Nebraska’s approval of an alternative route could throw more

uncertainty into the mix for the long-delayed Keystone XL oil pipeline.

The Public Service Commission approved TransCanada Corp.’s

project on a three-to-two vote, removing one of the last hurdles to the

Calgary-based company’s construction of the $8 billion, 1,179-mile

(1,897-kilometer) conduit, which has been on its drawing boards since

2008. The decision, though, wasn’t wrinkle-free: The panel mandated an

alternative route that was immediately targeted by the project’s

opponents as lacking adequate vetting.

TransCanada

is now "assessing how the decision would impact the cost and schedule

of the project,” Russ Girling, TransCanada’s chief executive officer,

said in a statement. The company’s shares rose 1.3 percent to C$63.35 at

12:24 p.m. in New York trading.

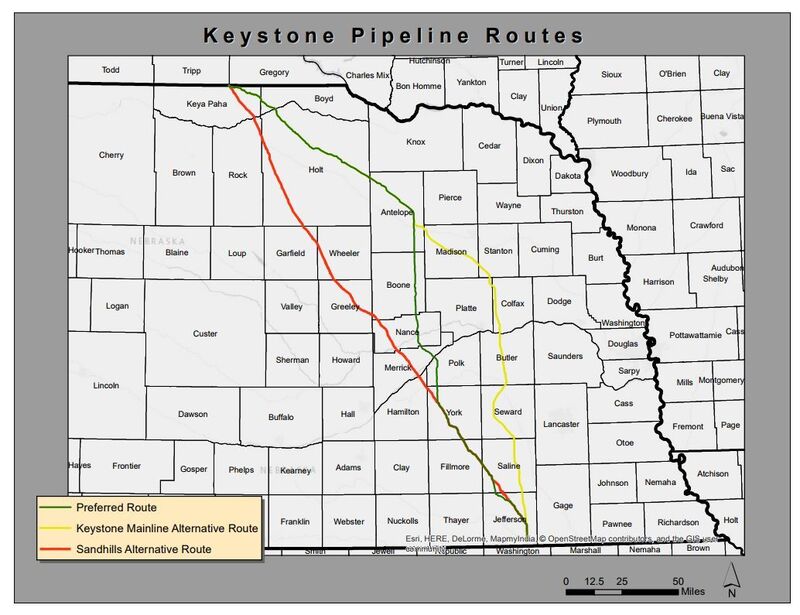

Source: Nebraska Public Service Commission

The uncertainty expressed by Girling was quickly reflected in analyst notes.

"While

today’s Keystone XL pipeline approval is an important milestone, it

does not provide certainty that the project will ultimately be built and

begin operating," said Gavin MacFarlane, a vice president at Moody’s

Investors Service. “Pipeline construction would negatively affect

TransCanada’s business risk profile through increased project execution

risk, and would likely put pressure on financial metrics."

Jane

Kleeb, president of the environmental advocacy group Bold Alliance, said

green-lighting the alternative may have helped the commission reach a

"middle ground solution.” But it opens new questions that she said her

group would likely explore in federal court.

That view mirrored a

dissenting opinion from Commissioner Crystal Rhoades. The alternative

route needed more study on both the state and federal level, she

said before the final vote, and it failed to give landowners along that

different path the ability to address the commission.

The

commissioners who supported the route change said it would impact fewer

threatened and endangered species, fewer wells, less irrigated cropland,

and that it included one less river crossing.

Additionally, they wrote, “it is in the public interest for

the pipelines to be in closer proximity to each other, so as to maximize

monitoring resources and increase the efficiency of response times”

with “issues that may arise with either pipeline.”

South Dakota Spill

The

decision came just days after a spill on TransCanada’s existing

Keystone line in South Dakota on Thursday sparked new attacks by

environmentalists who pointed to the event as something the state could

expect if the project is approved.

In its post-hearing brief,

TransCanada told the panel its "preferred route was the product of

literally years of study, analysis and refinement by Keystone, federal

agencies and Nebraska agencies," and that no alternate route, even one

paralleling the Keystone mainline as the approved path does, was truly

comparable.

Demonstrators hold a rally against the Keystone XL pipeline outside of the White House on Jan. 10, 2015.

Photographer: Pete Marovich/Bloomberg

Producers

in the Alberta oil sands region and elsewhere in Western Canada are

facing pipeline bottlenecks, forcing increased volumes onto rail cars.

Since rail is a more expensive form of transport, heavy Canadian crude

prices will need to trade at a bigger discount to West Texas

Intermediate futures.

That discount widened to more than $15 a

barrel Monday from less than $10 in August. Keystone XL construction,

along with Kinder Morgan Inc.’s Trans Mountain expansion and Enbridge

Inc.’s Line 3 expansion, could narrow the gap to less than $10 by early

next decade, Tim Pickering, chief investment officer at Auspice Capital

Advisors Ltd., said in a telephone interview.

Mexico, Venezuela

The

pipeline may also be more commercially viable given declining heavy oil

production in Mexico and ongoing instability in Venezuela, said Zachary

Rogers, a refining and oil markets research analyst at Wood Mackenzie,

said in a statement. Canadian producers are an alternate source of heavy

crude for U.S. Gulf Coast refiners.

Brett Harris, a spokesman for Calgary-based Cenovus Energy Inc.,

a committed oil-sands shipper on the proposed pipeline, said the

approval “is in the best interest of the industry, best interest of

Canada and the best interest of the U.S. as well. We are pleased to see

that decision.”

Dennis McConaghy, former executive vice president

of corporate development at TransCanada, said he would expect senior

management to announce they will go ahead with the project by year’s end

with construction by the later half of 2019. Completion of the line

would come a couple years later.

“The project could have been very seriously set back if they hadn’t got this approval today,” he said.

Volume Needed

McConaghy

said he believes the company has secured the volume needed to make the

project economically viable. But he added that “there is no question

there is going to be all kinds of legal obstruction that will be

resorted to by opponents.”

Nebraska’s decision overrode the

objections of environmental groups, Native American tribes and

landowners along the pipeline’s prospective route. The project had the

support of the state’s governor, Republican Pete Ricketts, its chamber

of commerce, trade unions and the petroleum industry.

With

Nebraska’s go-ahead in hand, TransCanada still must formally decide

whether to proceed with construction on the line, which would send crude

from Hardisty, Alberta, through Montana and South Dakota to Nebraska,

where it will connect to pipelines leading to U.S. Gulf Coast

refineries. The XL pipeline would add the ability to move 830,000

barrels a day, more than doubling the existing line’s capacity.

Shipping Commitments

The

company’s open season for gauging producers’ interest closed late last

month, and TransCanada executives have indicated that they’ve secured enough shipping commitments to make the project commercially worthwhile.

President Barack Obama’s administration rejected the pipeline in 2015. President Donald Trump

vowed to reverse that determination and, in January, invited the

company to reapply. Approval was quickly granted. He also championed

completion of the Energy Transfer Partners LP-led Dakota Access Pipeline, which runs from northwestern North Dakota to Illinois via South Dakota and Iowa.

The

panel heard testimony and took in evidence during a four-day August

hearing. Its power over the project is drawn from the state’s

constitution.

The case is In the Matter of the Application of TransCanada Keystone Pipeline LP for Route Approval of the Keystone XL Pipeline Project, 0p-0003, Nebraska Public Service Commission (Lincoln).

No comments:

Post a Comment