Wildfires in Canada are sending Canadian oil prices

higher as a second oil producer is forced to shut-in production, with

Cenovus Energy joining Canadian Natural Resources in halting operations

due to safety concerns, according to World Oil.

Over

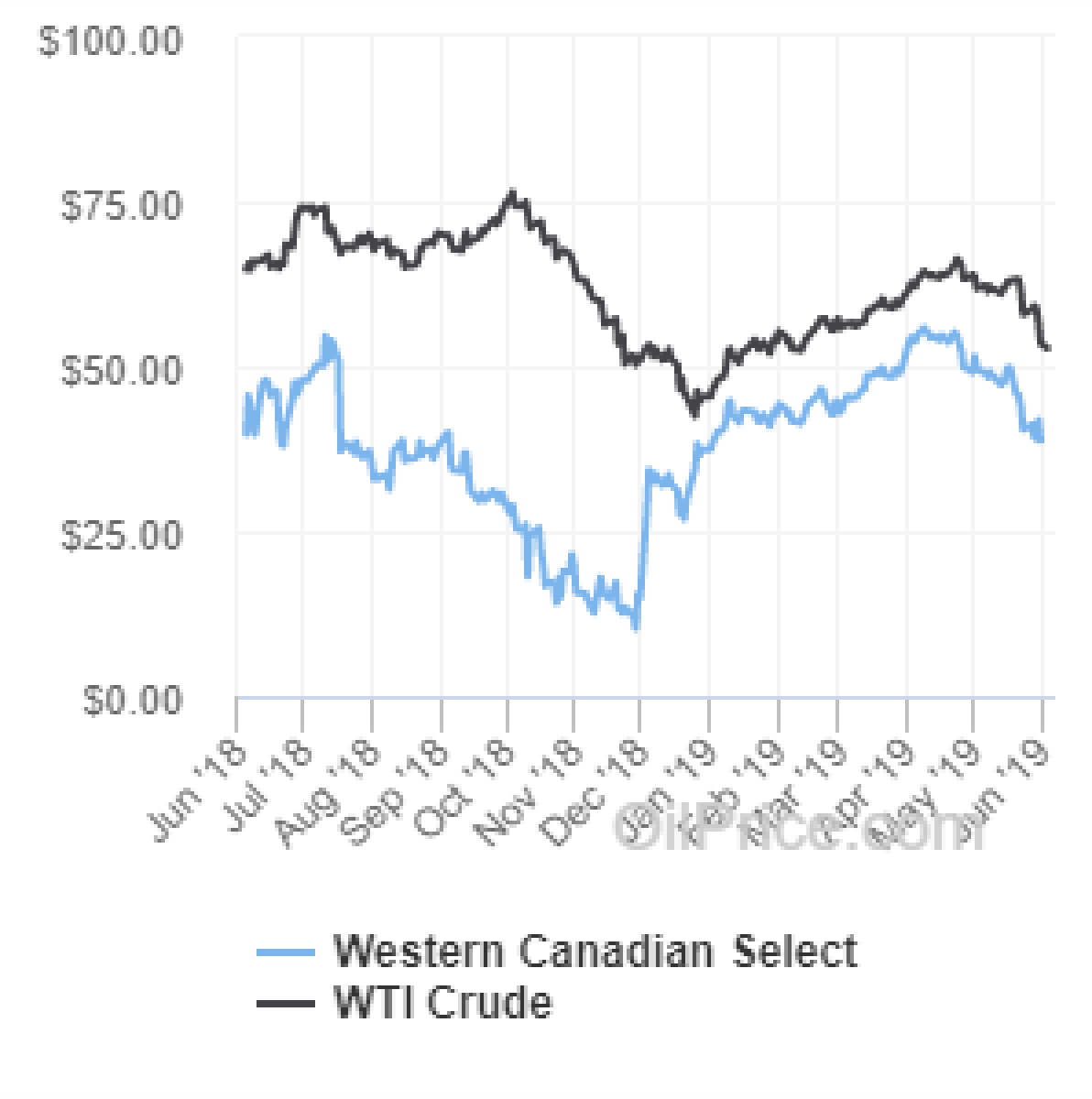

the past year, Canada’s oil industry has suffered under the weight of

its deeply discounted benchmark crude oil, Western Canadian Select. The

painful discount, worsened by Canada’s provincial bickering over oil

flows and pipeline projects, pressured oil-rich Alberta last year

curtail oil production in an effort to shore up the discount. It worked.

In October 2018, the WCS discount was over $60.

That discount fell to just $15 last week, and is now looking to shrink even further thanks to the wildfire.

The

wildfires bring back painful memories of wildfires ripping through

Alberta in 2016, crippling multiple producers and shutting in hundreds

of thousands of barrels of production. The total estimated cost of those

fires were $1 billion. The wildfire damage was so far reaching, that it affected global oil prices as well.

The

latest wildfire has so far claimed just the two producers. The first of

which is Canadian Natural Resources LTD (NYSE: CNQ), which has seen a

drop in stock price of 1.44% to trade at $26.60. Cenovus Energy Inc.

(NYSE: CVE) was trading down 1.71% at $8.06.

Canadian Natural

Resources have stopped 65,000 barrels daily of heavy crude oil—a

resource that at the moment is already constrained as Venezuela’s crude

oil production—which is of the heavy variety—has dropped to new lows.

Iran’s oil too—also heavy—is also being restricted.

US Gulf

refineries are configured to process his heavy crude oil, which is

becoming increasingly difficult (or increasingly expensive) to find, and

driving season is now underway. Most refineries ramp up production for

driving season, but the global shortage of heavy crude oil—made worse by

the wildfires—will surely cut into refinery margins.

By Julianne Geiger for Oilprice.com

No comments:

Post a Comment