Sunday, June 30, 2019

Friday, June 28, 2019

Possible conflict with Iran - impacts on trade

VesselsValue has analysed the effect on a conflict with Iran would have on the VLCC market.

A wider war with Iran would be negative for most types of ships and for

the oil markets in general. Fewer ships will transit the Straits of

Hormuz, the analyst said.

In the Iran/Iraq tanker war of 1987-1988, US vessels escorted ships

through the Strait of Hormuz by temporarily re-flagging Kuwaiti tankers

under the US flag.

Rates for ships fell overall as tensions pushed up the oil price at the

start of the war, eroding TCE returns and reducing demand for Arabian

barrels.

Today’s events have already led to a higher war risk cost. This will be

borne by most likely the charterer, according to the current war risk

clause wording. However commercial terms will be negotiated on a case by

case basis. Armed guards are also a possibility, which introduces an

additional cost and escalates overall risk.

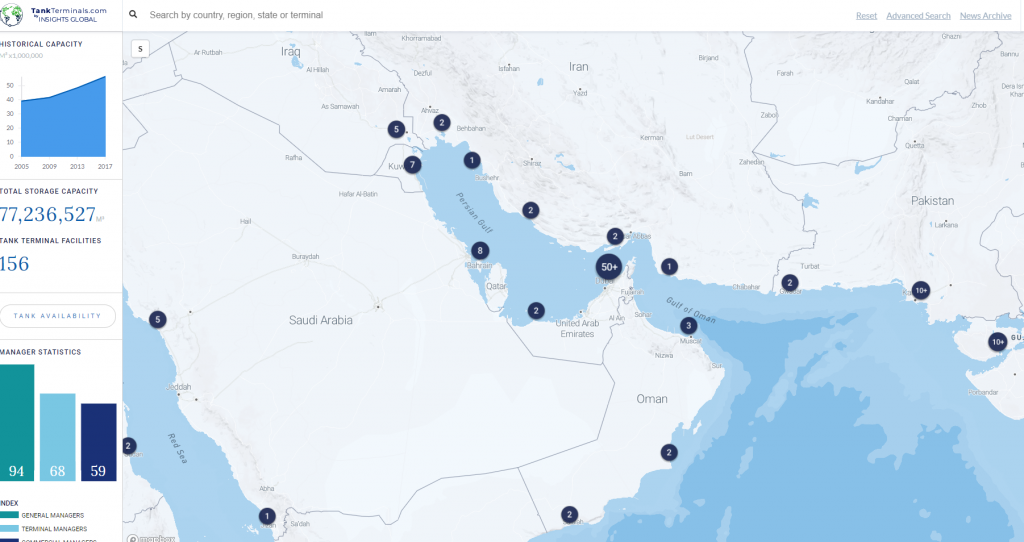

VesselsValue said that a significant increase in exports from other key

oil producing countries who can provide seaborne trades, would be

expected. For example, Red Sea loadings would increase almost

immediately, as Saudi Arabia would maximise export volumes, which could

be sent through the country’s Red Sea terminals.

US crude exports, which continue to de-bottleneck, would surge upwards

as pricing differentials would encourage more exports, and more West

African barrels would be brought onstream.

Another likely outcome would be an immediate relaxation of Venezuelan

sanctions, which have a more discretionary basis for their

implementation. This could result in the Aframax trade in the Caribbean

seeing a surprise resurgence.

Putting aside other sources of crude oil, Far East countries dominate

the destinations for VLCC cargoes out of the Arabian Gulf.

Oil flows to Asian refiners and India would be disrupted, which would

reduce refinery crack spreads in these countries, discouraging runs.

There would be some demand fall as a result of price increases, but the

markets these refineries support would seek refined products from other

regions, which would benefit US and European refiners who have easier

access to Atlantic Basin trades.

Rising tensions could spur renewed interest in some offshore projects

outside the Arabian Gulf, and producers may seek to optimise production

from offshore locations depending on the severity of the conflict.

Regardless, the increased probability of supply disruptions will push

some towards making positive investment decisions.

The main result of any Arabian Gulf conflict would be higher oil

prices, resulting in lower demand for oil products in the short and

medium term.

Producers outside the Arabian Gulf would see the greatest benefit, particularly in the US, West Africa, and Brazil.

These markets are mainly served by Suezmaxes and Aframaxes, due to port

limitations. VesselsValue concluded its analysis by saying that it

would expect many VLCC ballasters to head to West Africa, Brazil, and

the US Gulf.

Thursday, June 27, 2019

Billionaire Carl Icahn steps up his fight with Occidental over Anadarko deal, wants 4 board seats

Adam Jeffery | CNBC

https://www.cnbc.com/2019/06/27/billionaire-carl-icahn-steps-up-his-fight-with-occidental-over-anadarko-deal-wants-4-board-seats.html

- Carl Icahn ratcheted up his fight with Occidental Petroleum over its pending purchase of rival Anadarko Petroleum by calling for a special shareholder meeting where he hopes to win board seats.

- Icahn said he planned to oust and replace four Occidental directors and change the company’s charter through a stockholder consent solicitation to prevent it from ever engineering a similar takeover again.

- Occidental said it will review the latest materials filed by Icahn, and looks forward to addressing them in ongoing conversations with shareholders.

Billionaire investor Carl Icahn on Wednesday ratcheted up his fight with Occidental Petroleum over its pending purchase of rival Anadarko Petroleum by calling for a special shareholder meeting where he hopes to win board seats.

In

a regulatory filing, Icahn said he planned to oust and replace four

Occidental directors and change the company’s charter through a

stockholder consent solicitation to prevent it from ever engineering a

similar takeover again.

Responding to the filing, Occidental said it will review the latest

materials filed by Icahn, and looks forward to addressing them in

ongoing conversations with shareholders.

Icahn, one of industry’s

most powerful activist investors, cast himself as one of the deal’s most

fervent critics by charging that Occidental’s $38 billion bid for

Anadarko was too expensive and could endanger Occidental’s future if oil

prices sink.

The deal has been approved by the U.S. Federal Trade Commission and is expected to close in the second half of the year.

Icahn’s

move on Wednesday put fresh pressure on Occidental’s management and

Chief Executive Vicki Hollub at a critical time and has sparked

speculation that Occidental may try to settle with him.

“It is

important to add new directors to Occidental’s Board of Directors to

oversee future extraordinary transactions like the Anadarko transaction

and to ensure that they are not consummated without stockholder approval

when appropriate,” Icahn said in a statement to shareholders on Wednesday.

Icahn owned a $1.6 billion stake in Occidental as of May 30.

While

the move was notable, it hardly came as a surprise as Icahn had been

hinting for weeks that he might push for a special meeting where other

shareholders would be able to express their frustration with management.

In

May he sued Occidental in Delaware court, and earlier this week he went

out of his way to criticize the Occidental-Anadarko deal while

discussing the merger of major casino operators Caesars Entertainment and Eldorado Resorts.

“The recent Occidental Petroleum fiasco is a great example of how CEOs

and boards will go to great lengths, including ‘betting the company’ to

serve their own agendas,” Icahn said in a statement about the

Caesars-Eldorado merger. “If their bet is successful, they and possibly

their shareholders win, but if it is unsuccessful, only the shareholders

lose.”

While Icahn has said publicly that the Occidental-Anadarko

deal likely would not be derailed, his filing illustrates how he wants

to make sure that nothing similar happens again.

He said

Occidental lacks effective corporate governance and that its directors

made mistakes in how and at what cost they pursued the acquisition of

Anadarko, according to the filing.

Icahn is calling on the board to set a record date to determine which shareholders could petition to hold a special meeting.

The oil and gas producer’s bid for Anadarko topped one by Chevron and includes a $10 billion financing deal with Warren Buffett’s Berkshire Hathaway.

The

merger of the two U.S. shale producers would increase Occidental’s debt

to around $40 billion. Icahn, in his lawsuit filed in Delaware Court of

Chancery in May, sought access to the oil producer’s financial records

and details of negotiations.

Wednesday, June 26, 2019

Tuesday, June 25, 2019

Top Copper Miner Strike Seen Wiping 10,000 Tons From Market

-

Chuquicamata stoppage enters 12th day as talks remain stalled

-

Workers rejected Codelco’s latest offer in a vote on Saturday

A strike at a major copper mine in the world’s largest producer of

the metal risks wiping out 10,000 metric tons from a market that’s

already expected to end the year in deficit, according to an industry

consultant.

The stoppage at the Chuquicamata mine in northern Chile could cost No. 1 global supplier Codelco

$50 million as it loses production if it lasts two weeks, said Juan

Carlos Guajardo, executive director at Santiago-based consultancy

Plusmining. The strike at the mine, which produced 321,000 tons of copper last year, entered its 12th day on Tuesday with no signs of agreement between the company and unions.

“Codelco

has been quite clear that they are offering the best possible terms for

workers,” Guajardo said in a telephone interview Monday. “And workers

say the only way to end this conflict is not higher bonuses, but equal

conditions between existing and new workers.”

Copper futures rose in New York Tuesday as supply risks mount

at Chile’s state-owned Codelco. The disruption at Chuquicamata, the

company’s third-largest mine, has helped lift the outlook for prices at a

time when supply is already tight, with the International Copper Study

Group forecasting a deficit of 189,000 tons by the end of this year.

BMO

Capital Markets was expecting 3% of global production in the copper

market would be disrupted in 2019, when it calculated its supply and

demand outlook for the year, according to analyst Colin Hamilton. The

Chuquicamata strike adds to production losses earlier in the year,

including rains in northern Chile and stoppages at several smelters in Zambia, shaving about 5% of output so far this year.

“While we have expectations of a prolonged period of trade

friction, copper will struggle to get in the good books of macro asset

allocators,” Hamilton said. “But the deficit the copper market has been

waiting on for years is now here.”

Copper

miners celebrate the rejection of the state-run Codelco Chuquicamata

mine's final offer for a contract at union headquarters in Calama, Chile

on May 29, 2019.

Photographer: Cristobal Olivares/Bloomberg

Talks stalled

No

talks are scheduled between Codelco and Chuquicamata’s Unions 1, 2 and

3, which represent around 3,200 workers at the mine, Liliana Ugarte,

president at Union No. 2, said Tuesday by telephone. Chuquicamata

workers blocked the road that leads to the company’s northern division,

and to Freeport-McMoRan Inc.’s

El Abra mine for a few hours on Tuesday for the second consecutive day

in a protest that delayed workers from reporting to the facility.

A Codelco official declined to comment on the state of

negotiations or the effects of the protests on Monday. While El Abra

operations are running normally, Freeport is monitoring the situation, a

company official said by email Monday.

On Saturday, 55% of workers

voted to reject the company’s latest offer and continue the strike.

Under Chilean labor rules, Codelco can make a new offer on June 28, or

workers can abandon the strike individually from June 29, automatically

accepting a previous offer from the company.

One central issue in

the negotiations is the retirement plans of about 1,700 workers whose

jobs will be cut once the mine transitions from open pit to underground

operations in the next 12 months. Younger workers -- who joined the

company after the last commodities downturn with lower salaries and

fewer benefits -- also want the same package of benefits as experienced

workers.

“When the older workers leave as part of the retirement

plan, it will be the young guys with precarious jobs who will replace

them,” Rolando Milla, president at Union No. 3, said by phone. “The

strike ends with equal conditions for all workers, that’s it.”

— With assistance by Danielle Bochove

Monday, June 24, 2019

Gulf war risk insurance soars

War risk

insurance has soared to around $185,000 for tankers passing through the

Strait of Hormuz area, according to a report from Bloomberg.

This was,due to increased tensions in the Gulf region, following the 13th June attacks on two tankers in the Gulf of Oman.

Following the earlier incidents in May at Fujairah, the war risk insurance had risen to $50,0000 per vessel.

A day after the two recent attacks, Royal Boskalis Westminster was appointed salvor for both vessels.

Shortly after the incidents, the insurers of both vessels appointed

Boskalis subsidiary SMIT Salvage to salvage the vessels and their cargo.

The salvage operations were undertaken in close consultation with the

relevant local authorities, including the Marine Emergency Mutual Aid

Centre (MEMAC).

Frontline said that the ‘Front Altair’s’ crew members had either

returned home or have re-embarked on the vessel to assist with recovery

operations and ship-to-ship transfer of cargo into another Frontline

operated vessel.

The company claimed it was able to deploy emergency responders in a

timely manner, who extinguished the fire on the vessel within hours of

the incident and ensured no pollution resulted.

‘Front Altair’ was in stable condition and anchored off Fujairah.

Following transfer of cargo, the LR2s damage will be further inspected

and the vessel will ultimately be moved to a shipyard for repair.

As previously reported, the possibility that the damage was caused by mechanical or human error has been ruled out completely.

Until further information is received regarding the cause of the

explosion and the security of this important shipping lane is secured,

Frontline will exercise extreme caution when considering new contracts

in the region and will consider all possible measures to insure the

safety of our crews and vessels operating in the area, the company

emphasised.

The other vessel involved in the alleged attacked, the ‘Kokuka

Courageous’ was also towed to Fujairah Anchorage. Her crew were reported

to be safe.

Meanwhile, VLCC spot freight rates between the Arabian Gulf and China

rose 101% in the days between 13th and 20th June 2019, in the aftermath

of the attacks, BIMCO’s Peter Sand said.

Spot freight rates for a VLCC reached $25,994 per day on 20th June, the

highest level since March and significantly above the May average of

$9,979 per day.

Despite this increase, rates on this route only narrowly exceeded the

daily breakeven costs of a VLCC, which on average amounts to $25,000 per

day.

Measured against global oil demand, around a fifth of global oil

consumption sails through the Strait of Hormuz, making the strait a

critical choke point for global energy markets, Sand said.

Taking into consideration seaborne transportation of crude oil, the

19.7 mill barrels per day transiting Hormuz represents 49% of the 40.5

mill barrels shipped in total - source: Clarksons Research.

Although spot freight rates for crude oil tankers ex Arabian Gulf have

risen sharply, rates for LR2s carrying clean oil products, such as

naphtha, remained much more stable. For example, spot freight rates for

an LR2 carrying 500,000 barrels of naphtha condensate from the Middle

East Gulf to Japan, rose by only 4% between the dates since the attack.

“The unchanged rates for oil product tankers compared with the jump in

freight rates for crude oil tankers, illustrate the differences between

the two market as well as the effects of sentiment on crude oil freight

rates,” Sand said. “The vast majority of tanker owners are more or less

going about with business as usual, although they have ratcheted up

their safety and security precautions when trading their ships in the

Arabian Gulf.”

These additional measures include speeding up while sailing through the

Strait of Hormuz, as well as avoiding sailing through it at night when

watchkeeping becomes more difficult.

The added costs of safety measures as well as higher insurance

premiums, which rose sharply following the news of the attacks, meant

that shipowners will not only face higher risks but also higher costs

when trading in the region.

“To avoid major disruption, it is vital for global energy trade that

the Strait of Hormuz remains accessible and safe for ships to sail

through. As long as tensions aren’t escalated the attacks are unlikely

to have a more profound effect. However, the risks that the conflict

will escalate remains very present and a great worry to everyone

involved with oil trading in the region,” Sand added.

BIMCO has urged all nations to do what they can to de-escalate the

situation and allow ships to pass safely through the Strait of Hormuz.

Friday, June 21, 2019

Thursday, June 20, 2019

US Navy drone shot down by Iranian missile over Strait of Hormuz in 'unprovoked attack,' central command says

U.S. military officials returned fire -- verbally -- hours after Iran blasted a Navy high-altitude drone out of the sky over the Strait of Hormuz,

with U.S. Central Command leaders on Thursday slamming the "unprovoked"

strike and Tehran's subsequent "false" justifications for it.

President Trump said on Twitter that Iran "made a very big mistake!"

The downing of the drone, via surface-to-air missile, is only the most recent Iranian provocation

in the region, coming on the heels of a disputed attack on a pair of

oil tankers in the Gulf of Oman last week. U.S. officials say Iran was

behind the tanker attacks, however, the Islamic Republic has not claimed responsibility and even suggested American involvement in the plot. -- but American officials stated unequivocally the

incident occurred in international airspace.

Similarly, Iran claimed the U.S. drone on Thursday was over Iranian

airspace when it was shot down -- but American officials stated

unequivocally the incident occurred in international airspace.

The U.S. Navy’s RQ-4A Global Hawk drone deployed to the Middle

East in the past few days as part of reinforcements approved by

President Trump last month.

(U.S. Navy/Handout via REUTERS)

U.S.

Central Command said in a statement that a U.S. Navy Broad Area

Maritime Surveillance ISR aircraft, known as a BAMS-D, was shot down at

approximately 7:35 p.m. ET on Wednesday.

"Iranian reports that the

aircraft was over Iran are false," Capt. Bill Urban, a U.S. Central

Command spokesman, said in a statement. "This was an unprovoked attack

on a U.S. surveillance asset in international airspace."

The U.S.

Navy’s RQ-4A Global Hawk drone was over international airspace

and about 17 miles from Iran at the time, a military source told Fox

News. The drone provides real-time intelligence, surveillance, and

reconnaissance missions "over vast ocean and coastal regions,"

according to the military.

Iran also tried to shoot down another

drone, but missed, U.S. officials told Fox News. Officials are now

scrambling to find the wreckage in the water before Iranian forces

recover it.

The Navy RQ-4A Global Hawk drone that was shot down by Iran.

(Fox News)

The

Navy RQ-4A Global Hawk drone deployed to the Middle East in the past few

days as part of reinforcements approved by President Trump last month.

The

high-altitude drone can fly up to 60,000 feet or 11 miles in altitude

and loiter for 30 hours at a time. It's used to spy on Iranian military

communications and track shipping in the busy waterways. Each drone

costs up to $180 million dollars.

The U.S. Navy’s RQ-4A Global Hawk drone is a high-altitude drone

can fly up to 60,000 feet or 11 miles in altitude and loiter for 30

hours at a time.

(U.S. Navy/Handout via REUTERS)

Besides

the drone incident, U.S. officials told Fox News that Iranian-backed

forces fired cruise missiles Wednesday night into Saudi Arabia, hitting a

power plant. The spate of recent attacks come amid the backdrop of

heightened tensions after the U.S. decision a year ago to withdraw from

Tehran's nuclear deal reimpose sanctions.

A commander for Iran's

Revolutionary Guard claimed the drone was shot down over Iranian

airspace to send a "clear message" to the U.S., and marked the first

direct Iranian-claimed attack of the crisis.

"We do not have any

intention for war with any country, but we are fully ready for war,"

Revolutionary Guard commander Gen. Hossein Salami said in a televised

address.

Foreign Relations Committee member Sen. Lindsey Graham on the Trump administration's strategy to combat Iran aggression.

Iran's

paramilitary Revolutionary Guard, which answers only to Supreme Leader

Ayatollah Ali Khamenei, said it shot down the drone on Thursday morning

-- causing some confusion about the timeline of the incident -- when it

entered Iranian airspace near the Kouhmobarak district in southern

Iran's Hormozgan province. Kouhmobarak is some 750 miles southeast of

Tehran and close to the Strait of Hormuz.

The

Guard said it shot down the drone at 4:05 a.m. after it collected data

from Iranian territory, including the southern port of Chahbahar near

Iran's border with Pakistan. Iran used its air defense system known as

Third of Khordad to shoot down the drone — a truck-based missile system

that can fire up to 18 miles into the sky, the semi-official Fars news

agency reported.

The Panama-flagged, Japanese owned oil tanker Kokuka Courageous,

that the U.S. Navy says was damaged by a limpet mine, is anchored off

Fujairah, United Arab Emirates, during a trip organized by the Navy for

journalists, Wednesday, June 19, 2019.

(AP Photo/Fay Abuelgasim)

The

Guard described the drone as being launched from the southern Persian

Gulf but did not elaborate. American RQ-4A Global Hawks are stationed at

the Al-Dhafra Air Base in the United Arab Emirates, near the capital,

Abu Dhabi.

Salami, speaking to a crowd in the western city of

Sanandaj, described the American drone as "violating our national

security border."

"Borders are our red line," Salami said. "Any enemy that violates the borders will be annihilated."

The U.S. said Iran fired a missile at another drone last week that responded to the attack on two oil tankers near the Gulf.

Another senior U.S. official told Fox News last week that an MQ9 Reaper drone was fired on by the Iranians shortly after it arrived at the scene where the MV Altair tanker sent out a distress signal.

Sailors stand on deck above a hole the U.S. Navy says was made by a

limpet mine on the damaged Panama-flagged, Japanese owned oil tanker

Kokuka Courageous, anchored off Fujairah, United Arab Emirates, during a

trip organized by the Navy for journalists, Wednesday, June 19, 2019.

(AP Photo/Fay Abuelgasim)

Secretary of State Mike Pompeo has blamed Iran for the "blatant assault" on oil tankers in the Gulf of Oman.

After

the tanker incident, Pompeo said his assessment was based on

"intelligence, the weapons used, the level of expertise needed to

execute the operation, recent similar Iranian attacks on shipping, and

the fact that no proxy group operating in the area has the resources and

proficiency to act with such a high degree of sophistication.”

Fox News' Jennifer Griffin, Lukas Mikelionis and The Associated Press contributed to this report

Wednesday, June 19, 2019

Limpet mine used in oil tanker attacks 'bears striking resemblance' to similar Iranian Mines, US Navy says

The limpet mine used on a Japanese-owned oil tanker in the Strait of

Hormuz “bears a striking resemblance” to other Iranian mines, U.S. Navy

officials said.

(U.S. Navy)

https://www.foxnews.com/world/limpet-mine-oil-tanker-striking-resemblance-iranian-mines

The limpet mine used on a Japanese-owned oil tanker in the Strait of Hormuz “bears a striking resemblance” to other Iranian mines, U.S. Navy officials said Wednesday.

Cmdr.

Sean Kido of the U.S. Navy’s 5th Fleet claimed Wednesday that the

damage done to the tanker was “not consistent with an external flying

object hitting the ship.”

The

remark contradicts the claim made by the ship’s owner who insisted that

eyewitnesses aboard saw “flying objects” before the attack in the Gulf of Oman.

The

Navy official added that investigators have recovered fingerprints and a

handprint from the side of the ship after the attack.

The revelation follows ever-increasing tensions in the region. The

Iraqi military said three rockets hit an installation north of Baghdad

on Monday that was used by Iraqi troops American trainers.

The

attack on camp Taji, about 17 miles north of Baghdad, was the second on a

military post housing U.S. personnel. An attack on an airbase, also

housing U.S. trainers, north of Baghdad on Saturday caused a small fire.

The U.S. claimed the Iranian regime was responsible for the “blatant

assault” on two oil tankers last week, bringing the Middle East on a

brink of a military conflict.

Secretary of State Mike Pompeo said

Iran’s culpability was based on “intelligence, the weapons used, the

level of expertise needed to execute the operation, recent similar

Iranian attacks on shipping, and the fact that no proxy group operating

in the area has the resources and proficiency to act with such a high

degree of sophistication.”

The so-called limpet mines got the name from the real limpets, small sea snails that easily cling to hard surfaces and rocks.

The

weapon was first developed by the British during World War 2 and is

often used in covert action in order to damage ships because they are

easily attachable.

There are certain variations, with some

detonated by a time fuse while others explode only after the vessel to

which the mine is attached travels a specific distance.

In most cases, the mines are magnetic and are easily attachable to

the hulls of a ship. They normally just disable rather than sink a

vessel.

This wouldn’t be the first time Iran used the mines to

attack oil tankers. In the 1980s, the “Tanker War” erupted in the midst

of the eight-year conflict between Iran and Iraq, threatening to disrupt

the global oil supply.

The U.S. government has been working to provide enough credible

evidence linking Iran with the oil tanker attacks. Pictures of pieces of

a limpet mine were released as part of that effort by the U.S. Navy on

Tuesday.

Last week, U.S. officials released a video last week

supposedly showing Iran’s Revolutionary Guard removing an unexploded

limpet mine from one of the vessels.

The black-and-white footage, as well as still photos released by the

U.S. military’s Central Command on Friday, appeared to show the limpet

mine on the Japanese-owned Kokuka Courageous, before a Revolutionary

Guard patrol boat pulled alongside the ship and removed the mine,

Central Command spokesman Capt. Bill Urban said.

U.S. Central

Command (CENTCOM) also released additional images Monday showing the

aftermath of mine attacks against the oil tankers, including some images

purporting to show Iranian forces removing an unexploded device from

the hull of one of the vessels.

Iranians dismissed the

allegations, with Iranian Defense Minister Gen. Amir Hatami saying they

were unfair and aimed at tarnishing the country’s image.

“The accusation against Iran is totally a lie and I dismiss it firmly.”— Iranian Defense Minister Gen. Amir Hatami

“The

accusation against Iran is totally a lie and I dismiss it firmly,” he

said, according to the semi-official Fars news agency on Wednesday.

While

the U.S. claims of Iran’s responsibly are viewed cautiously in Europe,

with Britain being a notable exception, some European countries are

warning that the risk of war cannot be ruled out.

German Foreign

Minister Heiko Maas said the risk of war in the Persian Gulf region is

not ruled out amid the heightened tensions and said the “the situation

is serious” and “everything must be done” to avoid further escalation of

the tensions in the region.

Iran, meanwhile, said Wednesday that

Europe won’t be granted extra time beyond the July 8 deadline to come up

with improvements in the nuclear deal to protect the Iranian economy

amid U.S. sanctions, Reuters reported.

The spokesman for Iran’s Atomic Energy Organization said Iran will

begin enriching uranium to a higher level if Europe did improve the

nuclear accord.

The Associated Press contributed to this report.

Tuesday, June 18, 2019

Struggling PDVSA Plans To Restart Curacao Refinery

Venezuela’s struggling oil company PDVSA plans to resume operations

at its Isla refinery on Curacao, a company official who wished to remain

unnamed told S&P Global Platts.

The

refinery has a nameplate capacity of 335,000 but its actual throughput

is a maximum of 270,000-290,000 bpd. It is operated by a local company,

Rafineria di Korsou, “under the direction of PDVSA,” according to the

company official.

The refinery has suffered its share of the

fallout from the U.S. sanctions against Venezuela with scarcity of

feedstock forcing all but the suspension of operations. This, in turn,

has made the Curacao autonomous government, with which PDVSA has a

contract for the operation of the refinery, to look for an alternative

operator.

As a result of all

this, Isla is facing bankruptcy: "PDVSA will have to make the decision

to send some 3 million barrels of crude to generate cash flow to cover

expenses from September to December 2019 or send $60 million to honor

the contract and avoid claims,” the company official told S&P Global

Platts. "If not, Isla will have to declare force majeure and

bankruptcy. The refinery is now totally paralyzed. PDVSA promised the

reactivation and offered to supply crude in July but through an

intermediary."

The Isla refinery received an exemption

from the January sanctions the U.S. slapped on Venezuela. Under the

exemption, the refinery can continue working with U.S. companies until

January 15, 2020 but it has not helped it much, it seems. On top of all

its other troubles, it was also targeted by ConocoPhillips in an asset seizure move against PDVSA.

The

scenario with PDVSA sending crude for the refinery is the less likely

one, as another company official explained. "For PDVSA the refinery has a

low priority. Crude production in Venezuela has decreased

significantly. In this scenario, sending crude to Curacaco makes no

sense, especially when you take in to account that PDVSA cannot sell

products from Curacao because of the embargo."

For Curacao,

however, the refinery is high priority: it accounts for a tenth of the

island’s GDP and a solid portion of its employment.

By Irina Slav for Oilprice.com

Monday, June 17, 2019

Stocks Drop Across the Gulf as Oil Tankers Incident Fuels Risk

Equities in Dubai, Qatar, Oman and Saudi Arabia decline. The U.S. Fifth Fleet says two oil tankers were damaged.

Every major stock index in the Gulf retreated after an incident in the

Sea of Oman threatened to inflame the already tense relationship Iran

has with its neighbors. Bonds also fell.

The benchmark equity indexes in Dubai, Kuwait, Riyadh, Muscat and

Doha fell 1% or more. The yield on its 2028 dollar bonds climbed 7 basis

points, the most among Gulf peers.

The U.S. Fifth Fleet said two oil tankers were damaged near the

Strait of Hormuz, with one of the ships’ operators describing the

incident as a suspected attack. The development comes after attacks on

oil tankers near the Persian Gulf last month and raises the possibility

of a disruption of crude flows.

“This is the second time in a month’s time. That is worrying. Shows how sensitive the region is to such news,” said Joice Mathew, head of equity research at United Securities in Muscat. “One can’t really see what’s going to happen, especially when all sides are very stubborn.”

The Strait of Hormuz, at the entrance of the Persian Gulf, is a

waterway for about 40% of the world’s seaborne oil shipments. While most

economies in the region are trying to diversify their income away from

crude, revenue from energy sales still accounts for a large proportion

of their cash inflow.

The decline may be a knee-jerk reaction, said Nader Naeimi, the head

of dynamic markets at AMP Capital Investors Ltd. in Sydney. “Even if

it’s not an accident, we have seen incidents like this before and they

usually pass, without a prolonged effect. Unless, of course, if a war

breaks out!”

Saudi Arabia’s Tadawul All Share Index dropped 1.6% on Thursday, the

first decline in five sessions. Al Rajhi Bank, Saudi Basic Industries

and National Commercial Bank contributed the most to the decrease.

“The question is if we see escalation from here, or efforts to calm tensions,” said Timothy Ash, a strategist at Blue Bay Asset Management in London. “Trump

appeared eager to call off the attack dogs in his administration last

month. He seems eager to avoid a major war in the Middle East, involving

U.S. troops.”

Friday, June 14, 2019

Gulf of Guinea piracy continues to threaten seafarers

Members

of the shipping community, flag states and agencies from Gulf of Guinea

(GoG) gathered at the IMO Headquarters for a day-long symposium on

maritime security in the region.

The event, organised to highlight the continuing danger to seafarer in

the GoG, was co-sponsored by BIMCO, IMCA, ICS, ITF and OCIMF, featured

speakers from regional maritime agencies, as well as shipping officials,

academics and military staff.

In opening the symposium, Dr Grahaeme Henderson, Chair of the UK

Shipping Defence Advisory Committee and Vice President of Shell Shipping

& Maritime, said; “Simply put, the high level of piracy and armed

robbery attacks in the Gulf of Guinea is not acceptable. Yet it is

happening every day and this is not business as usual. We need to take

urgent action now.”

Concerns raised by industry were supported by figures from the IMB,

which showed that the number of attacks in the GoG region had doubled in

2018. There was also a marked increase towards kidnapping for ransom

and armed robbery incidents.

Piracy expert Prof Bertand Monnet, who has interviewed pirate gangs in

the Niger Delta, estimated that there were around 10 groups of pirates

that were responsible for the majority of attacks in the area, and they

were well organised and motivated.

Dr Dakuku Peterside, Director General and CEO of the Nigerian Maritime

Authority and Safety Agency (NIMASA),acknowledged the maritime security

risks present in the GoG, but stated that new initiatives underway to

improve the joint capacity of Nigerian law enforcement and Navy

capabilities could make seafarer kidnappings “history” within a matter

of months.

He went on to say that he is keen to improve international co-operation, particularly with the shipping industry.

Dr Peterside said;: "We have no option but to work together, but we

cannot have imposed solutions.” He also stated that "NIMASA and the

Nigerian Navy will also be hosting a Global Maritime Security Conference

in October to seek tailored short and long term solutions to strengthen

regional and international collaborations in the Gulf of Guinea."

The forum also included an interview led by Branko Berlan, the ITF

representative to the IMO, with a seafarer who had been attacked and

kidnapped in a recent incident. He said the attack appeared to be well

organised and led from ashore. “The first indication I had of the attack

was a knock on my cabin door and two men holding guns appeared.” He was

subsequently held in a camp onshore along with other members of his

crew until his release could be secured.

Other speakers at the event emphasised the region was starting to build

capacity and joint co-operation to fight maritime crime through the

Yaoundé Process, which focuses on joint co-operation across the region

for reporting and response. The international community is also

sponsoring long-term capacity building and partnerships.

However, the shipping industry, seafarer groups and flag states were

keen to identify actions that can have an immediate impact. For example,

delegates heard about recent Spanish Navy action to assist Equatorial

Guinea to rescue seafarers from a piracy attack last month, as well as

the new US programme to embark law enforcement officers on regional

vessels. Jakob Larsen, BIMCO’s Head of Security pointed out that

regional states needed to play their part as well.

“Nigerian piracy mainly affects a small geographical area of around 150

x 150 nautical miles. The problem can be solved easily and quickly,

especially if Nigeria partners with international navies. Nigeria holds

the key to solving this problem,” Larsen said.

The symposium was held in the lead-up to a series of meetings focused

on seafarer safety and security at the IMO. Concerns over increased

piracy in the GoG have resulted in several member states submitting

proposals that could help address the crisis.

According to Russell Pegg, OCIMF Security Adviser, “We are encouraging

all stakeholders to take a pro-active role on this issue and are working

with member states to support those proposals that could help mitigate

the risks to seafarers.”

Guy Platten, ICS Secretary General, concluded, “It is unacceptable that

seafarers are being exposed to such appalling dangers and we need the

authorities to take action now.”

Thursday, June 13, 2019

Tanker attacks in Gulf of Oman stoke security and oil fears

The attacks on the tankers took place near the Strait of Hormuz. (AP)

https://www.reuters.com/article/us-mideast-tanker/two-oil-tankers-struck-in-suspected-attacks-in-gulf-of-oman-shipping-firms-idUSKCN1TE0OI

DUBAI (Reuters) - Two oil tankers were attacked and left adrift on

Thursday in the Gulf of Oman, driving up oil prices and stoking fears of

a new confrontation between Iran and the United States.

The White House said U.S. President Donald Trump had been briefed on

the issue, after Washington accused Tehran of being behind a similar

incident on May 12 when four tankers were attacked in the same area, a

vital oil shipping route.

Russia was quick to urge caution,

saying no one should rush to conclusions about Thursday’s incident or

use it to put pressure on Tehran, which has denied the U.S. accusations.

There were no immediate statements apportioning blame after Thursday’s incidents, nor any claims of responsibility.

The crew of the Norwegian-owned Front Altair abandoned ship in waters

between Gulf Arab states and Iran after a blast that a source said

might have been from a magnetic mine. The ship was ablaze, sending a

huge plume of smoke into the air.

The crew were picked up by a passing ship and handed to an Iranian rescue boat.

The

second ship, a Japanese-owned tanker, was hit by a suspected torpedo,

the firm that chartered the ship said. Its crew were also picked up

safely.

The Bahrain-based U.S. Navy Fifth Fleet said it had assisted the two tankers after receiving distress calls.

Crude prices climbed 4% after the attacks near entrance to the Strait

of Hormuz, a crucial shipping artery for Saudi Arabia, the world’s

biggest oil exporter, and other Gulf energy producers.

“We

need to remember that some 30% of the world’s (seaborne) crude oil

passes through the straits. If the waters are becoming unsafe, the

supply to the entire Western world could be at risk,” said Paolo

d’Amico, chairman of INTERTANKO tanker association.

“SUSPICIOUS”

Tensions

have risen in the region since the United States pulled out of a deal

between Iran and global powers that aimed to curb Tehran’s nuclear

ambitions.

Japanese Prime Minister Shinzo Abe, who was visiting

Tehran when Thursday’s attacks occurred, carried carrying a message for

Iran from Trump, who has demanded that the Islamic Republic curb its

military programs and its influence in the Middle East.

Abe, whose country was a big importer of Iranian oil until Washington

ratcheted up sanctions, urged all sides not to let tensions in the area

escalate.

Iranian Foreign Minister Mohammad Javad Zarif

described Thursday’s incidents as “suspicious” on Twitter, noting they

occurred during Abe’s Tehran visit. The minister called for regional

dialogue.

Iran also said it would not respond to Trump’s overture, the substance of which was not made public.

Britain

said it was “deeply concerned” about the attacks. Germany, which like

Britain remains a signatory to the nuclear pact with Iran, said the

“situation is dangerous” and all sides needed to avoid an escalation.

The Arab League said some parties were “trying to instigate fires in the region”, without naming a particular party.

Oman and the United Arab Emirates, which have coastlines on the Gulf of Oman, did not immediately issue any public comment.

Saudi

Arabia and the UAE, both majority Sunni Muslim nations that have a

long-running rivalry with predominantly Shi’ite Iran, have previously

said attacks on oil assets in the Gulf pose a risk to global oil

supplies and regional security.

HULL BREACHED

Bernhard

Schulte Shipmanagement said the Japanese tanker Kokuka Courageous was

damaged in a “suspected attack” that breached the hull above the water

line while transporting methanol from Saudi Arabia to Singapore.

Japan’s Kokuka Sangyo, owner of the Kokuka Courageous, said the ship was hit twice over a three-hour period.

A shipping broker said the vessel might have been struck by a

magnetic mine. “Kokuka Courageous is adrift without any crew on board,”

the source said.

The crew of about 21 or 22 people was picked up

by the Coastal Ace vessel, Denis Bross of Acta Marine in the Netherlands

told Reuters. He said they were handed to a U.S. Navy vessel.

Taiwan’s

state oil refiner CPC said the Front Altair, owned by Norway’s

Frontline, was “suspected of being hit by a torpedo” around 0400 GMT

carrying a Taiwan-bound cargo of 75,000 tonnes of petrochemical

feedstock naphtha, which Refinitiv Eikon data showed had been picked up

from Ruwais in the UAE.

Frontline said its vessel was on fire but afloat, denying a report by the Iranian news agency IRNA that the vessel had sunk.

Front

Altair’s 23-member crew abandoned ship after the blast and were picked

up by the nearby Hyundai Dubai vessel. The crew was then passed to an

Iranian rescue boat, Hyundai Merchant Marine said in a statement.

Iran’s IRNA reported that Iranian search and rescue teams picked up

44 sailors from the two damaged tankers and took them to the Iranian

port of Jask. The numbers in the Iranian media report could not be

independently confirmed.

Thursday’s attacks came a day after

Yemen’s Iran-aligned Houthis fired a missile on an airport in Saudi

Arabia, injuring 26 people. The Houthis also claimed an armed drone

strike last month on Saudi oil pumping stations.

Iranian Supreme

Leader Khamenei told Abe during his visit to Iran that Tehran would not

repeat its “bitter experience” of negotiating with the United States,

state media reported.

“I do not see Trump as worthy of any

message exchange, and I do not have any reply for him, now or in

future,” the Iranian leader said.

Reporting

by Koustav Samanta and Jessica Jaganathan in Singapore, Liang-Sa Loh

and Yimou Lee in Taipei, Terje Solsvik in Oslo, Ghaida Ghantous in

Dubai, Hyunjoo Jin in Seoul and Jonathan Saul in London; Writing by

Edmund Blair; Editing by Jon Boyle and Alison Williams

Our Standards:The Thomson Reuters Trust Principles.

Wednesday, June 12, 2019

Oil prices down more than 2% on U.S. inventories, demand worries

https://www.reuters.com/article/us-global-oil/oil-falls-over-2-on-weaker-demand-growth-gain-in-u-s-crude-stocks-idUSKCN1TD03H

NEW YORK (Reuters) - Oil prices fell more than 2% on Wednesday,

pressured by an unexpected rise in U.S. crude inventories and by a

weaker outlook for global oil demand.

Brent crude futures, the international benchmark for oil prices, fell

$1.36, or 2.2%, to $60.93 a barrel by 11 a.m. EDT (1500 GMT). U.S. West

Texas Intermediate crude futures were down $1.39, or 2.6%, to $51.88 a

barrel.

Oil futures extended losses after the U.S. Energy

Information Administration (EIA) reported domestic crude stockpiles

climbed last week by 2.2 million barrels. Analysts had forecast a

decrease of 481,000 barrels.

Gasoline stocks also increased more than expected.

“The report was mostly bearish, given the sizeable crude oil

inventory build,” said John Kilduff, a partner at Again Capital LLC in

New York. “It was also impressive that gasoline inventories rose,

despite very strong demand on the week.”

The EIA on Tuesday cut its forecasts for 2019 world oil demand growth and U.S. crude production.

Trade

tensions between the United States and China, the world’s two biggest

oil consumers, also weighed on prices. U.S. President Donald Trump said

he was holding up a trade deal with China.

European shares

pulled back from three-week highs on Wednesday as this month’s recovery

rally ran out of steam on the back of soft Chinese factory activity and

trade frictions.

Hedge fund managers are liquidating bullish oil positions at the fastest rate since the fourth quarter of 2018.

With

the next meeting of the Organization of the Petroleum Exporting

Countries set for the end of June, the market is looking to whether the

world’s major oil producers will prolong their supply cuts.

OPEC

countries and non-member producers including Russia, have limited their

oil output by 1.2 million barrels per day this year to prop up prices.

Goldman Sachs said an uncertain macroeconomic outlook and

volatile oil production from Iran and others could lead OPEC to roll

over supply cuts.

“The sell off in recent weeks shows how

vulnerable the market is and it may force Russia’s hand in extending the

deal,” said Warren Patterson, head of commodities strategy at ING.

The energy minister of the United Arab Emirates, Suhail bin Mohammed

al-Mazroui, said on Tuesday that OPEC members were close to reaching an

agreement on continuing production cuts.

OPEC is due to meet on

June 25 after talks with its allies led by Russia on June 26, although

sources have told Reuters that Russia has suggested a date change to

July 3 to 4.

Additional reporting by Julie Payne in London; Editing by David Gregorio

Our Standards:The Thomson Reuters Trust Principles.

Tuesday, June 11, 2019

US ramps up prohibitions on Venezuelan petroleum trade, holds off secondary sanctions

https://www.spglobal.com/platts/en/market-insights/latest-news/oil/061019-us-ramps-up-prohibitions-on-venezuelan-petroleum-trade-holds-off-secondary-sanctions

Washington —

Trump administration officials are still considering secondary

sanctions to push the Maduro regime out of power in Venezuela, though

analysts said Monday that there may be little reason to impose them.

"I think for the most part we are already seeing the impact that

secondary sanctions would have," said Lisa Viscidi, director of energy,

climate change and extractive industries at Inter-American Dialogue. "I

think official secondary sanctions would close some loopholes Venezuela

is still able to exploit, but Venezuela is already very dependent on

exporting to countries that refuse to get in line with US sanctions

policy."

The Trump administration has blocked imports of Venezuelan crude

and condensate into the US, prohibited US dollar transactions with

state-run PDVSA and threatened sanctions on essentially all diluent

trade with the company. But the US has yet to impose secondary sanctions

on Venezuelan oil flows, similar to those fully re-imposed on Iranian

crude last month, subjecting essentially all petroleum trade with a

targeted country to US sanctions.

India, for example, has agreed to stop exporting gasoline to

Venezuela and has reduced its Venezuelan crude imports in response to

pressure from the US, Viscidi said. But Russia, Venezuela's most

significant remaining crude and refined product trading partner, may not

halt purchases even if secondary sanctions are imposed, she said.

"Russia is not going to stop trading oil with Venezuela as a result

of official secondary sanctions, especially since Russia itself is

being sanctioned by the US," she said.

State-run Russian companies may be unlikely to comply with US

sanctions, keeping at least some Venezuelan petroleum flows viable even

if secondary sanctions are imposed, according to Paul Sheldon, chief

geopolitical advisor with S&P Global Platts Analytics.

"Among other factors, assisting a US adversary in the Americas

carries geopolitical benefits for the Kremlin," Sheldon said in a note.

PDVSA exported an average of 720,000 b/d of crude and fuel oil in

May, up about 150,000 b/d from April, but well below the nearly 1.29

million b/d exported out of Venezuela a year earlier, according to a

PDVSA document seen by Platts.

In May, PDVSA sold 8.8 million barrels of crude to Russia's

Rosneft, including diluted crude oil and Merey 16, roughly 40% of all

crude and fuel oil it sold in May, according to the PDVSA document.

Venezuelan oil production fell to 720,000 b/d in May, down 60,000

b/d from April and less than half the 1.5 million b/d the country

produced in May 2018, according to a Platts OPEC survey released Monday.

For months, the Trump administration has been considering secondary

sanctions, but has avoided imposing them due partly to the impact on

oil and gasoline prices amid other sanctions and trade disputes.

SANCTIONS THREAT

But the risk of secondary sanctions has caused a steep decline in

trade with PDVSA, according to Joe McMonigle, an analyst with Hedgeye

Risk Management.

"The threat of sanctions is definitely having an impact," McMonigle said. "Companies don't want to risk that kind of exposure."

But while Russia and China have continued to trade petroleum with

Venezuela, secondary sanctions could amplify that risk, according to

Francisco Monaldi, Latin American energy policy fellow at Rice

University's Baker Institute for Public Policy.

"It is hard to know how far they will be willing to go to help

[President Nicolas] Maduro, under a tougher sanctions environment,"

Monaldi said. "Would Russia consume Venezuelan oil in their domestic

market? Would China pay cash for Venezuelan oil? Would they be willing

to invest in the Venezuelan oil industry?"

In January, the US unveiled sanctions on PDVSA, Venezuela's

state-owned oil company, which have served as a de facto ban on US

imports of Venezuelan crude and an immediate ban on US exports of

diluent to Venezuela. On April 28, the US prohibited transactions

between non-US firms and PDVSA involving the US financial system,

essentially banning the use of US dollars in all transactions with

PDVSA.

Last week, the US announced further prohibitions on essentially all

diluent trade with PDVSA, which PDVSA uses in the production and

marketing of its heavy crudes, in an attempt to accelerate declines in

Venezuela's oil sector.

-- Brian Scheid, brian.scheid@spglobal.com

-- Edited by Richard Rubin, newsdesk@spglobal.com

Monday, June 10, 2019

BP, ExxonMobil Commit $10M Apiece to Alaska LNG

BP and ExxonMobil are contributing $10 million apiece to help get the $43 billion Alaska LNG Project get its federal construction authorization, Lt. Gov. Kevin Meyer said Thursday.

Meyer made the announcement at the Alaska Oil and Gas Association’s annual conference in Anchorage.

The state-owned Alaska Gasline Development Corp. estimates it will

take roughly $30 million to complete the environmental impact statement

the Federal Energy Regulatory Commission is currently drafting.

FERC is scheduled to release a draft version of the Alaska LNG

Project EIS in June; the agency pushed back from February earlier this

year. AGDC officials said at a May 22 board meeting they expect the

draft document to be roughly 4,000 pages.

The major producers signed a memorandum of understanding with AGDC in

March to provide technical assistance on the project. They also signed

separate confidential gas sales precedent agreements with AGDC last year

that outline the terms — including price — under which they would sell

gas from the Prudhoe Bay and Point Thomson North Slope fields into the

project.

The state capital budget that passed the Senate in early May

authorizes AGDC to accept up to $25 million from outside sources to

support the Alaska LNG Project.

AGDC officials expect to have approximately $22 million remaining for

the project at the end of the 2019 fiscal year, which is June 30.

Gov. Mike Dunleavy has stressed a desire to bring the producers back

into the project after they stepped away in 2016 amid poor oil and gas

market conditions.

The state has since focused on advancing the regulatory and marketing aspects of the project.

“All future decisions on Alaska LNG will be rooted in world-class LNG experience,” Meyer said.

The companies are also currently assisting AGDC in reevaluating the

overall economics of the project and its $43 billion cost estimate amid

new global LNG market conditions.

BP Alaska Vice President of Commercial Ventures Damian Bilbao said in

an interview that the company continues to be excited about monetizing

Alaska natural gas because the company’s share of North Slope reserves

are still its “single largest undeveloped resource on the planet.”

On the $43 billion estimated cost of the project — a figure

calculated in 2016 that includes $9 billion in contingencies — Bilbao

said he believes there are avenues in supply procurement and other areas

to bring the cost down.

Alaska LNG officials have always cited the cost of the 800-mile gas

pipeline from the North Slope to the Kenai Peninsula as the main cost

obstacle to developing the long-sought project.

“Four years is a long time in this industry; it’s a technology-driven

industry so our experts feel very confident that the number that was

delivered at the end of (the preliminary design period), that $43-$44

billion — they can really look at some opportunities to bring that into

the high 30s and we’re going to look at some opportunities to take that

down even further,” he said.

As for North Slope oil, Assistant Secretary of the Interior Joe

Balash, a former Alaska Department of Natural Resources commissioner,

said during remarks at the conference that a draft environmental impact

statement should be published by the end of summer for ConocoPhillips’

large Willow prospect in the National Petroleum Reserve-Alaska, with a

final EIS coming in 2020. ConocoPhillips estimates Willow, with a cost

of $4 billion to $6 billion, could produce more than 100,000 barrels of

oil per day.

Balash also said the Bureau of Land Management, which he oversees,

just completed consultation with Canadian officials over the potential

impacts to the Porcupine caribou herd from possible oil and gas activity

in the Arctic National Wildlife Refuge; the herd migrates across the

border. A final EIS analyzing industry development in the ANWR coastal

plain should be ready in August and a lease sale will follow towards the

end of the year, according to Balash.

Subscribe to:

Posts (Atom)