Wednesday, January 31, 2018

China's independent refineries rush to buy spot crude ahead of new tax reporting rules

https://www.platts.com/latest-news/oil/singapore/chinas-independent-refineries-rush-to-buy-spot-27910145

China's independent refiners are stepping up efforts to secure spot

crude oil cargoes to ensure that they arrive ahead of the implementation

of stricter tax reporting rules in March, a move that could boost

imports in the near term.

Beijing in early January announced tighter regulations for oil products consumption tax reporting, effective March 1. The new regulations require refineries and fuel retailers to use a special tax module to allow local tax authorities to collect a consumption tax on oil products by monitoring the whole transaction chain of the product from producers to end-users.

In an effort to avoid the tighter tax regulations, a few Shandong-based independent refiners were reported to be scouting around for prompt cargoes, in addition to the plentiful arrivals already scheduled for this month and for February.

A survey by S&P Global Platts previously showed that a total of around 8.15 million mt, or 1.93 million b/d, of crude had been scheduled to arrive in Shandong in January, compared with about 7.49 million mt discharged in December. The actual number could be higher given the additional demand seen.

Beijing in early January announced tighter regulations for oil products consumption tax reporting, effective March 1. The new regulations require refineries and fuel retailers to use a special tax module to allow local tax authorities to collect a consumption tax on oil products by monitoring the whole transaction chain of the product from producers to end-users.

In an effort to avoid the tighter tax regulations, a few Shandong-based independent refiners were reported to be scouting around for prompt cargoes, in addition to the plentiful arrivals already scheduled for this month and for February.

A survey by S&P Global Platts previously showed that a total of around 8.15 million mt, or 1.93 million b/d, of crude had been scheduled to arrive in Shandong in January, compared with about 7.49 million mt discharged in December. The actual number could be higher given the additional demand seen.

"It's quite easy to sell crude cargoes for prompt delivery. They could

be sold from bonded storage, as well as Russian ESPO cargoes [which have

a shorter voyage time]," a Shandong-based source said, highlighting the

robust demand from independent refiners.

Several independent refineries in Shandong's Dongying, Heze and Weifang cities last week bought five crude cargoes totaling around 650,000 mt. Most of those cargoes were brought in by trading houses and were looking for homes in Shandong. They changed hands as soon as they arrived, according to market sources.

RUSH FOR CARGOES

The additional demand was mainly attributed to the final window available to bring in cargoes under the old tax reporting system that could save refiners some costs.

Under the old tax system, independent refiners could take advantage of a loophole and managed a tax exemption of as high as Yuan 1,218 ($192)/mt for their refined products, which they said was produced from fuel oil and not crude oil.

Gasoline and gasoil refined from crude oil attracts Yuan 2,110/mt and Yuan 1,411/mt of consumption tax, respectively. But, the consumption tax is waived partly if those barrels are produced from other oil products such as fuel oil, which attracts Yuan 1,218/mt of consumption tax. By reporting to the authorities that they are producing gasoline and gasoil from fuel oil, refiners actually enjoyed a tax rebate.

But under the new tax reporting system, it will be difficult for refiners to report crude oil as fuel oil as tax officials will be able to track down the entire value chain.

"That is why refiners are looking for cargoes for arrival by early February as this will allow them to go through the whole process as per the old reporting system," a market source said.

-- Oceana Zhou, oceana.zhou@spglobal.com, Staff reports

-- Edited by Geetha Narayanasamy, geetha.narayanasamy@spglobal.com

Several independent refineries in Shandong's Dongying, Heze and Weifang cities last week bought five crude cargoes totaling around 650,000 mt. Most of those cargoes were brought in by trading houses and were looking for homes in Shandong. They changed hands as soon as they arrived, according to market sources.

RUSH FOR CARGOES

The additional demand was mainly attributed to the final window available to bring in cargoes under the old tax reporting system that could save refiners some costs.

Under the old tax system, independent refiners could take advantage of a loophole and managed a tax exemption of as high as Yuan 1,218 ($192)/mt for their refined products, which they said was produced from fuel oil and not crude oil.

Gasoline and gasoil refined from crude oil attracts Yuan 2,110/mt and Yuan 1,411/mt of consumption tax, respectively. But, the consumption tax is waived partly if those barrels are produced from other oil products such as fuel oil, which attracts Yuan 1,218/mt of consumption tax. By reporting to the authorities that they are producing gasoline and gasoil from fuel oil, refiners actually enjoyed a tax rebate.

But under the new tax reporting system, it will be difficult for refiners to report crude oil as fuel oil as tax officials will be able to track down the entire value chain.

"That is why refiners are looking for cargoes for arrival by early February as this will allow them to go through the whole process as per the old reporting system," a market source said.

-- Oceana Zhou, oceana.zhou@spglobal.com, Staff reports

-- Edited by Geetha Narayanasamy, geetha.narayanasamy@spglobal.com

Tuesday, January 30, 2018

Tanker unloads LNG at Everett terminal that contains Russian gas

LNG Tanker Gasleys / Everett, Massachusetts /1-29-18

IMO:

9320075

MMSI:

228333700

Call Sign:

FMLU

Flag:

France [FR]

AIS Vessel Type:

Tanker - Hazard D (Recognizable)

Gross Tonnage:

97741

Deadweight:

74300 t

Length Overall x Breadth Extreme:

289.6m × 43.35m

Year Built:

2007

Status:

Active

https://www.bostonglobe.com/business/2018/01/29/tanker-unloads-lng-everett-terminal-that-contains-russian-gas/rewj1wKjajaKtLp79irzTI/story.html?et_rid=1745543262&s_campaign=todaysheadlines:newsletter

The Russian gas has finally arrived in Boston.

A giant tanker

of liquefied natural gas that unloaded at the Distrigas terminal in

Everett over the past two days included fuel from a plant in Siberia

owned by a Russian company under US sanctions.

Located far above

the Arctic Circle, the $27 billion Yamal gas plant opened in December,

and some of its first output ended up in the cargo that will be used to

heat homes and generate electricity in the Boston area.

The majority owner of the Yamal plant is a Russian company called

Novatek, whose shareholders include an ally of Vladimir Putin, Gennady

Timchenko. The US Treasury initially imposed sanctions that prohibited

US companies from providing new financing to Novatek and another Russian

energy firm in 2014, in response to what the agency had described as

Russia’s destabilization of eastern Ukraine and its annexation of

Crimea.

Treasury officials did not respond to requests for comment about the arrival Monday of the tanker, the Gaselys.

Since these particular sanctions involve just the money that Novatek

could access, energy industry experts said they do not prevent Western

companies from buying the gas produced at its Yamal plant.

“The

company that developed the project was sanctioned, but the gas itself

was not sanctioned,” explained James Henderson, director of natural gas

research at the Oxford Institute for Energy Studies in the United

Kingdom.

It’s unclear how much of the LNG carried by the Gaselys

came from Russia because it was mixed with liquefied gas from other

countries while stored temporarily at a UK facility. The owner of the

Distrigas facility, the French company Engie, bought the fuel on global

spot markets when the extreme cold spell earlier this winter sapped

inventories and drove up prices of natural gas coming in by pipeline.

“We needed an extra cargo to make up for some of the gas we sold

because of the very cold weather,” said Engie spokeswoman Carol

Churchill.

“This transaction is compliant with all US trade laws,”

she added. “There are no imposed sanctions on LNG or oil cargoes that

are partially or totally sourced from Russia. The only sanctions against

Yamal related to financing of construction . . . not purchasing of

fuel.”

The sanctions forced the Yamal’s developers to redo the

plant’s financing and seek outside funders, including loans from Chinese

banks. Novatek owns just over half of the Yamal plant, with the rest

split among the French energy giant Total and two Chinese state

companies.

Jim Bride, president of Energy Tariff Experts LLC in

Cambridge, said the acceptance of Russian gas comes as the United States

is promoting energy independence and targeting exports to counter

Russia’s grip on European gas markets. The importing of Russian gas into

New England, he said, doesn’t help with this narrative.

The Yamal

plant is so far north that the waters around it are frozen solid for

much of the year, and that required the owners to commission

ice-breaking tankers that can sail into ice two meters thick.

After anchoring off the coast for several days, the Gaselys arrived

in Everett Sunday morning, Churchill said; it typically takes up to 20

hours for the ship to unload its cargo.

This was the first

shipment containing Russian gas at the Everett terminal in its five

decades of operation, Churchill said. The company typically gets LNG

from a more temperate place: Trinidad.

The terminal had already

accepted five shipments since mid-December, all from Trinidad. Some of

the gas is fed into the region’s two main pipeline networks, while other

gas is trucked in still-liquid form to storage tanks across New

England. The terminal’s gas is also used for power generation.

But

in anticipation of increased demand this season, Churchill said another

shipment of LNG Engie ordered that is scheduled to arrive in February

from a French terminal will probably include gas from Russia.

Jon Chesto can be reached at jon.chesto@globe.com. Follow him on Twitter @jonchesto.

Continue Reading

Monday, January 29, 2018

Nvidia and GE’s Baker Hughes team on AI for oil and gas

https://techcrunch.com/2018/01/29/nvidia-and-ges-baker-hughes-team-on-ai-for-oil-and-gas/

Nvidia and GE subsidiary Baker Hughes want to

bring the power of artificial intelligence to bear on the oil and gas

industry – and do so throughout the space, covering everything from

locating new oil sources, bringing it up to the surface, refining it for

use and even delivering it to the end customer.

Baker Hughes is working with Nvidia on making this happen using its

range of AI-enabling GPU tech, including both its Nvidia DGX-1

supercomputers, which are large, data center powerhouses, to its DGX

Stations for desktop supercomputer capabilities, and even the Nvidia

Jetson AI, its platform for computing at the edge, which enables deep

learning processing locally, rather than routing it through the cloud.

Nvidia’s full range of options is key to making this work – the oil

and gas industry has needs that range from solving massive computing

problems via simulation and data processing to anticipate new drill

spots and how to deal with seismic activity at drilling sites, for

instance, but it also needs platforms that can work installed on

offshore platforms where connectivity is sketchy at best, and not

incredibly bandwidth-rich, either.

Part of this work is about locating and maximizing the return on

natural resource, but it’s also about making sure the equipment runs and

runs well, with models that predict wear and maintenance schedules,

which could stop major malfunctions before they ever occur. That has

benefits in terms of cost, for sure, but also in terms of the safety of

site personnel working on rigs and using potentially dangerous hardware

regularly.

First 2018 Open Season Auction Announced for Pemex Terminals and Pipelines

Pemex

Logística, the Petróleos Mexicanos subsidiary that manages the network

of terminals and pipelines of the state company, plans to hold 11

auctions to reserve transportation and storage capacity in 60 terminals

and 27 stretches of pipeline throughout various regions of Mexico.

The first 2018 procedure was called on Jan. 9. It is

the open season for the North Zone Border System (Sistema Norte Zona

Frontera) to offer available storage capacity and transportation of

gasoline and diesel fuel for a number of terminals and ducts in

Satélite, Monclova and Sabinas in the state of Coahuila, along with

Nuevo Laredo in the state of Tamaulipas (Open Season, Stage 1.2).

Key dates to remember are:

- Jan. 9-29 – Prequalification

- Jan. 18-19 and March 5-6 – Workshops

- Jan. 24 and Feb. 20 – Visits to site (registration needed)

- Jan. 30-Feb. 27 – Reception of proposals

- March 14 – Award and capacity allocation

This open season is the continuity of the procedure carried out for

the Rosarito System, which was awarded to U.S.-based Andeavor (formerly

Tesoro) in 2017 (Open Season, Stage 1.1).

It is expected that open season auctions will be called monthly

during 2018. The terms and conditions, as well the activity calendars,

are still in a regulatory process review, which includes the calculation

of capacity that Pemex will hold before calling the procedures.

Saturday, January 27, 2018

Friday, January 26, 2018

Saudi Arabia Struck Gold With Corruption Crackdown

Ritz Carlton Riyadh

- The $100 billion in expected settlement deals will boost the economy, still struggling to recover from the 2014 drop in oil prices.

Around midnight on Jan. 21, the Ritz-Carlton in Riyadh hardly looks

like the holding pen for some of Saudi Arabia’s most wanted. Since

November, some of the kingdom’s richest princes, cabinet officials, and

businessmen have been detained in the palatial five-star hotel

as part of a sweeping anticorruption purge. There are no armed guards

visible; only one police car is seen outside the compound. In the

well-lit lobby, with Arabic music playing over speakers, government

staffers are scattered around cafe tables. There’s a buffet, but nobody

is eating.

On

a couch near the reception desk, Sheikh Saud Al Mojeb, the Saudi

attorney general, does a head count of detainees. So far, about 90 have

been released, having reached settlement deals with the government.

Fewer than 100 remain, including five who are weighing proposed deals.

Those who don’t reach an agreement will be referred to prosecutors. “The

royal order was clear,” Al Mojeb says. “Those who express remorse and

agree to settle will have any criminal proceedings against them

dropped.”

The

Saudi detention plan is winding down, with authorities expecting the

Ritz to be cleared of detainees by the end of January. The government

sees it as a resounding success. One senior official believes it will

net more than $100 billion in settlement deals. That money could be a

shot in the arm for the Saudi economy, still struggling to recover from

the 2014 drop in oil prices. The payments have been a combination of

cash, real estate, stocks, and other assets and will likely be managed

by a government committee, according to the official.

Alwaleed.

Photographer: Chesnot/Getty Images

The purge, led by Crown Prince Mohammed bin Salman, the

32-year-old son of King Salman, began without notice on Nov. 4, as

authorities swept across the country rounding up hundreds of suspects, including some of the most prominent citizens. Prince Alwaleed bin Talal,

considered the richest man in Saudi Arabia, was detained, as was former

Finance Minister Ibrahim Al-Assaf and Adel Al Fakeih, who was removed

as minister of economy and planning on the eve of the arrests. Prince

Miteb, son of the late King Abdullah and minister of the powerful

National Guard, was held and then released a few weeks later after

agreeing to pay more than $1 billion.

News

of the purge reverberated across boardrooms, financial markets, and

world capitals as bankers, analysts, and diplomats sought to assess its

impact on the biggest Arab economy. Stocks in companies owned by

detainees slumped.

Although Saudi Arabia is trying to become more open, the probe was

conducted in a “pretty nontransparent way,” Moritz Kraemer, global chief

rating officer at S&P Global Ratings, said in a Jan. 22 interview

on Bloomberg Television. The probe “could be a step in the right

direction, but it could also be a step towards more arbitrary ruling,”

he said.

Saudi officials say Prince Mohammed had to tackle graft

as he tries to revitalize the economy by weaning it off oil. “Corruption

had reached epidemic proportions,” says the senior official. “It was as

if the nation woke up and realized there was good news and bad news:

The bad news was that it had cancer. The good news was that it’s

treatable, but we have to go through surgery, chemotherapy, radiation,

and amputation.”

One

of the biggest mysteries is the fate of Alwaleed. Three people

following his case say he’s left the Ritz and wasn’t in prison—rather,

he was held at another location as he negotiates an agreement. Three

others, however, say he’s still at the hotel. In December two people

with knowledge of the matter said Alwaleed was balking at steep

financial demands that would force him to give up control of his $9 billion holding company.

Bloomberg

was unable to meet with detainees or to verify the attorney general’s

claims that all of them were allowed access to legal counsel. Two people

who’ve spoken to some of them say not everyone was given access to

lawyers or let out of their rooms except for questioning. Al Mojeb

denies the suspects’ rights were violated and says the antigraft

committee wants to exhaust all options that can lead to a settlement

before referring anyone to prosecution. Still, the message is clear. “We

are in a new era,” Al Mojeb says. “The campaign against corruption

won’t stop.”

Thursday, January 25, 2018

Rare gasoline Suezmax to load from Ventspils in late January: sources

https://www.platts.com/latest-news/shipping/london/rare-gasoline-suezmax-to-load-from-ventspils-26876486

A newly built Suezmax is due to load 100,000 mt of gasoline from the

Ventspils Nafta terminal around January 26, with Vitol as charterer and West

Africa as the most likely final destination, trading sources said Wednesday.

The 159,559 dwt Sea Icon, which made its maiden voyage last month as a clean product carrier, is expected to arrive in Ventspils, Latvia, on January 26, according to data from cFlow, S&P Global Platts trade flow software.

While the final destination of the vessel remains unconfirmed, many gasoline market participants expect the Sea Icon to sail to West Africa, notably because demand for gasoline into Nigeria is particularly strong at the moment.

"The ship has multiple options," a source at Vitol said.

West Africa is a likely destination as Vitol has shorts into the region, but the Persian Gulf is also a possible destination, a trader said.

Vitol is one of around 17 companies participating in the 2017 edition of the Direct Sale Direct Purchase program organized by Nigerian National Petroleum Corporation, whereby ten companies are paired with ten other companies to export crude from Nigeria and imports gasoline in exchange.

Flows of gasoline into West Africa, especially Nigeria, have increased in the past month amid gasoline shortages in the oil-producing country since early December.

Since the beginning of the week, a flurry of vessels were heard fixed or on subjects to bring more gasoline from Europe to West Africa, including three long-range tankers and at least seven medium-range tankers. While most of these vessels will load from the Amsterdam-Rotterdam-Antwerp hub, one is to load from Norway and another one from the Baltic.

Over the past ten days, three vessels reportedly loaded gasoline from the Baltic and are en-route to West Africa, according to a shipping report. The vessels are the Elandra Palm, which sailed from Klaipeda around January 15 and is said to be heading to Nigeria; the Lincoln, which departed from Ventspils on January 22 and is thought to be on its way to Lagos, Nigeria; and the MR Aries, which left Tallin on January 13 and is reportedly going to Lome, Togo.

--Virginie Malicier, virginie.malicier@spglobal.com

--Edited by Derek Sands, derek.sands@spglobal.com

The 159,559 dwt Sea Icon, which made its maiden voyage last month as a clean product carrier, is expected to arrive in Ventspils, Latvia, on January 26, according to data from cFlow, S&P Global Platts trade flow software.

While the final destination of the vessel remains unconfirmed, many gasoline market participants expect the Sea Icon to sail to West Africa, notably because demand for gasoline into Nigeria is particularly strong at the moment.

"The ship has multiple options," a source at Vitol said.

West Africa is a likely destination as Vitol has shorts into the region, but the Persian Gulf is also a possible destination, a trader said.

Vitol is one of around 17 companies participating in the 2017 edition of the Direct Sale Direct Purchase program organized by Nigerian National Petroleum Corporation, whereby ten companies are paired with ten other companies to export crude from Nigeria and imports gasoline in exchange.

Flows of gasoline into West Africa, especially Nigeria, have increased in the past month amid gasoline shortages in the oil-producing country since early December.

Since the beginning of the week, a flurry of vessels were heard fixed or on subjects to bring more gasoline from Europe to West Africa, including three long-range tankers and at least seven medium-range tankers. While most of these vessels will load from the Amsterdam-Rotterdam-Antwerp hub, one is to load from Norway and another one from the Baltic.

Over the past ten days, three vessels reportedly loaded gasoline from the Baltic and are en-route to West Africa, according to a shipping report. The vessels are the Elandra Palm, which sailed from Klaipeda around January 15 and is said to be heading to Nigeria; the Lincoln, which departed from Ventspils on January 22 and is thought to be on its way to Lagos, Nigeria; and the MR Aries, which left Tallin on January 13 and is reportedly going to Lome, Togo.

--Virginie Malicier, virginie.malicier@spglobal.com

--Edited by Derek Sands, derek.sands@spglobal.com

Largest East Coast oil refinery owner files for bankruptcy: report

http://thehill.com/policy/energy-environment/370170-largest-east-coast-oil-refinery-owner-files-for-bankruptcy-report

The owner of the largest East Coast oil-refining complex is filing

for bankruptcy and blaming an Environmental Protection Agency (EPA)

biofuel mandate.

Philadelphia Energy Solutions, owner of two refineries, announced the news to employees Sunday in an internal memo obtained by Reuters.

The

bankruptcy comes just six years after the company was financially

rescued by the Carlyle Group, a private equity firm, and petroleum

company Sunoco.

The

internal memo told employees, which currently number 1,100, that in a

new agreement with creditors the company secured $260 million in

financing, adding the bankruptcy filings would have no immediate effect

on workers. About $75 million of the new funding comes from Sunoco

Logistics.

The memo was confirmed to Reuters by a spokeswoman for Philadelphia Energy Solutions.

The

two refineries, operated by Philadelphia Energy Solutions, are equipped

to convert about 335,000 barrels of crude oil per day into gasoline,

jet fuel and diesel.

Money strains of having to adhere to the EPA's Renewable Fuels Standard are listed as partly to blame.

The

Bush-era biofuel law mandates that either refiners blend biofuels made

from ethanol into their fuel supply or they have to buy credits from

companies that do.

Philadelphia Energy Solutions chose the latter

route and since 2012 has spent more than $800 million on credits to keep

up with the law. According to the memo, the credits were the company's

second-largest expense next to the purchasing of crude oil.

"We

will continue to work with the government to address the broken RFS

system that is harming smaller, independent merchant refiners like PES.

This is a win for the region, the Commonwealth of Pennsylvania and the

City of Philadelphia,” said Greg Gatta, CEO PES in a statement on

Monday.

The company's woes come amidst experts’ expectations that

crude oil consumption and production in the U.S. will continue to grow.

The U.S. Energy Information Administration forecasts that

average crude oil production in 2018 will increase by about 1 million

barrels per day from 2017 levels. If true, it would be the highest

annual average on record.

Last week, Fatih Birol, executive director of the International Energy Agency, said he foresees the United States becoming the "undisputed leader" in oil and gas production for "years to come."

Aramco Starts Swapping Saudi Oil for Fuel to Tap New Markets

Saudi Aramco CEO Says 'We Are Ready' for IPO in Second Half of 2018

https://www.bloomberg.com/news/articles/2018-01-24/aramco-trading-starts-swapping-saudi-crude-oil-for-refined-fuels

-

Unit of Saudi Aramco previously traded mostly oil products

-

Mediterranean offers ‘opportunities for trading’: Al-Buainain

Saudi Aramco’s

trading unit started swapping the kingdom’s crude oil for products

refined in other countries, allowing the company to tap new markets,

according to its chief executive officer.

The

company has supplied crude to refiners in the Mediterranean region and

gotten fuel in return, Ibrahim Al-Buainain, chief executive officer of

Saudi Aramco Products Trading Co., said Wednesday by phone. The refined

products have been sold in Europe, North Africa and the west coast of

Saudi Arabia, and the aim is to do more of the processing deals,

Al-Buainain said.

“In

the Mediterranean there is plenty of spare refining capacity,”

Al-Buainain said. “That’s creating opportunities for trading.”

Al-Buainain said the company was trading small amounts of Saudi crude in

the processing deals and that the swaps allowed it to reach new

customers.

Saudi Arabia is the world’s biggest crude exporter and the

kingdom is preparing to sell shares in state energy producer Saudi

Arabian Oil Co., also known as Aramco, in what could be the world’s

biggest initial public offering. The strategy of dealing in Saudi crude

is a change for Aramco Trading which previously bought and sold mostly

fuels like gasoline, diesel or fuel oil. Last year the unit started

trading crude produced by other countries.

Expanding Sales

State

oil companies like Saudi Aramco are expanding their crude sales and

refining capacity to better compete in a market flush with supply. Crude

from U.S. shale oil fields and from Russian deposits is increasingly

vying for buyers in Asia, the biggest market for Middle Eastern

producers.

“They have to adapt to the market and look to take

advantage of opportunities to improve profitability,’’ said Bassam

Fattouh, director of the Oxford Institute for Energy Studies.

Aramco

has stakes in 5.4 million barrels a day of refining capacity in Saudi

Arabia to South Korea and the U.S. The company aims to double that

capacity within a decade even as it battles other crude producers for

market share. The trading unit may also supply crude to Aramco’s 600,000

barrel-a-day Motiva Enterprises LLC refinery in Port Arthur, Texas, the

biggest refinery in the U.S., according to Al-Buainain.

“Saudi

Aramco is developing the trading business to take advantage of the

expansion in their refining business,’’ Oxford’s Fattouh said.

Trading Opportunities

Aramco is increasingly joining integrated oil companies like

BP Plc and Royal Dutch Shell Plc that aim to take advantage of their

pipelines, storage units, refineries and oil production fields to take

advantage of trading opportunities and boost profit. It’s a shift for

state oil producers which traditionally pumped crude and shipped it to

buyers under long-term contracts.

The wholly owned trading unit of

Saudi Aramco has done at least two processing deals with Saudi crude

and it’s also traded crude and condensate produced in other countries,

Al-Buainain said.

Aramco Trading handles about 1.5 million barrels

a day of refined fuels, and wants to increase that to more than 2

million barrels, Al-Buainain said

in May. It also plans to buy crude from other producers to supply some

of Saudi Aramco’s joint-venture refineries globally, he said Wednesday.

Wednesday, January 24, 2018

Stop Trying to Guess When OPEC Will Hit Its Target

Saudi Arabia's Energy

Minister Khalid al-Falih attends a meeting of the 4th OPEC-Non-OPEC

Ministerial Monitoring Committee in St. Petersburg on July 24, 2017.

https://www.bloomberg.com/news/articles/2018-01-23/opec-supply-cut-target-stop-trying-to-guess-the-end

When will OPEC finally succeed in rebalancing the oil market? The second quarter? The fall? Next year?

As you ponder this question, keep this in mind: OPEC has moved on already.

Speaking

Tuesday on the sidelines of the World Economic Forum in Davos, Saudi

Arabia's energy minister, Khalid Al-Falih, said OPEC needed to extend

its cooperation with several non-OPEC producers on managing supply

"beyond the current agreement." As for Saudi Arabia's recently

established alliance with Russia, Al-Falih sees this lasting "decades

and generations."

Al-Falih was echoing comments he made last weekend in Muscat,

when -- apart from urging members of the so-called Vienna Group of OPEC

and non-OPEC members to consider cooperating beyond this year -- he

also raised questions about the target they should be pursuing. Right

now, it's the five-year average of commercial oil inventories in the

OECD. But, as he said, that's a dynamic target influenced by the very

glut OPEC seeks to eliminate (something I pointed out here). He held out the possibility that any extended agreement might target different levels of production or inventories.

The original six-month agreement announced in November 2016 has now been running for more than a year and was extended recently to the end of 2018. Now, though, there appears to be a new timescale: forever.

The reason for this was, coincidentally, laid out in a report

published earlier this month by the Oxford Institute for Energy Studies

and authored by Spencer Dale, chief economist at BP Plc, and Bassam

Fattouh, a director at the OIES. They argue the current craze for timing

the peak of global oil demand misses the point because, even after this

happens, demand will likely fall slowly and the world will still

require millions of barrels a day for a long time to come.

Rather,

they argue that the prospect of peak demand reflects a shift from an

era of scarcity -- "peak supply" was the dominant view only a decade ago

-- to one of relative abundance as resources such as U.S. tight oil

have entered the market. Abundance of anything usually means heightened

competition for market share, and oil is no different. However, there's a

catch.

Several of the world's largest producers of oil, such as

Saudi Arabia, cannot embrace such a competitive paradigm fully. Although

they can produce oil from their fields for maybe $10 to $20 a barrel --

far below current prices around $70 -- they cannot sustain their

oil-rent-reliant societies for that price.

Low-Cost Producers?

OPEC members require an average of $88 a barrel to balance their public spending in 2018

Data: RBC Capital Markets; graphic by Bloomberg Gadfly

Note: Nigeria ($124), Libya ($170) and Venezuela ($223) not shown.

This is why Saudi Arabia is belatedly trying to refashion itself as a diversified economy.

Yet this is a long and risky process. So, in the meantime, they will do

what they can to keep oil prices high enough to cover the "social

costs" of being a petrostate, rather than simply compete for market

share. As Dale and Fattouh wrote:

It is likely that many low-cost producers will delay adopting a more competitive strategy until they have made significant progress in reforming their economies. This is likely to slow the speed at which the new competitive oil market emerges.

My quibble with this point is that, while

OPEC members will likely continue to fight against the competitive

trend, it is doubtful they can actually do this sustainably.

Clearly,

they've had some success over the past six months. Consider what that

has taken, though. First, OPEC couldn't do it alone; they had to rope in

11 other countries, including Russia. Second, as I wrote here,

a large share of the supply cuts delivered so far are due to some

countries, such as Venezuela, "over-delivering," to use Al-Falih's

uncomfortable euphemism. These, along with OPEC's thinly veiled appeals to U.S. shale operators to just dial it back already, are admissions of weakness rather than boasts of strength.

The

history of restrictive commodity agreements like OPEC's is largely one

of failure, punctuated by the occasional ability to keep prices far

above their marginal cost of production for several years. Keeping

prices high encourages rival supplies into the market (see the North Sea

in the 1970s and U.S. tight oil this past decade) and discourages

demand (see fuel-economy standards and nuclear power in the 1970s and

the push toward vehicle electrification

now). It's also hard to prevent cheating on supply quotas the longer

they remain and prices and circumstances change. On hearing Al-Falih's

comment about the alliance with Russia lasting "generations," my first

thought was that Russia in its present form has barely existed for one

generation.

In

the old days, an OPEC supply cut could keep prices high for years until

supply and demand responded to take them back. Nowadays, shale

producers rush to hedge

when oil rises above $50 a barrel, and thereby raise their output.

Demand, meanwhile, responds not just with knee-jerk reactions like

recessions but a gathering, structural change in the technology of

mobility that doesn't stop if prices fall again.

Saudi Arabia,

like several of its fellow OPEC members, feels compelled by its

vulnerable economic model to resist embracing a truly competitive oil

market and keep trying to manage the market well beyond 2018. Yet the

weaknesses of this approach are apparent already.

Looking ahead,

another sustained upswing in oil prices may well result less from some

coordinated effort but instead the chaotic removal of supply as some

weaker petrostates undergo wrenching changes à la Venezuela. The reality

is that the self-appointed guardians of "balance" in the oil market

constitute the very fragility lying at the heart of it.

Tuesday, January 23, 2018

Construction begins on Keystone XL

https://fluidhandlingmag.com/display_news/13342/Construction_preparation_begins_on_Keystone_XL/

The company has secured enough 20

year order commitments to proceed to the next stage of the project. The

orders represent a supply of 500,000 barrels per day. TransCanada, the

owner of the pipeline, is continuing to look for further long-term

supply contracts.

As well as private contracts, the Alberta Government has agreed to ship 50,000 barrels of regionally produced oil per day through the pipeline, according to local press. At capacity, Keystone XL is expected to be able to transport 830,000 barrels per day.

The company said in a statement that it was working with land owners to secure the necessary easements along the approved route. Preparation for work has begun and will increase as the necessary permit process progresses in 2018. Construction proper is expected to begin in 2019.

TransCanada’s president and CEO said in a press release: “Over the past 12 months, the Keystone XL project has achieved several milestones that move us significantly closer to constructing this critical energy infrastructure for North America." He also said that he was grateful to the Trump administration as well as regional government support from Nebraska and Alberta.

The pipeline extension has become a bitterly contested project, with environmentalists, Native Americans and some landowners and ranchers opposing construction. If completed, it will transport oil from Canada’s tar sands (another source of contention, as tar sands are often seen as one of the dirtier energy sources) in Alberta to markets in the US. The Obama administration had withdrawn approval for Keystone XL (the fourth phase of the Keystone project) in 2015, which was then overturned by President Trump in 2017.

As well as private contracts, the Alberta Government has agreed to ship 50,000 barrels of regionally produced oil per day through the pipeline, according to local press. At capacity, Keystone XL is expected to be able to transport 830,000 barrels per day.

The company said in a statement that it was working with land owners to secure the necessary easements along the approved route. Preparation for work has begun and will increase as the necessary permit process progresses in 2018. Construction proper is expected to begin in 2019.

TransCanada’s president and CEO said in a press release: “Over the past 12 months, the Keystone XL project has achieved several milestones that move us significantly closer to constructing this critical energy infrastructure for North America." He also said that he was grateful to the Trump administration as well as regional government support from Nebraska and Alberta.

The pipeline extension has become a bitterly contested project, with environmentalists, Native Americans and some landowners and ranchers opposing construction. If completed, it will transport oil from Canada’s tar sands (another source of contention, as tar sands are often seen as one of the dirtier energy sources) in Alberta to markets in the US. The Obama administration had withdrawn approval for Keystone XL (the fourth phase of the Keystone project) in 2015, which was then overturned by President Trump in 2017.

After three years the Penneast Pipeline gets FERC approval

https://fluidhandlingmag.com/display_news/13347/after_three_years_the_penneast_pipeline_gets_ferc_approval/

The Federal Energy Regulatory

Committee assented to the project, concluding that the public benefits

outweighed the environmental hazards. Environmental activists and

commissioners have called for an upcoming review of the approval process

to assign more weight to communities and landowners.

FERC’s 19 January order approving the highly contested LNG pipeline denied requests for an evidentiary hearing, but imposed environmental conditions on the pipeline’s construction. In the order, FERC concluded: “the benefits that the PennEast Project will provide to the market outweigh any adverse effects on existing shippers, other pipelines and their captive customers, and on landowners and surrounding communities.” The 116 mile system will connect east coast municipalities to the Marcellus Shale formation in the west using a 36 inch pipeline.

In a statement, PennEast’s board of managers chair Anthony Cox called the order “a major victory for New Jersey and Pennsylvania families and businesses”, adding: “They will reap the benefits of accessing one of the most affordable and abundant supplies of natural gas in all of North America.” Earlier in 2018, the company cited high energy costs for New Jersey consumers during ‘extreme’ cold weather as rationale for increased capacity.

Speaking to local press, a PennEast spokesperson said that the company expects to begin construction this year, with service starting in 2019.

One of the criteria for project approval is market demand, which takes the form of supply contracts. Of the contracts PennEast has received guaranteeing pipeline use, 75% of them are with PennEast affiliates (so far, the subscribed supply makes up 90% of the pipeline’s capacity). Commissioner Richard Glick, who dissented the order, highlighted this fact and called for the commission to weight this evidence appropriately: “In today’s order, the Commission relies exclusively on the existence of precedent agreements with shippers to conclude that the PennEast Project is needed… the existence of precedent agreements that are in significant part between the pipeline developer and its affiliates is insufficient to carry the developer’s burden to show that the pipeline is needed.” The Sierra Club environmental group applauded the commissioner’s statement, calling the new pipeline unnecessary and concluding that “fracked gas pipelines have no place in our communities.”

During the approval process PennEast has struggled to carry out necessary assessments as many landowners have denied them access to land on the proposed route. This order allows the company to exercise eminent domain to force access to the land. Commissioner Neil Chatterjee said in a statement that he had considered landowners’ rights and encouraged them and PennEast to cooperate with the commission to minimise impacts on landowners.

In the same statement cited above, Cox from PennEast said: “In the coming days, we will work to finalise fair and positive compensation agreements with landowners,” added Cox. “In the weeks ahead, survey crews will collect remaining field data in support of our permit applications to ensure minimal environmental and community impact.

In December 2017, FERC Chairman Kevin J. McIntyre announced the intention to review the LNG pipeline approval process. In a statement affirming her support for the order, Commissioner Cheryl A. LaFleur said that she supported McIntyre’s decision: “I believe this review should include both our needs determination and our environmental review of proposed projects. Today’s order highlights the issue of how pipeline developers engage with landowners, which I believe should also be explored in the upcoming generic proceeding.” She said that until the review was conducted, she would continue to assess pipeline applications on a case-by-case basis.

FERC has been accused of being a ‘rubber stamp’ for energy companies, a view that was compounded after a report commissioned by the Natural Resources Defence Council found that the commission had approved twice as much capacity as was consumed in 2016.

By Luke Acton

FERC’s 19 January order approving the highly contested LNG pipeline denied requests for an evidentiary hearing, but imposed environmental conditions on the pipeline’s construction. In the order, FERC concluded: “the benefits that the PennEast Project will provide to the market outweigh any adverse effects on existing shippers, other pipelines and their captive customers, and on landowners and surrounding communities.” The 116 mile system will connect east coast municipalities to the Marcellus Shale formation in the west using a 36 inch pipeline.

In a statement, PennEast’s board of managers chair Anthony Cox called the order “a major victory for New Jersey and Pennsylvania families and businesses”, adding: “They will reap the benefits of accessing one of the most affordable and abundant supplies of natural gas in all of North America.” Earlier in 2018, the company cited high energy costs for New Jersey consumers during ‘extreme’ cold weather as rationale for increased capacity.

Speaking to local press, a PennEast spokesperson said that the company expects to begin construction this year, with service starting in 2019.

One of the criteria for project approval is market demand, which takes the form of supply contracts. Of the contracts PennEast has received guaranteeing pipeline use, 75% of them are with PennEast affiliates (so far, the subscribed supply makes up 90% of the pipeline’s capacity). Commissioner Richard Glick, who dissented the order, highlighted this fact and called for the commission to weight this evidence appropriately: “In today’s order, the Commission relies exclusively on the existence of precedent agreements with shippers to conclude that the PennEast Project is needed… the existence of precedent agreements that are in significant part between the pipeline developer and its affiliates is insufficient to carry the developer’s burden to show that the pipeline is needed.” The Sierra Club environmental group applauded the commissioner’s statement, calling the new pipeline unnecessary and concluding that “fracked gas pipelines have no place in our communities.”

During the approval process PennEast has struggled to carry out necessary assessments as many landowners have denied them access to land on the proposed route. This order allows the company to exercise eminent domain to force access to the land. Commissioner Neil Chatterjee said in a statement that he had considered landowners’ rights and encouraged them and PennEast to cooperate with the commission to minimise impacts on landowners.

In the same statement cited above, Cox from PennEast said: “In the coming days, we will work to finalise fair and positive compensation agreements with landowners,” added Cox. “In the weeks ahead, survey crews will collect remaining field data in support of our permit applications to ensure minimal environmental and community impact.

In December 2017, FERC Chairman Kevin J. McIntyre announced the intention to review the LNG pipeline approval process. In a statement affirming her support for the order, Commissioner Cheryl A. LaFleur said that she supported McIntyre’s decision: “I believe this review should include both our needs determination and our environmental review of proposed projects. Today’s order highlights the issue of how pipeline developers engage with landowners, which I believe should also be explored in the upcoming generic proceeding.” She said that until the review was conducted, she would continue to assess pipeline applications on a case-by-case basis.

FERC has been accused of being a ‘rubber stamp’ for energy companies, a view that was compounded after a report commissioned by the Natural Resources Defence Council found that the commission had approved twice as much capacity as was consumed in 2016.

By Luke Acton

Monday, January 22, 2018

Citgo Says It Will Keep Its Headquarters In Houston

Citgo

Petroleum said it will keep its headquarters in Houston, warding off

speculation that it was considering moving its executive hub to the

Caribbean.

The Venezuelan refiner confirmed it is maintaining its

Houston home after its new president and CEO, Asdrúbal Chávez, a cousin

of the late Venezuelan president Hugo Chávez, arrived in Houston last

week to attend his first meetings. But Citgo at first would not address

the potential headquarters change.

The CEO change came amid the company's ongoing controversies

regarding the arrests of the company's previous leadership team in

Venezuela late last year. Citgo is a subsidiary of the state oil company

in Venezuela, which is mired in economic and political turmoil.

Chávez was installed as the new president at the end of November by

current Venezuelan President Nicolas Maduro. Earlier in November, the

Venezuelan government swept up much of the previous Citgo leadership

team, most of whom are dual American citizens living in the Houston

area, on embezzlement and corruption charges. The moves are widely seen

as an effort by Maduro to further consolidate power. Those arrested

remain in custody.

Argus Media reported last week week that Citgo was considering moving

its headquarters from Houston to Aruba, where Citgo also has a

refinery. However, Maduro recently cut off ties temporarily with Aruba

and some other neighboring Caribbean nations because of concerns about

smugglers.

Chávez, a chemical engineer, plans to unveil his vision for the

future of the company over the coming months, Citgo said. Chávez also is

a politician and former Venezuelan oil minister.

Citgo is a U.S. company with a more than 100-year history that was

acquired by Venezuela's state-run oil company nearly 30 years ago. Citgo

now acts as the U.S. refining and gasoline marketing arm of Venezuela.

Citgo employs about 4,000 people in the U.S., including more than 800

in Houston. The company has roughly 160 branded gas stations in the

Houston area, and about 5,500 nationwide. Citgo owns oil refineries in

Corpus Christi, Lake Charles, Louisiana, and Illinois.

Friday, January 19, 2018

Global insurance broker and risk management provider, Marsh issues sulfur cap insurance warning

http://www.tankeroperator.com/ViewNews.aspx?NewsID=9339

Vessels

could be deemed unseaworthy and their insurance cover affected by

failing to comply with the sulfur emissions (SOx) regulations set to be

introduced on 1st January, 2020, according to insurance broker and risk

management provider, Marsh.

Marsh’s report, ‘Emissions Regulations: Concerns for the Marine

Industry’, explores the risks and insurance implications associated with

measures introduced by the IMO to reduce the sulfur footprint of

commercial shipping.

The report states that shipowners should not assume that insurance

cover will continue to remain in place following a breach of the MARPOL

Annex VI after 1st January, 2020.

The failure to comply with international conventions, and consequently

losing flag state convention certification, could affect the validity of

a shipowner’s insurance cover if they continue to operate without prior

insurer consent.

Marcus Baker, Marsh’s global marine practice chairman, commented: “As

1st January, 2020 approaches, Marsh envisages large numbers of vessels

seeking to book space in repair yards for the installation of new

equipment or conversion to LNG in an effort to comply with the MARPOL

requirements.

“Latecomers may find that convenient or preferred yards have no room

and, being unable to comply with the new sulfur cap rules by 2020, may

risk their vessels becoming non-compliant, which could have

ramifications for their insurance provision. Shipowners should act early

to ensure any modifications that are required can be carried out in

good time.”

Another tanker fire

http://www.tankeroperator.com/ViewNews.aspx?NewsID=9327

Another

tanker fire

The Indian Coast Guard (ICG) has claimed to have contained a fire that

broke out on board the 2000-built, 46,145 dwt Indian flag product tanker

‘Genessa’, earlier this week.

Messaging on Twitter, the ICG said that it had saved all of the 26 crew

on board, including two who suffered major burns. One has since passed

away.

It also said that it suspected that the fire started in the vessel’s

accommodation area or engine room, while the vessel was at Kandla

anchorage, Gulf of Kutch, western India on Wednesday.

‘Genessa’ was reportedly carrying at least 30,000 tonnes of diesel fuel

when the fire started. She was believed to be managed by Seven Islands

Shipping.

An ICG hovercraft was deployed to check the shoreline for oil traces,

however, the Ministry of Defence for Gujarat State stated that ocean

water samples showed no signs of an oil spill.

Meanwhile, the wreck of NITC’s sunken Suezmax ‘Sanchi’ has been

located, Beijing said on Wednesday, but gave no new details about the

environmental impact of the disaster, although reports continued to

emerge of a massive oil slick.

‘Sanchi’ sank on Sunday after a new fire erupted, following the

collision with a Chinese bulk carrier a week earlier. The bodies of only

three of the 32 crew members — 30 Iranians and two Bangladeshis — had

been found thus far.

“The location of the wreck has been confirmed,” China's transport

ministry said on its official social media platform, adding that the

ship lay at a depth of around 115 m. “Underwater robots will be deployed

to explore the wreck waters,” the ministry added.

Takuya Matsumoto, a spokesman for Japan's coastguard said it was not

yet clear how much fuel remained in the ship, Associated Press reported.

Thursday, January 18, 2018

Exxon Mobil signs deal for deepwater oil exploration off Ghana

https://www.reuters.com/article/us-ghana-oil/exxon-mobil-signs-deal-for-deepwater-oil-exploration-off-ghana-idUSKBN1F7147

Exxon Mobil Corp signed a deal with Ghana on Thursday to explore for

oil in the Deepwater Cape Three Point offshore (DWCTP) oilfield.

The

signing followed direct negotiations between Ghana and Exxon Mobil

without an open competitive tender due to the nature of the field, where

the depth ranges from 2,000 to 4,000 meters, Ghanaian officials said.

Ghana,

which exports cocoa and gold, began commercial production of oil from

its flagship Jubilee reserves in late 2010. Other firms drilling in the

West African country include UK’s Tullow oil and Kosmos Energy.

The

Exxon Mobil deal is the first to be signed after the International

Tribunal for the Law of the Sea last September drew an ocean boundary

favoring Ghana in a dispute with its neighbor Ivory Coast.

Exxon

Mobil, lead operator, holds an 80-percent interest in the DWCTP, while

state-run Ghana National Petroleum Corporation holds 15 percent. Exxon

is yet to select a local partner to own the remaining 5 percent as

Ghana’s laws required, Energy Minister Boakye Agyarko told Reuters.

The agreement is subject to approval by parliament and Exxon is expected to start exploration this year, Agyarko said.

Reporting by Kwasi Kpodo; Editing by Andrew Heavens

Wednesday, January 17, 2018

Bitcoin's Nouveau Riche Run to Gold as Cryptocurrency Crashes

https://www.bloomberg.com/news/articles/2018-01-17/online-gold-sales-quintupled-as-bitcoin-plunged-coininvest-says

Amid the wild Bitcoin ride that’s wiped more than 40 percent off the

cryptocurrency’s price in a month, a pattern may be emerging: sellers

are switching out of digital gold and into the real thing.

Bullion

dealer Sharps Pixley, a subsidiary of Europe’s largest precious metal

coin and bar outlet regularly sees trades north of a million pounds,

while sales of gold coins at Frankfurt-based CoinInvest jumped fivefold

as the largest digital asset collapsed after surging 1,400 percent last

year, according to Director Daniel Marburger.

“Yesterday

was a hell of a crazy day,” he said from Frankfurt. “Emails and phones

did not stand still with customers asking how they could turn their

crypto into gold.”

The current price swings across seemingly every

cryptocurrency are bringing to the fore a question that has loomed over

the industry since its inception: to what extent can a virtual asset be a

store of value? By swapping out of digital gold and into the real

thing, some investors may be providing an answer.

After Gold Rush

Ross

Norman, a gold dealer with a store tucked in a corner of London

frequented by the upper classes, started exchanging gold for bitcoin via

an intermediary three months ago. He describes his customers as almost

embarrassed by their new-found fortunes. They often store it in safety

deposit boxes in his underground vault, following extensive

due-diligence to prevent money laundering.

“We’re seeing trades

north of a million pounds every couple of weeks,” said Norman from his

shop in St James’s St. “It’s been a welcome addition to our business in a

period when physical demand from more traditional sources has been

subdued.”

Customers as young as 25 come in carrying laptops

holding bitcoin they accumulated when it traded at $1 or below. One,

Norman said, had 1,000 bitcoin he intends to turn into physical metal.

The company, owned by Degussa Goldhandel GmbH, doesn’t take possession

of bitcoin. Customers buy via an intermediary.

“Bitcoin is a bit

of a lobster pot -- it’s easy to get in, but hard to get out,” Norman

said. “Gold also offers investors 4,000 years of history as a store of

value, and that’s looking quite appealing right now.”

Lack of demand hasn’t proved much of a headwind to gold

prices in recent weeks. The yellow metal, supported by a falling dollar,

rallied 7.5 percent in the past month to a four-month high before

tempering gains. Bitcoin fluctuated on Wednesday, but was about 44

percent lower than its peak in December.

Marburger said CoinInvest

sold almost 30 kilograms of gold, worth $1.2 million in the spot

market, as Bitcoin dropped 23 percent on Tuesday. One bitcoin buys about

eight one-ounce Britannia gold coins, he said.

It was a similar

story at GoldCore Ltd., where clients have been diversifying away from

cryptocurrencies and into physical gold in both bars and coins,

according to Director Mark O’Byrne.

“They told us they were

concerned that the massive price appreciation was unsustainable and they

got nervous about it,” he said in an emailed note. “We think

increasingly people are realizing that these digital assets have much

higher risk levels than the traditional safe haven asset.”

But

Marburger at CoinInvest says physical gold bullion also holds attraction

for bitcoin investors because the assets have much in common.

“Both

are limited in quantity, easy to trade and you can store them

decentralized,” he said. Gold has advantages because there are “no

passwords you can lose, the volatility is much lower, sustainable growth

and in the end you can hold your investment in your hands,” he said.

Bitcoin

dropped below $10,000 on Wednesday and was trading 5 percent lower at

$10,132 at 11:45 a.m. New York time. It reached a record high of $19,511

on Dec. 18. Gold was 0.4 percent lower at $1,332.48.

— With assistance by Todd White

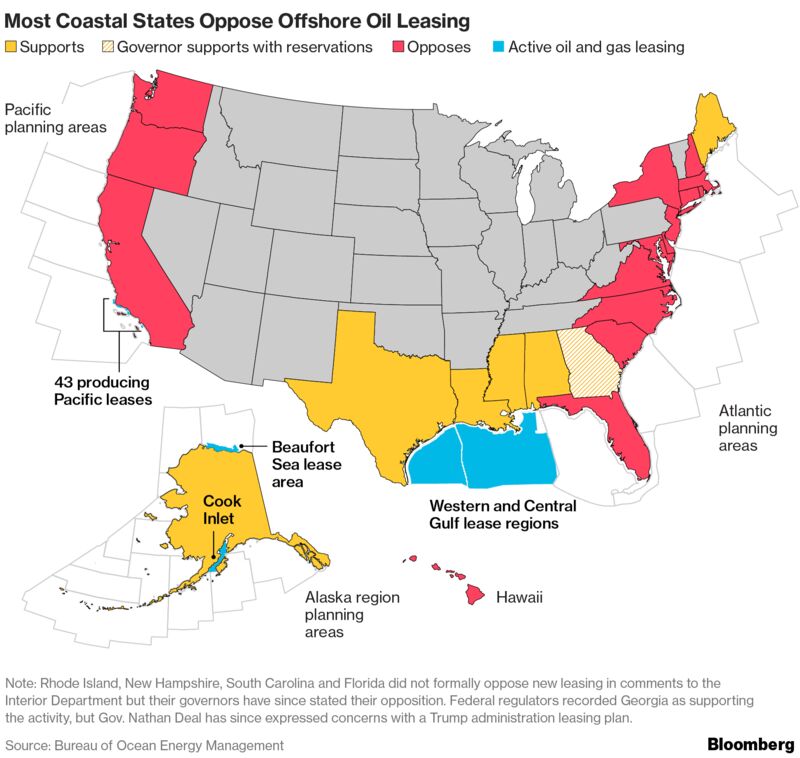

Trump's Offshore Oil Plan Faces Opposition on All Coasts: Map

The Trump administration is hoping to lure investment to the U.S. with a proposal to sell leases

in almost every inch of the nation’s outer continental shelf --

including waters hugging the U.S. East Coast that share characteristics

with Brazil, Guyana, Ghana and other countries attracting hundreds of

millions of dollars in oil companies’ quest for crude. Geologists

speculate that the U.S. waters could hold an equally tantalizing amount

of crude and natural gas. But oil companies may be unwilling to endure

the high production costs and public opposition to find out. A gusher of

litigation is more likely than a gusher of oil.

By

Jennifer A Dlouhy

and Dave Merrill

Tuesday, January 16, 2018

Digging data not ditches

Phillips 66 Assets

https://fluidhandlingmag.com/display_news/13325/digging_data_not_ditches/

A OneBridge-Phillips 66 joint

development project is set to advance digital management and machine

learning for pipelines into the cloud.

The US Pipeline and Hazardous Materials Administration reports that since 1997, in Natural Gas pipelines alone incidents have resulted in 322 deaths and damages totalling to over $7 billion. Ageing infrastructure and increased public scrutiny on how energy companies conduct their business means that being able to know what a pipeline looks like and where the problems are is only becoming more important.

In September 2017 OneBridge, a software company out of Alberta, Canada, supplied the Houston-based diversified company, Phillips 66 with something to address this issue: a machine learning and data science system called the cognitive integrity management (CIM) solution. Now both companies are looking to build on the system by moving the software into an online app, dubbing it the ‘integrity management solution’ (IMP). The IMP is now in development, and is aimed at catering to the needs of major pipeline operators.

The previous pipeline management solution was a combination of the CIM and Phillips 66’s pipeline data management system (PT-DMS). Phillips 66’s system was developed to be a comprehensive solution to manage its pipelines, combining functions including assessment team scheduling, analyses of data integrity and anomaly worklist tracking.

The CIM built on this by providing data normalisation and alignment, and applying machine learning technology to identify threats to the pipeline. In a statement, the software company said that they reduced the time it took to analyse the data from ten weeks, to two hours. CIM also allowed all of the data to be assessed whereas in the previous manual process could only process 5% of data collected.

OneBridge has patented this machine learning technique.

The resulting boost in awareness of pipeline condition allows companies to streamline their maintenance programme and allow engineers to spend more time on more substantial tasks like risk analysis and corrosion modelling. OneBidge is also preparing to use Microsoft’s HoloLens to enhance pipeline assessment.

In a press release, OneBridge President Tim Edward said: “This development project with Phillips 66 represents an important milestone for OneBridge… Our vision at the outset was to develop a cloud application that enables pipeline operators to manage their pipeline assets as smart infrastructure.”

CTO Brandon Taylor added: “PT-DMS is one of the most comprehensive and sophisticated pipeline management solutions within the industry today, which will ease migration to the cloud and reduce time-to-market for IMP.”

The company expects IMP to launch market-wide in Q4 of 2018.

The US Pipeline and Hazardous Materials Administration reports that since 1997, in Natural Gas pipelines alone incidents have resulted in 322 deaths and damages totalling to over $7 billion. Ageing infrastructure and increased public scrutiny on how energy companies conduct their business means that being able to know what a pipeline looks like and where the problems are is only becoming more important.

In September 2017 OneBridge, a software company out of Alberta, Canada, supplied the Houston-based diversified company, Phillips 66 with something to address this issue: a machine learning and data science system called the cognitive integrity management (CIM) solution. Now both companies are looking to build on the system by moving the software into an online app, dubbing it the ‘integrity management solution’ (IMP). The IMP is now in development, and is aimed at catering to the needs of major pipeline operators.

The previous pipeline management solution was a combination of the CIM and Phillips 66’s pipeline data management system (PT-DMS). Phillips 66’s system was developed to be a comprehensive solution to manage its pipelines, combining functions including assessment team scheduling, analyses of data integrity and anomaly worklist tracking.

The CIM built on this by providing data normalisation and alignment, and applying machine learning technology to identify threats to the pipeline. In a statement, the software company said that they reduced the time it took to analyse the data from ten weeks, to two hours. CIM also allowed all of the data to be assessed whereas in the previous manual process could only process 5% of data collected.

OneBridge has patented this machine learning technique.

The resulting boost in awareness of pipeline condition allows companies to streamline their maintenance programme and allow engineers to spend more time on more substantial tasks like risk analysis and corrosion modelling. OneBidge is also preparing to use Microsoft’s HoloLens to enhance pipeline assessment.

In a press release, OneBridge President Tim Edward said: “This development project with Phillips 66 represents an important milestone for OneBridge… Our vision at the outset was to develop a cloud application that enables pipeline operators to manage their pipeline assets as smart infrastructure.”

CTO Brandon Taylor added: “PT-DMS is one of the most comprehensive and sophisticated pipeline management solutions within the industry today, which will ease migration to the cloud and reduce time-to-market for IMP.”

The company expects IMP to launch market-wide in Q4 of 2018.

Monday, January 15, 2018

DOE Interest 'Extremely Important' to Making Underground NGL Storage a Reality, Researcher Says

tankterminals.com

It

could be anywhere from six months to two years before the U.S.

Department of Energy decides whether it will guarantee a $1.9 billion

loan for an underground storage hub in Appalachia.

Appalachian Development Group is trying to secure the loan

guarantee to help build the hub somewhere in the quad-state region —

Kentucky, Ohio, Pennsylvania or West Virginia. ADG recently was invited

to continue to Part II of DOE’s vetting process for the loan guarantee,

which would facilitate construction of secure storage for high-value

natural gas liquids.

ADG CEO Steve Hedrick had said the initial cost for a storage hub would be “north of $3 billion,”

but West Virginia University Energy Institute Director Brian Anderson

had said costs for a full build-out could eventually reach as high as

$10 billion. A federal loan guarantee would help erase some of the

uncertainty surrounding financing for the hub, the American Chemistry

Council said in a 2016 study.

That study suggested keeping the NGLs in the Appalachian region

rather than shipping them to the Gulf Coast could spark as much as $36

billion in investments by chemical and plastics companies and create

more than 100,000 jobs in the quad-state area.

Hedrick said ADG has already completed its pre-engineering work

needed to satisfy Part I of DOE’s application process. The focus now is

on developing the framework for requesting information and proposals for

the permitting, detailed design, engineering and construction of the

hub.

“ADG will work closely with the DOE on Part II of the application

process while simultaneously working to avail the market with the

opportunity to secure an equity position in this development,” said

Hedrick, who also is president and CEO of Mid-Atlantic Technology,

Research & Innovation Center in Charleston. “We all have to be

patient as we move forward.

“With the invitation for ADG to now complete Part II of the

application process and seek the issuance of the loan guarantees, we are

excited to take next steps.”

Hedrick said they still haven’t selected a site for the hub, saying their plan is to use the “best available and most technically sound geologic formations, in the most viable geographic locations.”

“This may include hard rock limestone formations, sandstone formations or salt strata,” he said. “All

of these geologic formations exist in Appalachia, as was outlined in

the geologic study led by WVU and brought forward from Ohio,

Pennsylvania and West Virginia. While plans are in fact made, it is

premature to publicly discuss specific prospective sites until further

permitting and engineering has been completed.”

Anderson, who headed that research team, said the announcement that

China Energy Corporation had signed a memorandum of understanding to

invest up to $84.7 billion in energy projects in the Mountain State

hasn’t changed the timeline, but it does bring a sense of urgency to the

project.

China Energy’s interest “serves as a significant indicator that the

(storage hub) is a critical component of the infrastructure needed for

substantial growth in the petrochemical industry in Appalachia,” he

said, pointing out it’s a vertically-integrated company that “believes in investing in the supply chain to their proposed petrochemical investments.”

Anderson said the hub would integrate the NGL storage network with

surface infrastructure, including pipelines that provide the

inter-connectivity between petrochemical sites, fractionation and

storage.

“As such, the flexibility in locations provided by the geology of

the region identified in the geologic report last summer is extremely

valuable to minimize the disturbance caused by the pipeline network,” he said.

“The maximization of the potential growth of the petrochemical

industry is less reliant on the location of the storage as it is on the

development of available industrial sites and the coordination of the

inter-connectivity of these sites through the surface infrastructure

associated with the ASTH.

Anderson said DOE’s announcement was an extremely important step to

bringing the project to fruition, saying it indicates that the project

meets eligibility requirements associated with the Advanced Fossil Loan

Program.

“The two primary requirements are that the project will deploy

advanced and innovative technologies and that the project will reduce

emissions of CO2 and other gases as compared to existing technology,” he said. “The

(storage hub) will be incorporating cutting edge technologies that

serve to protect the environment and minimize the environmental impact.”

Friday, January 12, 2018

Number of piracy incidents drop

http://www.tankeroperator.com/ViewNews.aspx?NewsID=9312

Around

180 incidents of piracy and armed robbery against ships were reported to

the International Chamber of Commerce’s (ICC) International Maritime

Bureau (IMB) last year, according to its report.

This is the lowest annual number of incidents since 1995, when 188 reports were received.

In 2017, 136 vessels were boarded, while there were 22 attempted

attacks, 16 vessels fired upon and six vessels hijacked. In 15 separate

incidents, 91 seafarers were taken hostage and 75 were kidnapped from

their vessels in 13 other incidents. Three crew members were killed last

year and six injured.

In the previous year, 191 incidents were reported, with 150 vessels boarded and 151 crew members taken hostage.

The report also underlined several highlights from the past year.

For example, in the Guff of Guinea (GoG), there were 36 reported

incidents but no vessels were hijacked and 10 incidents of kidnapping,

involving 65 crew members in or around Nigerian waters. Globally, 16

vessels reported being fired upon—including seven in the GoG.

“Although the number of attacks is down this year in comparison with

last year, the Gulf of Guinea and the waters around Nigeria remain a

threat to seafarers. The Nigerian authorities have intervened in a

number of incidents helping to prevent incidents from escalating,” said

Pottengal Mukundan, IMB director.

Nine incidents were recorded off Somalia last year, up from two in 2016.

Following an attack on a containership, six Somali pirates were

detained by EU NAVFOR, transferred to the Seychelles and charged with

‘committing an act of piracy’ where they face up to 30 years’

imprisonment if convicted.

“This dramatic incident, alongside our 2017 figures, demonstrates that

Somali pirates retain the capability and intent to launch attacks

against merchant vessels hundreds of miles from their coastline,”

Mukundan warned.

Elsewhere, Indonesia recorded 43 incidents last year, down from 49 in

2016. The IMB report said that Indonesian Marine Police patrols

continued to be effective in the country’s 10 designated safe

anchorages.

In the Philippines, however, the number of reported incidents more than

doubled, from 10 in 2016 to 22 in 2017. According to the report, the

majority of these incidents were low-level attacks on anchored vessels,

mainly at the ports of Manila and Batangas.

Vessels underway off the Southern Philippines were boarded and crew

kidnapped in the first quarter of 2017. However, alerts broadcast by

the IMB’s Piracy Reporting Centre (PRC), on behalf of the Philippine

authorities, have since helped to avoid further successful attacks.

Thursday, January 11, 2018

Analysis: China's slow strategic petroleum reserves build signals reduced dependency for energy security

https://www.platts.com/latest-news/oil/singapore/analysis-chinas-slow-strategic-petroleum-reserves-27904696

China's pace of strategic petroleum reserves growth slowed over mid-2016

to mid-2017, compared to the previous two years, in a sign that Beijing

was comfortable in lowering its dependency on those reserves for energy

security.

The country did not bring any new SPR storage site on stream in that period.

But the country's implied crude stocks growth over the same period hit a record high, suggesting more crude barrels went into commercial storage.

Some analysts expected China to need more crude to build its SPR in H2 2017, and also in 2018, because of more SPR storage sites coming online.

The country did not bring any new SPR storage site on stream in that period.

But the country's implied crude stocks growth over the same period hit a record high, suggesting more crude barrels went into commercial storage.

Some analysts expected China to need more crude to build its SPR in H2 2017, and also in 2018, because of more SPR storage sites coming online.

PIRA Energy Group, a unit of S&P Global Platts, expects China to build 100,000 b/d of crude stocks for its SPR in 2018.

The National Bureau of Statistics at the end of December said the country's SPR had reached 37.73 million mt of crude as of mid-2017, or 276.56 million barrels, up 4.48 million mt, or 89,968 b/d from 33.25 million mt recorded in mid-2016.

The SPR stocks build pace was 37% slower than the 143,195 b/d over mid-2015 to mid-2016, and was at only one-third the pace of 274,524 b/d over mid-2014 to mid-2015, S&P Global Platts' calculations based on NBS data showed.

"No new SPR storage site was launched over the period [mid-2016 to mid-2017], preventing the government from bringing in more crude to build the reserves," Wang Zhuwei, senior analyst with S&P Global Platts' China Oil Analytics said.

The nine SPR storage sites, which were in use as of mid-2017, were the same as of mid-2016 -- having a total capacity of 198.83 million barrels, according to NBS announcements. In contrast, the Zhoushan II site in Zhejiang province, with a capacity of 18.87 million barrels, was put into use over mid-2015 to mid-2016.

From mid-2014 to mid-2015, the capacity of SPR storage sites had surged by 76.8 million barrels to 179.93 million barrels due to the launch of four sites -- Dushanzi, Lanzhou, Tianjin and Huangdao II.

Analysts estimate that Beijing would need more crude barrels from the previous period over mid-2016 to mid-2017 to build its SPR, amid expectations that PetroChina's Jinzhou (18.87 million barrels capacity) SPR storage site would have been put to use in H2 2017, while CNOOC's 31.45 million barrels capacity Huizhou site would be functional in 2018.

The National Bureau of Statistics at the end of December said the country's SPR had reached 37.73 million mt of crude as of mid-2017, or 276.56 million barrels, up 4.48 million mt, or 89,968 b/d from 33.25 million mt recorded in mid-2016.

The SPR stocks build pace was 37% slower than the 143,195 b/d over mid-2015 to mid-2016, and was at only one-third the pace of 274,524 b/d over mid-2014 to mid-2015, S&P Global Platts' calculations based on NBS data showed.

"No new SPR storage site was launched over the period [mid-2016 to mid-2017], preventing the government from bringing in more crude to build the reserves," Wang Zhuwei, senior analyst with S&P Global Platts' China Oil Analytics said.