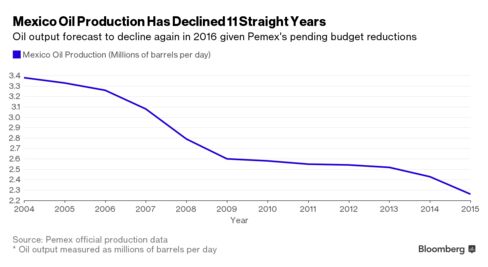

Two years after Mexico passed sweeping energy reforms, the new CEO

of Petroleos Mexicanos is racing against time to bring in partners that

can revitalize its money-losing refineries and rescue it from an 11-year

slump in oil output.

"If Pemex hasn’t found partners by next

year, we are going to be in deep trouble,” Chief Executive Officer Jose

Antonio Gonzalez Anaya said in an interview Tuesday at Bloomberg’s

headquarters in New York.

Jose Antonio Gonzalez Anaya

Photographer: Michael Nagle/Bloomberg

Gonzalez

Anaya is promising investors and analysts that they’ll hear by

Thanksgiving how he plans to attract international oil companies to

partner with Mexico’s troubled oil giant. To provide short-term

financing while the company waits for alliances to be formed, Pemex will

return to the bond market to issue about $1.5 billion this year, he

said.

Pemex

has been pummeled by the worst plunge in oil prices in a generation and

a decline in production that has stretched for more than a decade.

Gonzalez Anaya is aiming for 100 billion pesos ($5.77 billion) of cost

cuts this year to stem the company’s losses, which reached $32 billion

last year and will continue in the first quarter. To do that, he is

looking for partners in the "entire line" of Pemex’s business, including

about $2 billion in deals with private equity firms KKR & Co. LP

and First Reserve Corp.

Bringing

in partners may include giving up an operating interest in some of its

refineries, which lose 100 billion pesos a year, according to Gonzalez

Anaya. Pemex still plans to modernize its refineries to improve

efficiency, though doing so will require financial and technical

assistance from a partner, he said.

"There a lot things that, within the new rules, they don’t necessarily have to be run by Pemex," Gonzalez Anaya said in an interview on Bloomberg TV with Erik Schatzker. He

said that Pemex is open to have a majority operator in upstream and

downstream areas "in the entire structure," and he’s already in talks

with some potential partners.

Pemex,

which celebrated Mexico’s opening of the country’s long-standing

government oil production monopoly in 2013, has yet to capitalize on the

legislation that allows the company to create joint ventures to boost

crude production in areas where it lacks the technical ability to do so,

such as in deepwater fields. Its six refineries have deteriorated as

the company has delayed maintenance and failed to invest enough money to

modernize the plants. That has kept Mexico dependent on fuel imports,

particularly from the U.S.

Capital Infusion

Pemex’s first

quarter earnings are likely to be "very bad" given the slump in Mexico’s

crude prices during the first three months of the year, Gonzalez Anaya

said. Pemex finished 2015 with more than $87 billion in debt, according

to the company’s fourth quarter earning statement.

Mexico

announced on April 13 that it would give Pemex a capital injection of

73.5 billion pesos to pay off outstanding debts to oil service providers

and absorb some of the company’s pension liabilities. The infusion

comes as the spread between Pemex and Mexico’s sovereign debt is the

widest between all state-owned oil companies and the countries that

control them, according to data compiled by Bloomberg.

The purpose

of the trip for Gonzalez Anaya, who was accompanied in New York by

Chief Financial Officer Juan Pablo Newman and Mexican Finance Minister

Luis Videgaray, was to explain the February budget adjustments and the

recent government aid package, he said.

Deficit Target

"The

bottom line for us is that we have taken these two big steps, in terms

of the budget adjustment and the government support, and they give us a

solid financial foundation to do the structural things," he said. "But

we need to do the structural things, otherwise it’s not going to work."

Asked

if he will be able to deliver on a financial deficit target for the

year set at 100 billion pesos, Gonzalez Anaya said "Yes. I’m going to

try really, really, really hard to do that."

The meetings held

with banks and credit rating companies marked the first time in at least

three decades that Mexico’s Finance Minister and the Pemex director

held a joint meeting with investors, Gonzalez Anaya said. The meeting

was used to "send a clear signal that the government is behind us," he

said.

No comments:

Post a Comment