https://www.bloomberg.com/news/articles/2018-05-16/morgan-stanley-says-a-shipping-revolution-has-oil-headed-for-90

Forget Iran and OPEC -- there’s another issue that will keep oil

prices supported for the next two years, according to Morgan Stanley.

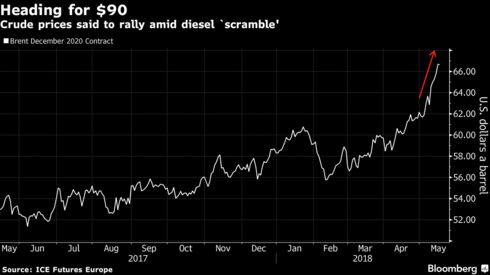

Brent

crude will reach $90 a barrel by 2020 as new international shipping

regulations take effect, overhauling the types of fuels produced by

refiners, the bank’s analysts said in a report.

The

changes, which force vessels to consume lower sulfur fuels beginning in

January of that year, will lead to a boom in demand for middle

distillate products including diesel and marine gasoil, triggering the

need for more crude, they said.

“We foresee a scramble for middle distillates that will drive

crack spreads higher and drag oil prices with it,” wrote Morgan Stanley

analysts including Martijn Rats.

While

crude has already received a boost due to supply cuts by the

Organization of Petroleum Exporting Countries and geopolitical events

including the U.S. decision to reimpose sanctions on Iran, the rule

changes add to the impact. Global benchmark Brent, which neared $80 a

barrel earlier this week, is trading at the highest levels since late

2014. Futures for the January 2020 contract are at about $66.60 a

barrel.

The rules from the International Maritime Organization

call for ships to reduce the maximum sulfur content of their fuels to

0.5 percent, from 3.5 percent in most regions currently, in an effort to

curb air pollution that has been linked to respiratory diseases and

acid rain. The changes are expected to create an oversupply of

high-sulfur fuel oil while sparking demand for IMO-compliant products,

putting pressure on the refining industry to produce more of the latter

fuels.

Repsol SA, Reliance Industries Ltd., Valero Energy Corp.

and Tupras Turkiye Petrol Rafinerileri AS are among those who stand to

benefit most, according to Morgan Stanley.

“The refining systems

of these companies are highly geared towards middle distillates” and

minimal high-sulfur fuel oil output, which is “the most advantageous

combination after 2019,” the bank said in a related report.

Middle distillate markets are already showing signs of tightness. Diesel

and gasoil stockpiles in key storage hubs in Europe, the U.S. and Asia

are below their five-year seasonal averages. At the same time, middle

distillate demand has grown at an annual rate of about 600,000 barrels a

day since 2011, accelerating to 800,000 barrels a day in recent

quarters, Morgan Stanley estimates.

Increased Demand

With

the IMO ship-fuel regulations expected to boost demand by an additional

1.5 million barrels a day by 2020, traders will seek to get the right

product supplies, which should boost crude prices, according to the

bank. While global crude production will rise, it probably won’t

increase by the 5.7 million barrels a day needed by 2020 to meet the

additional demand for fuels, the analysts said.

“The last period

of severe middle distillate tightness occurred in late-2007/early-2008

and arguably was the critical factor that drove up Brent prices in that

period,” Rats wrote, referring to the period when crude oil approached

levels close to $150 a barrel.

U.S. oil output, now at a record,

likely won’t come to the rescue, since the crude pumped in America’s

shale regions is light and not ideal for producing middle distillates,

Morgan Stanley noted.

“We expect the crude oil market to remain

under-supplied and inventories to continue to draw,” the bank said.

“This will likely underpin prices.”

No comments:

Post a Comment