- Output cuts ‘not an option for us’: IFX cites Russian envoy

- U.S. stockpiles probably rose by 2 million barrels: survey

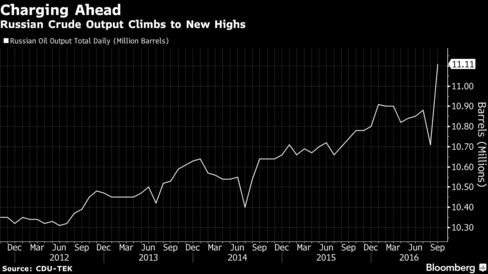

Crude fell to a one-week low as speculation mounts that Russia won’t

join OPEC to curb supply and analysts predict U.S. stockpiles climbed.

Futures

dropped 1.1 percent in New York. Output cuts aren’t “an option for us,”

said Russia’s envoy at OPEC, Vladimir Voronkov, according to Interfax.

The producer group has wanted Russia to join it in curbing shipments to

support prices. U.S. crude supplies probably rose 2 million barrels last

week, a Bloomberg survey showed before Energy Information

Administration data Wednesday. Oil came off its lows as the dollar

retreated against its peers.

Oil

has fluctuated near $50 a barrel amid uncertainty about whether the

Organization of Petroleum Exporting Countries can implement an accord to

cut output when its members gather in November. A committee will meet

this week to try to resolve differences

over how much individual members should pump. Last month’s OPEC deal

pushed prices higher, bringing some drilling back in the U.S., which has

in turn prevented crude from making new highs.

“The

nonsense around the production agreement comes in and out of the

market,” said John Kilduff, a partner at Again Capital LLC, a New

York-based hedge fund that focuses on energy. “It’s coming out of oil

today because of the Russian statements, which come after Iraq made it

clear that they weren’t going to make a cut.”

West Texas

Intermediate for December delivery slipped 56 cents to settle at $49.96 a

barrel on the New York Mercantile Exchange. It’s the lowest close since

Oct. 17. Total volume traded was 15 percent below the 100-day average.

Brent

for December settlement dropped 67 cents, or 1.3 percent, to $50.79 a

barrel on the London-based ICE Futures Europe exchange. It’s the lowest

close since Sept. 30. The global benchmark ended the session at an

83-cent premium to WTI.

U.S. Stockpiles

U.S. crude

supplies dropped to 468.7 million barrels in the week ended Oct. 14, the

lowest since January, according to EIA data. Inventories have declined

in six of the past seven weekly reports.

“The

most important dynamic that’s been a surprise is the drop in U.S.

supplies,” said Jay Hatfield, the New York-based portfolio manager of

the InfraCap MLP ETF with $120-million in assets. “The OPEC agreement

brought the rally forward by a few months. It was going to happen early

next year because of supply and demand.”

Saudi

Arabia faces the prospect of much deeper -- and financially painful --

oil production cuts after Iraq joined the queue of group members seeking

immunity from the deal hatched in Algiers. Iraq is the fourth OPEC

member -- after Iran, Nigeria and Libya -- to seek an exemption. Iraq

shouldn’t have to take part because it’s embroiled in a war with Islamic

militants, Oil Minister Jabbar Al-Luaibi said Sunday in Baghdad.

Mind Boggling

“The

idea that they will come together and form a coalition to make cuts is

mind-boggling,” said Stephen Schork, president of the Schork Group Inc.,

a consulting company in Villanova, Pennsylvania.

Iraq could

accept a decision to freeze output based on an “actual” production level

of more than 4.7 million barrels a day rather than the lower figure

OPEC uses from secondary sources, Oil Ministry spokesman Asim Jihad said

Tuesday. The organization pegs Iraqi production at less than 4.2

million barrels a day.

OPEC Secretary-General Mohammed

Barkindo said the 14-nation group is facing its toughest challenge after

meeting Al-Luaibi for talks in Baghdad Tuesday. The organization is

also trying to woo non-OPEC producers to join in the cuts.

So far

this month, Libya and Nigeria have managed to increase their daily

output by 220,000 barrels and 300,000 barrels respectively. Iran has

steadily increased production since sanctions were lifted at the start

of the year. Tehran has repeated it aims to ramp up its output to around

4 million barrels day from around 3.7 million a day estimated by OPEC

for September.

“OPEC is not a well-oiled machine when it comes to

implementing cuts,” Hatfield said. “Their credibility is low and they’re

deeply divided politically.”

Oil-market news:

- Nigerian militants have attacked Chevron Corp.’s Escravos pipeline, Niger Delta Avengers spokesman Mudoch Agbinibo said in a Twitter post. Chevron’s Houston-based spokeswoman Isabel Ordonez declined to comment.

- A key pipeline capable of carrying 400,000 barrels a day of crude to the Texas Gulf Coast from the largest U.S. storage hub at Cushing, Oklahoma, was shut after a spill late Sunday.

No comments:

Post a Comment