Crude oil prices surged to their highest level since June 15 as

Saudi’s anti-corruption purge catalysed new waves of concerns over the

stability of the world’s largest oil exporter.

Dozens of princes, ministers and business leaders were arrested under

corruption and money laundering charges by Crown Prince Mohammed bin

Salman. The news even triggered some profit taking and panic selling

during early Asian trading hours on Monday. The crackdown’s full impact

to the oil market remains to be seen, but usually market have short

memory on regional political events and the impact tends to be impulsive

and short-lived.

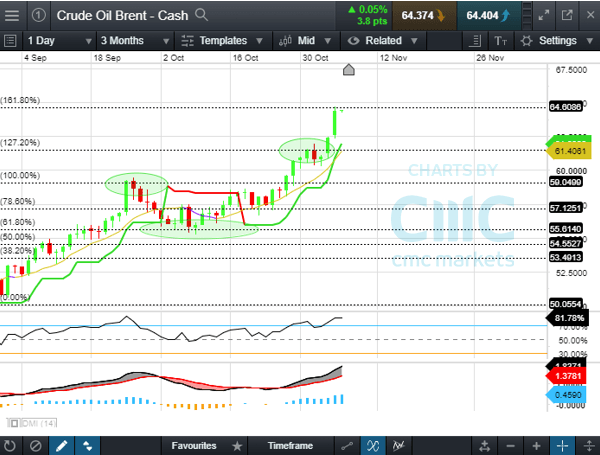

Technically, Brent’s price broke out above $61.4 resistance and is

facing some selling pressure at around $64.6 area (161.8% Fibonacci

extension level). The 10-day simple moving average line and SuperTrend

(10, 2) are both sloped upwards, suggesting the current bull trend

remains intact. Momentum indicator MACD remains strong, showing no sign

of slowdown. The RSI, however, has entered into overbought zone at

around 80%, suggesting that some technical pullback is possible in the

days to come.

President Donald Trump announced there is a ‘very unfair trade

situation’ with US’ largest trading partners including Japan during his

visit in Tokyo yesterday. It is widely expected that he will further

address the trade deficit and intellectual property disputes with

Chinese leader Xi in his upcoming visit to Beijing, in an attempt to win

a ‘free trade, fair trade, or reciprocal trade’ between US and China.

Outside of trade agreements and investments, North Korea is also on top

of his agenda this time.

Technical Analysis:

Brent – Cash

- The 10-Day Simple Moving Average and SuperTrend (10,2) are both sloped upwards, suggesting uptrend remains intact

- Facing strong resistance level at around $64.6 area, which is the 161.8% Fibonacci Extension level

- Momentum indicator MACD and RSI suggest strong upward sentiment

No comments:

Post a Comment