-

Permian woes drill stocks for Parsley, Pioneer, Concho

-

Diverse drillers, refiners are beneficiaries in pipe shortage

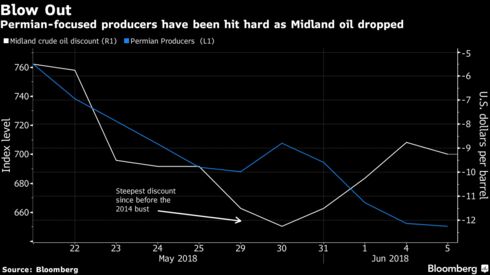

More than $1 billion a day. That’s the price tag for a Permian Basin pipeline crunch that’s increasingly affecting investors as much as it is West Texas oil drillers.

Eight

of the top explorers focused on the booming U.S. shale region have lost

$15.6 billion in combined market value in about two weeks, as shipping

constraints devour the profit they can fetch for a barrel of crude.

Parsley Energy Inc. shares have wilted 16 percent in that time;

Diamondback Energy Inc. has been defanged, down 18 percent.

Even

as production soars, dwindling pipeline space and a rail and trucking

shortage have raised shipping costs, boosting the discount Permian

producers take to offload their oil. The bottleneck benefits refiners

who can buy cheaper crude and pipeline owners with extra space, but it’s

dragging down explorers.

“You just don’t want to touch these Permian names," said

Gabriele Sorbara, a Williams Capital Group analyst in New York. "They

are falling off a cliff."

Relief

may not come until 2020, when new pipelines are expected to be up and

running. For now, here’s a rundown of winners and losers amid the space

crunch:

Permian Explorers

Being a “pure-play" shale producer, even a Permian stalwart, is no longer the ticket to success for energy equities.

Since

May 21, the price of benchmark West Texas Intermediate crude has fallen

about 10 percent and companies focused primarily on the Permian have

been shunned. The hardest fall: Concho Resources Inc, which had lost

$4.1 billion off its market capitalization as of Tuesday.

As of Wednesday, oil in Midland, Texas, was trading for about $19 a barrel below Brent crude, the global benchmark price.

Even Pioneer Natural Resources Co., with relatively strong

finances and secure pipeline contracts, has been swept up, Williams

Capital’s Sorbara said by telephone. It’s lost $3.2 billion in market

value, or 9 percent, since May 21.

While the shortages are real,

he deems much of the market selloff “overblown," since even discounted

Permian crude is selling for well above where many producers set their

budgets earlier this year.

Diverse Portfolios

Investors,

though, are fleeing to the relative safety of larger names with more

diverse portfolios such as Occidental Petroleum Corp., whose shares are

flat over the past couple weeks. The Permian’s biggest oil producer also

pumps in the Middle East and Colombia, with roughly 40 percent of its

output this year based on higher international crude pricing, Capital

One Securities said in an analyst note.

The company also operates

pipelines and a Gulf Coast export terminal that will benefit from

cheaper U.S. crude prices. “The largest companies or companies with

diverse portfolios can rotate capital around,” Sorbara said. “If you’re a

pure play, the only thing you can do is step on the brakes.”

Inland Refiners

With

bottlenecks between the Permian and major Gulf Coast refiners,

operators in other parts of the country served by less congested

pipelines have a relative advantage, analysts say.

That includes

Delek US Holdings Inc., CVR Refining LP and HollyFrontier Corp. -- with

refineries in New Mexico, Arkansas and northeastern Texas, among other

locations, according to Barclays Plc. Delek gets about 78 percent of its

crude from the Permian, HollyFrontier gets 39 percent and CVR gets 14

percent, the bank said in a June 5 analyst report.

Delek shares have climbed 7.5 percent in the past two weeks while CVR is up 3.3 percent and HollyFrontier is up 1 percent.

"Simply

put, we think U.S. refiners win big with lower input costs," analysts

including Justin Jenkins at Raymond James & Associates said in a

June 4 note.

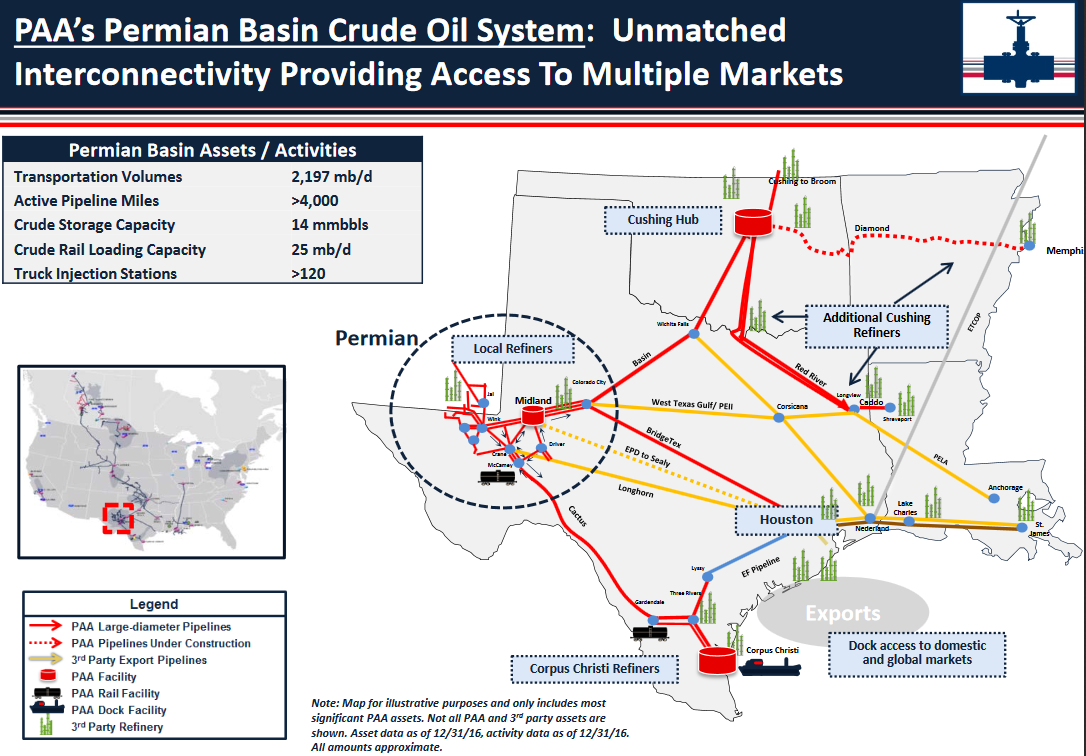

Pipeline Demand

Enterprise Products Partners

LP and Magellan Midstream Partners LP also stand to benefit from the

blow out in Midland prices as they own crucial pipelines in the Permian

and dock space on the Gulf used for exports -- and have plans to add

more.

“The very idea of congestion is beneficial," said Sandy

Fielden, director of oil research at Chicago-based Morningstar Inc. “If

I’m going to pitch my new pipeline or expand my pipeline, and I’m going

to hold my open season, I can expect to see a full crowd there anxious

to sign up quickly."

Enterprise started full service in April on

its 416-mile Midland-to-Sealy pipeline, which can carry some 575,000

barrels per day of crude from the heart of the Permian to key export

facilities in Houston. They also own the lion’s share of crude storage

tanks and docks along the Gulf.

Magellan operates and owns part of

the 400,000 barrel-a-day BridgeTex pipeline, transporting oil from the

Permian to Corpus Christi, Texas. That route is scheduled for expansion

in early 2019 because of added interest. The company said last month

that almost all existing customers on its Longhorn pipeline, connecting

the Permian to Houston, have renewed their contracts for two years.

— With assistance by Catherine Ngai

No comments:

Post a Comment