The value

of the variation between Brent and West Texas Intermediary (WTI) has

gained further importance for the tanker market since the removal of the

US crude export ban.

This is because it provides cargo holders with new commercial

opportunities, dictating tanker trading patterns and global tanker

demand, McQuilling Services said in a new report.

The repeal of the ban on US exports in late 2015 opened a variety of

new markets beyond Canada for US crude oil. In the first five months of

this year, crude exports averaged just under 500,000 barrels per day

with only 61% heading to Canada, down from a 92% average in 2015,

according to the US EIA.

The remaining 204,000 barrels per day were exported to countries,

including the Netherlands, Curacao, Singapore, Italy and the UK. Curacao

was the most popular destination for US crude next to Canada, with

exports averaging 54,000 barrels per day in 2016.

Venezuela’s state-owned oil company, Petroleos de Venezuela (PDVSA) uses refining and storage infrastructure on the Caribbean island to

facilitate the blending of US light oil with its domestic heavy grades

for re-export to the East among other destinations.

The Netherlands is the third largest US crude export destination with

exports to the European country averaging 39,000 barrels per day through

the first five months of this year.

Demand for new crude sources outside of Europe is also growing amid

lower production levels at North Sea oilfields and volatile supply in

West Africa and North Africa.

Another major destination for US crude exports is the East, as steady

volumes to Singapore and Japan have been observed. Data provided by JBC

Energy indicated increasing demand for light distillates, such as

gasoline and naphtha in the Far East and Southeast Asia since 2013,

which is expected to continue.

In the summer months of June and July, the market saw lower US crude

exports, driven by a weaker Brent/WTI spread. In June, Brent posted a

discount to WTI for the majority of the month causing the spread to

average $0.45 per barrel. Moving into July, Brent was pricing at an

average of $0.15 per barrel above WTI.

Reported crude charter activity declined to six total fixtures during

June and July, while May recorded five market fixtures. US EIA data

further supported this notion, as total US exports fell 42% in June;

however, the late summer widening of the Brent/WTI spread from $0.54 to

$2.73 in August reversed this trend.

Market reported crude fixtures out of the US Gulf increased by seven

month-on-month, to total nine cargoes for August. This activity is

similar to the seven crude cargoes seen out of the US Gulf in April;

however, the stem size increased.

The April cargoes averaged over 93,000 tonnes shipped on five

Aframaxes, one Panamax and one co-loaded VLCC. The August cargoes were

taken on two Aframaxes and seven Suezmaxes.

Another trend to note is that more US crude cargoes were destined to

the East in 2016. The wider range of destinations opens opportunities

for longer haul voyages and may support overall tonne/mile demand,

McQuilling said.

August fixture data showed that seven US crude cargoes went East,

compared to two voyages to South America. The recent destination of

choice in the East was Singapore, as three crude fixtures were reported

for August, more than any other month this year.

Two of these charters were fixed by a major trading house, who has

traditionally sourced from the UK/Cont and West Africa to satisfy Asian

crude demand.

In August, the freight rate for a VLCC on the West Africa/Singapore

trade averaged $1.14 per barrel, while the rate for a Suezmax on the US

Gulf/Singapore trade averaged $2.47 per barrel, representing a $1.33 per

barrel cost variance.

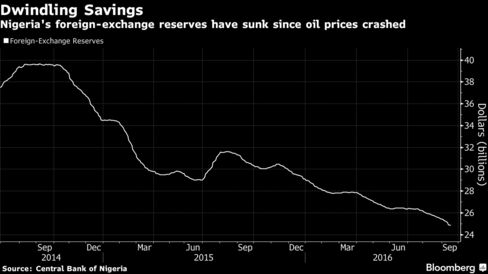

Despite the recent calm, supply disruptions continued to be a concern

in West Africa as militant attacks compromised key Nigerian oil

terminals, while production levels in Angola remained relatively flat,

due to curbed investment and operational challenges.

Lower oil supply in Europe, coupled with production disruptions in West

Africa, could support Brent pricing and further widen the premium to

WTI.

US production may have found a bottom as the rig count inched higher.

Increasing production could pressure the pricing of WTI-linked crudes

and create a higher discount to the North Sea grade, potentially

resulting in more Suezmax and Aframax loadings in the US Gulf.

Forecasting to the end of 2016, McQuilling expected Suezmax freight

rates on the US Gulf/Singapore trade to average $3.35 per barrel, while

rates for a VLCC on the West Africa/Singapore route was anticipated to

average $1.84 per barrel- a $1.51 per barrel cost variance.

Longer haul voyages from the West to the East would help support

tonne/mile demand, increasing fleet usage and potentially adding some

support to freight rates in the fourth quarter, McQuilling concluded.

OPEC’s decision to cut production on Thursday has taken analysts by

surprise but most think it will put around $10 on Brent going forward.

It is too early to say how the drop will affect the tanker market and even if all member countries will abide by the ruling.