-

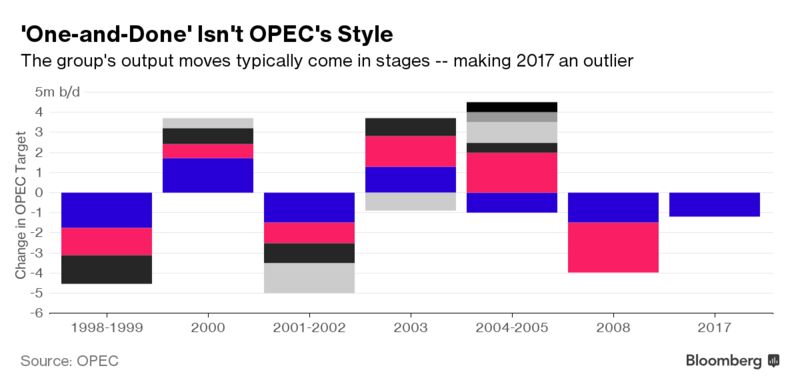

In the past, OPEC has often delivered supply cuts in stages

-

U.S. shale makes group wary of deepening production curbs

The chorus in the oil market calling for deeper production cuts gets

louder almost every day. By resisting the clamor, OPEC is breaking with

its own history.

As crude sank below $50 a barrel -- less than half the price of two years ago -- market-watchers from Goldman Sachs Group Inc.

to former OPEC officials said supply curbs imposed this year need to be

intensified. That would be consistent with past behavior, when

production cuts or increases often arrived in stages a few months

apart.

This

time is different. The emergence of U.S. shale oil producers -- who can

adjust supply more rapidly than OPEC’s previous rivals -- means the

Organization of Petroleum Exporting Countries cannot act with the same

freedom it once did. As economic pressure mounts for exporting

countries, using the old playbook runs the risk that new American

supplies would fill in any extra cutbacks.

“When OPEC was in control, it would often act in stages,”

said Chakib Khelil, a former Algerian energy minister who was OPEC

president in 2008. “The market is different than in 2008. Today,

non-OPEC plays a larger role in supply. And the major issue is how long

can they sustain this supply.”

Oil has given up almost all its

gains since OPEC and Russia launched their initiative to clear a

three-year surplus. Their supply cuts have failed to deplete the world’s

bloated fuel stockpiles quickly enough and West Texas Intermediate

futures have declined about 16 percent this year, trading at $45.06 a

barrel at 10:04 a.m. in New York on Thursday. Previously, that would

probably have prompted OPEC to revise its plans and agree on additional

reductions.

“In the past if it didn’t work, OPEC would adjust

lower,” said Mike Wittner, head of oil market research at Societe

Generale SA in New York. “It’s a process. That’s what supply management

means.”

The last time OPEC intervened, when the global recession

took hold in 2008, it initially agreed a supply cut in October and, when

prices continued to plunge, supplemented this with another reduction in

December, the biggest in the group’s history.

Not Sacrosanct

Between

2004 and 2005, the organization increased output targets six times to

satisfy booming consumption in China. And three cuts were made in quick

succession from 1998 to 1999 as oil demand tumbled in the wake of the

Asian financial crisis.

“One-and-done has certainly not been sacrosanct policy,” said

Helima Croft, head of commodity strategy at RBC Capital Markets LLC.

While

the organization didn’t always take a sequential approach, “when the

situation required further action,” it wasn’t unusual for OPEC to take

it, said Adnan Shihab-Eldin, director-general of the Kuwait Foundation

for the Advancement of Sciences and former OPEC secretary-general.

With

the world’s fuel inventories still brimming, the organization needs to

revert to that old approach with a “deeper cut,” said Nordine

Ait-Laoussine, president of Geneva-based consultants Nalcosa and former

energy minister of Algeria.

Although the organization and its partners -- known

as the Vienna Group -- agreed last month to prolong the cuts until next

April, they’ve shown no interest yet in amplifying them. Saudi Arabian

Energy Minister Khalid Al-Falih reiterated on June 19 that global

markets are already on the path to re-balancing, while a committee of producers that met in Vienna the next day was said to have given additional cutbacks no serious consideration.

United

Arab Emirates Energy Minister Suhail Mazrouei said in Paris on Thursday

that there are “no plans or talks" to enlarge the cuts.

Shale Difference

The

key difference from previous OPEC efforts is that U.S. shale producers

can rebound quickly enough to undo their work, according to Bob McNally,

president of consultants The Rapidan Group LLC. That concern had

deterred OPEC from reducing output in this crisis until late last year.

“Sequential

steps were seen during the big price busts of 1998 and 2008,” McNally

said. “Arguably we are seeing a soft repeat of sequencing with the

extension. The difference is that shale’s bounce back is helping to

frustrate the Vienna Group’s attempts to normalize inventories and

thereby remove the threat of a price collapse.”

U.S. crude

producers, who unleashed the glut OPEC is now fighting to clear, have

recovered almost all the output they lost during the market’s three-year

rout, as the nation’s shale-oil drillers learn to live with lower

prices. National output is projected to hit a record next year, according to the Energy Information Administration.

Old Habit

Still,

the very resilience of shale supply could yet lure OPEC back to its old

habit of making supplementary cuts, according to McNally and Wittner.

With

inventories still swollen and prices in a rut, the organization may

soon face two main options: accept that their efforts have failed and

reverse the cutbacks, or take the gamble of deepening them.

Cutting

output any further would also mean betting on a big enough jump in

prices to offset the loss of exports. While that happened in the first

quarter, according to the International Energy Agency, the benefit has

been fading, with Saudi Arabia’s foreign reserves dwindling this year by

about $35 billion, or 6.7 percent.

Saudi Arabia’s Al-Falih has

promised to do “whatever it takes” to re-balance the market. The kingdom

-- architect of the current policy -- may be unwilling to endure the

humiliation of a reversal, said Wittner.

That could see OPEC

“double-down on their decision and cut significantly more,” he said.

“But an additional cut brings its own dangers, which is a U.S.

production recovery.”

No comments:

Post a Comment