- Estimate increased by 110,000 barrels a day to almost 500,000

- Agency cites improved outlook for Russian production

The International Energy Agency increased its estimate of oil

production from countries outside OPEC next year, citing an improved

outlook for Russia.

Supply growth from nations outside the

Organization of Petroleum Exporting Countries will be “just shy” of

500,000 barrels a day, an increase of 110,000 from the agency’s forecast

last month, it said Thursday. Russian production is likely to grow by

190,000 barrels a day, building on a 230,000-barrel increase in 2016.

Swelling

output from non-OPEC countries including Russia, Brazil and Kazakhstan

presents a challenge for the 14-member exporters’ group, which meets at

the end of November to hammer out the details of a production cut to

buoy prices. While Russia has said it will consider joining an OPEC

agreement, its own output has climbed to a post-Soviet record.

Brazil

is set to increase production by 280,000 barrels a day next year, while

Canadian output will rise by 225,000 barrels and Kazakh supply by

160,000, the Paris-based IEA forecast in its monthly report. Non-OPEC

supply will total 57.2 million barrels a day.

“This means that 2017 could be another year of relentless global supply growth similar to that seen in 2016,” IEA said.

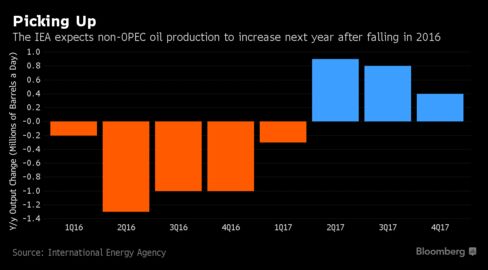

While

non-OPEC production is likely to drop by 900,000 barrels a day this

year, it rose by almost 500,000 a day last month as new fields started,

according to the agency. Maintenance and unscheduled shutdowns,

especially in the North Sea, had curbed production in September.

Kazakhstan’s giant Kashagan

field boosted output in October after coming online the previous month,

and oil-loading schedules suggest North Sea production also rebounded.

OPEC Policy

OPEC,

led by Saudi Arabia, decided in November 2014 against curtailing

production to support oil prices and instead pump at capacity to

increase market share. This drove crude to a 12-year low in January this

year and pushed high-cost U.S. production down. Following more than two

years of low prices, OPEC reversed its policy in September, saying it

would cut production for the first time in eight years.

The

consequent rally in prices brought back some U.S. drilling. In October,

14 out of a total 25 oil rigs returning to service were added in the

Permian shale basin, where production rates are beating expectations,

the IEA said. Output in the Bakken and Eagle Ford shales isn’t as

strong, and the IEA sees U.S. crude supply declining “modestly” in 2017.

Total

U.S. oil and natural-gas liquids production will shrink by 465,000

barrels a day this year to 12.5 million barrels, and stay around this

level in 2017, the agency forecasts.

No comments:

Post a Comment