Saudi Arabia, the world’s biggest oil exporter, won’t boost output to

capacity and flood the market, the kingdom’s Energy Minister Khalid

Al-Falih said as OPEC members plan to meet next month to discuss ways to

stabilize crude prices.

Saudi Arabia isn’t concerned about global

demand in spite of a drop in prices and a slower economy, Al-Falih said

in an interview with Al-Arabiya television. The country is able to pump

as much as 12.5 million barrels a day of oil, he said in comments

broadcast during an official visit to buyers in Asia, its biggest

market, including China.

Khalid Al-Falih

Photographer: Akos Stiller/Bloomberg

“The

market is now saturated with stored crude at beyond usual levels and we

don’t see in the near future a need for the kingdom to reach its

maximum capacity,” Al-Falih said. Demand in China is “very healthy” and

consumption in India is “very good,” he said. Saudi domestic use is

rising due to two new refineries in Yanbu and Jubail, which have raised

consumption by a combined 800,000 barrels a day, Al-Falih said.

Record Output

Saudi

Arabia is producing near record levels as it tries to preserve market

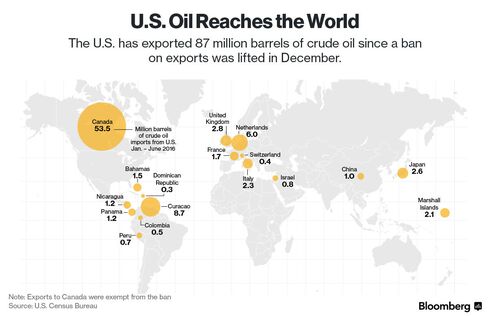

share in the face of a worldwide glut. Increased oil supply, including

from U.S. shale drillers, triggered a drop in prices of more than 50

percent since their 2014 peak. Saudi Arabia plans to hold informal talks

on stabilizing prices with other members of the Organization of

Petroleum Exporting Countries in Algeria next month.

Al-Falih’s

comments show that “Saudi Arabia is not interested for the time being in

coming to terms with the impact of low oil prices on producers’

economies,” said Abdulsamad al-Awadhi, a London-based analyst who served

as Kuwait’s representative to OPEC from 1980 to 2001. “To state that as

long as we have requests from customers for crude we will meet them at

any price shows a total disregard for others.”

‘Price War’

Brent

crude was trading $1.24 lower on Wednesday at $47.13 a barrel in London

a 4:11 p.m. local time. The international benchmark rose as high as

$115.71 a barrel in June 2014.

“There is no price war,” Al-Falih

said. Saudi Arabia isn’t threatened by competition in China, the world’s

largest energy consumer, and finds it “normal” for producers, including

neighboring Russia, to try to maximize their sales there, he said.

The

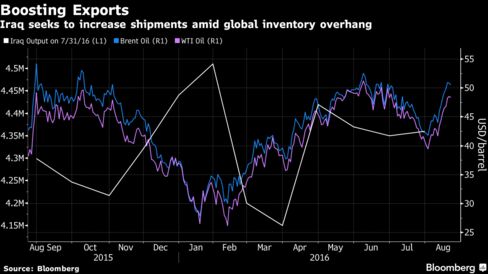

kingdom pumped 10.43 million barrels a day in July compared with a

record 10.57 million in the same month of 2015, data compiled by

Bloomberg show.

“Saudi Arabia will remain flexible in its

petroleum policy,” Al-Falih said. “We will meet demand if it rises as

was the case for this year and last year.”

Saudi Arabian Oil Co.,

known as Aramco, is negotiating for crude storage projects to help China

import more Saudi oil, Al-Falih said. It’s also pursuing refinery

ventures in China valued at more than $20 billion, he said. Aramco is in

advanced talks with China National Petroleum Corp. for two refineries

in Yunnan province and hopes to reach an agreement this year, he said.

Aramco also has a project with China Petroleum and Chemical Corp., known

as Sinopec, for a refinery in Qingdao, he said.