with the

tokens, according to the people, who asked not to be identified

discussing internal deliberations. Staffers are also studying proposals

that would allow cryptocurrencies to be counted toward international

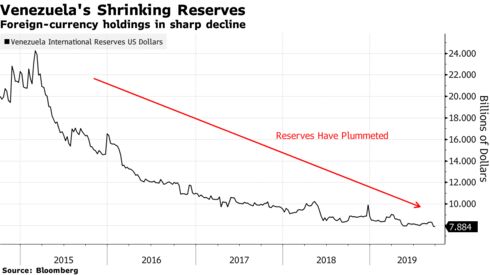

reserves, now near a three-decade low at $7.9 billion.

U.S.

sanctions against Nicolas Maduro’s authoritarian regime have largely

isolated Venezuela from the global financial system, exacerbating one of

world’s most severe economic crises and forcing officials to use a

patchwork of methods to move money around. While Maduro’s plans to start

the world’s first sovereign crypto largely failed,

the continued efforts to use digital currencies shows how desperate the

government is to come up with a way to skirt the restrictions.

Press officials for the central bank and PDVSA didn’t reply to requests for comment.

It

isn’t clear how PDVSA came to own Bitcoin and Ethereum, or the value of

its holdings. But the oil producer has struggled to get paid by

customers via conventional channels because major banks are hesitant to

do business with a sanctioned entity. Last month, the company received

most of a $700 million payment in Chinese yuan after the parties struggled to find financial institutions that would facilitate a transaction.

PDVSA may be hesitant to sell its cryptocurrencies on the

open market because it would require the company to register with an

exchange and subject itself to due diligence. Instead, it wants the

central bank, which officials at the oil company believe is less exposed

to potential blocks, to use the crypto to pay entities PDVSA owes money

to.

Bitcoin and Ethereum use decentralized, online ledgers known

as blockchain to verify and record transactions. In some cases that

allows for relatively anonymous transfers without the need for a

middleman. Few banks touch digital tokens because of the

know-your-client and money laundering issues that arise and cause

compliance problems.

Cryptocurrencies have staged a comeback this

year following 2018’s rout, thanks to expectations of greater

institutional adoption and Facebook Inc.’s plan to launch a coin,

but remain quite volatile. While Bitcoin has plummeted almost 20% in

the past four days, it’s still up more than 130% this year.

In order to shield itself from the effects of further

sanctions, Venezuela’s government has also been considering the

possibility of switching to a Russian-operated international payments messaging system as an alternative to the SWIFT system that most financial institutions use.

— With assistance by Ben Bartenstein, Fabiola Zerpa, and Olga Kharif

No comments:

Post a Comment