https://www.bloomberg.com/news/articles/2018-03-21/top-refiners-await-gilded-age-as-ships-forced-to-cut-pollution

-

Sophisticated plants can already comply with 2020 sulfur rules

-

Demand and prices for compliant marine diesel fuel are rising

Ready the cash-printing machines -- the world’s most sophisticated

refineries are about to enjoy great times thanks to what might seem like

a minor tweak in rules for the type of fuel ships consume.

From

2020, vessels must buy fuel with less sulfur, or alternatively be

fitted with equipment to curb emissions of the pollutant. One thing is

clear: only a tiny fraction of the merchant fleet will have such gear

when the rules enter force, since many shipowners argue it’s the responsibility of refineries to sell the right fuel.

That’s

fantastic news for complex plants, including some of the biggest on the

U.S. Gulf Coast, in Europe and in Asia. Unlike simpler refineries, they

can already make marine gasoil -- a distillate fuel similar to diesel

that ships are going to need -- without churning out leftover,

non-compliant fuel oil, according to Alan Gelder, vice president for

refining, chemicals and oil markets at Wood Mackenzie Ltd. in London.

“They’ll print money,” he said. “If the shipping industry needs more clean fuels, then that’s good for refining.”

The

new sulfur standards, established by the International Maritime

Organization in 2016, aim to cut the presence of a pollutant that has

been blamed as a contributor to human health conditions like asthma and

environmental damage like acid rain. Some shippers say that in an

extreme scenario, the changes could upend world trade if the cost of compliance is too high.

The

existing global standard is generally 3.5 percent sulfur in fuel oil --

normally the residue when refineries make higher-value products like

gasoline, diesel and jet fuel. The new IMO rules establish a 0.5 percent

limit, encouraging refiners to make cleaner, compliant fuel to meet

rising demand from the shipping industry.

‘Field Day’

Plants that have greater flexibility on the types of crude that they process -- such as Reliance Industries Ltd.’s

Jamnagar facility in India and those on the U.S. Gulf Coast -- will be

among the top beneficiaries from the rule change, said Eugene Lindell, a

senior analyst at JBC Energy GmbH in Vienna.

“Crude feedstock costs will be lower, allowing for an exceptionally high margin environment,” he said. “They will have a field day.”

More than 80 percent of U.S. Gulf Coast refineries have

coking units that can create transport fuels from the residual fuel oil

from heavy crude, according to research from Morningstar Inc. Reliance

didn’t respond to a request for comment.

As ships move away from

high-sulfur fuel oil, they’ll increasingly favor distillate fuels like

marine gasoil and other compliant fuels. That stands to benefit refiners

who already produce a high ratio of distillates to dirty fuel oil.

BP

Plc is best-placed among Europe’s oil majors to benefit from the IMO

rule change, analysts at JPMorgan Chase & Co., including Christyan

Malek, said in a research note earlier this month. Distillates account

for about 47 percent of the energy giant’s total fuels output, while high-sulfur fuel oil comprises about 3 percent, according to BP.

Rising Margins

In

the European Union, the rule change will raise refining margins by an

average of 60 cents, to $8.10 per barrel in 2020, JPMorgan said. Other

companies are also set to benefit, according to the bank, which

highlighted Finland’s Neste Oyj and Spain’s Repsol SA as having among the highest proportion of capacity at their facilities to avoid making fuel oil.

“We

are going to take advantage of this new margin in a significant way

because our system is fully prepared to do that,” Repsol Chief Executive

Officer Josu Miguel said during a Feb. 28 earnings call, adding that

the company will “experience two, three, four good years” due to its

refining capabilities. Fuel oil accounts for just 4-to-5 percent of

production at Repsol, which has refineries in Spain and Peru, he said.

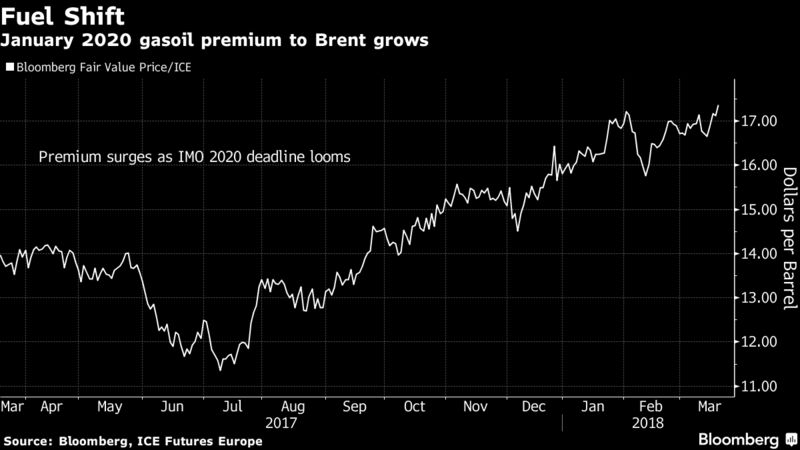

The

fuel shift is already starting to appear in futures prices. In Europe,

the premium that low-sulfur fuel oil will attract over its dirtier

counterpart in January 2020 has grown by 66 percent since the start of

the year, according to fair value data compiled by Bloomberg. In

Singapore, one of the world’s primary hubs for ship refueling, the

premium of gasoil to crude in January 2020 has risen by 25 percent

during the same time frame.

Simple Refineries

For less-sophisticated refineries, the post-2020 world is less clear.

“Some

of the world’s simplest refineries will likely be forced to cut runs or

close,” Energy Aspects Ltd. said in an emailed research note Wednesday.

Production of high quantities of low-value fuel oil at some of Mexico’s

state-owned coastal refineries “will pose a growing financial headache

to the Mexican government and likely prove unsustainable,” the

researcher said, noting that national oil companies often let

money-losing plants stay in business.

A few refineries that run

medium sour crude from Saudi Arabia and don’t have coking capacity could

be at risk, PBF Energy Inc. Chief Executive Officer Thomas Nimbley said

at a conference in Houston earlier this month.

Still, demand for

marine gasoil will swell to 1.74 million barrels a day in 2020, the

Paris-based International Energy Agency estimates, adding almost a

million barrels a day of the fuel compared to this year. The surge in

demand is expected to be matched by a spike in diesel prices, the agency

said in a March 5 report.

That should be good for simple plants in addition to complex

facilities because margins will have to rise to make cleaner fuel from

existing capacity, according to Steve Sawyer, head of refining at

researcher Facts Global Energy.

“Refinery utilization has to be very high to make the product base that we need,” he said.

— With assistance by Rachel Graham, Laura Blewitt, Alaric Nightingale, Debjit Chakraborty, Alex Longley, and Rakteem Katakey

No comments:

Post a Comment