- Iraq to increase crude shipments by about 5% in next few days

- Nigerian militants declare end to attacks for government talks

Oil

retreated, halting the longest run of gains in four years as Iraq

sought to increase exports amid a global oversupply and Nigerian

militants called an end to hostilities.

Futures slid by 3 percent

in New York after climbing 16 percent the previous seven sessions in a

rally fueled by speculation that OPEC talks in September may lead to an

output freeze. Iraq will boost crude shipments

by about 5 percent in the next few days following an agreement to

resume exports from three oil fields in Kirkuk. The Niger Delta Avengers

declared an end to attacks on oil infrastructure and will conduct talks

with the government, according to a statement on a website that says it

represents the group.

“Certainly,

the news out of Nigeria, Iraq was a catalyst to get this market a bit

lower,” Bart Melek, head of global commodity strategy at TD Securities

in Toronto, said by telephone. “We had a nice, robust rally into bull

market territory. With that, I think the market is somewhat

uncomfortable to take it much higher.”

Bull Market

Oil entered a bull market

last week, having climbed more than 20 percent since sliding below $40 a

barrel earlier in August. Speculation that informal talks with members

of the Organization of Petroleum Exporting Countries in September may

lead to action to stabilize the oil market helped push prices higher,

even though a previous meeting in Doha in April between the world’s

biggest producers ended with no agreement.

OPEC’s output is at an eight-year high, with its 14 members having

pumped 33.39 million barrels a day in July, according to an August 11

International Energy Agency report.

“OPEC showed their cards,”

Phil Streible, senior market strategist at RJO Futures in Chicago, said

by telephone. “You can’t have higher prices and ramp up production at

the same time. Because of that, prices are going to readjust lower.”

West

Texas Intermediate for September delivery, which expires Monday,

declined by $1.47 to settle at $47.05 a barrel on the New York

Mercantile Exchange. The more-active October contract fell by $1.70, or

3.5 percent, to end the session at $47.41 a barrel.

Brent for

October settlement slipped $1.72, or 3.4 percent, to settle at $49.16 a

barrel on the London-based ICE Futures Europe exchange, trading at a

premium of $1.75 to WTI for the same month.

Iraqi Exports

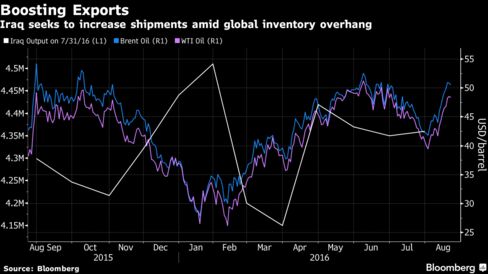

Iraq

will increase exports by about 150,000 barrels a day as shipments

resume from the Baba Gorgor, Jambour and Khabbaz fields, Fouad Hussein, a

member of the oil and energy committee of the Kirkuk provincial

council, said by phone Sunday. The nation is the second-biggest OPEC

producer, pumping 4.36 million barrels a day last month, according to

data compiled by Bloomberg.

Nigerian militants said they will

cease hostilities in the Niger Delta “against all interest of the

multinational oil corporations,” to support talks with the government,

according to the statement.

Watch Next: Oil Reverses Gear Into a Bear Market

“If

they do get a ceasefire that does hold, that will definitely put

downward pressure on the market,” Phil Flynn, senior market analyst at

Price Futures Group in Chicago, said by telephone. If Iraq starts

resuming exports from fields in Kirkuk, “that could mean more supply on

the marketplace.”

Oil-market news:

- Cushing, Oklahoma crude inventories increased by 200,000 barrels in the week ended August 19, according to a Bloomberg proprietary model ahead of an Energy Information Administration report that will be released later in the week.

- BNP Paribas SA raised its forecast for the average WTI price this year by $2 to $42 a barrel, the bank said in an e-mailed note.

No comments:

Post a Comment