https://www.bloomberg.com/news/articles/2017-11-16/norway-s-1-trillion-wealth-fund-wants-out-of-oil-and-gas-stocks

For a generation, the huge, whitewashed storage tanks at America’s

largest oil refinery in Port Arthur, Texas, have stored almost nothing

but Saudi crude.

The

plant is owned by Saudi Arabia’s state-run oil company, Aramco, and

since it first bought a stake in 1988, the Motiva refinery guaranteed

the kingdom a strategic foothold in the world’s largest energy market.

The tankers carrying millions of barrels a month of Arab Light crude

from Saudi export terminals to Port Arthur were testament to the

strength of the energy and political ties binding Riyadh and Washington.

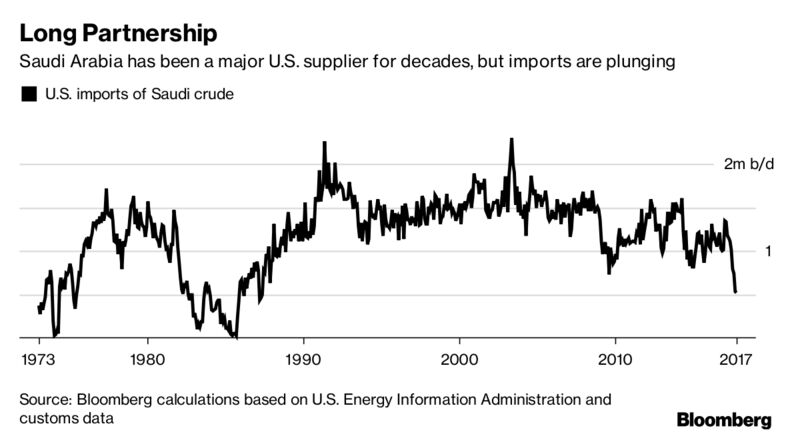

All

of a sudden, there are very few Saudi ships arriving in Texas. Since

July, Aramco has constricted supply, attempting to drain the crude

storage tanks at Motiva -- and many others across America -- part of a

plan to lift oil prices, even at the cost of sacrificing its once prized

U.S. market.

While Motiva is most affected, the rest of the U.S. oil

refining system, from El Segundo in California to Lake Lake Charles in

Louisiana, has also taken a hit. The result: Saudi crude exports into

America fell to a 30-year low last month.

"The

drop is huge," said Amrita Sen, chief oil analyst at consultant Energy

Aspects Ltd. in London. "It’s not just that Saudi exports are low, but

they have been low for several months.”

At

a stroke, the freedom from Saudi oil that’s been a rhetorical

aspiration for generations of American politicians, from Jimmy Carter to

George W. Bush, is within reach -- even if it’s largely the choice of

supplier rather than customer.

The U.S. imported just 525,000

barrels a day of Saudi crude in October, the lowest since May 1987 and

down from 1.5 million barrels a day a decade ago, according to Bloomberg

News calculations based on custom data.

The export drop was part

of a wider undertaking by the Organization of Petroleum Exporting

Countries to fight a global glut that has weighed on oil prices. OPEC

and its non-OPEC allies including Russia are scheduled to meet later

this month to discuss prolonging the cuts through 2018.

Saudi

Arabia, which for decades fought hard to be the second-largest oil

supplier to the U.S. after Canada, last month dropped to fourth position

for the first time since at least 1990, falling behind Iraq and Mexico.

The

drop in supplies has been so dramatic that Motiva bought in July almost

exactly the same amount of crude from Saudi Arabia (4.01 million

barrels) as it did from Iraq (3.96 million), according to custom data.

Saudi crude that month accounted for just 36 percent of Motiva’s

imports, down from a typical 70-90 percent in the past.In August, the

most recent monthly data available at company level, Saudi crude

accounted for less than half of Motiva’s imports.

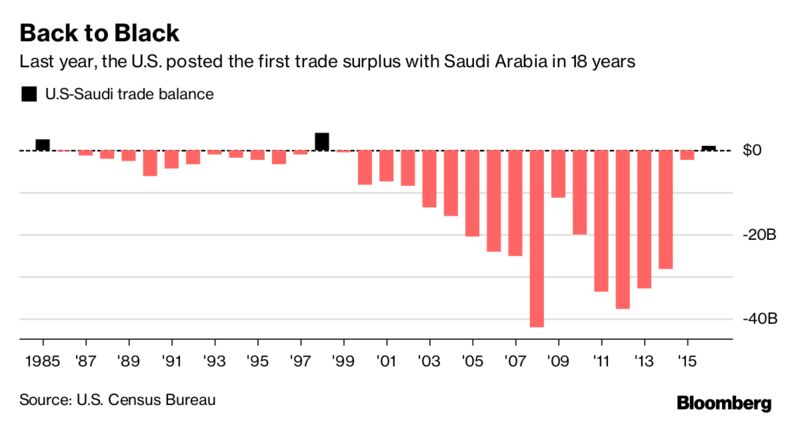

The combination

of falling Saudi oil exports into the U.S. last year, cheap crude and

higher exports of American weapons had already turned upside-down the

trade relationship between the two countries. Last year, the U.S.

enjoyed its first trade surplus with Saudi Arabia since 1998 -- only the

third in 30 years, according to data from the U.S. Census Bureau. The

sharper cuts in oil exports since the summer will likely amplify that

trend.

As

Saudi supplies fell, U.S. crude inventories dropped sharply over the

summer and autumn to their lowest since January 2016. Oil prices have

followed and Brent, the global benchmark, traded at a two-year high

above $60 a barrel this month.

"The policy has been a tremendous

success," said Anas Alhajji, a Dallas-based oil consultant who tracks

Saudi oil policy. "The U.S. is the only country in the world that

publishes oil inventories data on a weekly basis and investors closely

follow it. Saudi Arabia needed to focus on the data that matters to

investors, and it did by lowering exports to the U.S."

Saudi

officials said that oil exports are set to drop even further in this

month and next, with shipments into the U.S. expected to fall another 10

percent from November.

"The cuts show that when the Saudis say

they will do ’whatever it takes’ they mean it," said Helima Croft,

global head of commodity strategy at RBC Capital Markets LLC and a

former analyst at the Central Intelligence Agency.

Yet, driving

its exports into the U.S. to a three-decade low isn’t without risks for

Riyadh. Once a country gives up its market share, it can be costly to

recover it. The drop in Saudi shipments also reflects the changing U.S.

energy market as rising shale production reduces the overall need for

foreign oil. The EIA expects U.S. output to reach an all-time high of

10.1 million barrels a day by December 2018.

"Our import

dependence has collapsed," said Bob NcNally, a former White House oil

official and head of consultant Rapidan Energy Group LLC. "What should

worry Riyadh is if they need to sustain the cuts not a few more months,

but a lot longer.”

The International Energy Agency painted a rosy outlook

for U.S. domestic production up to 2025 in its annual World Energy

Outlook flagship report, saying the surge in oil and gas output in

America is the biggest boom in history.

However, owning Motiva gives Saudi Arabia a route to regaining market share, traders and refining executives said.

"Motiva

has taken the brunt of the Saudi cuts, so Riyadh would be able to

increase exports to the U.S. relatively easily in the future as and when

they decide to reverse the policy," said Sen at Energy Aspects.

For

the Saudi Arabian Oil Co., as Aramco is formally known, the loss of

market share comes at a delicate moment. The company is preparing for an

initial public offering that Riyadh hopes will value the company at an

eye-watering $2 trillion.

The

American market has long been Aramco’s most prized, and the Port Arthur

refinery is one of the company’s jewels -- nearly $10 billion was spent

expanding its capacity in 2013. In preparation of its initial public

offering, scheduled for the second half of 2018, Aramco earlier this

year paid to $2.2 billion to take full control of Motiva, dissolving a

50-50 joint-venture it held with Royal Dutch Shell Plc.

Aramco declined to comment.

At

any other time, the loss of U.S. market share would have worried the

Saudi regime, fearing a loss in political influence. But with President

Donald Trump, the Saudis believe the strength of their relationship with

the White House is as good as it’s been in decades, said David Goldwyn,

a Washington-based energy consultant and former U.S. State Department

top oil diplomat.

"The Saudis are not worried about the need to have U.S. oil market share to secure themselves diplomatically," Goldwyn said.

The

shift away from the U.S. show the increasing important of Asian markets

for Saudi Arabia, most notably China, but also India, Indonesia, Japan

and South Korea. While Saudi exports to the U.S. plunged, sales in Japan

earlier this year jumped to a 28-year high.

"Saudi Arabia doesn’t

care any more about its market share in the U.S -- it’s going after the

Asian market," said Jan Stuart, an oil economist at consultant

Cornerstone Macro LLC in New York.

I recently came across your blog and have been reading along. I thought I would leave my first comment. I don't know what to say except that I have enjoyed reading. Nice blog. I will keep visiting this blog very often. Enhanced Oil Recovery

ReplyDeleteThis is a great article thanks for sharing this informative information. I will visit your blog regularly for some latest post. I will visit your blog regularly for Some latest post. buy 50 instagram likes cheap

ReplyDelete