Photographer: Fayez Nureldine/AFP via Getty Images

https://www.bloomberg.com/news/articles/2017-10-26/saudi-crown-prince-backs-extending-opec-output-cuts-into-2018-j987r4ea

-

Prince Mohammed bin Salman says ‘of course’ supports roll-over

-

Heir to throne says Saudi Aramco IPO is ‘on track’ for 2018

Saudi Arabian Crown Prince Mohammed bin Salman backed the extension

of OPEC production cuts beyond March 2018, making it all but certain the

cartel and its allies will roll over the curbs at a meeting next month.

The

prince, who’s become the kingdom’s dominant political force, said in an

interview with Bloomberg News that "of course" he wanted to extend the

cuts into 2018. "We need to continue stabilizing the market," he said.

Until

now, Saudi officials have signaled they favored prolonging the cuts,

but stopped short of making a formal commitment, saying all options were

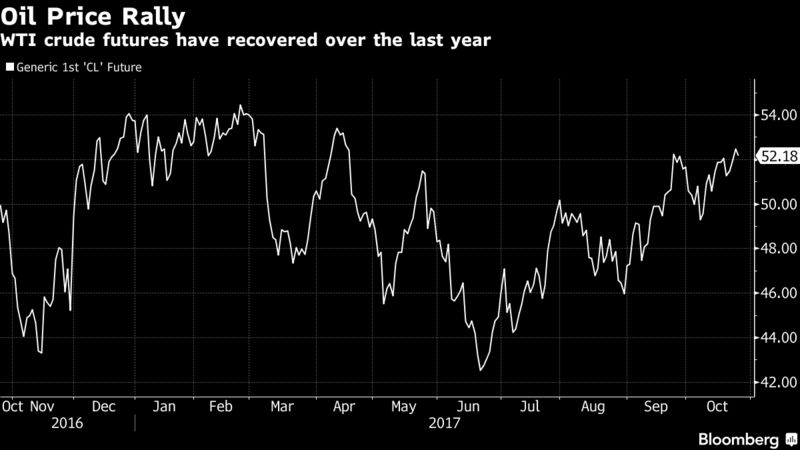

still open. Oil erased losses on Prince Mohammed’s comments, with West

Texas Intermediate crude little changed at $52.17 a barrel at 10:26 a.m.

in London after having earlier dropped as much as 0.4 percent.

His comments, weeks after Russian President Vladimir Putin

also gave provisional backing to an extension, signal that Riyadh and

Moscow are ready to prolong their collaboration to reduce oil supply and

lift energy prices. If confirmed at OPEC’s meeting next month, the

extension may boost oil prices, improving the fortunes of the global

energy industry and oil-dependent countries from Nigeria to Brazil.

For

Prince Mohammed, who replaced his cousin earlier this year as heir to

the throne, higher prices will help revive economic growth in Saudi

Arabia and eventually feed through to the initial public offering of the

country’s state-owned oil giant, Saudi Aramco.

IPO Plans

The

32-year-old royal said Aramco will IPO in 2018, most likely in the

second half. "We are on the right track," he said, repeating the same

formula Saudi officials have been using for weeks to counter talk of a

potential delay.

"We don’t have any problems, we have a lot of work and a lot

of decisions and there are a lot of things that will be announced," he

added. The Aramco IPO is the cornerstone of Vision 2030, a much wider

plan conceived to reshape the Saudi economy and diminish its dependence

on oil.

Tadawul, Saudi Arabia’s stock exchange, hopes to be the sole venue

for the Aramco listing, Chief Executive Officer Khalid Al Hussan said

at a conference in Riyadh on Thursday. The company is still considering

locations for the listing, with London and New York vying for a major

role alongside Hong Kong, Singapore, Tokyo and Toronto.

Prince Mohammed said that extending the cuts would bring benefits for both OPEC and non-OPEC producers.

"Everyone

is benefiting," he said. "It’s the first time we have an OPEC and

non-OPEC deal in stabilizing the oil market," he added, speaking as the

country welcomed a who’s who of global finance in a meeting in Riyadh

many participants dubbed "Davos in the Desert."

Putin said earlier

this month in Moscow that if OPEC and its allies decided to extend the

cuts, they should do it until the end of next year. OPEC

Secretary-General Mohammad Barkindo said last week that statement is the

basis for talks ahead of next month’s meeting, led by Russian Energy

Minister Alexander Novak and his Saudi counterpart Khalid Al-Falih.

"Every day, everyone is starting to believe it

more," Prince Mohammed said in Riyadh, declining to give a timeline of

the extension. "They have seen the results. So everyone has the interest

to continue keeping the agreement.”

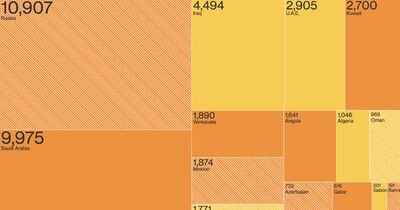

OPEC and a coalition of

non-OPEC nations, led by Russia, agreed a year ago to reduce production

by 1.8 million barrels a day -- roughly equal to the consumption of

France. The deal, personally negotiated by Prince Mohammed and President

Putin, was the first Saudi-Russia collaboration in oil in a decade,

marking a turn in the frosty relationship between the two nations.

The

24 oil-producing nations that participated in the cuts initially

intended to reduce output for six months starting in January, but the

supply glut that has weighed on prices since late 2014 has ebbed more

slowly than expected. As a result, the group agreed to roll over the

cuts in June for another nine months, until the end of March 2018.

While

oil prices have risen, with international benchmark Brent near $60 a

barrel as the physical market has improved, traders and analysts are

still painting a cautious outlook for next year due to forecasts for

rising output from the U.S., Brazil and Kazakhstan.

Yet, Prince Mohammed gave a rosier view of the oil market, suggesting he believes higher prices are coming.

"The

market has already swallowed the new supply of the shale oil,” he said.

"It’s swallowed. Now it’s part of supply. Now we are going into a new

era.”

— With assistance by Riad Hamade, Erik Schatzker, Wael Mahdi, Glen Carey, and Matthew Martin

No comments:

Post a Comment